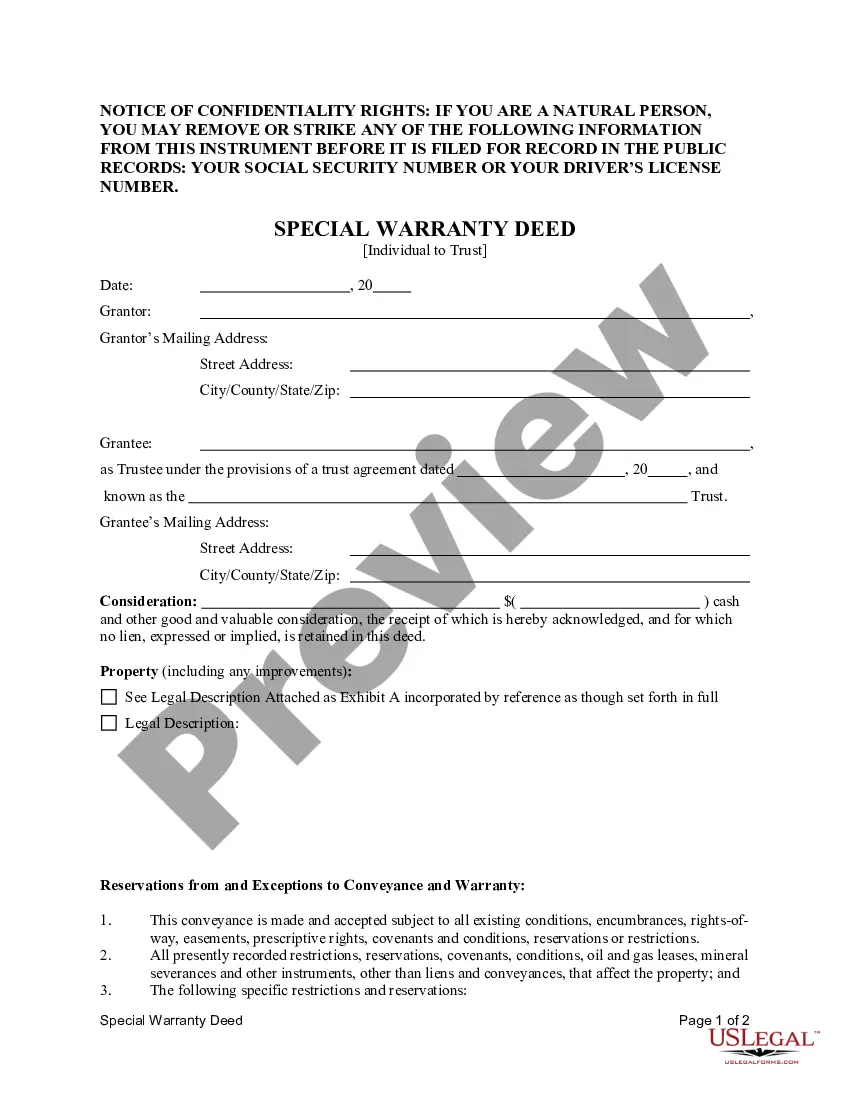

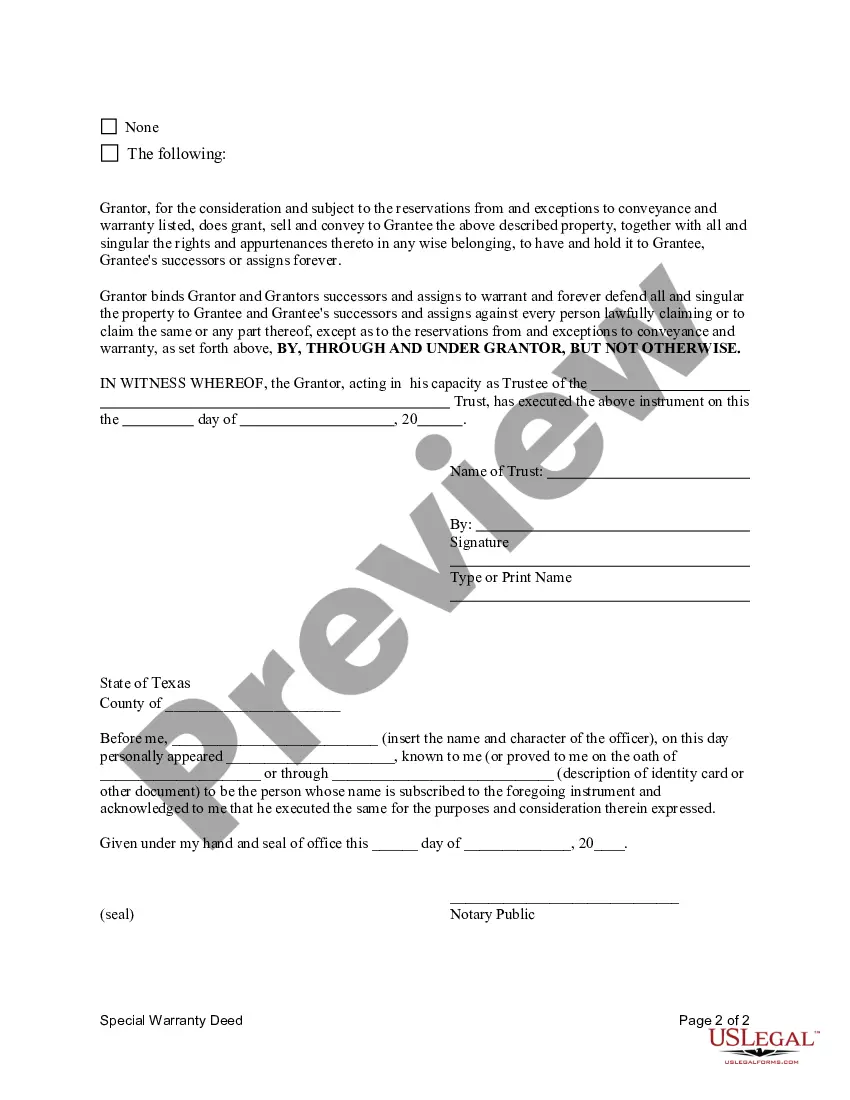

This form is a Special Warranty Deed where the Grantor is an individual and the Grantee is a trust. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Ggrantor, but not otherwise. This deed complies with all state statutory laws.

thisA Sugar Land Texas Special Warranty Deed from an Individual to a Trust is a legal document that facilitates the transfer of ownership of a property located in Sugar Land, Texas, from an individual property owner to a trust entity. This type of deed provides certain specific warranties and protections to the grantee (the trust) against any defects in the title only during the time the granter (the individual) held ownership interest in the property. The Special Warranty Deed from an Individual to a Trust in Sugar Land, Texas, establishes the legal framework for transferring real estate ownership while ensuring that the granter is providing assurances about the condition and chain of title for the duration of their ownership, but does not warrant against any defects that may have existed before their time of ownership. Essentially, this deed type offers a warranty that covers the period that the granter owned the property but doesn't extend beyond that. In Sugar Land, Texas, there are various variations of the Special Warranty Deed from an Individual to a Trust that can be applied depending on specific circumstances. These variations include: 1. Limited Special Warranty Deed: This type of special warranty deed provides limited warranties to the grantee. The granter only guarantees that there were no defects in title during their period of ownership and does not assume liability for any issues that may have arisen prior to their ownership. 2. General Special Warranty Deed: In this variation, the granter warrants against any defects in the title during the time they held ownership of the property, including any claims arising before their ownership. This provides a broader level of protection to the grantee. 3. Statutory Special Warranty Deed: This form of special warranty deed follows the statutory guidelines set forth by the state of Texas. It includes the specific language and provisions required by state law to ensure the validity and enforceability of the deed. 4. Special Purpose Special Warranty Deed: This type of special warranty deed is utilized for specific purposes, such as transferring property ownership from an individual to a trust for estate planning or asset protection purposes. It may include additional provisions or limitations tailored to the specific objectives of the transfer. In Sugar Land, Texas, the Special Warranty Deed from an Individual to a Trust serves as an essential legal document that formalizes the transfer of real estate ownership while providing a measure of protection for the grantee against any defects in title that may have arisen during the granter's period of ownership. It is crucial to consult with a qualified attorney or real estate professional to ensure the correct type of special warranty deed is utilized for a particular transaction, considering the unique circumstances and goals of the transfer.