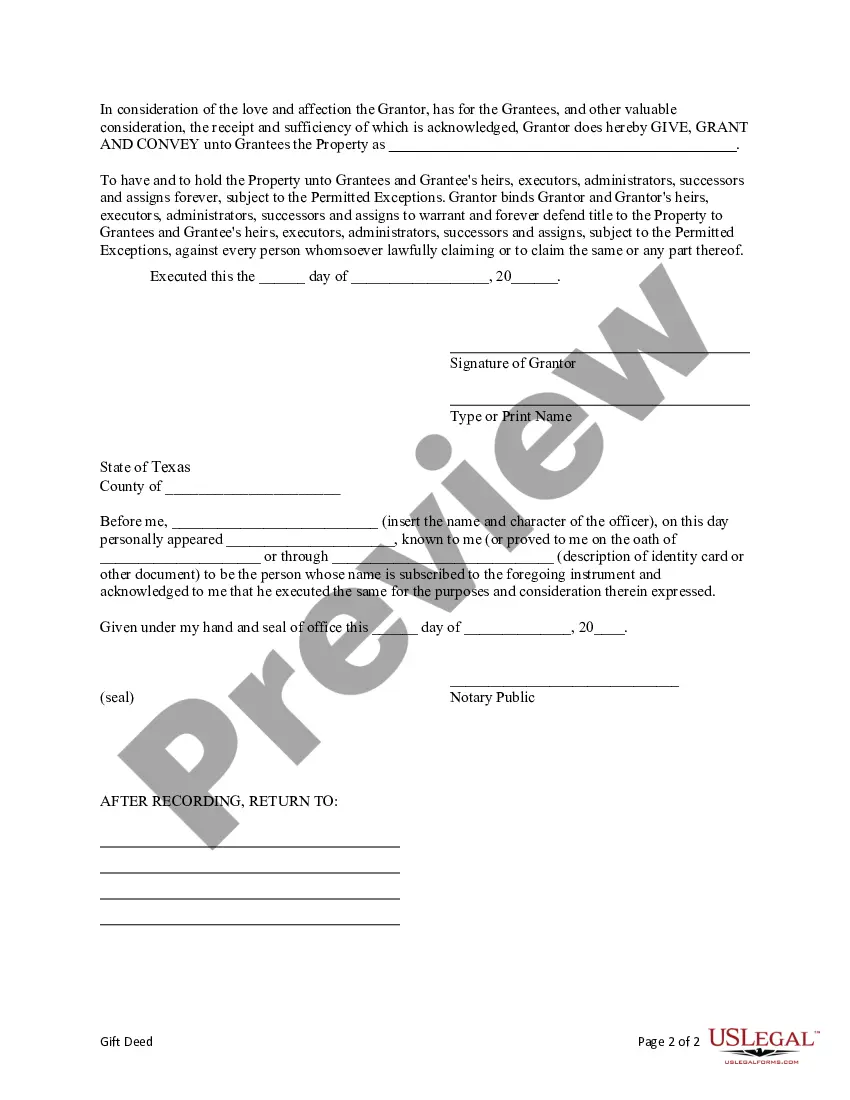

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee are three individuals. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

A Dallas Texas Gift Deed from an Individual to Three Individuals is a legal document that transfers ownership of a property or asset without any consideration or payment required in return. This type of deed is often used to gift real estate, personal property, or financial assets to multiple individuals, ensuring equal ownership shares among the recipients. These gift deeds can be broadly categorized into two types: 1. Dallas Texas Gift Deed with Survivorship: This type of gift deed ensures that if one of the three individuals passes away, their ownership interest automatically transfers to the remaining surviving individuals. It provides security and clarity on the distribution of the gift in the event of death. 2. Dallas Texas Gift Deed without Survivorship: This variant of the gift deed does not include the survivorship feature. In case any of the three individuals pass away, their ownership interest will be distributed according to their respective wills or the intestate laws of Dallas Texas. When drafting a comprehensive Dallas Texas Gift Deed from an Individual to Three Individuals, certain crucial elements must be included to make it legally binding and enforceable: 1. Granter and Grantee Information: The names, addresses, and legal descriptions of the granter (the individual gifting the property) and the grantees (three individuals receiving the gift) should be mentioned explicitly. 2. Property Description: A detailed description of the property being gifted, including its address, dimensions, and any relevant identifying information, must be clearly stated. For real estate, it's advisable to attach a legal description from the original deed or survey. 3. Consideration Clause: Since this deed involves a gift, the consideration clause states that the transfer is made without any payment or consideration required from the grantees. 4. Gifting Language: The deed should explicitly state that the granter intends to gift and convey the property to the three individuals, indicating that it is a voluntary transfer made out of generosity and without any expectation of compensation. 5. Execution and Acknowledgment: To ensure the validity of the gift deed, it must be signed by the granter in the presence of a notary public or other authorized official. The signatures of all three grantees may also be required to acknowledge their acceptance of the gift. Dallas Texas Gift Deed from an Individual to Three Individuals provides a legally sound and straightforward method to transfer ownership of assets without consideration. It's essential to consult with a legal professional or attorney to ensure compliance with specific state laws and to customize the document to suit individual circumstances.A Dallas Texas Gift Deed from an Individual to Three Individuals is a legal document that transfers ownership of a property or asset without any consideration or payment required in return. This type of deed is often used to gift real estate, personal property, or financial assets to multiple individuals, ensuring equal ownership shares among the recipients. These gift deeds can be broadly categorized into two types: 1. Dallas Texas Gift Deed with Survivorship: This type of gift deed ensures that if one of the three individuals passes away, their ownership interest automatically transfers to the remaining surviving individuals. It provides security and clarity on the distribution of the gift in the event of death. 2. Dallas Texas Gift Deed without Survivorship: This variant of the gift deed does not include the survivorship feature. In case any of the three individuals pass away, their ownership interest will be distributed according to their respective wills or the intestate laws of Dallas Texas. When drafting a comprehensive Dallas Texas Gift Deed from an Individual to Three Individuals, certain crucial elements must be included to make it legally binding and enforceable: 1. Granter and Grantee Information: The names, addresses, and legal descriptions of the granter (the individual gifting the property) and the grantees (three individuals receiving the gift) should be mentioned explicitly. 2. Property Description: A detailed description of the property being gifted, including its address, dimensions, and any relevant identifying information, must be clearly stated. For real estate, it's advisable to attach a legal description from the original deed or survey. 3. Consideration Clause: Since this deed involves a gift, the consideration clause states that the transfer is made without any payment or consideration required from the grantees. 4. Gifting Language: The deed should explicitly state that the granter intends to gift and convey the property to the three individuals, indicating that it is a voluntary transfer made out of generosity and without any expectation of compensation. 5. Execution and Acknowledgment: To ensure the validity of the gift deed, it must be signed by the granter in the presence of a notary public or other authorized official. The signatures of all three grantees may also be required to acknowledge their acceptance of the gift. Dallas Texas Gift Deed from an Individual to Three Individuals provides a legally sound and straightforward method to transfer ownership of assets without consideration. It's essential to consult with a legal professional or attorney to ensure compliance with specific state laws and to customize the document to suit individual circumstances.