This form is a Quitclaim Deed where the Grantor is an individual and the Grantee are three individuals. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

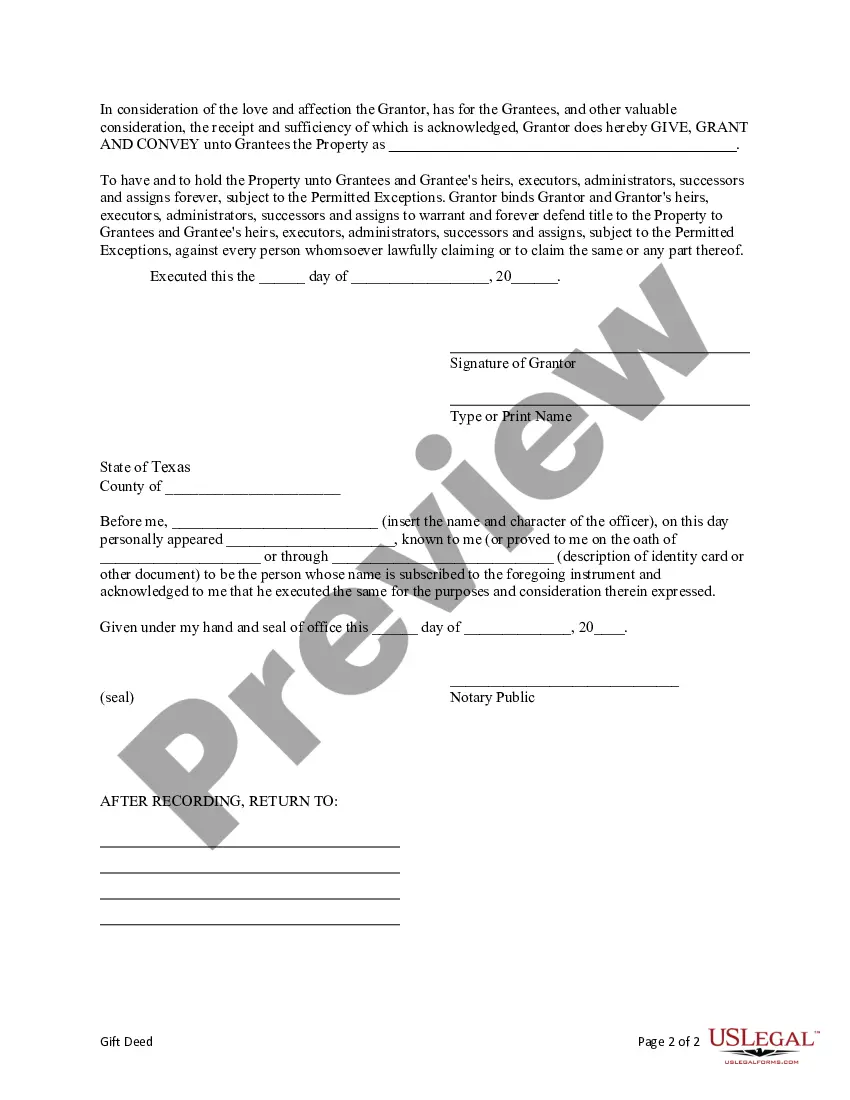

Houston Texas Gift Deed from an Individual to Three Individuals is a legal document that transfers the ownership of a property from one individual to three others as a gift. This type of deed is commonly used in Houston, Texas, and serves as a formal and legally binding way of conveying real estate as a gift. The gift deed involves the transfer of the property's ownership rights without any consideration or payment in return. It is typically executed voluntarily by the donor, who is the individual gifting the property, and accepted by the recipients, who are the three individuals receiving the gift. The deed contains important information about the property, such as its legal description, address, and any encumbrances. The purpose of a gift deed is to legally and officially transfer the property's ownership to the recipients, providing them with the legal rights and responsibilities associated with the property. This can include the right to occupy, use, sell, or lease the property, as well as the obligation to pay property taxes and maintain the property in proper condition. In Houston, Texas, there are different types of gift deeds, depending on the specific circumstances and intentions of the parties involved. Some common types include: 1. Inter vivos gift deed: This gift deed is executed and becomes effective during the donor's lifetime. It allows for the immediate transfer of property ownership to the recipients. 2. Testamentary gift deed: This gift deed is created within a will and takes effect after the donor's death. It is commonly used when individuals want to transfer property as a gift to multiple recipients upon their demise. 3. Conditional gift deed: This gift deed contains specific conditions or requirements that the recipients must meet in order to receive the property. These conditions could include the completion of certain tasks, such as education or achieving a specific milestone. 4. Joint tenancy gift deed: This gift deed establishes joint ownership of the property between the three individuals. Each recipient holds an equal share and has the right to survivorship, meaning that if one recipient passes away, their interest in the property automatically transfers to the surviving recipients. Overall, a Houston Texas Gift Deed from an Individual to Three Individuals is a legally binding document that allows for the transfer of property ownership as a gift from one individual to three others. It provides a way to formalize the transfer of real estate without any payment in return, ensuring that the recipients have the legal rights and responsibilities associated with the property.Houston Texas Gift Deed from an Individual to Three Individuals is a legal document that transfers the ownership of a property from one individual to three others as a gift. This type of deed is commonly used in Houston, Texas, and serves as a formal and legally binding way of conveying real estate as a gift. The gift deed involves the transfer of the property's ownership rights without any consideration or payment in return. It is typically executed voluntarily by the donor, who is the individual gifting the property, and accepted by the recipients, who are the three individuals receiving the gift. The deed contains important information about the property, such as its legal description, address, and any encumbrances. The purpose of a gift deed is to legally and officially transfer the property's ownership to the recipients, providing them with the legal rights and responsibilities associated with the property. This can include the right to occupy, use, sell, or lease the property, as well as the obligation to pay property taxes and maintain the property in proper condition. In Houston, Texas, there are different types of gift deeds, depending on the specific circumstances and intentions of the parties involved. Some common types include: 1. Inter vivos gift deed: This gift deed is executed and becomes effective during the donor's lifetime. It allows for the immediate transfer of property ownership to the recipients. 2. Testamentary gift deed: This gift deed is created within a will and takes effect after the donor's death. It is commonly used when individuals want to transfer property as a gift to multiple recipients upon their demise. 3. Conditional gift deed: This gift deed contains specific conditions or requirements that the recipients must meet in order to receive the property. These conditions could include the completion of certain tasks, such as education or achieving a specific milestone. 4. Joint tenancy gift deed: This gift deed establishes joint ownership of the property between the three individuals. Each recipient holds an equal share and has the right to survivorship, meaning that if one recipient passes away, their interest in the property automatically transfers to the surviving recipients. Overall, a Houston Texas Gift Deed from an Individual to Three Individuals is a legally binding document that allows for the transfer of property ownership as a gift from one individual to three others. It provides a way to formalize the transfer of real estate without any payment in return, ensuring that the recipients have the legal rights and responsibilities associated with the property.