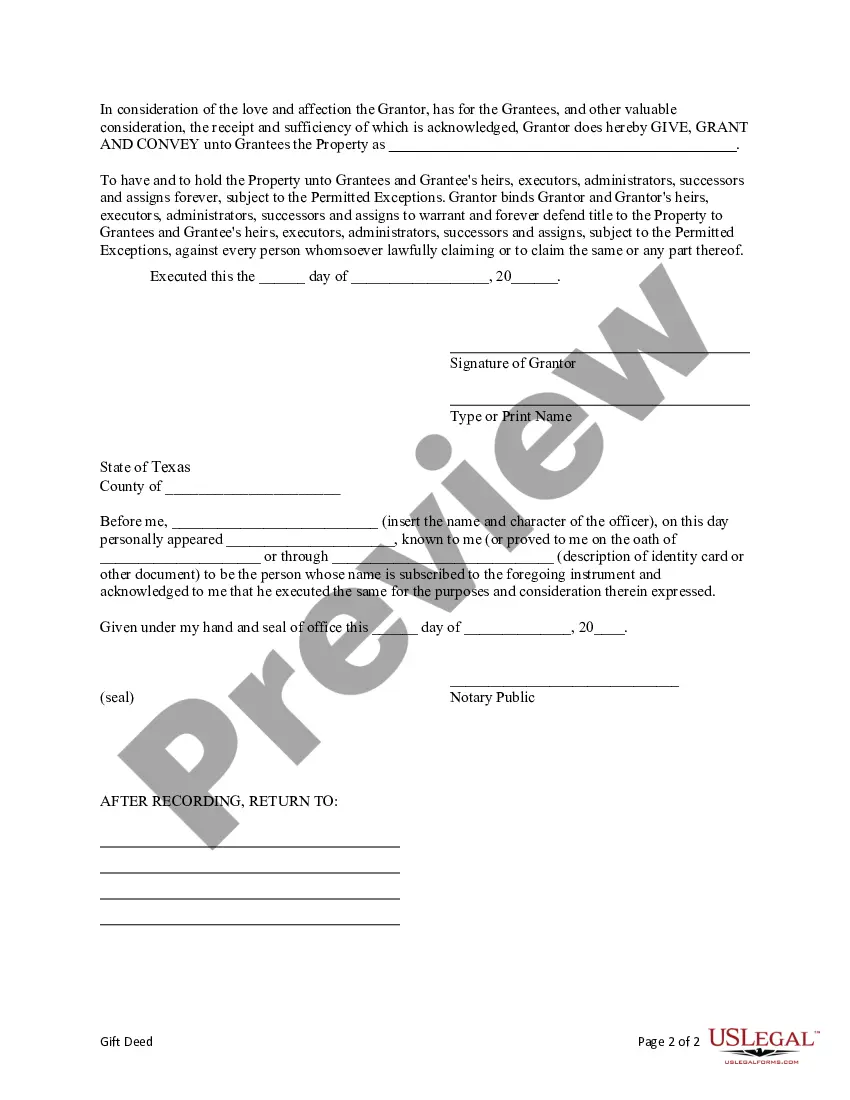

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee are three individuals. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

A Pasadena Texas Gift Deed from an Individual to Three Individuals is a legal document used to transfer ownership of real estate, personal property, or a combination of both, from one individual (the donor) to three other individuals (the recipients) without any monetary exchange or consideration. This type of legal instrument allows the donor to gift their assets to the three specified recipients without any expectation of compensation or payment. The Pasadena Texas Gift Deed from an Individual to Three Individuals is commonly used in situations where the donor wishes to distribute their property or assets to specific individuals, such as family members or close friends, as a gesture of generosity, goodwill, or as part of an estate planning strategy. There are various types of Pasadena Texas Gift Deed from an Individual to Three Individuals that can be utilized, depending on the nature of the assets being transferred: 1. Real Estate Gift Deed: This type of gift deed is used when the donor wishes to gift ownership of a physical property, such as a house, land, or commercial building, to the three recipients. 2. Personal Property Gift Deed: In some cases, the assets being gifted might include movable assets or personal property, such as vehicles, jewelry, artwork, or collectibles. A personal property gift deed outlines the transfer of ownership of these assets to the three individuals. 3. Mixed Gift Deed: This type of gift deed combines both real estate and personal property assets being gifted to the three individuals. It covers the transfer of both immovable and movable assets as specified by the donor. It's essential to ensure that the Pasadena Texas Gift Deed from an Individual to Three Individuals is drafted with careful attention to detail, complying with all relevant legal requirements of the state of Texas. Consulting with a qualified attorney or legal professional is highly recommended ensuring the gift deed accurately reflects the donor's intentions and protects the rights of all parties involved.A Pasadena Texas Gift Deed from an Individual to Three Individuals is a legal document used to transfer ownership of real estate, personal property, or a combination of both, from one individual (the donor) to three other individuals (the recipients) without any monetary exchange or consideration. This type of legal instrument allows the donor to gift their assets to the three specified recipients without any expectation of compensation or payment. The Pasadena Texas Gift Deed from an Individual to Three Individuals is commonly used in situations where the donor wishes to distribute their property or assets to specific individuals, such as family members or close friends, as a gesture of generosity, goodwill, or as part of an estate planning strategy. There are various types of Pasadena Texas Gift Deed from an Individual to Three Individuals that can be utilized, depending on the nature of the assets being transferred: 1. Real Estate Gift Deed: This type of gift deed is used when the donor wishes to gift ownership of a physical property, such as a house, land, or commercial building, to the three recipients. 2. Personal Property Gift Deed: In some cases, the assets being gifted might include movable assets or personal property, such as vehicles, jewelry, artwork, or collectibles. A personal property gift deed outlines the transfer of ownership of these assets to the three individuals. 3. Mixed Gift Deed: This type of gift deed combines both real estate and personal property assets being gifted to the three individuals. It covers the transfer of both immovable and movable assets as specified by the donor. It's essential to ensure that the Pasadena Texas Gift Deed from an Individual to Three Individuals is drafted with careful attention to detail, complying with all relevant legal requirements of the state of Texas. Consulting with a qualified attorney or legal professional is highly recommended ensuring the gift deed accurately reflects the donor's intentions and protects the rights of all parties involved.