This form is a Quitclaim Deed where the Grantor is an individual and the Grantee are three individuals. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

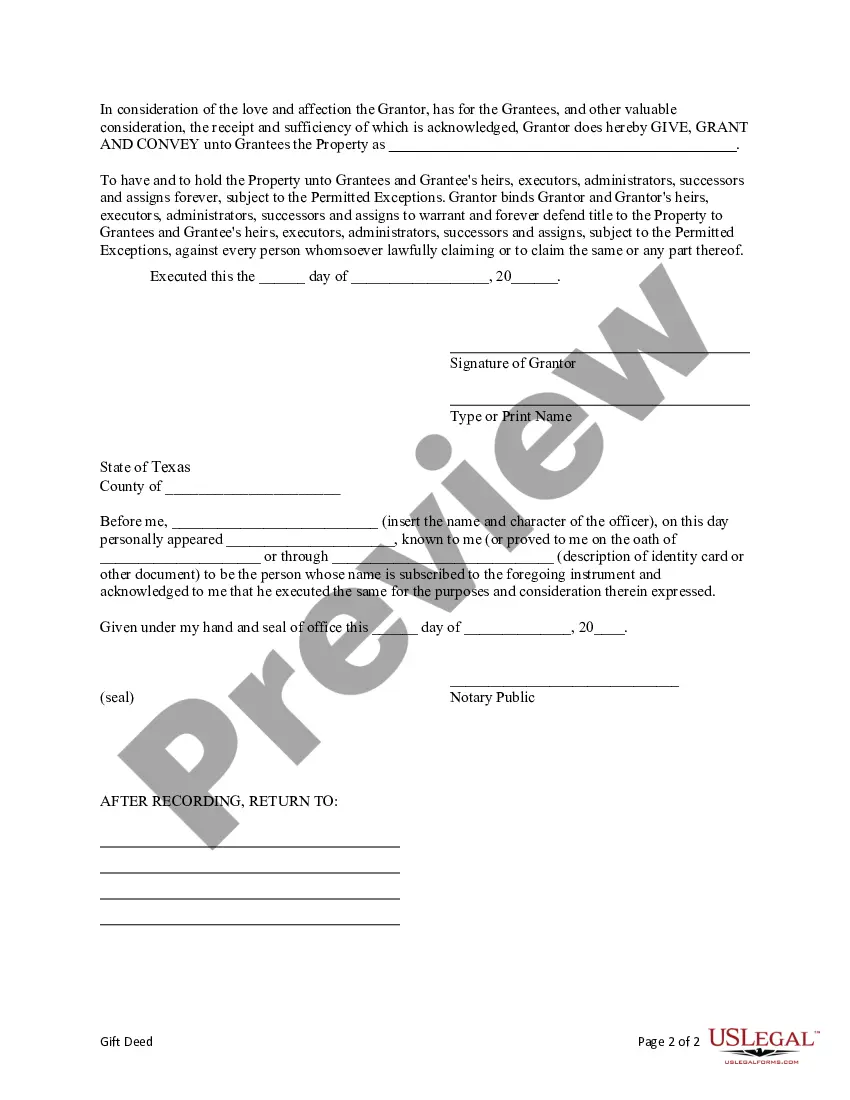

A Sugar Land Texas Gift Deed from an Individual to Three Individuals is a legal document that transfers ownership of a property from one person (the donor) to three individuals (the recipients) as a gift. This type of deed provides an irrevocable transfer of property without any compensation or consideration required from the recipients. Key features of a Sugar Land Texas Gift Deed from an Individual to Three Individuals include: 1. Property Details: The deed will include detailed information about the property being transferred, such as the legal description, address, and tax identification number. 2. Donor Details: The donor's full name, contact information, and legal capacity to transfer the property will be mentioned. 3. Recipient Details: The names, addresses, and contact information of the three individuals receiving the gift will be specified. 4. Granting Clause: This clause signifies the donor's intent to transfer the property as a gift, stating that the donor has full authority to gift the property and is doing so without any consideration. 5. Conveyance Clause: This clause confirms that the donor grants, bargains, and sells the property to the recipients as a gift, with the intent to transfer complete ownership and possession. 6. Legal Description: A detailed description of the property, including boundary lines, acreage, and any relevant easements or encumbrances, will be included. 7. Consideration Statement: A gift deed does not involve monetary consideration, but it typically mentions a nominal amount like "one dollar" for legal purposes. 8. Delivery and Acceptance: It is important to specify that the gift deed is delivered and accepted by all parties involved, ensuring the intent for effective transfer. 9. Signatures and Witnesses: The donor and all three recipients must sign the gift deed in the presence of at least two disinterested witnesses who will also sign the document. 10. Recording: It is recommended to record the gift deed with the county recorder's office in Sugar Land, Texas, to provide notice to the public of the transfer and establish a chain of title. Different types of Sugar Land Texas Gift Deed from an Individual to Three Individuals may have additional variations depending on specific circumstances. These may include: — Joint Tenancy: The recipients may hold the property as joint tenants or tenants in common, with or without right of survivorship. — Life Estate: The donor may retain a life estate, allowing them to live on the property until their death while granting ownership to the three individuals after. — Trusts: The gift deed can be combined with a trust agreement, allowing the donor to transfer the property into a trust for the three individuals' future benefit. — Specific Conditions: The gift deed may include specific conditions or restrictions on the use of the property by the recipients, such as prohibiting certain activities or requiring maintenance obligations. It is crucial for all parties involved to consult with a qualified real estate attorney while drafting and executing a Sugar Land Texas Gift Deed from an Individual to Three Individuals to ensure compliance with applicable laws and to protect all parties' rights.A Sugar Land Texas Gift Deed from an Individual to Three Individuals is a legal document that transfers ownership of a property from one person (the donor) to three individuals (the recipients) as a gift. This type of deed provides an irrevocable transfer of property without any compensation or consideration required from the recipients. Key features of a Sugar Land Texas Gift Deed from an Individual to Three Individuals include: 1. Property Details: The deed will include detailed information about the property being transferred, such as the legal description, address, and tax identification number. 2. Donor Details: The donor's full name, contact information, and legal capacity to transfer the property will be mentioned. 3. Recipient Details: The names, addresses, and contact information of the three individuals receiving the gift will be specified. 4. Granting Clause: This clause signifies the donor's intent to transfer the property as a gift, stating that the donor has full authority to gift the property and is doing so without any consideration. 5. Conveyance Clause: This clause confirms that the donor grants, bargains, and sells the property to the recipients as a gift, with the intent to transfer complete ownership and possession. 6. Legal Description: A detailed description of the property, including boundary lines, acreage, and any relevant easements or encumbrances, will be included. 7. Consideration Statement: A gift deed does not involve monetary consideration, but it typically mentions a nominal amount like "one dollar" for legal purposes. 8. Delivery and Acceptance: It is important to specify that the gift deed is delivered and accepted by all parties involved, ensuring the intent for effective transfer. 9. Signatures and Witnesses: The donor and all three recipients must sign the gift deed in the presence of at least two disinterested witnesses who will also sign the document. 10. Recording: It is recommended to record the gift deed with the county recorder's office in Sugar Land, Texas, to provide notice to the public of the transfer and establish a chain of title. Different types of Sugar Land Texas Gift Deed from an Individual to Three Individuals may have additional variations depending on specific circumstances. These may include: — Joint Tenancy: The recipients may hold the property as joint tenants or tenants in common, with or without right of survivorship. — Life Estate: The donor may retain a life estate, allowing them to live on the property until their death while granting ownership to the three individuals after. — Trusts: The gift deed can be combined with a trust agreement, allowing the donor to transfer the property into a trust for the three individuals' future benefit. — Specific Conditions: The gift deed may include specific conditions or restrictions on the use of the property by the recipients, such as prohibiting certain activities or requiring maintenance obligations. It is crucial for all parties involved to consult with a qualified real estate attorney while drafting and executing a Sugar Land Texas Gift Deed from an Individual to Three Individuals to ensure compliance with applicable laws and to protect all parties' rights.