This form is a Quitclaim Deed where the Grantor is an individual and the Grantee are three individuals. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

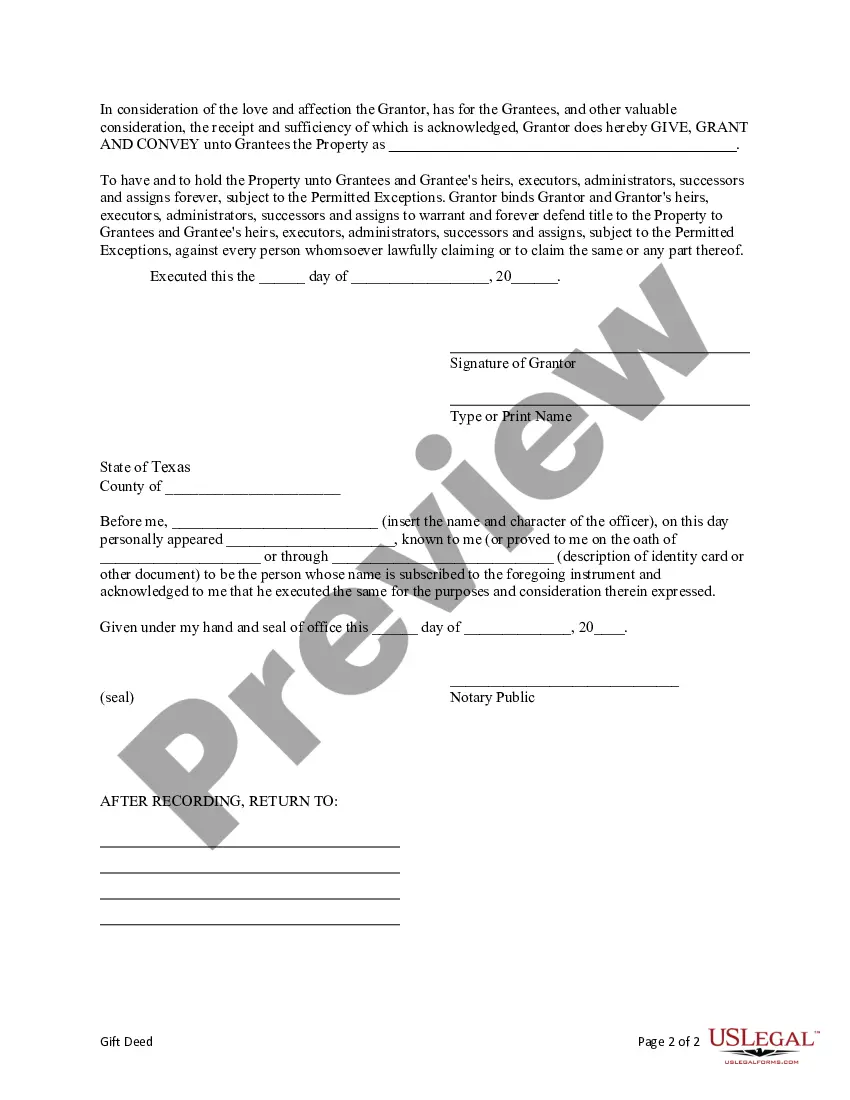

A Tarrant Texas Gift Deed from an Individual to Three Individuals is a legal document that transfers ownership of a property or real estate from one person (the donor) to three other individuals (the done BS) as a gift, with no consideration or payment involved. This type of deed is commonly used when someone wishes to pass on their property to multiple recipients, such as family members, friends, or beneficiaries, while they are still alive. The Tarrant Texas Gift Deed from an Individual to Three Individuals contains several essential elements, including the names and addresses of the donor and the three recipients, a detailed description of the property being gifted, and the date of the transfer. It also states that the transfer is being made as a gift and that no payment is required or expected from the three individuals who receive the property. By executing this gift deed, the donor relinquishes all rights and interests in the property and transfers complete ownership and possession to the three individuals simultaneously. As a gift transaction, it is crucial to note that the three individuals receiving the property may become responsible for any future taxes, liens, or maintenance fees associated with the property. There might be different variations of the Tarrant Texas Gift Deed from an Individual to Three Individuals depending on specific circumstances or requirements. Some possible types of gift deeds within the Tarrant Texas jurisdiction could include: 1. Tarrant Texas Gift Deed with Reservation of a Life Estate: This variation allows the donor to retain a life estate in the property, meaning they can live on or use the property until their death. After their passing, the ownership automatically transfers to the three individuals. 2. Tarrant Texas Gift Deed with Conditions or Restrictions: This type of gift deed may involve certain conditions or restrictions imposed by the donor. For example, the donor might require the three individuals to maintain the property's historical appearance or use it only for specific purposes. 3. Conditional Life Estate Tarrant Texas Gift Deed: In this variation, the donor can gift the property to three individuals but with specific conditions or limitations on how and when they can use or transfer the property. The conditions may involve restrictions on selling, leasing, or transferring ownership. It is crucial to consult with a qualified real estate attorney or legal professional when considering a Tarrant Texas Gift Deed from an Individual to Three Individuals, as each case may have unique characteristics and legal implications.A Tarrant Texas Gift Deed from an Individual to Three Individuals is a legal document that transfers ownership of a property or real estate from one person (the donor) to three other individuals (the done BS) as a gift, with no consideration or payment involved. This type of deed is commonly used when someone wishes to pass on their property to multiple recipients, such as family members, friends, or beneficiaries, while they are still alive. The Tarrant Texas Gift Deed from an Individual to Three Individuals contains several essential elements, including the names and addresses of the donor and the three recipients, a detailed description of the property being gifted, and the date of the transfer. It also states that the transfer is being made as a gift and that no payment is required or expected from the three individuals who receive the property. By executing this gift deed, the donor relinquishes all rights and interests in the property and transfers complete ownership and possession to the three individuals simultaneously. As a gift transaction, it is crucial to note that the three individuals receiving the property may become responsible for any future taxes, liens, or maintenance fees associated with the property. There might be different variations of the Tarrant Texas Gift Deed from an Individual to Three Individuals depending on specific circumstances or requirements. Some possible types of gift deeds within the Tarrant Texas jurisdiction could include: 1. Tarrant Texas Gift Deed with Reservation of a Life Estate: This variation allows the donor to retain a life estate in the property, meaning they can live on or use the property until their death. After their passing, the ownership automatically transfers to the three individuals. 2. Tarrant Texas Gift Deed with Conditions or Restrictions: This type of gift deed may involve certain conditions or restrictions imposed by the donor. For example, the donor might require the three individuals to maintain the property's historical appearance or use it only for specific purposes. 3. Conditional Life Estate Tarrant Texas Gift Deed: In this variation, the donor can gift the property to three individuals but with specific conditions or limitations on how and when they can use or transfer the property. The conditions may involve restrictions on selling, leasing, or transferring ownership. It is crucial to consult with a qualified real estate attorney or legal professional when considering a Tarrant Texas Gift Deed from an Individual to Three Individuals, as each case may have unique characteristics and legal implications.