This form is a Quitclaim Deed where the Grantor is an individual and the Grantee are three individuals. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

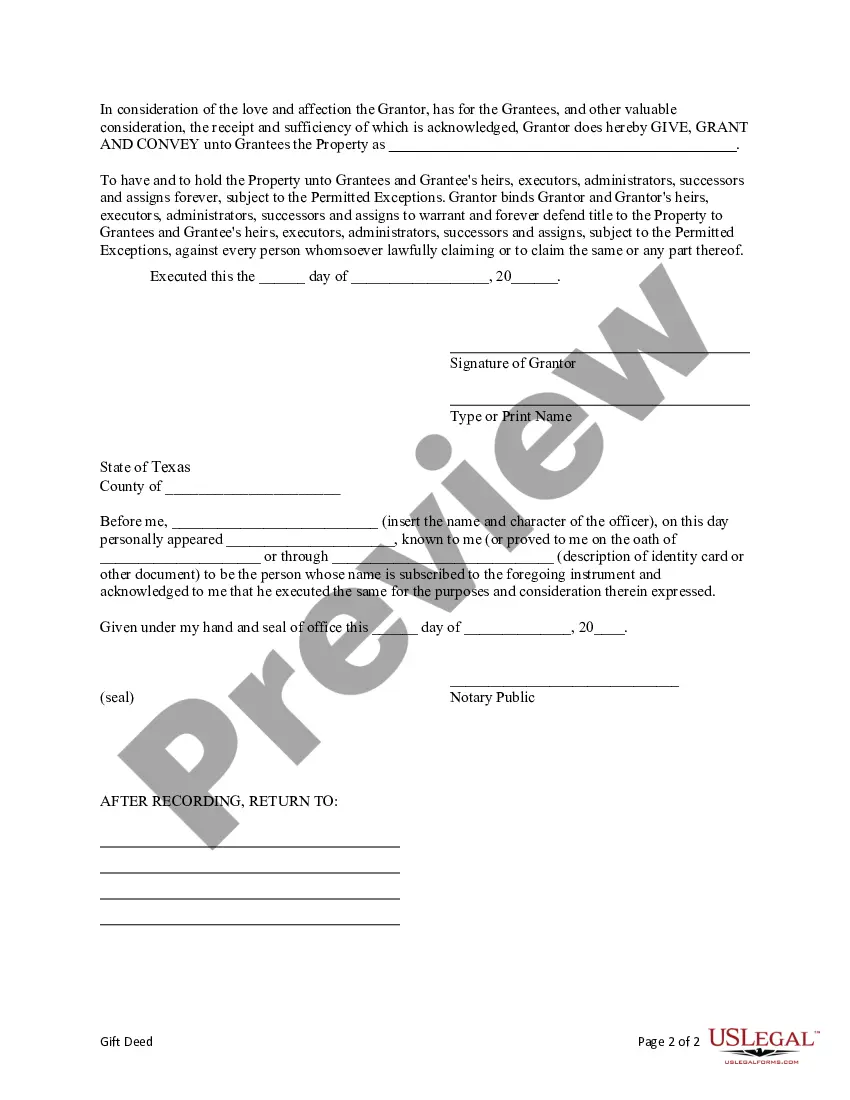

A Waco Texas Gift Deed from an Individual to Three Individuals is a legal document that transfers ownership of a property from one person (the granter) to three specific individuals (the grantees), as a gift. This type of deed is commonly used when someone wishes to gift real estate or other property outright to multiple recipients. The Waco Texas Gift Deed outlines the details of the transaction, identifying the granter and grantees by their legal names and addresses, as well as providing a clear description of the property being gifted. This description typically includes the address, lot or parcel number, and any relevant boundaries or landmarks. The deed also contains specific language indicating that the transfer of ownership is being executed as a gift, with no consideration or payment required from the grantees. This distinguishes it from other types of deeds used in real estate transactions, such as warranty deeds or quitclaim deeds. Different types of Waco Texas Gift Deeds from an Individual to Three Individuals may include: 1. Residential Gift Deed: This type of gift deed transfers ownership of a residential property, such as a house, condo, or townhouse, from the granter to three grantees. It is commonly used when a family member or friend wants to gift their home to multiple individuals. 2. Vacant Land Gift Deed: This type of gift deed transfers ownership of a piece of undeveloped land from the granter to three grantees. It can be used for gifting land for various purposes, such as recreational use, farming, or future development. 3. Commercial Property Gift Deed: This type of gift deed transfers ownership of a commercial property, such as a retail store, office building, or warehouse, from the granter to three grantees. This can be used when a business owner wants to gift their property to multiple successors or partners. In all cases, it is important to consult with a qualified real estate attorney or legal professional to ensure the gift deed is properly drafted, executed, and recorded according to Waco Texas and state laws. This will help protect the interests and rights of all parties involved in the gift transaction.