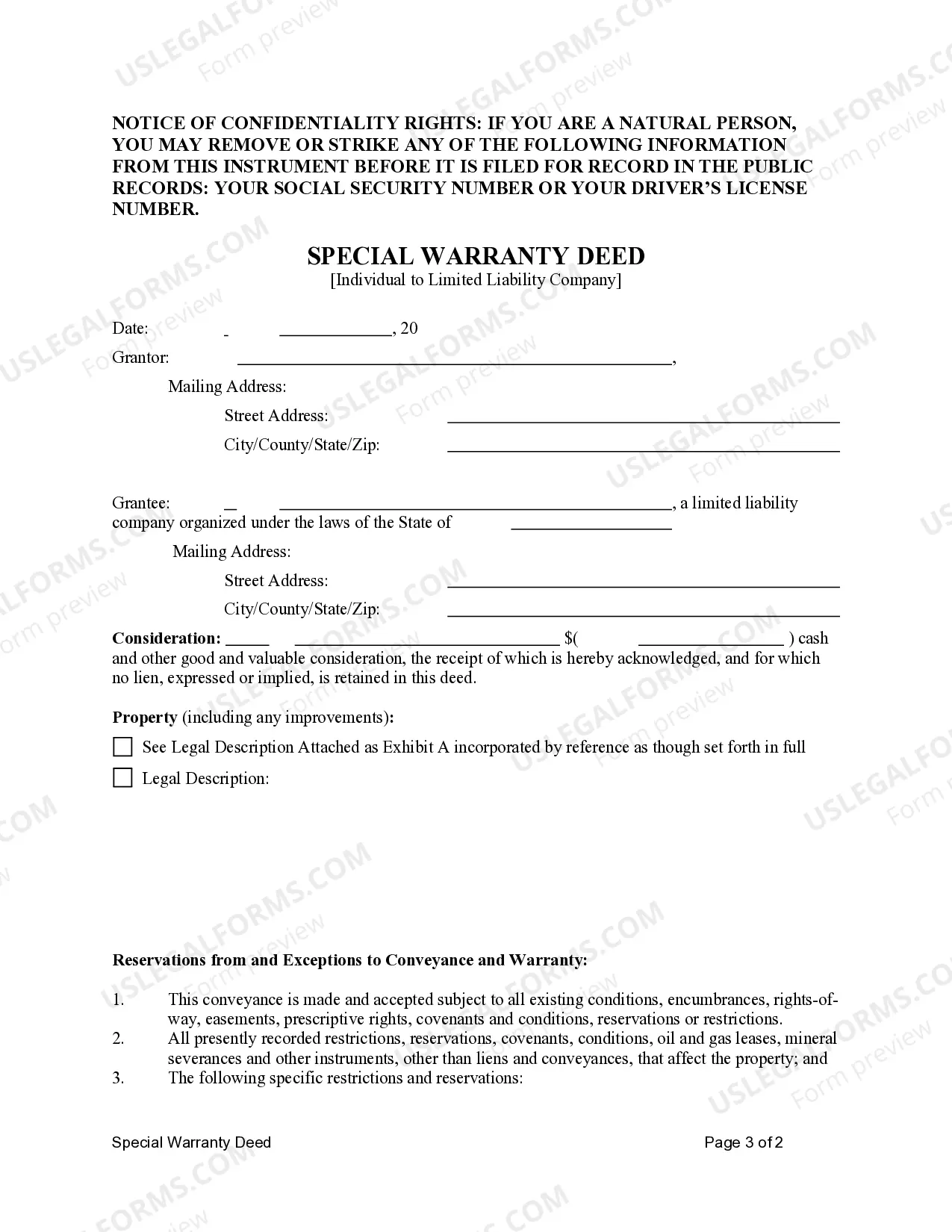

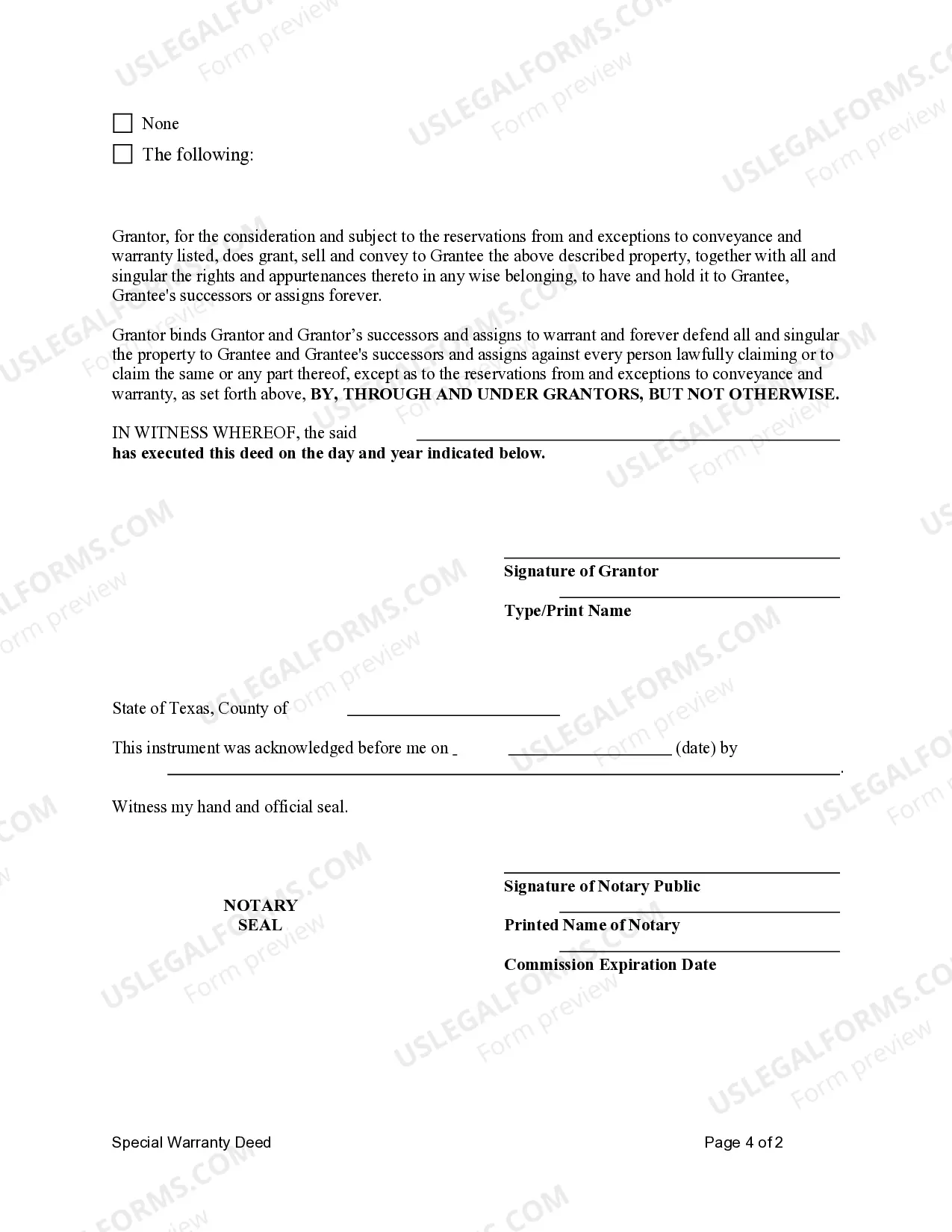

This form is a Special Warranty Deed where the Grantor is an individual and the Grantee is a limited liability company. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

A Special Warranty Deed is a legal document used in real estate transactions to transfer ownership of a property from an individual to a Limited Liability Company (LLC) in Austin, Texas. This type of deed provides specific assurances about the title of the property being transferred. The Special Warranty Deed — Individual to LLC in Austin, Texas is specifically designed for situations where an individual owner wishes to transfer their property to an LLC entity. This may occur for various reasons, such as asset protection, tax benefits, or business purposes. The deed contains essential information about the property, including its legal description, boundaries, and identification number. It identifies the granter (individual owner) and the grantee (LLC). The deed also states the consideration, or purchase price, paid for the property. The Special Warranty Deed provides limited warranties of title, meaning that the granter guarantees that they have not done anything to impair the title to the property during their period of ownership. It implies that the granter has not encumbered the property or allowed any liens or claims against it (except as otherwise stated in the deed). There are different types of Special Warranty Deeds — Individual to LLC, depending on the specific circumstances of the transfer. Some common variations include: 1. Special Warranty Deed with LLC Formation: This type of deed may be used when an individual simultaneously establishes an LLC and transfers the property into the newly formed entity. It may include additional language recognizing the creation and purpose of the LLC. 2. Special Warranty Deed — Asset Protection: Here, the individual transfers their property to an existing LLC primarily for asset protection purposes. The deed may contain provisions specifying the LLC's liability shield, ensuring that personal assets remain separate and protected from potential property-related legal issues. 3. Special Warranty Deed — Tax Efficiency: This variation is utilized when an individual wants to place their property under an LLC for tax benefits, such as the ability to deduct property-related expenses or depreciation. The deed may include certain tax-related provisions or be accompanied by additional tax-related documents. It's important to note that the specific language and provisions included in an Austin Texas Special Warranty Deed — Individual to LLC can vary based on the preferences of the parties involved, legal requirements, and individual circumstances. It is always recommended consulting with a qualified real estate attorney or legal professional when drafting or executing such a deed to ensure compliance with the applicable laws and regulations.A Special Warranty Deed is a legal document used in real estate transactions to transfer ownership of a property from an individual to a Limited Liability Company (LLC) in Austin, Texas. This type of deed provides specific assurances about the title of the property being transferred. The Special Warranty Deed — Individual to LLC in Austin, Texas is specifically designed for situations where an individual owner wishes to transfer their property to an LLC entity. This may occur for various reasons, such as asset protection, tax benefits, or business purposes. The deed contains essential information about the property, including its legal description, boundaries, and identification number. It identifies the granter (individual owner) and the grantee (LLC). The deed also states the consideration, or purchase price, paid for the property. The Special Warranty Deed provides limited warranties of title, meaning that the granter guarantees that they have not done anything to impair the title to the property during their period of ownership. It implies that the granter has not encumbered the property or allowed any liens or claims against it (except as otherwise stated in the deed). There are different types of Special Warranty Deeds — Individual to LLC, depending on the specific circumstances of the transfer. Some common variations include: 1. Special Warranty Deed with LLC Formation: This type of deed may be used when an individual simultaneously establishes an LLC and transfers the property into the newly formed entity. It may include additional language recognizing the creation and purpose of the LLC. 2. Special Warranty Deed — Asset Protection: Here, the individual transfers their property to an existing LLC primarily for asset protection purposes. The deed may contain provisions specifying the LLC's liability shield, ensuring that personal assets remain separate and protected from potential property-related legal issues. 3. Special Warranty Deed — Tax Efficiency: This variation is utilized when an individual wants to place their property under an LLC for tax benefits, such as the ability to deduct property-related expenses or depreciation. The deed may include certain tax-related provisions or be accompanied by additional tax-related documents. It's important to note that the specific language and provisions included in an Austin Texas Special Warranty Deed — Individual to LLC can vary based on the preferences of the parties involved, legal requirements, and individual circumstances. It is always recommended consulting with a qualified real estate attorney or legal professional when drafting or executing such a deed to ensure compliance with the applicable laws and regulations.