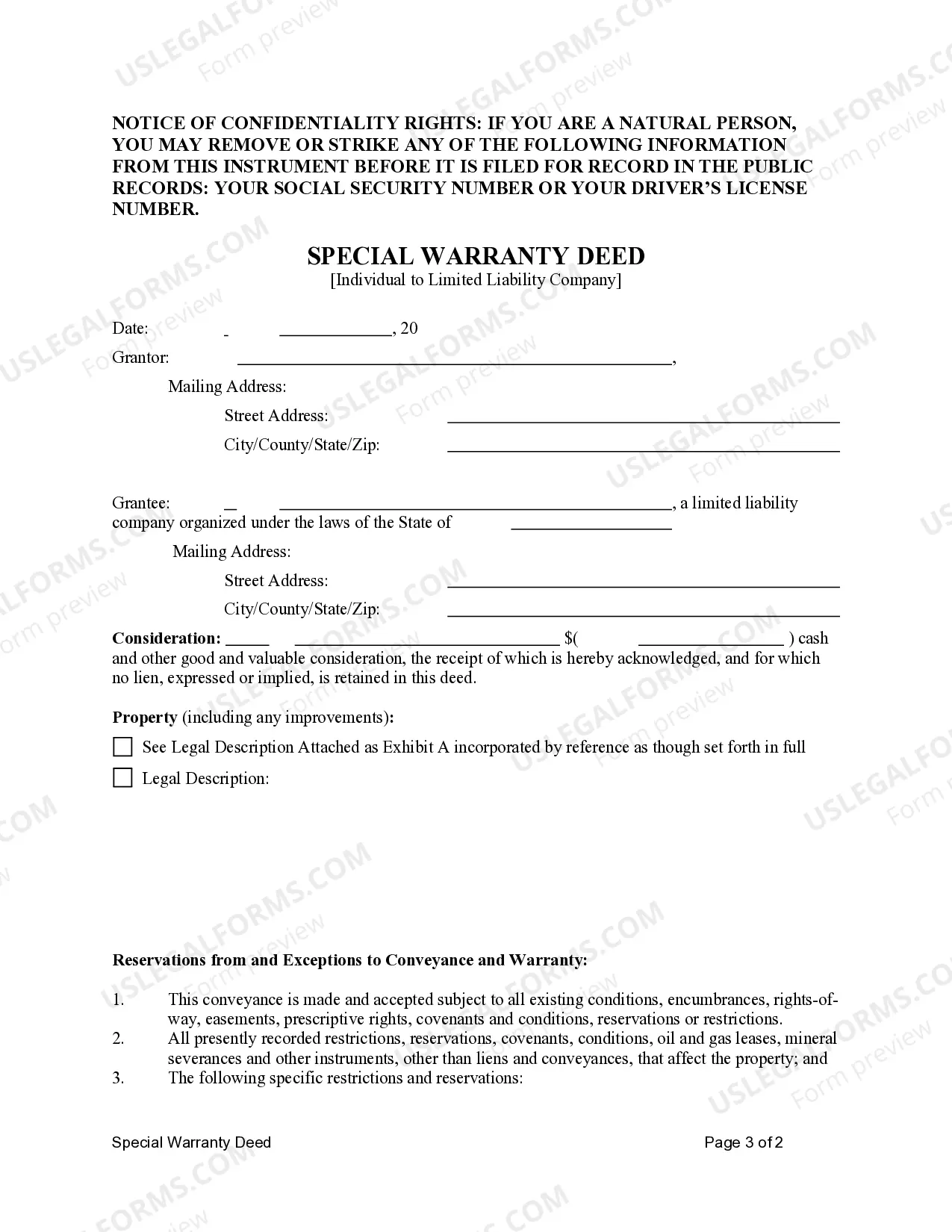

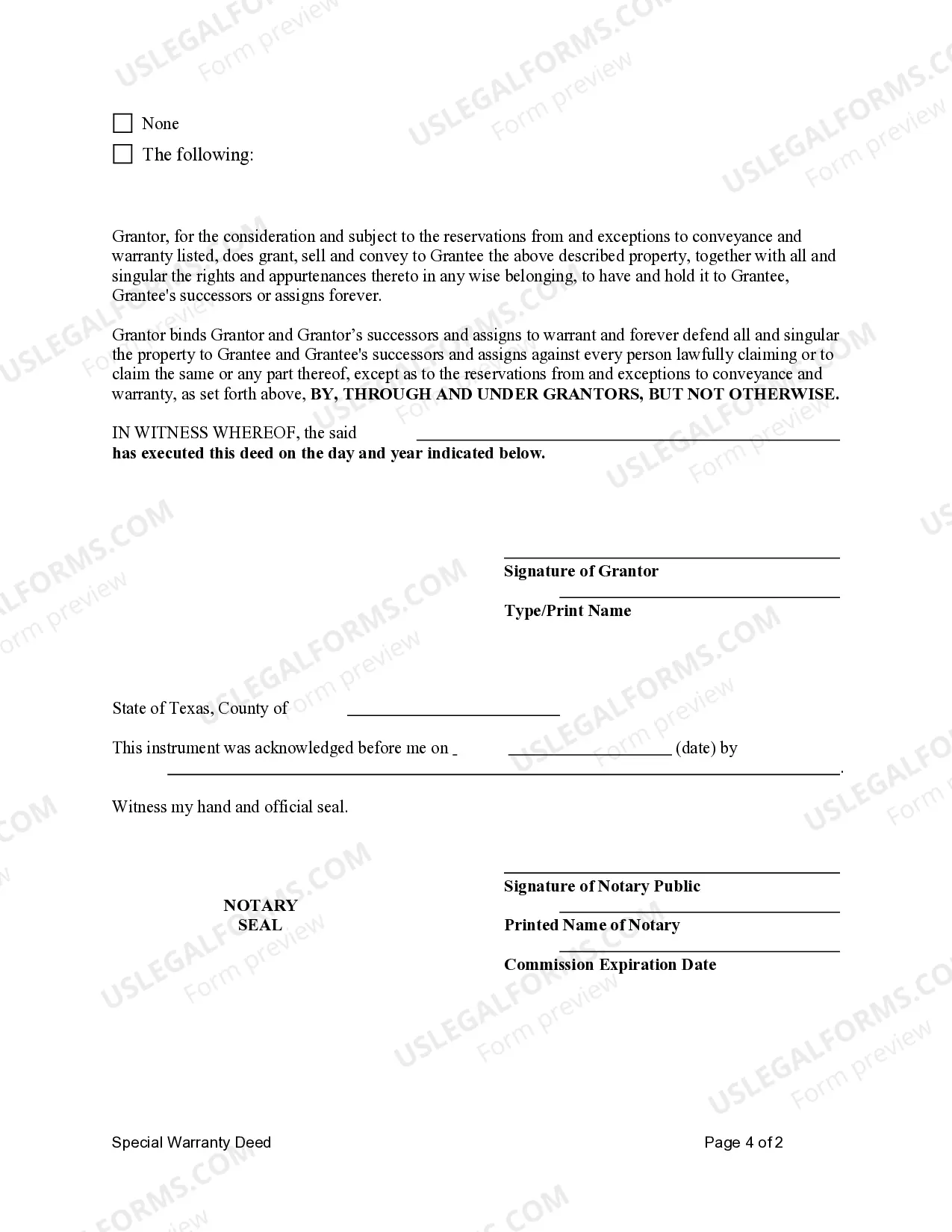

This form is a Special Warranty Deed where the Grantor is an individual and the Grantee is a limited liability company. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

A Travis Texas Special Warranty Deed — Individual to LLC is a legal document used to transfer ownership of real estate from an individual to a limited liability company (LLC) located in Travis County, Texas. This type of deed provides a limited warranty as to the title, meaning the granter guarantees that they have not done anything to impair the title during their ownership, but they do not guarantee against any defects or claims that existed prior to their ownership. The Travis Texas Special Warranty Deed — Individual to LLC is commonly used in real estate transactions where an individual wishes to transfer property into an LLC for various reasons such as asset protection, tax benefits, or business purposes. It allows for a smooth transition of ownership while ensuring the grantee, in this case, the LLC, receives the property with certain protections regarding the title. There are no specific variations of the Travis Texas Special Warranty Deed — Individual to LLC in terms of different types. However, it is essential to note that the specific terms and conditions within the deed may vary depending on the agreement between the individual granter and the LLC grantee. These terms may include details such as the property description, purchase price or consideration, any encumbrances or liens on the property, and any additional clauses or provisions agreed upon by both parties. In summary, the Travis Texas Special Warranty Deed — Individual to LLC is a legal document used to transfer real estate ownership from an individual to an LLC in Travis County, Texas. It provides a limited warranty as to the title and allows for the smooth transfer of property while safeguarding the interests of the granter and grantee.