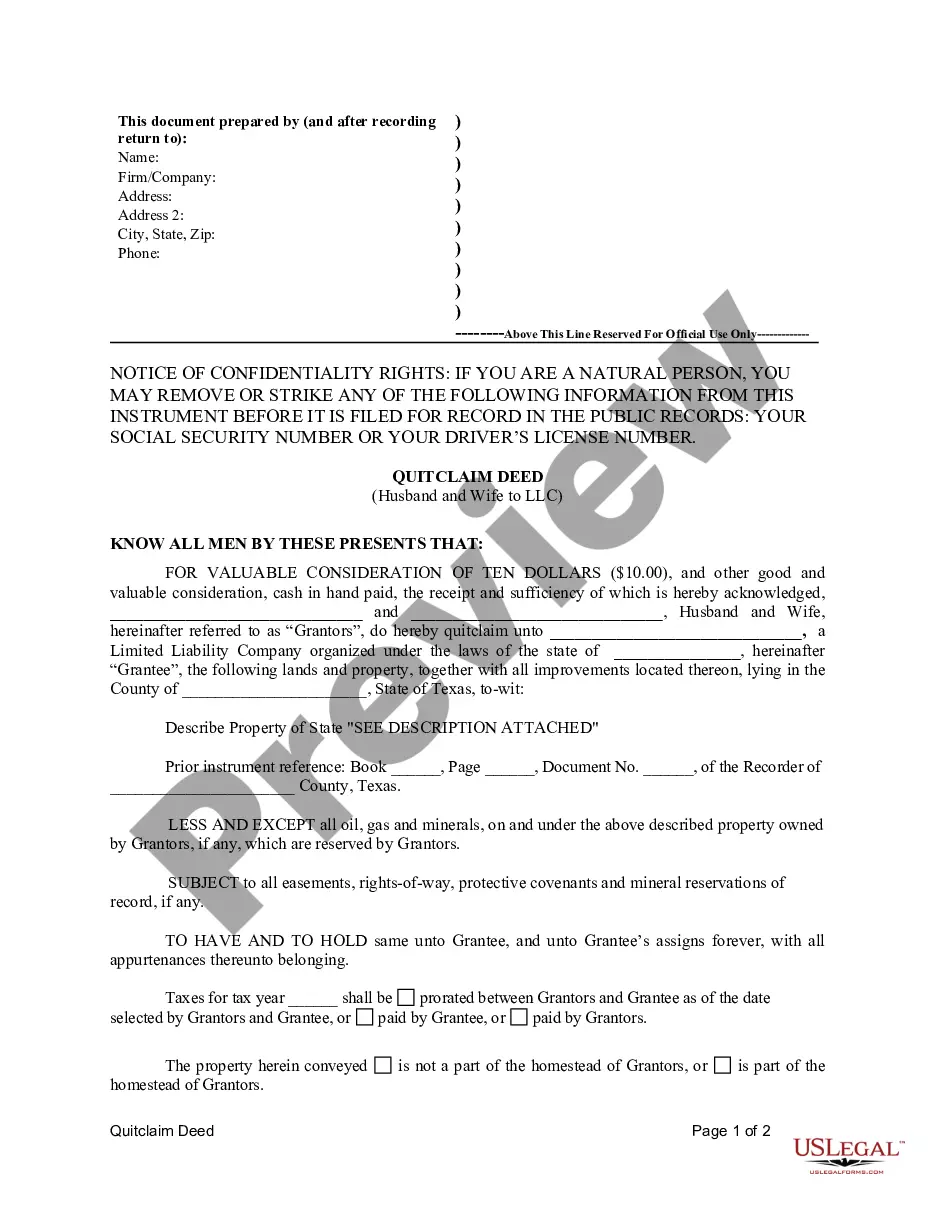

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

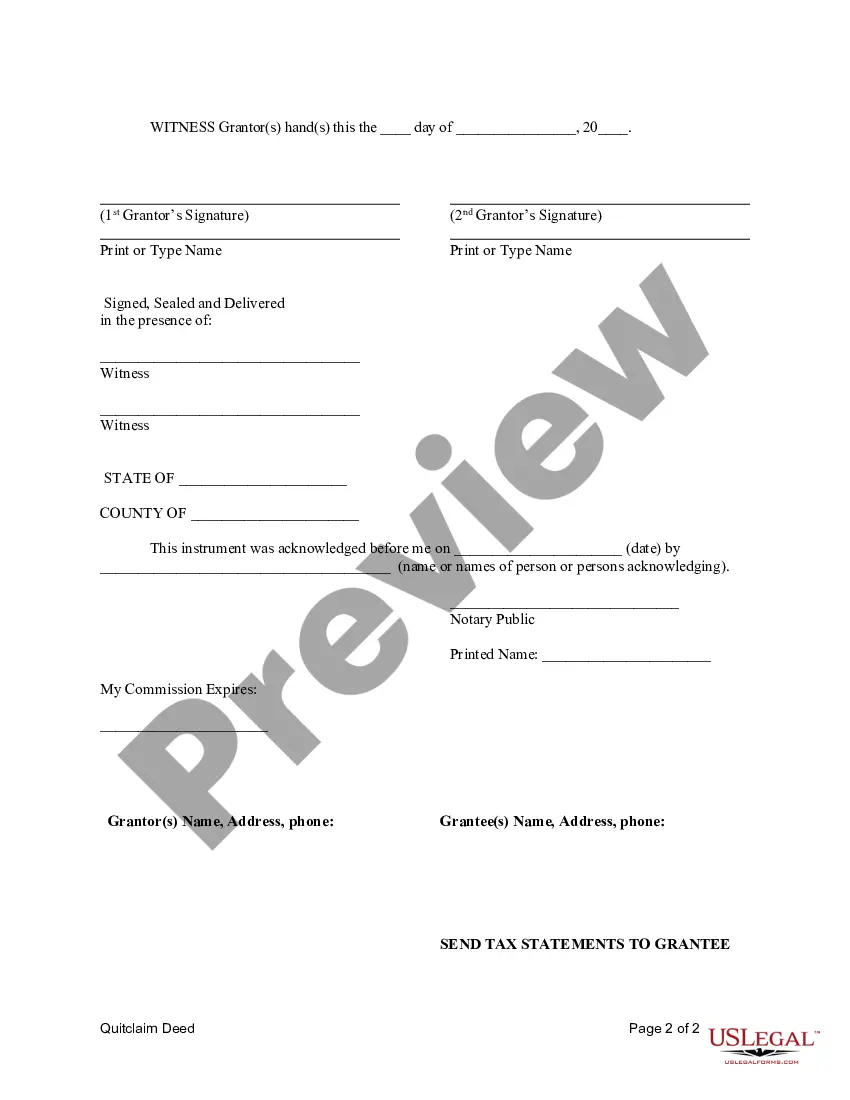

A Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real estate from a married couple to a limited liability company (LLC) in Austin, Texas. This type of deed is an important tool for asset protection, tax planning, and business purposes. The Quitclaim Deed serves as a legally binding contract and essentially "quits" or relinquishes any present and future rights that the husband and wife hold over the property. By transferring ownership to an LLC, the couple transfers the property to a separate legal entity, providing liability protection and separating personal assets from business assets. There are different types of Quitclaim Deeds from Husband and Wife to LLC that may be used depending on the specific circumstances. Some common types include: 1. General Quitclaim Deed: This type of deed transfers the property without any warranty or guarantee of the title's validity. It simply conveys all rights, interests, and claims that the couple has to the LLC. 2. Special Warranty Quitclaim Deed: This type of deed offers limited protection to the LLC. It guarantees that the husband and wife have not done anything to harm the title during their ownership period. 3. Limited Warranty Quitclaim Deed: Similar to the special warranty deed, this type of deed guarantees that the husband and wife have not caused any harm to the title, but it covers a more specific time frame or situation. Each type of deed has its own advantages and risks, so it is crucial to consult with a qualified real estate attorney or professional before deciding which type of Quitclaim Deed is most appropriate for the transfer. To execute the Austin Texas Quitclaim Deed from Husband and Wife to LLC, the couple must follow certain steps. First, they must draft the Quitclaim Deed using the correct legal language, which includes the description of the property being transferred, the names of the husband and wife, and the name of the LLC as the grantee. The deed must then be signed by both the husband and wife in the presence of a notary public. After the signing, the deed should be recorded with the Travis County Clerk's Office to make it part of the official public record. In summary, an Austin Texas Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real estate from a married couple to an LLC, providing asset protection, tax planning, and separation of personal and business assets. Different types of Quitclaim Deeds, such as general, special warranty, and limited warranty, may be used depending on the specific circumstances of the transfer. Consultation with a legal professional is recommended to ensure compliance with relevant laws and to determine the most suitable type of deed for the situation.A Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real estate from a married couple to a limited liability company (LLC) in Austin, Texas. This type of deed is an important tool for asset protection, tax planning, and business purposes. The Quitclaim Deed serves as a legally binding contract and essentially "quits" or relinquishes any present and future rights that the husband and wife hold over the property. By transferring ownership to an LLC, the couple transfers the property to a separate legal entity, providing liability protection and separating personal assets from business assets. There are different types of Quitclaim Deeds from Husband and Wife to LLC that may be used depending on the specific circumstances. Some common types include: 1. General Quitclaim Deed: This type of deed transfers the property without any warranty or guarantee of the title's validity. It simply conveys all rights, interests, and claims that the couple has to the LLC. 2. Special Warranty Quitclaim Deed: This type of deed offers limited protection to the LLC. It guarantees that the husband and wife have not done anything to harm the title during their ownership period. 3. Limited Warranty Quitclaim Deed: Similar to the special warranty deed, this type of deed guarantees that the husband and wife have not caused any harm to the title, but it covers a more specific time frame or situation. Each type of deed has its own advantages and risks, so it is crucial to consult with a qualified real estate attorney or professional before deciding which type of Quitclaim Deed is most appropriate for the transfer. To execute the Austin Texas Quitclaim Deed from Husband and Wife to LLC, the couple must follow certain steps. First, they must draft the Quitclaim Deed using the correct legal language, which includes the description of the property being transferred, the names of the husband and wife, and the name of the LLC as the grantee. The deed must then be signed by both the husband and wife in the presence of a notary public. After the signing, the deed should be recorded with the Travis County Clerk's Office to make it part of the official public record. In summary, an Austin Texas Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real estate from a married couple to an LLC, providing asset protection, tax planning, and separation of personal and business assets. Different types of Quitclaim Deeds, such as general, special warranty, and limited warranty, may be used depending on the specific circumstances of the transfer. Consultation with a legal professional is recommended to ensure compliance with relevant laws and to determine the most suitable type of deed for the situation.