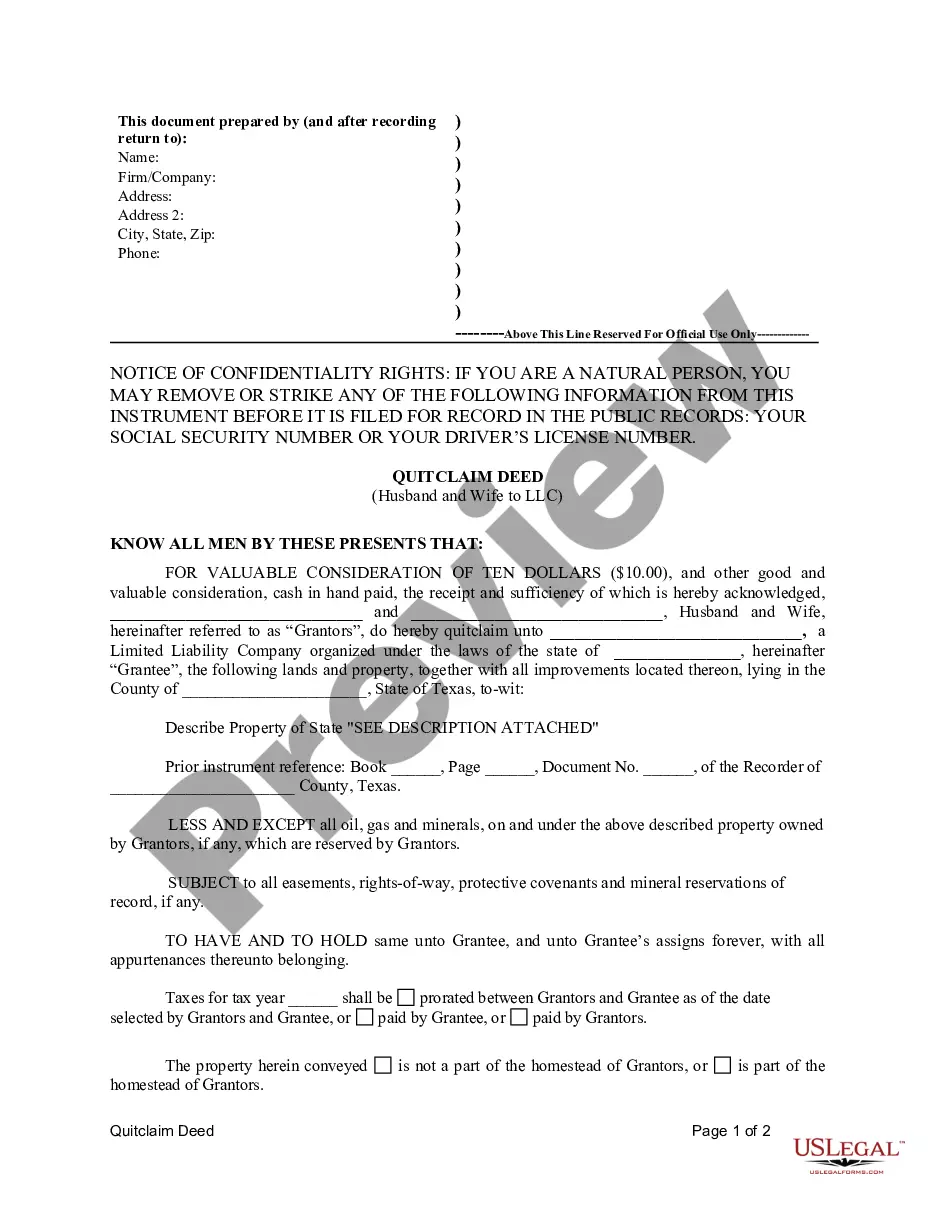

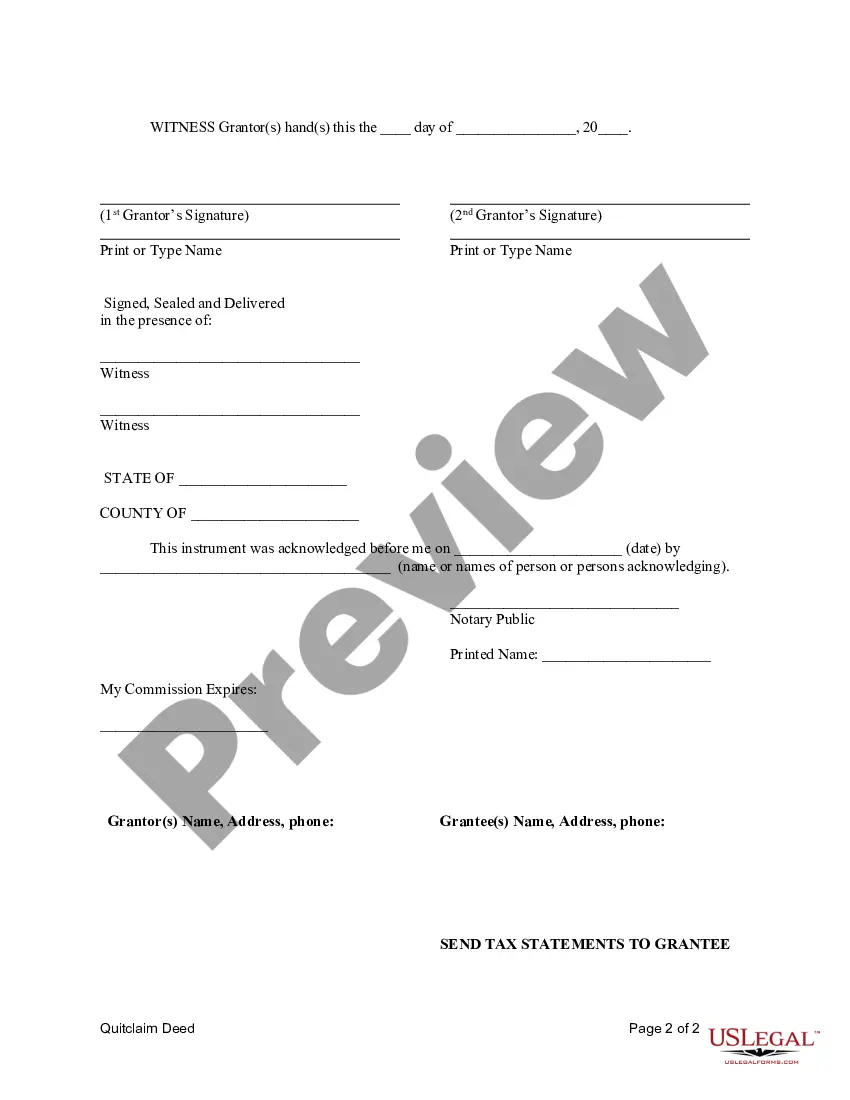

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Bexar Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of real property from a married couple (husband and wife) to a limited liability company (LLC). This type of deed is commonly used when a husband and wife decide to transfer their property to an LLC for various reasons, including asset protection, estate planning, or business purposes. The Bexar Texas Quitclaim Deed from Husband and Wife to LLC is a straightforward way for the couple to transfer their interest in the property to the LLC without making any warranties or guarantees about the property's title or condition. It is essential to consult with a real estate attorney or professional to ensure all legal requirements are met during the transfer. Specific types or variations of Bexar Texas Quitclaim Deed from Husband and Wife to LLC may include: 1. Traditional Quitclaim Deed: This type of quitclaim deed transfers the property ownership from the husband and wife to the LLC with no guarantees or warranties about the property's title. It merely conveys whatever interest the couple has in the property. 2. Enhanced Quitclaim Deed: This variation of the quitclaim deed may include additional provisions or clauses to enhance the level of protection for the LLC. These provisions may address issues such as potential claims, liens, or encumbrances against the property that may affect the LLC's ownership. 3. LLC Operating Agreement Integration: Some Bexar Texas Quitclaim Deeds from Husband and Wife to LLC may integrate clauses or references to the company's operating agreement. This integration ensures that the property's transfer aligns with the LLC's internal structure and guidelines. 4. Business Asset Transfer: In cases where the husband and wife's property is a business asset, this type of quitclaim deed facilitates the transfer of ownership to the LLC, ensuring all legal requirements are met. In summary, a Bexar Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers property ownership from a married couple to an LLC. It provides a convenient method for transferring ownership while limiting the warranties from the transferors. Different variations of this deed may exist, addressing specific concerns or integrating additional provisions to protect the LLC's interests. Seek professional advice to ensure all legal requirements are met during the transfer process.A Bexar Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of real property from a married couple (husband and wife) to a limited liability company (LLC). This type of deed is commonly used when a husband and wife decide to transfer their property to an LLC for various reasons, including asset protection, estate planning, or business purposes. The Bexar Texas Quitclaim Deed from Husband and Wife to LLC is a straightforward way for the couple to transfer their interest in the property to the LLC without making any warranties or guarantees about the property's title or condition. It is essential to consult with a real estate attorney or professional to ensure all legal requirements are met during the transfer. Specific types or variations of Bexar Texas Quitclaim Deed from Husband and Wife to LLC may include: 1. Traditional Quitclaim Deed: This type of quitclaim deed transfers the property ownership from the husband and wife to the LLC with no guarantees or warranties about the property's title. It merely conveys whatever interest the couple has in the property. 2. Enhanced Quitclaim Deed: This variation of the quitclaim deed may include additional provisions or clauses to enhance the level of protection for the LLC. These provisions may address issues such as potential claims, liens, or encumbrances against the property that may affect the LLC's ownership. 3. LLC Operating Agreement Integration: Some Bexar Texas Quitclaim Deeds from Husband and Wife to LLC may integrate clauses or references to the company's operating agreement. This integration ensures that the property's transfer aligns with the LLC's internal structure and guidelines. 4. Business Asset Transfer: In cases where the husband and wife's property is a business asset, this type of quitclaim deed facilitates the transfer of ownership to the LLC, ensuring all legal requirements are met. In summary, a Bexar Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers property ownership from a married couple to an LLC. It provides a convenient method for transferring ownership while limiting the warranties from the transferors. Different variations of this deed may exist, addressing specific concerns or integrating additional provisions to protect the LLC's interests. Seek professional advice to ensure all legal requirements are met during the transfer process.