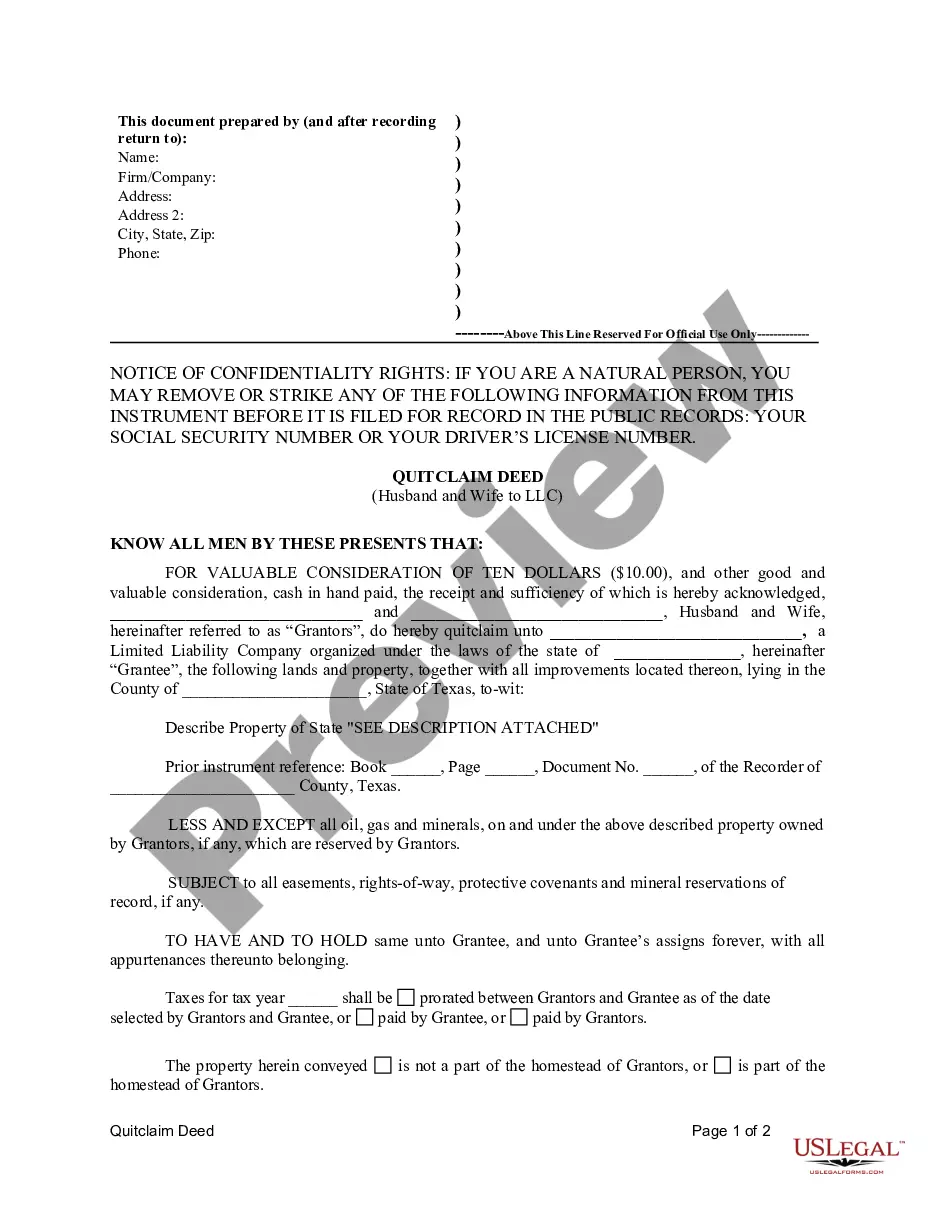

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

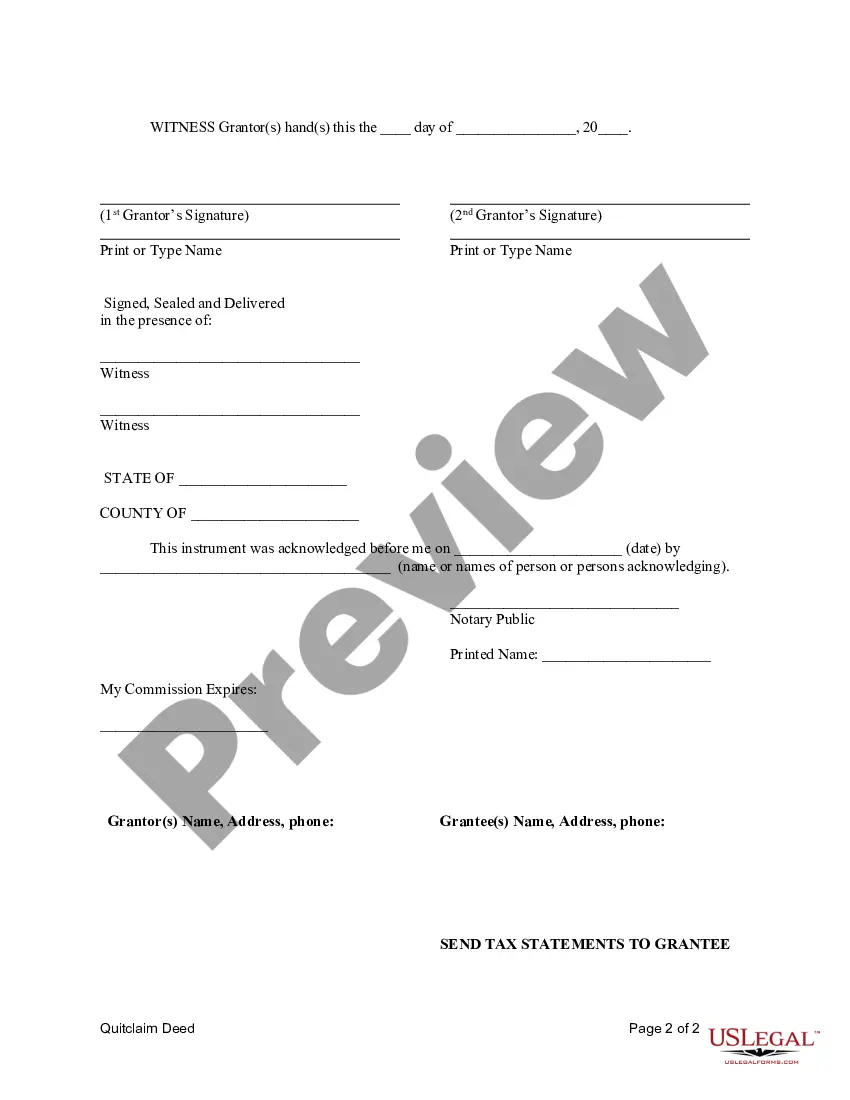

A College Stations Texas Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real estate property from a married couple to their Limited Liability Company (LLC). This type of deed is commonly used when individuals who jointly own property want to transfer it to their LLC, typically for business or asset protection purposes. The Quitclaim Deed acts as evidence of the transfer of ownership and serves to protect the rights and interests of both the husband and wife and the LLC. It ensures that the property is free from any claims or encumbrances, excluding those already specified in the deed itself. There are two main types of College Station Texas Quitclaim Deeds from Husband and Wife to LLC, which are commonly referred to as: 1. Inter-spousal Quitclaim Deed: This is a deed used when a married couple wants to transfer property to their jointly-owned LLC. The purpose of this deed is to transfer the property rights from the couple as individuals to their LLC as a business entity. It establishes clear ownership and protects the interests of both spouses in the property. 2. Quitclaim Deed with a Right of Survivorship: This type of quitclaim deed adds a layer of protection for the surviving spouse in case of the other spouse's death. It ensures that if one spouse passes away, their ownership interest in the property automatically transfers to the surviving spouse, without going through probate. This can be especially important for estate planning purposes. To execute a College Station Texas Quitclaim Deed from Husband and Wife to LLC, several steps need to be followed. Firstly, the deed must include the full legal names and addresses of both the husband and wife, as well as the LLC name and address. It should also accurately describe the property being transferred, including its legal description, parcel number, and any relevant address or boundaries. Both the husband and wife must sign the deed in the presence of a notary public to ensure its legality and validity. This step is crucial to prevent any future disputes or challenges to the deed's authenticity. Once signed and notarized, the deed should be recorded with the appropriate County Clerk's office to officially transfer ownership from the couple to the LLC. In summary, a College Station Texas Quitclaim Deed from Husband and Wife to LLC is an essential legal document used to transfer property ownership between a married couple and their Limited Liability Company. It offers various benefits, including asset protection and streamlined estate planning. By executing this deed correctly and ensuring proper recording, the property transfer can be completed smoothly and securely.