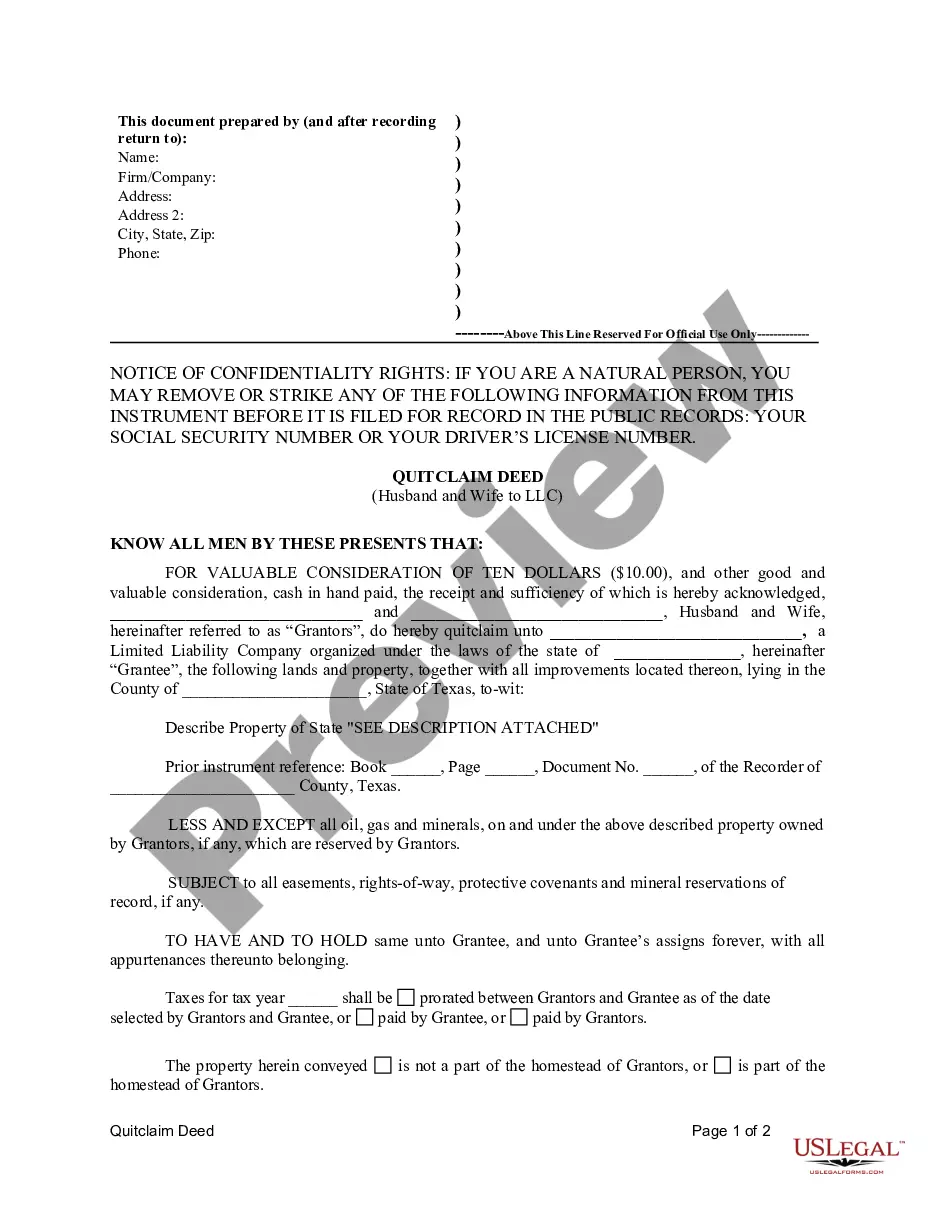

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

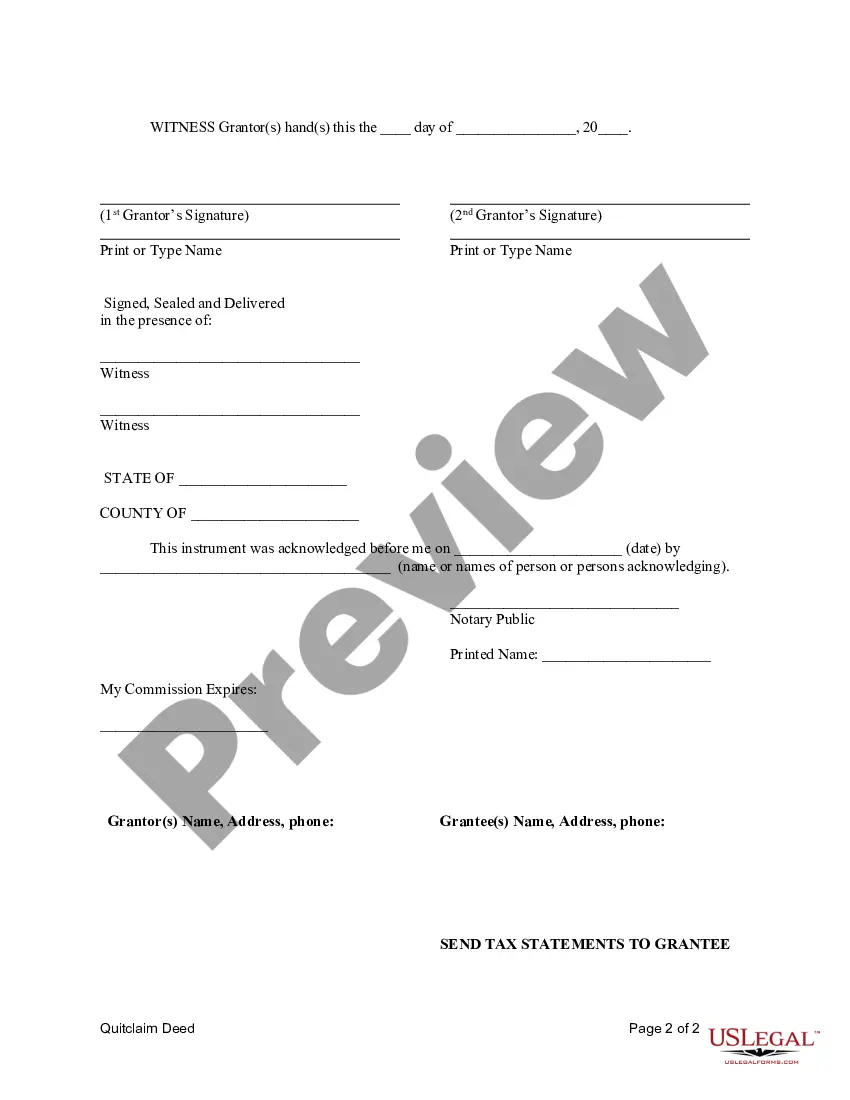

A Collin Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to a limited liability company (LLC) in Collin County, Texas. This type of deed is commonly used when a couple wants to transfer ownership of their property to an LLC they have established for various reasons. There are two main types of Collin Texas Quitclaim Deed from Husband and Wife to LLC: 1. General Collin Texas Quitclaim Deed from Husband and Wife to LLC: This type of quitclaim deed transfers the entire ownership interest in the property from the husband and wife to their LLC. It provides a broad transfer of ownership rights without any warranties or guarantees regarding the property's title. This means that the LLC accepts the property "as is" and assumes any risks or claims associated with it. 2. Special Collin Texas Quitclaim Deed from Husband and Wife to LLC: This type of quitclaim deed is more specific and may include certain conditions or limitations imposed by the husband and wife. For example, they may stipulate that the LLC can only use the property for a specific purpose or that certain portions of the property are excluded from the transfer. Special quitclaim deeds provide more control and customization to the transferring parties. The process of creating a Collin Texas Quitclaim Deed from Husband and Wife to LLC starts with drafting the deed itself, which should include the necessary legal language, property details, and the names of the husband and wife as granters, and the LLC as the grantee. Once the deed is drafted, it needs to be signed and notarized by the husband, wife, and a notary public. After notarization, the completed quitclaim deed must be filed with the County Clerk's office in Collin County, Texas. This official filing ensures that the transfer of property ownership is recognized by the local government and becomes a matter of public record. It is important to note that filing fees may apply, so it's advisable to inquire about the amount beforehand. By executing a Collin Texas Quitclaim Deed from Husband and Wife to LLC, the couple effectively transfers their property rights to their LLC. This can offer advantages like protecting personal assets from potential liabilities associated with the property or facilitating business operations and financing options for the LLC. However, it is crucial to seek legal advice before proceeding with any property transfers and to ensure compliance with local laws and regulations. Remember, this information is provided as a general overview. Consult with a legal professional to understand the specific requirements and implications of a Collin Texas Quitclaim Deed from Husband and Wife to LLC in your particular situation.A Collin Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to a limited liability company (LLC) in Collin County, Texas. This type of deed is commonly used when a couple wants to transfer ownership of their property to an LLC they have established for various reasons. There are two main types of Collin Texas Quitclaim Deed from Husband and Wife to LLC: 1. General Collin Texas Quitclaim Deed from Husband and Wife to LLC: This type of quitclaim deed transfers the entire ownership interest in the property from the husband and wife to their LLC. It provides a broad transfer of ownership rights without any warranties or guarantees regarding the property's title. This means that the LLC accepts the property "as is" and assumes any risks or claims associated with it. 2. Special Collin Texas Quitclaim Deed from Husband and Wife to LLC: This type of quitclaim deed is more specific and may include certain conditions or limitations imposed by the husband and wife. For example, they may stipulate that the LLC can only use the property for a specific purpose or that certain portions of the property are excluded from the transfer. Special quitclaim deeds provide more control and customization to the transferring parties. The process of creating a Collin Texas Quitclaim Deed from Husband and Wife to LLC starts with drafting the deed itself, which should include the necessary legal language, property details, and the names of the husband and wife as granters, and the LLC as the grantee. Once the deed is drafted, it needs to be signed and notarized by the husband, wife, and a notary public. After notarization, the completed quitclaim deed must be filed with the County Clerk's office in Collin County, Texas. This official filing ensures that the transfer of property ownership is recognized by the local government and becomes a matter of public record. It is important to note that filing fees may apply, so it's advisable to inquire about the amount beforehand. By executing a Collin Texas Quitclaim Deed from Husband and Wife to LLC, the couple effectively transfers their property rights to their LLC. This can offer advantages like protecting personal assets from potential liabilities associated with the property or facilitating business operations and financing options for the LLC. However, it is crucial to seek legal advice before proceeding with any property transfers and to ensure compliance with local laws and regulations. Remember, this information is provided as a general overview. Consult with a legal professional to understand the specific requirements and implications of a Collin Texas Quitclaim Deed from Husband and Wife to LLC in your particular situation.