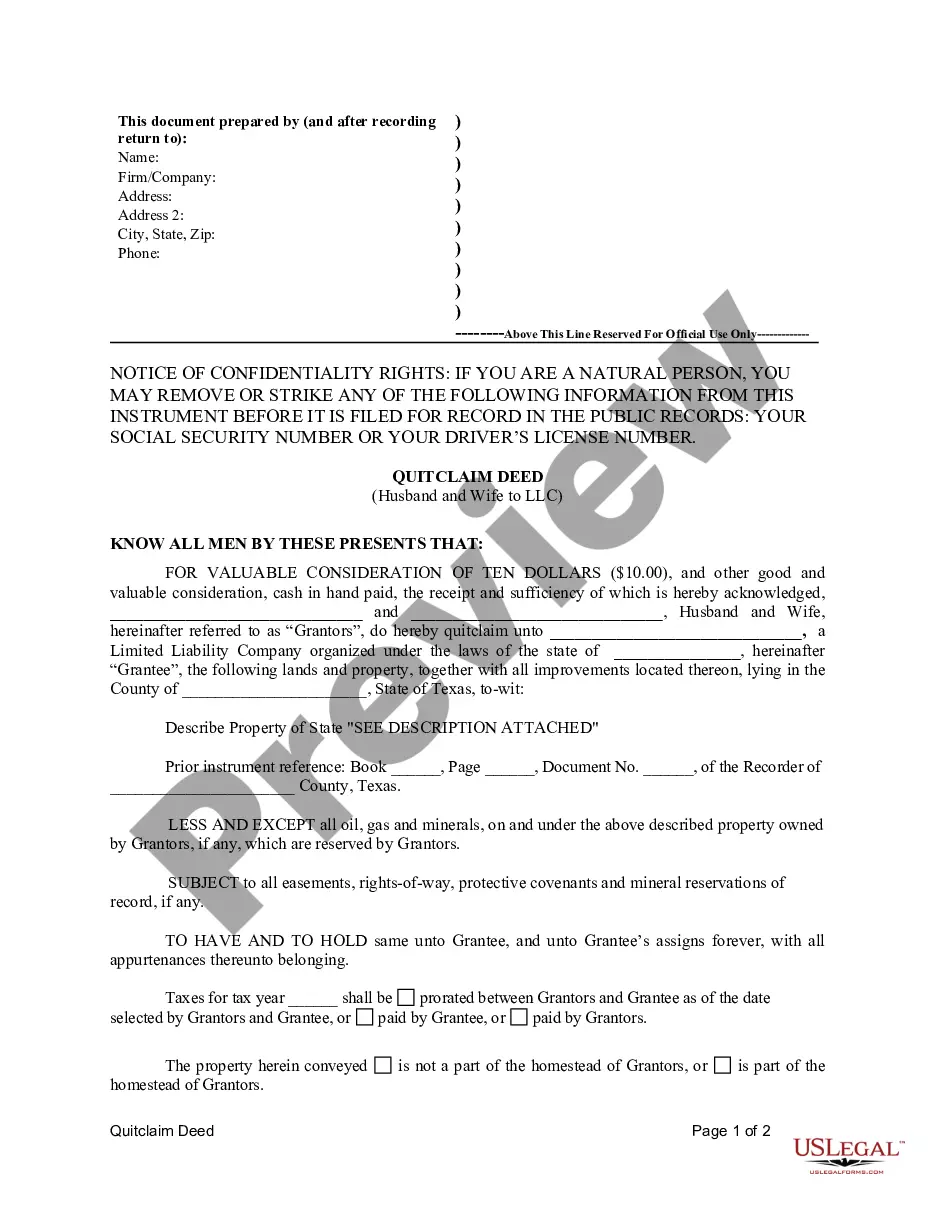

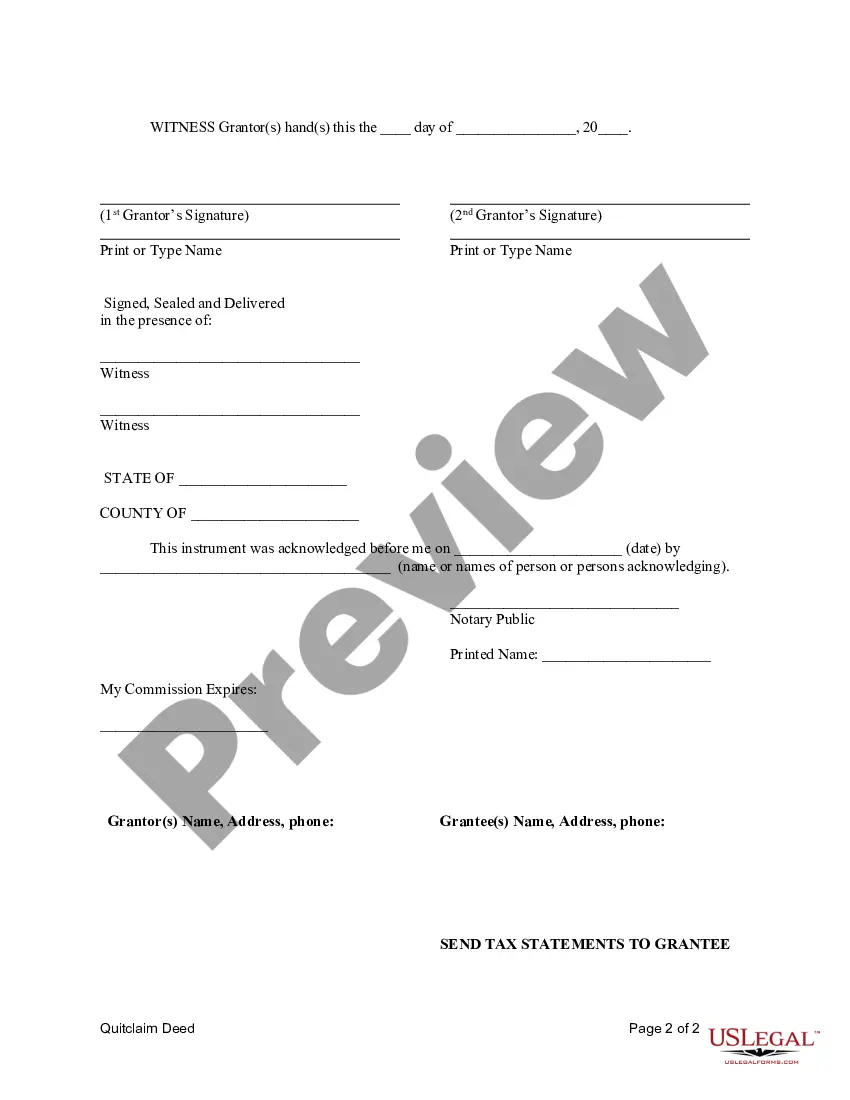

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Dallas Texas Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to a Limited Liability Company (LLC) in Dallas, Texas. This type of deed is commonly used when individuals wish to transfer real estate property to their LLC for various reasons, such as asset protection or business purposes. By executing a quitclaim deed, the husband and wife relinquish their rights and interests in the property, transferring them to the LLC. There are different variations of Dallas Texas Quitclaim Deed from Husband and Wife to LLC, each with its own specific purposes and conditions. Some common types include: 1. General Dallas Texas Quitclaim Deed from Husband and Wife to LLC: This is a standard transfer of property ownership from a married couple to an LLC. It is used when there are no specific conditions or restrictions attached to the transfer. 2. Dallas Texas Quitclaim Deed from Husband and Wife to LLC with encumbrance: This type of deed is used if the property being transferred carries any kind of encumbrance, such as a mortgage or lien. The husband and wife transfer their rights to the LLC, along with any existing liabilities or encumbrances. 3. Dallas Texas Quitclaim Deed from Husband and Wife to LLC with specific restrictions: In certain cases, the transferring couple may impose specific restrictions or conditions on the use or future transfer of the property. These restrictions can include limitations on the type of business that can be conducted on the property or restrictions on reselling the property within a certain time frame. 4. Dallas Texas Quitclaim Deed from Husband and Wife to LLC for tax planning purposes: This type of deed is utilized when the transferring couple aims to structure their property holdings for tax planning purposes. By transferring ownership to an LLC, they may be able to take advantage of certain tax benefits and deductions. Regardless of the specific type of Dallas Texas Quitclaim Deed from Husband and Wife to LLC, it is crucial to consult with a legal professional or a real estate attorney to ensure the legality and effectiveness of the deed. Each deed type may have different legal requirements and implications, and a professional can guide the couple through the process and ensure compliance with all applicable laws and regulations.Dallas Texas Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to a Limited Liability Company (LLC) in Dallas, Texas. This type of deed is commonly used when individuals wish to transfer real estate property to their LLC for various reasons, such as asset protection or business purposes. By executing a quitclaim deed, the husband and wife relinquish their rights and interests in the property, transferring them to the LLC. There are different variations of Dallas Texas Quitclaim Deed from Husband and Wife to LLC, each with its own specific purposes and conditions. Some common types include: 1. General Dallas Texas Quitclaim Deed from Husband and Wife to LLC: This is a standard transfer of property ownership from a married couple to an LLC. It is used when there are no specific conditions or restrictions attached to the transfer. 2. Dallas Texas Quitclaim Deed from Husband and Wife to LLC with encumbrance: This type of deed is used if the property being transferred carries any kind of encumbrance, such as a mortgage or lien. The husband and wife transfer their rights to the LLC, along with any existing liabilities or encumbrances. 3. Dallas Texas Quitclaim Deed from Husband and Wife to LLC with specific restrictions: In certain cases, the transferring couple may impose specific restrictions or conditions on the use or future transfer of the property. These restrictions can include limitations on the type of business that can be conducted on the property or restrictions on reselling the property within a certain time frame. 4. Dallas Texas Quitclaim Deed from Husband and Wife to LLC for tax planning purposes: This type of deed is utilized when the transferring couple aims to structure their property holdings for tax planning purposes. By transferring ownership to an LLC, they may be able to take advantage of certain tax benefits and deductions. Regardless of the specific type of Dallas Texas Quitclaim Deed from Husband and Wife to LLC, it is crucial to consult with a legal professional or a real estate attorney to ensure the legality and effectiveness of the deed. Each deed type may have different legal requirements and implications, and a professional can guide the couple through the process and ensure compliance with all applicable laws and regulations.