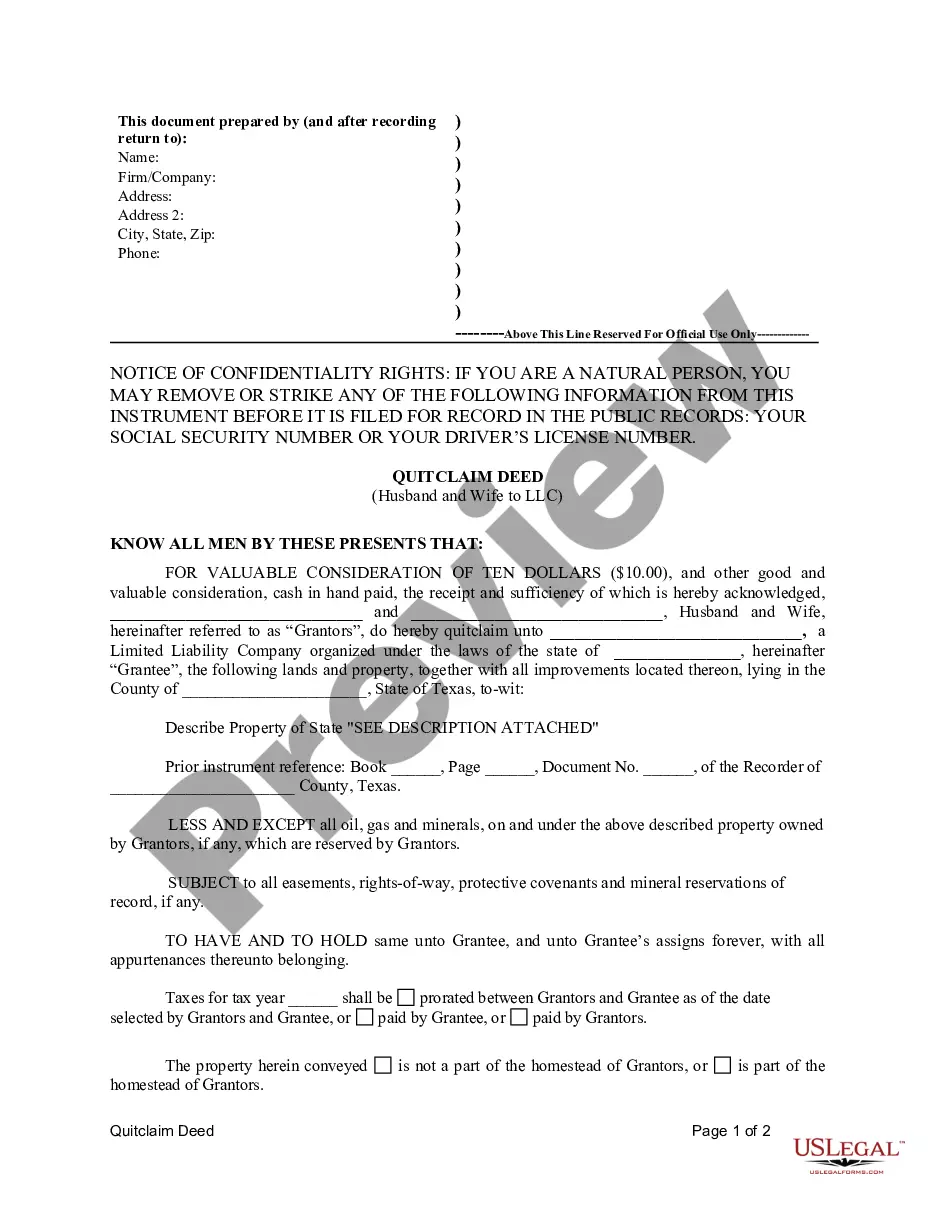

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

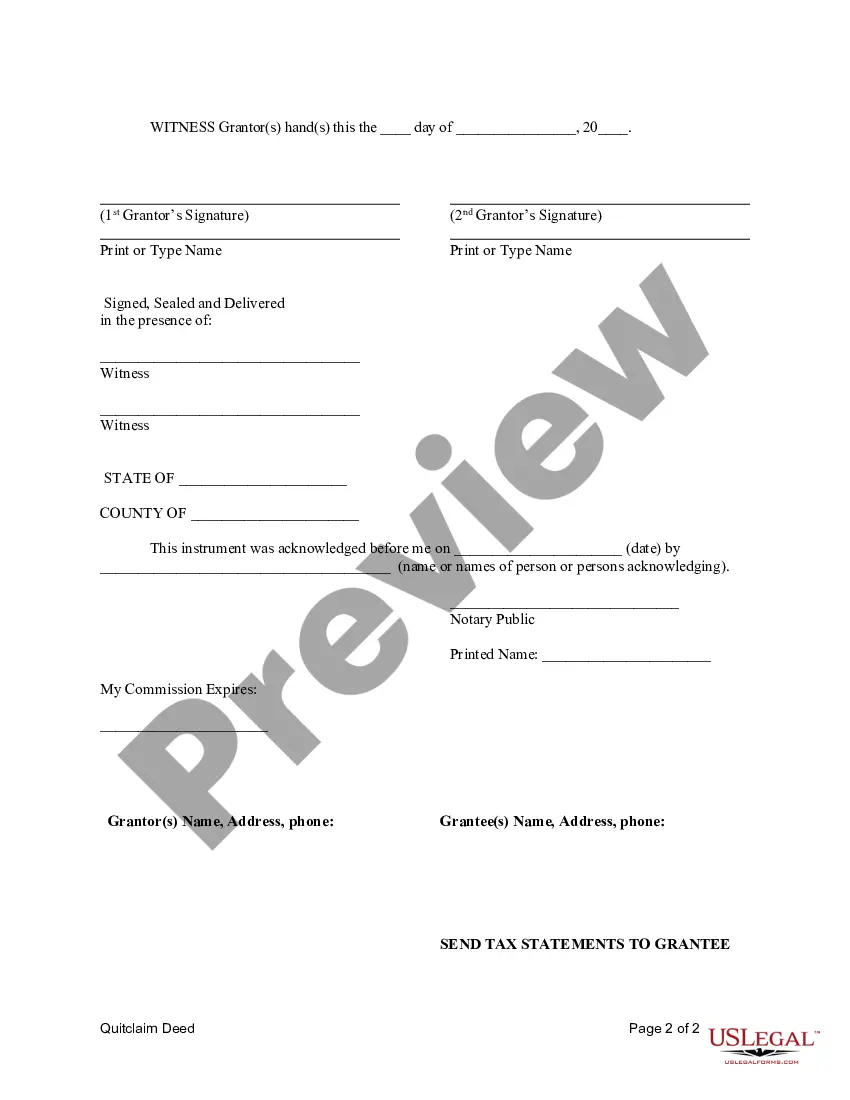

When it comes to transferring property ownership in Edinburg, Texas, a quitclaim deed is often used, particularly in the case of a transfer from a husband and wife to a Limited Liability Company (LLC) entity. This legal document serves to relinquish the interest or claim that the granters (husband and wife) have in the property, allowing it to be passed on to the designated LLC. This article will provide you with a detailed understanding of an Edinburg Texas Quitclaim Deed from Husband and Wife to LLC, including different variations that may exist. In Edinburg, Texas, a quitclaim deed from husband and wife to an LLC is a specific type of property transfer document. By executing this deed, the husband and wife, who are typically the current owners of the property, transfer their legal rights to the property to an LLC. The quitclaim deed is employed when the husband and wife wish to transfer their jointly owned property to the LLC without making any guarantees about the property title. Unlike a warranty deed, which provides assurances by the granters that the title is clear and free from claims, a quitclaim deed does not provide such protection. Thus, it is crucial for both parties involved to fully comprehend the implications of this type of property transfer. Since different situations can arise during property transfers, several variations of the Edinburg Texas Quitclaim Deed from Husband and Wife to LLC may exist. Some common types include: 1. General Edinburg Texas Quitclaim Deed from Husband and Wife to LLC: This is the fundamental type of quitclaim deed that is used to transfer ownership from the husband and wife to the LLC. It outlines the names of the husband and wife as granters, the name of the LLC as the grantee, and the legal description of the property being transferred. 2. Edinburg Texas Joint Tenancy with Right of Survivorship Quitclaim Deed from Husband and Wife to LLC: In cases where the husband and wife jointly own the property with a right of survivorship, this variation of the quitclaim deed is used. It specifies that if one of the spouses passes away, their share automatically transfers to the surviving spouse and is subsequently transferred to the LLC. 3. Edinburg Texas Community Property Quitclaim Deed from Husband and Wife to LLC: When the property is considered community property between the husband and wife, this specific quitclaim deed variation is utilized. It ensures that both spouses' interests are duly transferred to the LLC. It is important to consult with a qualified attorney or real estate professional when preparing an Edinburg Texas Quitclaim Deed from Husband and Wife to LLC, as the specific language and requirements can vary. Furthermore, it is essential to ensure that all necessary information is included, and the deed is executed and recorded following the proper legal procedures in Edinburg, Texas.When it comes to transferring property ownership in Edinburg, Texas, a quitclaim deed is often used, particularly in the case of a transfer from a husband and wife to a Limited Liability Company (LLC) entity. This legal document serves to relinquish the interest or claim that the granters (husband and wife) have in the property, allowing it to be passed on to the designated LLC. This article will provide you with a detailed understanding of an Edinburg Texas Quitclaim Deed from Husband and Wife to LLC, including different variations that may exist. In Edinburg, Texas, a quitclaim deed from husband and wife to an LLC is a specific type of property transfer document. By executing this deed, the husband and wife, who are typically the current owners of the property, transfer their legal rights to the property to an LLC. The quitclaim deed is employed when the husband and wife wish to transfer their jointly owned property to the LLC without making any guarantees about the property title. Unlike a warranty deed, which provides assurances by the granters that the title is clear and free from claims, a quitclaim deed does not provide such protection. Thus, it is crucial for both parties involved to fully comprehend the implications of this type of property transfer. Since different situations can arise during property transfers, several variations of the Edinburg Texas Quitclaim Deed from Husband and Wife to LLC may exist. Some common types include: 1. General Edinburg Texas Quitclaim Deed from Husband and Wife to LLC: This is the fundamental type of quitclaim deed that is used to transfer ownership from the husband and wife to the LLC. It outlines the names of the husband and wife as granters, the name of the LLC as the grantee, and the legal description of the property being transferred. 2. Edinburg Texas Joint Tenancy with Right of Survivorship Quitclaim Deed from Husband and Wife to LLC: In cases where the husband and wife jointly own the property with a right of survivorship, this variation of the quitclaim deed is used. It specifies that if one of the spouses passes away, their share automatically transfers to the surviving spouse and is subsequently transferred to the LLC. 3. Edinburg Texas Community Property Quitclaim Deed from Husband and Wife to LLC: When the property is considered community property between the husband and wife, this specific quitclaim deed variation is utilized. It ensures that both spouses' interests are duly transferred to the LLC. It is important to consult with a qualified attorney or real estate professional when preparing an Edinburg Texas Quitclaim Deed from Husband and Wife to LLC, as the specific language and requirements can vary. Furthermore, it is essential to ensure that all necessary information is included, and the deed is executed and recorded following the proper legal procedures in Edinburg, Texas.