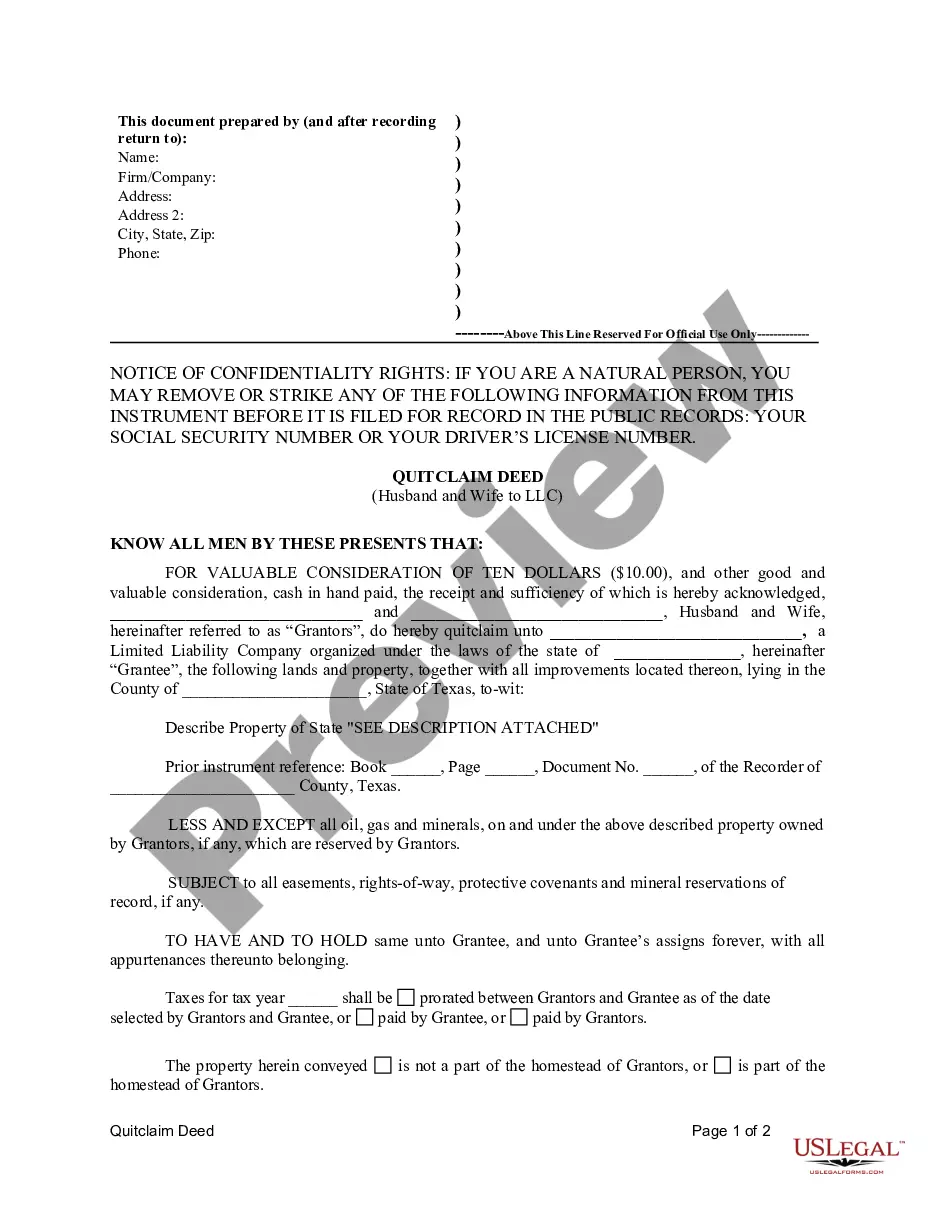

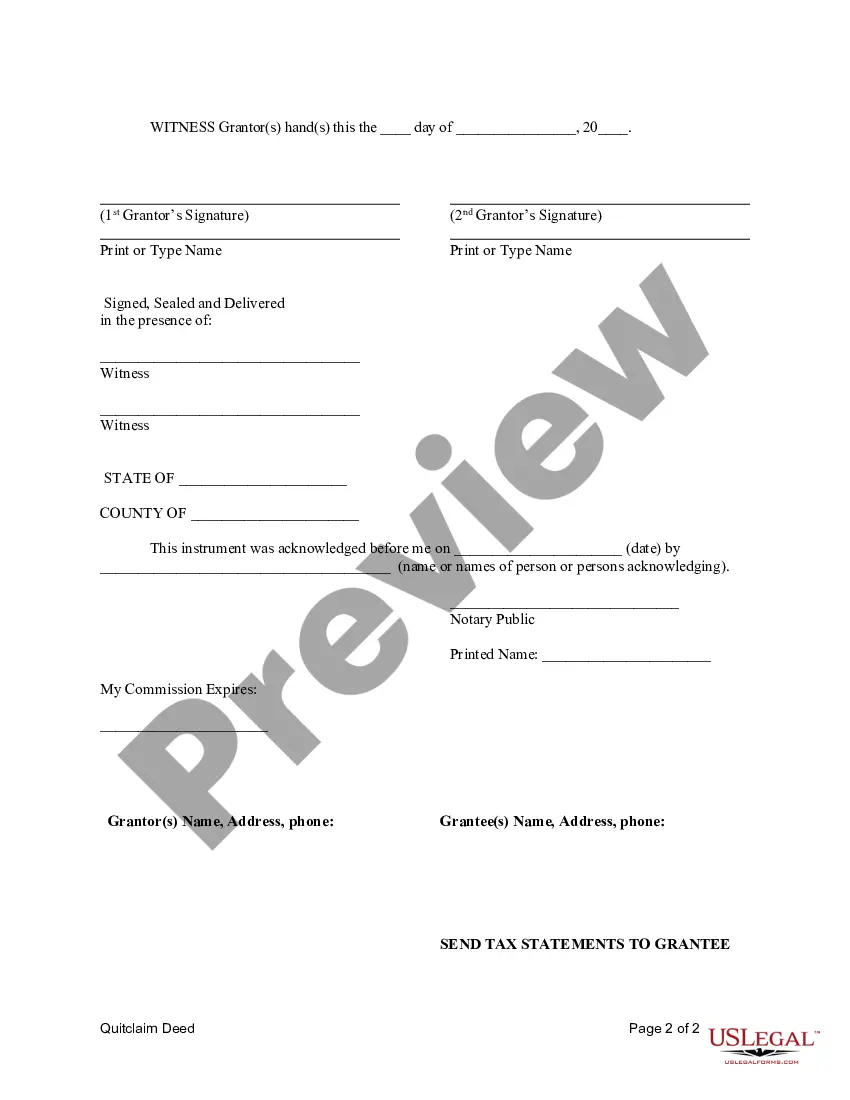

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Fort Worth Texas Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership rights from a married couple to a limited liability company (LLC) in Fort Worth, Texas. The deed relinquishes the couple's interest in the property, ensuring it is now solely owned by the LLC. This type of deed is commonly used in situations where a married couple wants to transfer property to an LLC they have formed for various reasons, such as protection against personal liability and tax advantages. It allows the couple to effectively separate their personal ownership from that of the LLC. The Fort Worth Texas Quitclaim Deed from Husband and Wife to LLC should include specific information, such as the full legal names of the husband and wife, the LLC's legal name, and the complete description of the property being transferred. It must also contain a clear statement indicating the intent of the husband and wife to transfer all their ownership interest in the property to the LLC without any warranties or guarantees. It is essential to consult with an attorney or a real estate professional to ensure the deed is drafted correctly and complies with all local, state, and federal laws. Failure to use the appropriate language or meet the specific requirements can invalidate the deed and lead to legal complications. While there may not be different types of Fort Worth Texas Quitclaim Deed from Husband and Wife to LLC per se, there might be variations or specific requirements depending on the purpose of the transfer or individual circumstances. Therefore, it is advisable to seek legal advice to determine any possible additional requirements or considerations. Overall, a Fort Worth Texas Quitclaim Deed from Husband and Wife to LLC is a legal instrument that facilitates the transfer of property ownership from a married couple to an LLC, allowing for the separation of personal and business assets while providing potential liability and tax benefits.A Fort Worth Texas Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership rights from a married couple to a limited liability company (LLC) in Fort Worth, Texas. The deed relinquishes the couple's interest in the property, ensuring it is now solely owned by the LLC. This type of deed is commonly used in situations where a married couple wants to transfer property to an LLC they have formed for various reasons, such as protection against personal liability and tax advantages. It allows the couple to effectively separate their personal ownership from that of the LLC. The Fort Worth Texas Quitclaim Deed from Husband and Wife to LLC should include specific information, such as the full legal names of the husband and wife, the LLC's legal name, and the complete description of the property being transferred. It must also contain a clear statement indicating the intent of the husband and wife to transfer all their ownership interest in the property to the LLC without any warranties or guarantees. It is essential to consult with an attorney or a real estate professional to ensure the deed is drafted correctly and complies with all local, state, and federal laws. Failure to use the appropriate language or meet the specific requirements can invalidate the deed and lead to legal complications. While there may not be different types of Fort Worth Texas Quitclaim Deed from Husband and Wife to LLC per se, there might be variations or specific requirements depending on the purpose of the transfer or individual circumstances. Therefore, it is advisable to seek legal advice to determine any possible additional requirements or considerations. Overall, a Fort Worth Texas Quitclaim Deed from Husband and Wife to LLC is a legal instrument that facilitates the transfer of property ownership from a married couple to an LLC, allowing for the separation of personal and business assets while providing potential liability and tax benefits.