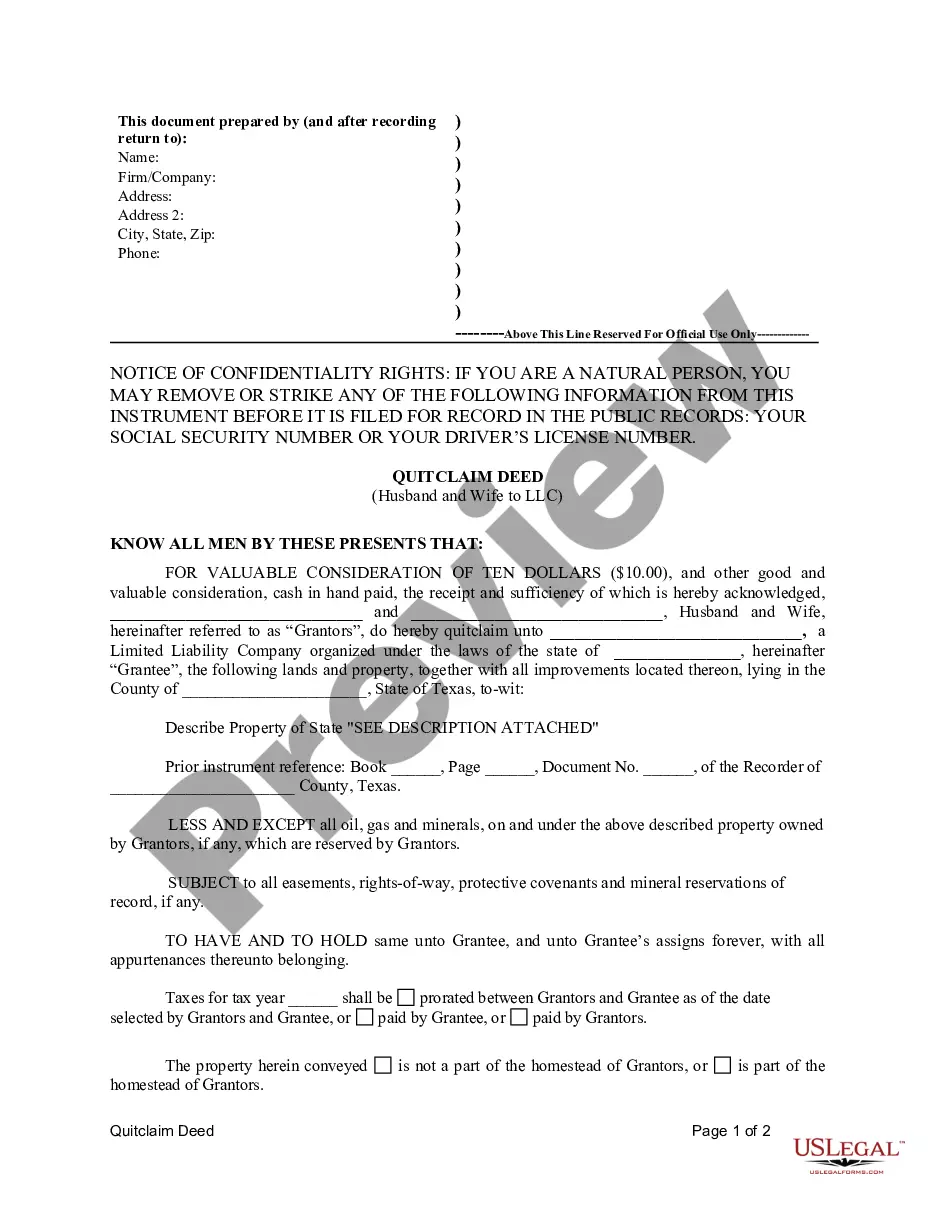

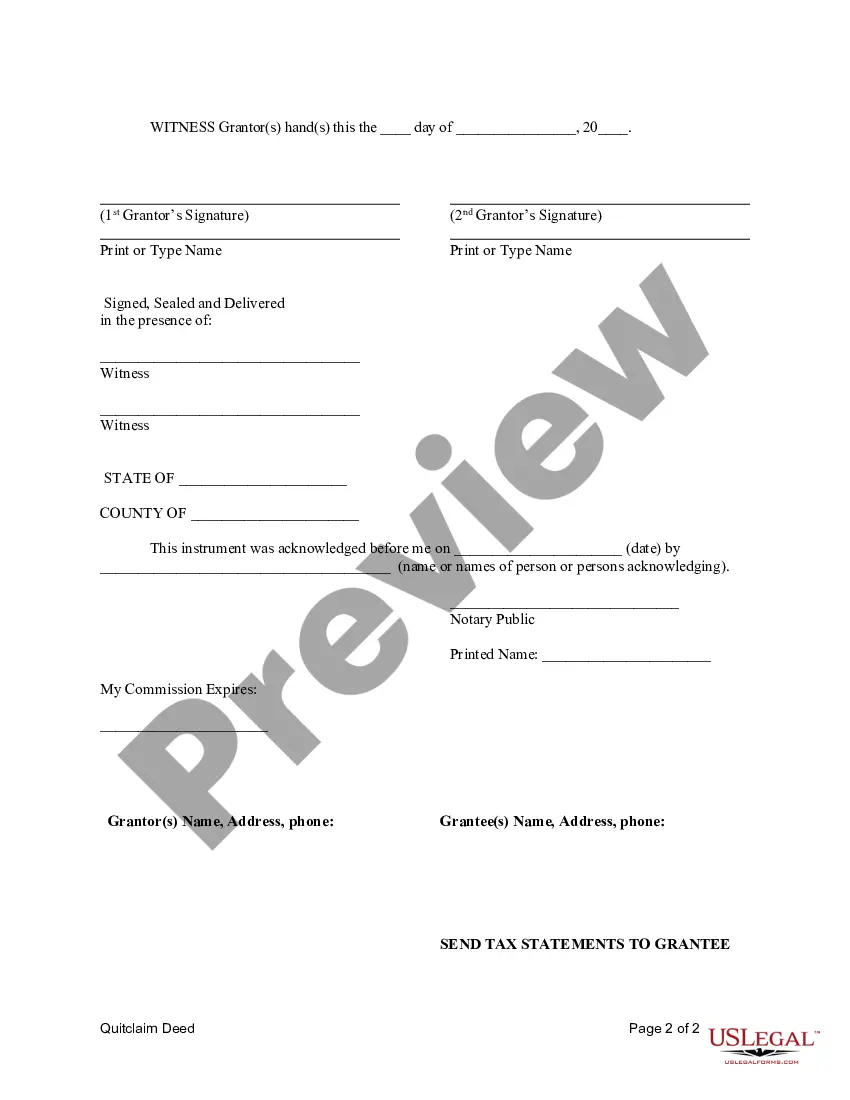

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Frisco Texas Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real property located in Frisco, Texas from a married couple to a limited liability company (LLC) in which they have an interest or wish to establish. This type of deed is commonly used when the husband and wife want to protect their personal assets by transferring the property to an LLC, which provides liability protection and potential tax advantages. There are a few different types of Frisco Texas Quitclaim Deeds that can be used in this scenario, including: 1. Frisco Texas Joint Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when both the husband and wife jointly own the property and want to transfer it to their LLC together. By executing a joint quitclaim deed, they are conveying both of their interests in the property to the LLC. 2. Frisco Texas Individual Quitclaim Deed from Husband to LLC and Wife to LLC: In some cases, the property may be owned individually by either the husband or wife. In this situation, separate quitclaim deeds would be prepared for each spouse to transfer their individual interests in the property to the LLC. 3. Frisco Texas Partial Quitclaim Deed from Husband and Wife to LLC: If the husband and wife only wish to transfer a portion of their ownership interest in the property to the LLC, they can use a partial quitclaim deed. This allows them to retain partial ownership while granting the LLC ownership of the remaining portion. In all these cases, it's important to note that a quitclaim deed only transfers the ownership interest that the granter(s) currently possess, without guaranteeing that the title is clear or that there are no other claims to the property. It is recommended to consult with a qualified real estate attorney or title company to ensure a smooth transfer of ownership and to address any potential legal or financial implications. Keywords: Frisco Texas, Quitclaim Deed, Husband and Wife, LLC, property ownership, real estate, legal document, limited liability company, joint quitclaim deed, individual quitclaim deed, partial quitclaim deed, transfer of ownership, liability protection, tax advantages.A Frisco Texas Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real property located in Frisco, Texas from a married couple to a limited liability company (LLC) in which they have an interest or wish to establish. This type of deed is commonly used when the husband and wife want to protect their personal assets by transferring the property to an LLC, which provides liability protection and potential tax advantages. There are a few different types of Frisco Texas Quitclaim Deeds that can be used in this scenario, including: 1. Frisco Texas Joint Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when both the husband and wife jointly own the property and want to transfer it to their LLC together. By executing a joint quitclaim deed, they are conveying both of their interests in the property to the LLC. 2. Frisco Texas Individual Quitclaim Deed from Husband to LLC and Wife to LLC: In some cases, the property may be owned individually by either the husband or wife. In this situation, separate quitclaim deeds would be prepared for each spouse to transfer their individual interests in the property to the LLC. 3. Frisco Texas Partial Quitclaim Deed from Husband and Wife to LLC: If the husband and wife only wish to transfer a portion of their ownership interest in the property to the LLC, they can use a partial quitclaim deed. This allows them to retain partial ownership while granting the LLC ownership of the remaining portion. In all these cases, it's important to note that a quitclaim deed only transfers the ownership interest that the granter(s) currently possess, without guaranteeing that the title is clear or that there are no other claims to the property. It is recommended to consult with a qualified real estate attorney or title company to ensure a smooth transfer of ownership and to address any potential legal or financial implications. Keywords: Frisco Texas, Quitclaim Deed, Husband and Wife, LLC, property ownership, real estate, legal document, limited liability company, joint quitclaim deed, individual quitclaim deed, partial quitclaim deed, transfer of ownership, liability protection, tax advantages.