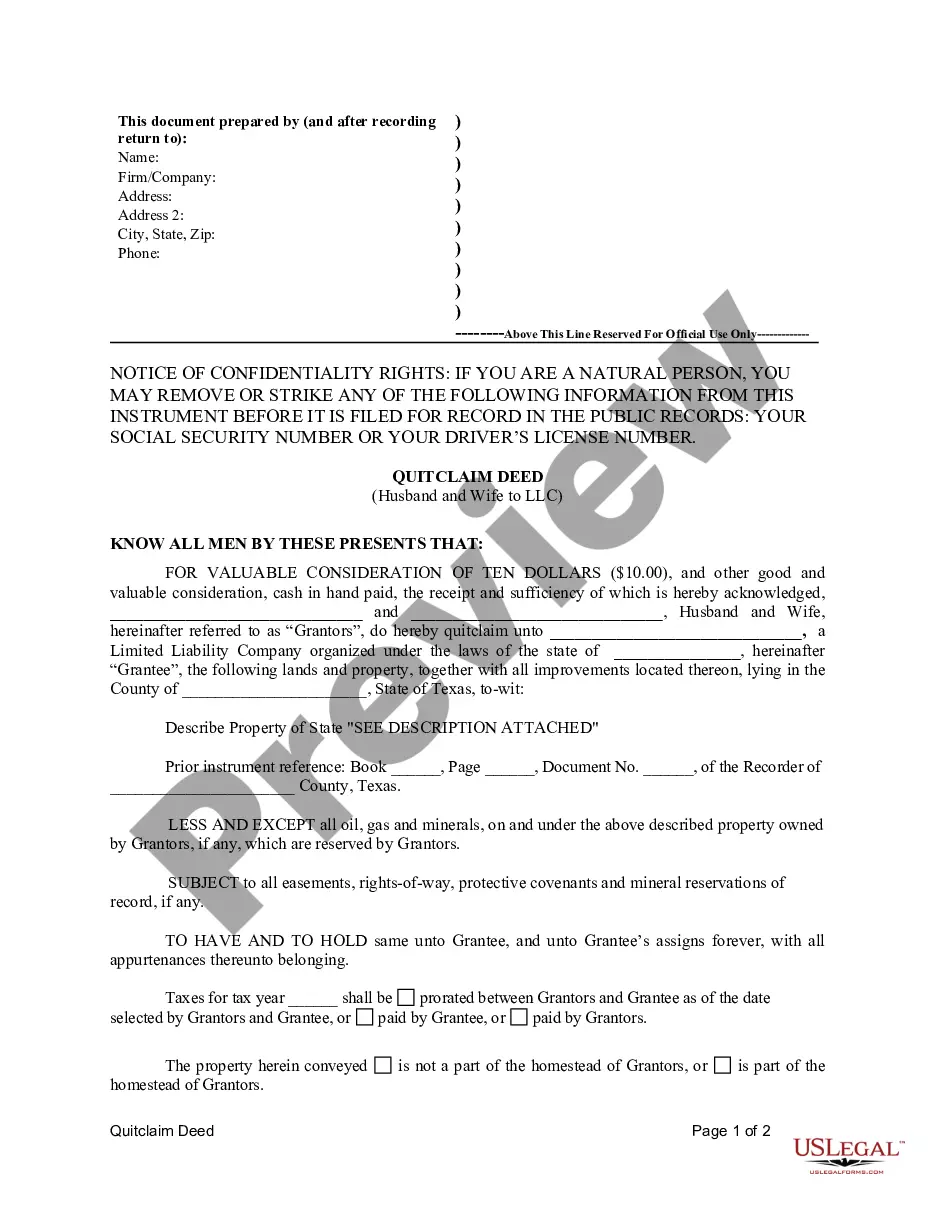

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

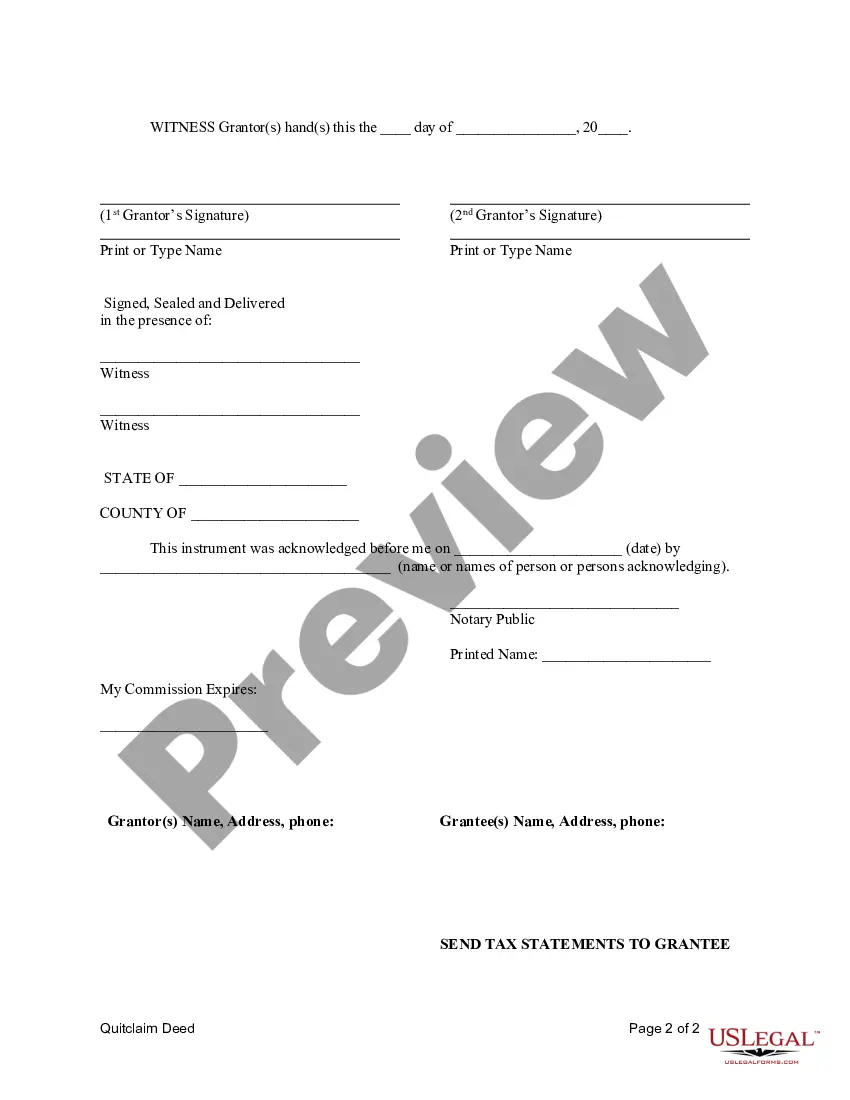

Title: Understanding the Harris Texas Quitclaim Deed from Husband and Wife to LLC Description: In this detailed article, we will delve into the various types of Harris Texas Quitclaim Deeds from Husband and Wife to LLC. We will discuss their purpose, requirements, and the importance of this legal document in real estate transactions. By exploring relevant keywords, such as Harris Texas, Quitclaim Deed, Husband and Wife, and LLC, we aim to provide comprehensive information on this topic. Keywords: Harris Texas, Quitclaim Deed, Husband and Wife, LLC, types, real estate, legal document, property ownership, joint ownership, transfer of ownership Types of Harris Texas Quitclaim Deeds from Husband and Wife to LLC : 1. Standard Harris Texas Quitclaim Deed from Husband and Wife to LLC: — This type of Quitclaim Deed allows a husband and wife to transfer their collective interest in a property to an LLC. — It ensures a smooth transfer of ownership and legally documents the change of property ownership from individuals to an LLC. 2. Joint Ownership Harris Texas Quitclaim Deed from Husband and Wife to LLC: — This type of Quitclaim Deed is applicable when a husband and wife jointly own a property and decide to transfer their interest to an LLC. — It solidifies the joint decision of transferring ownership and ensures that both parties legally relinquish their rights in favor of the LLC. 3. Partial Interest Harris Texas Quitclaim Deed from Husband and Wife to LLC: — This variation of Quitclaim Deed is used when the husband and wife each own a specific percentage or partial interest in a property. — It allows them to transfer their respective partial interests to an LLC, consolidating ownership and streamlining property management. Importance and Requirements: — Harris Texas Quitclaim Deed from Husband and Wife to LLC is crucial in ensuring a clear and legal transfer of property ownership rights. — It protects the interests of both parties involved and serves as proof of their intent to transfer the property to the LLC. — To execute this deed, individuals must fulfill specific requirements, such as properly drafting the document, including the legal description of the property, obtaining notarization, and filing with the appropriate county office in Harris, Texas. Conclusion: The Harris Texas Quitclaim Deed from Husband and Wife to LLC is an essential legal instrument for transferring property ownership from married couples to an LLC entity. By utilizing the various types of Quitclaim Deeds discussed, individuals can navigate the transfer process successfully. Understanding the importance and requirements associated with such deeds ensures a seamless transition and protects the interests of all parties involved. So, whether it's a standard, joint ownership, or partial interest Quitclaim Deed, ensuring compliance with the relevant guidelines is crucial in securing a lawful property transfer.Title: Understanding the Harris Texas Quitclaim Deed from Husband and Wife to LLC Description: In this detailed article, we will delve into the various types of Harris Texas Quitclaim Deeds from Husband and Wife to LLC. We will discuss their purpose, requirements, and the importance of this legal document in real estate transactions. By exploring relevant keywords, such as Harris Texas, Quitclaim Deed, Husband and Wife, and LLC, we aim to provide comprehensive information on this topic. Keywords: Harris Texas, Quitclaim Deed, Husband and Wife, LLC, types, real estate, legal document, property ownership, joint ownership, transfer of ownership Types of Harris Texas Quitclaim Deeds from Husband and Wife to LLC : 1. Standard Harris Texas Quitclaim Deed from Husband and Wife to LLC: — This type of Quitclaim Deed allows a husband and wife to transfer their collective interest in a property to an LLC. — It ensures a smooth transfer of ownership and legally documents the change of property ownership from individuals to an LLC. 2. Joint Ownership Harris Texas Quitclaim Deed from Husband and Wife to LLC: — This type of Quitclaim Deed is applicable when a husband and wife jointly own a property and decide to transfer their interest to an LLC. — It solidifies the joint decision of transferring ownership and ensures that both parties legally relinquish their rights in favor of the LLC. 3. Partial Interest Harris Texas Quitclaim Deed from Husband and Wife to LLC: — This variation of Quitclaim Deed is used when the husband and wife each own a specific percentage or partial interest in a property. — It allows them to transfer their respective partial interests to an LLC, consolidating ownership and streamlining property management. Importance and Requirements: — Harris Texas Quitclaim Deed from Husband and Wife to LLC is crucial in ensuring a clear and legal transfer of property ownership rights. — It protects the interests of both parties involved and serves as proof of their intent to transfer the property to the LLC. — To execute this deed, individuals must fulfill specific requirements, such as properly drafting the document, including the legal description of the property, obtaining notarization, and filing with the appropriate county office in Harris, Texas. Conclusion: The Harris Texas Quitclaim Deed from Husband and Wife to LLC is an essential legal instrument for transferring property ownership from married couples to an LLC entity. By utilizing the various types of Quitclaim Deeds discussed, individuals can navigate the transfer process successfully. Understanding the importance and requirements associated with such deeds ensures a seamless transition and protects the interests of all parties involved. So, whether it's a standard, joint ownership, or partial interest Quitclaim Deed, ensuring compliance with the relevant guidelines is crucial in securing a lawful property transfer.