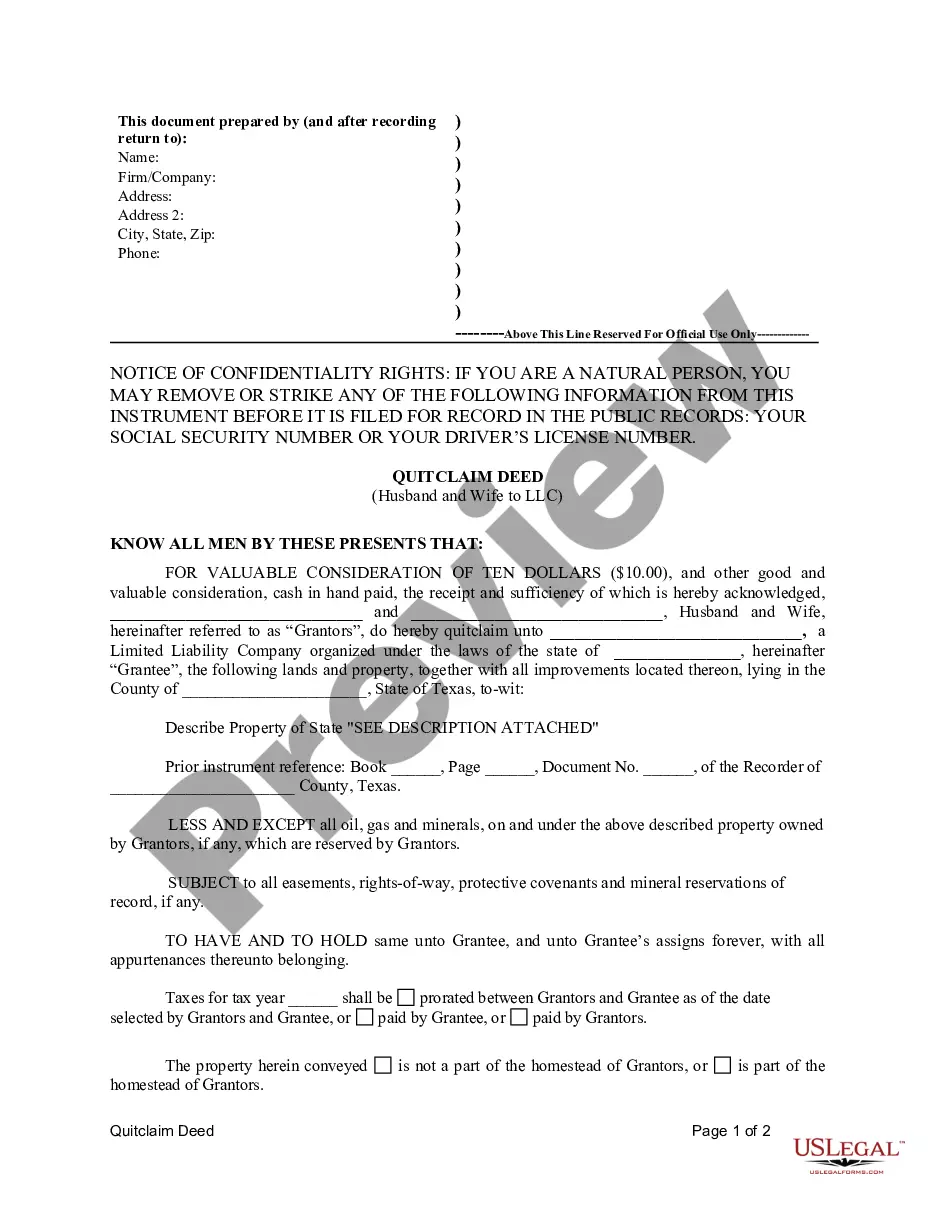

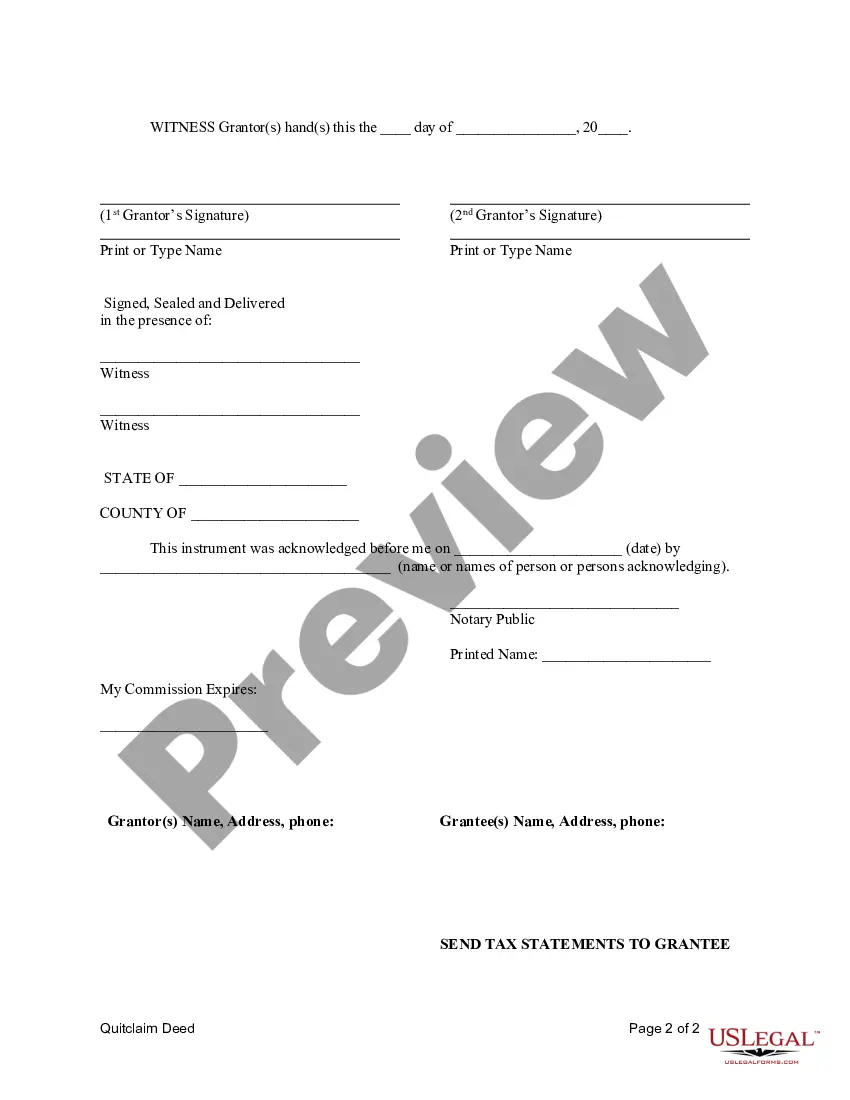

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Killeen Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership of real estate from a married couple to a limited liability company (LLC) in the city of Killeen, Texas. The purpose of this type of deed is to provide legal protection and separate personal assets from business assets. When drafting a Killeen Texas Quitclaim Deed from Husband and Wife to LLC, it is essential to include specific details such as the names of the husband and wife, their marital status, the name of the LLC, and the specific property being transferred. Additionally, it is crucial to mention the date of the transfer and any conditions or restrictions associated with the deed. The Killeen Texas Quitclaim Deed from Husband and Wife to LLC ensures a clear transfer of property rights and establishes the LLC as the new owner, protecting the husband and wife from any future liabilities related to the property. By conveying the property to the LLC, the couple effectively separates personal assets from potential business risks. There are different variations of the Killeen Texas Quitclaim Deed from Husband and Wife to LLC based on specific circumstances. Some of these include: 1. Voluntary transfer: The husband and wife willingly decide to transfer the property to their LLC to protect their personal assets and limit liability associated with the property. 2. Asset protection: The husband and wife use the quitclaim deed to shield their personal assets from any potential lawsuits or claims related to the property, ensuring that only the LLC's assets are at risk. 3. Estate planning: The couple may utilize the quitclaim deed as part of their estate planning strategy to transfer the property to the LLC, thereby providing additional protection and potential tax advantages for their heirs. 4. Financial restructuring: In some cases, the husband and wife may decide to transfer the property to their LLC to reorganize or restructure their finances, taking advantage of the LLC's flexibility and limited liability benefits. It is crucial to consult with a qualified attorney who specializes in real estate and business law to ensure the proper execution of a Killeen Texas Quitclaim Deed from Husband and Wife to LLC. They can guide the couple through the process, clarify any legal implications, and ensure compliance with local laws and regulations. Overall, a Killeen Texas Quitclaim Deed from Husband and Wife to LLC offers a legal framework for property transfer, asset protection, and business restructuring while safeguarding the personal assets of the couple and the integrity of their business endeavors.A Killeen Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership of real estate from a married couple to a limited liability company (LLC) in the city of Killeen, Texas. The purpose of this type of deed is to provide legal protection and separate personal assets from business assets. When drafting a Killeen Texas Quitclaim Deed from Husband and Wife to LLC, it is essential to include specific details such as the names of the husband and wife, their marital status, the name of the LLC, and the specific property being transferred. Additionally, it is crucial to mention the date of the transfer and any conditions or restrictions associated with the deed. The Killeen Texas Quitclaim Deed from Husband and Wife to LLC ensures a clear transfer of property rights and establishes the LLC as the new owner, protecting the husband and wife from any future liabilities related to the property. By conveying the property to the LLC, the couple effectively separates personal assets from potential business risks. There are different variations of the Killeen Texas Quitclaim Deed from Husband and Wife to LLC based on specific circumstances. Some of these include: 1. Voluntary transfer: The husband and wife willingly decide to transfer the property to their LLC to protect their personal assets and limit liability associated with the property. 2. Asset protection: The husband and wife use the quitclaim deed to shield their personal assets from any potential lawsuits or claims related to the property, ensuring that only the LLC's assets are at risk. 3. Estate planning: The couple may utilize the quitclaim deed as part of their estate planning strategy to transfer the property to the LLC, thereby providing additional protection and potential tax advantages for their heirs. 4. Financial restructuring: In some cases, the husband and wife may decide to transfer the property to their LLC to reorganize or restructure their finances, taking advantage of the LLC's flexibility and limited liability benefits. It is crucial to consult with a qualified attorney who specializes in real estate and business law to ensure the proper execution of a Killeen Texas Quitclaim Deed from Husband and Wife to LLC. They can guide the couple through the process, clarify any legal implications, and ensure compliance with local laws and regulations. Overall, a Killeen Texas Quitclaim Deed from Husband and Wife to LLC offers a legal framework for property transfer, asset protection, and business restructuring while safeguarding the personal assets of the couple and the integrity of their business endeavors.