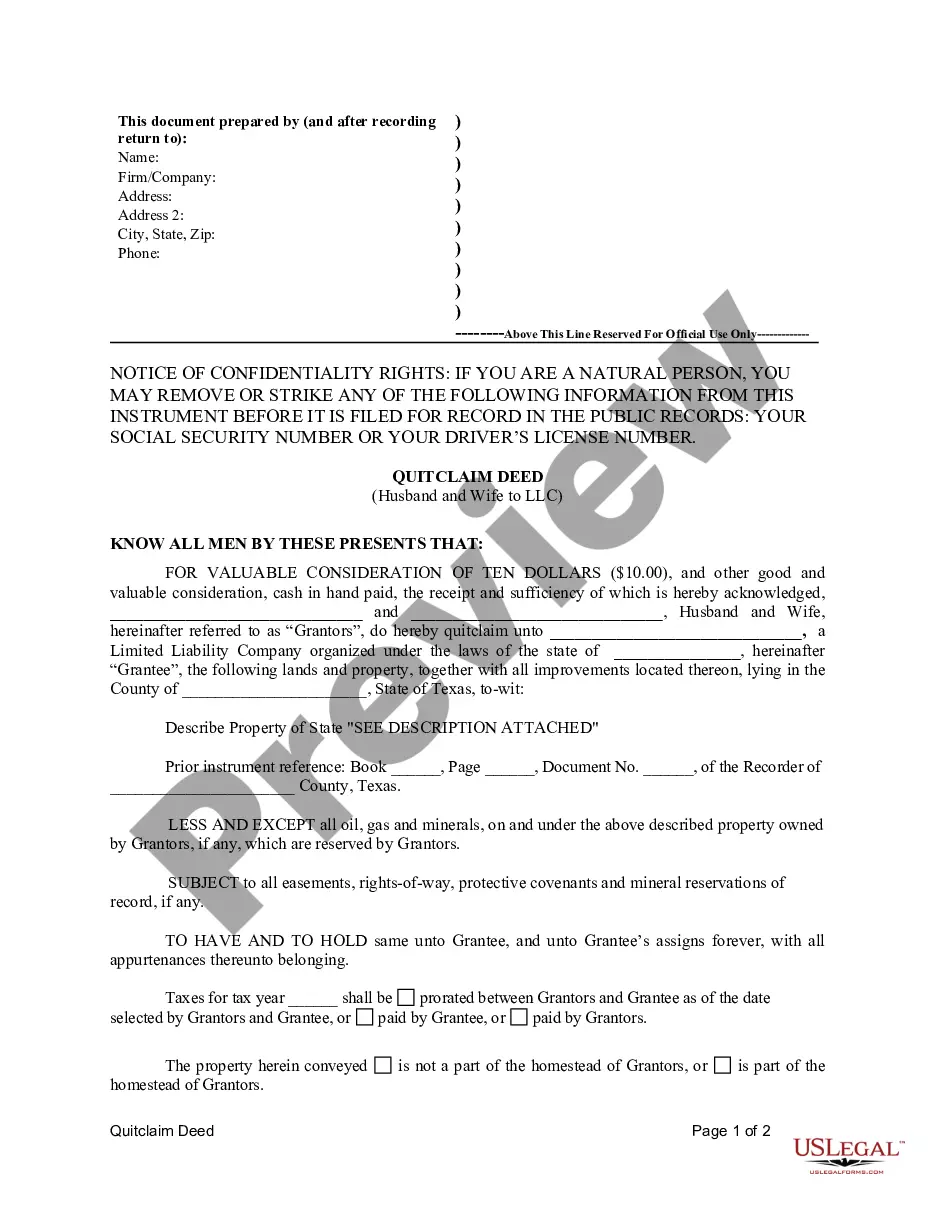

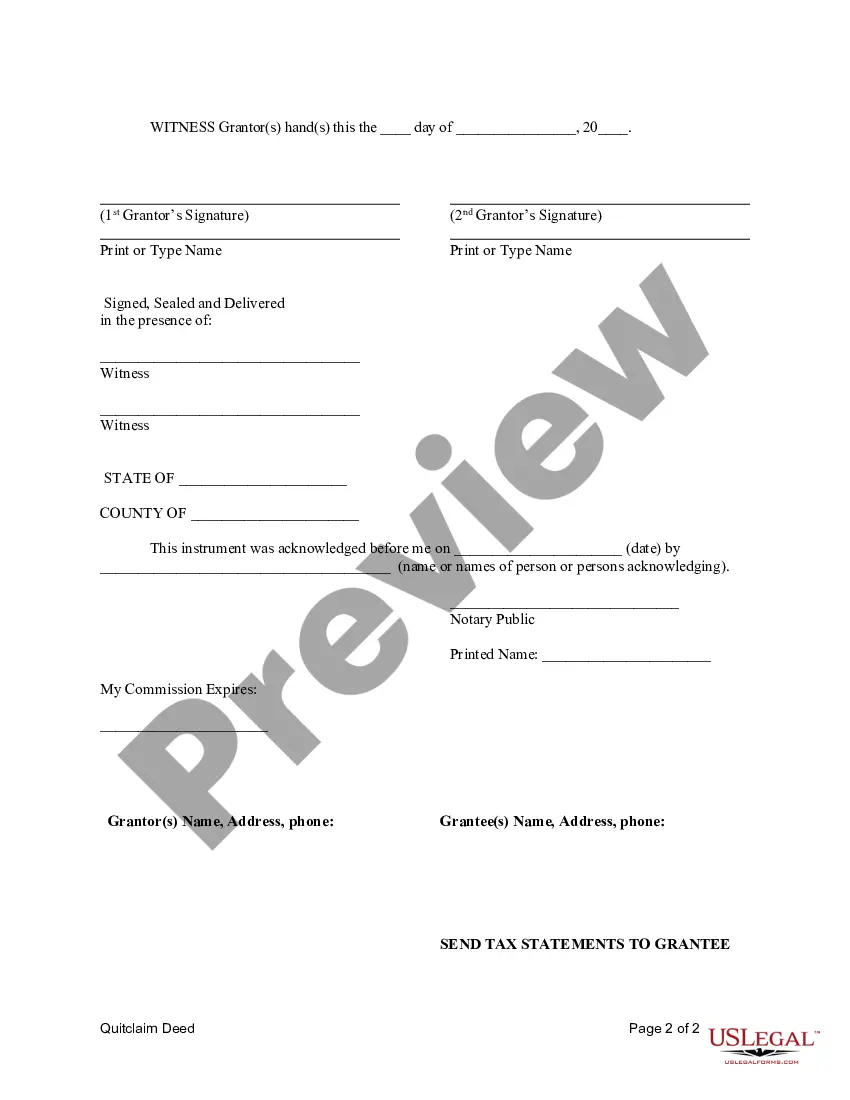

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. In the case of Mesquite, Texas, a quitclaim deed from a husband and wife to a limited liability company (LLC) refers to the transfer of property ownership from a married couple to their LLC entity. This type of transaction may occur for various reasons, such as asset protection, business consolidation, or estate planning. The Mesquite Texas Quitclaim Deed from Husband and Wife to LLC carries specific keywords associated with its nature and location. Here is a detailed description of the deed: Title: Mesquite Texas Quitclaim Deed from Husband and Wife to LLC Introduction: A Mesquite Texas Quitclaim Deed is a legal instrument through which a husband and wife relinquish their rights and interests in a property located in Mesquite, Texas, to an LLC entity. This document facilitates the seamless transfer of ownership, ensuring that the property is legally transferred to the LLC. Process: The husband and wife, collectively referred to as the granters, voluntarily transfer their interest in the property to the LLC entity, referred to as the grantee, by executing the Mesquite Texas Quitclaim Deed. This deed acknowledges their intention to convey the property without warranty or guarantee. It is important to note that unlike a warranty deed, a quitclaim deed does not guarantee clear title or protection against potential claims. Types: Mesquite Texas Quitclaim Deed from Husband and Wife to LLC may have various subtypes, depending on the specific situation and purpose of the transfer. Common types may include: 1. Business Consolidation Quitclaim Deed: This type of quitclaim deed is used when a married couple wants to place a property held jointly into an LLC they own, facilitating business operations and protecting their personal assets. 2. Asset Protection Quitclaim Deed: This type of quitclaim deed is utilized to transfer property ownership from a husband and wife to their LLC for asset protection purposes. By transferring the property to the LLC, the couple aims to separate personal and business assets, reducing personal liability. 3. Estate Planning Quitclaim Deed: In estate planning scenarios, a quitclaim deed may be employed to transfer property from a husband and wife to their LLC for easier succession planning or to facilitate property distribution among heirs. Conclusion: A Mesquite Texas Quitclaim Deed from Husband and Wife to LLC represents the voluntary transfer of property ownership from a married couple to their limited liability company. This legal document ensures the proper transfer of property rights, though it does not provide any warranties regarding the title. Different types of quitclaim deeds may exist, such as business consolidation, asset protection, or estate planning quitclaim deeds, each serving specific purposes for the granters and the LLC. It is prudent to consult with legal professionals or real estate experts to ensure compliance with all relevant laws and regulations throughout this property transfer process.A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. In the case of Mesquite, Texas, a quitclaim deed from a husband and wife to a limited liability company (LLC) refers to the transfer of property ownership from a married couple to their LLC entity. This type of transaction may occur for various reasons, such as asset protection, business consolidation, or estate planning. The Mesquite Texas Quitclaim Deed from Husband and Wife to LLC carries specific keywords associated with its nature and location. Here is a detailed description of the deed: Title: Mesquite Texas Quitclaim Deed from Husband and Wife to LLC Introduction: A Mesquite Texas Quitclaim Deed is a legal instrument through which a husband and wife relinquish their rights and interests in a property located in Mesquite, Texas, to an LLC entity. This document facilitates the seamless transfer of ownership, ensuring that the property is legally transferred to the LLC. Process: The husband and wife, collectively referred to as the granters, voluntarily transfer their interest in the property to the LLC entity, referred to as the grantee, by executing the Mesquite Texas Quitclaim Deed. This deed acknowledges their intention to convey the property without warranty or guarantee. It is important to note that unlike a warranty deed, a quitclaim deed does not guarantee clear title or protection against potential claims. Types: Mesquite Texas Quitclaim Deed from Husband and Wife to LLC may have various subtypes, depending on the specific situation and purpose of the transfer. Common types may include: 1. Business Consolidation Quitclaim Deed: This type of quitclaim deed is used when a married couple wants to place a property held jointly into an LLC they own, facilitating business operations and protecting their personal assets. 2. Asset Protection Quitclaim Deed: This type of quitclaim deed is utilized to transfer property ownership from a husband and wife to their LLC for asset protection purposes. By transferring the property to the LLC, the couple aims to separate personal and business assets, reducing personal liability. 3. Estate Planning Quitclaim Deed: In estate planning scenarios, a quitclaim deed may be employed to transfer property from a husband and wife to their LLC for easier succession planning or to facilitate property distribution among heirs. Conclusion: A Mesquite Texas Quitclaim Deed from Husband and Wife to LLC represents the voluntary transfer of property ownership from a married couple to their limited liability company. This legal document ensures the proper transfer of property rights, though it does not provide any warranties regarding the title. Different types of quitclaim deeds may exist, such as business consolidation, asset protection, or estate planning quitclaim deeds, each serving specific purposes for the granters and the LLC. It is prudent to consult with legal professionals or real estate experts to ensure compliance with all relevant laws and regulations throughout this property transfer process.