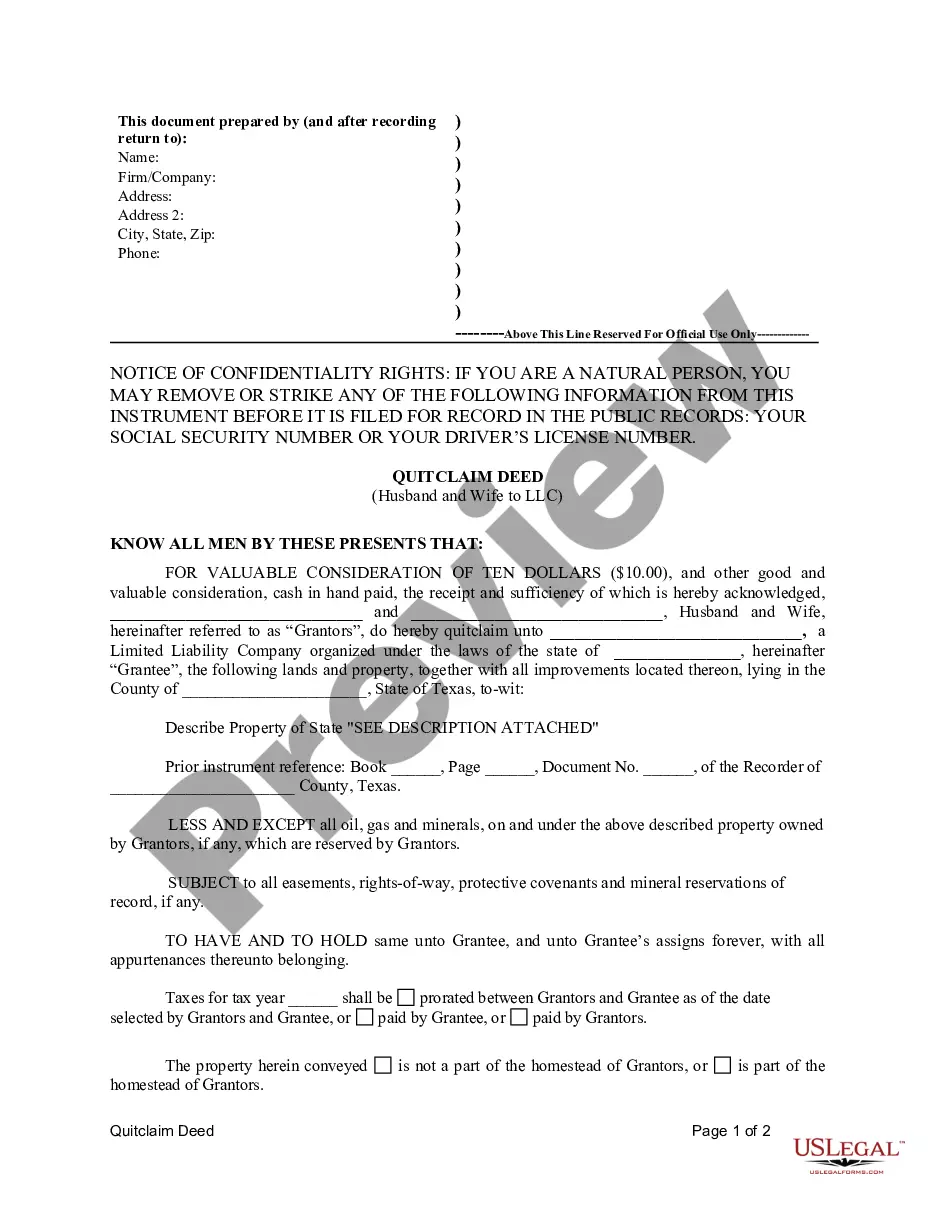

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

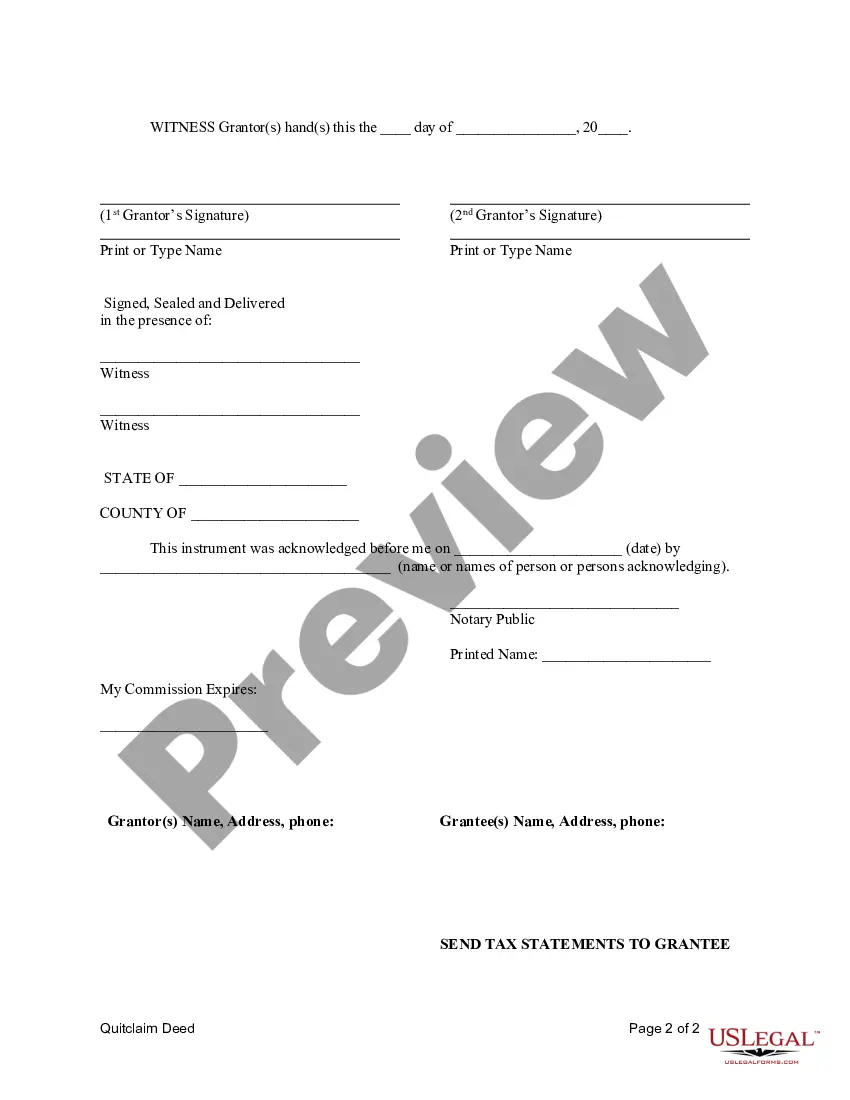

A quitclaim deed is a legal document commonly used in real estate transactions to transfer property ownership rights from one party to another. In the context of Odessa, Texas, a quitclaim deed specifically referring to the transfer of property from a husband and wife to a limited liability company (LLC) can have significant implications on property ownership and liability. Here is a detailed description of what an Odessa Texas Quitclaim Deed from Husband and Wife to LLC entails: In Odessa, Texas, a quitclaim deed from a husband and wife to an LLC allows for the transfer of property ownership from a married couple to a limited liability company. This type of transaction is often undertaken by couples who wish to hold their property under their LLC's ownership for various reasons, including asset protection, liability limitation, and tax advantages. When executing a quitclaim deed from husband and wife to LLC, the document relinquishes any interest, claim, or right the couple has in the property, transferring it to the LLC. It is essential to note that a quitclaim deed only transfers the current owner's interest in the property and does not provide any warranty or guarantee of the property's title. Therefore, it is crucial for both parties involved to ensure no encumbrances or potential issues with the property's title exist before proceeding with the transfer. Different types of Odessa Texas Quitclaim Deeds from Husband and Wife to LLC may include: 1. General Quitclaim Deed: This standard type of quitclaim deed transfers the entire interest the husband and wife have in the property to the LLC. It does not differentiate between individual percentages of ownership or contributions to the property. 2. Split Percentage Quitclaim Deed: In certain situations, a couple may wish to transfer ownership to their LLC but maintain specific individual ownership percentages. A split percentage quitclaim deed allows for the accurate allocation of ownership interests in the property between the husband, wife, and the LLC. 3. Special Quitclaim Deed: A special quitclaim deed could be used when certain conditions or restrictions need to be specified for the transfer of property to the LLC. This may include limitations on use, development rights, or specific language governing the transfer process. 4. Warranty Deed to LLC: Although not a quitclaim deed per se, some couples may prefer to transfer property ownership using a warranty deed instead. A warranty deed provides certain assurances and warranties about the property's title, assuring the LLC of a clean and clear transfer. It is advisable to seek professional legal advice or consult with a real estate attorney experienced in Texas property laws before executing any quitclaim deed. This ensures compliance with state-specific regulations and safeguards the interests of all parties involved in the transaction.A quitclaim deed is a legal document commonly used in real estate transactions to transfer property ownership rights from one party to another. In the context of Odessa, Texas, a quitclaim deed specifically referring to the transfer of property from a husband and wife to a limited liability company (LLC) can have significant implications on property ownership and liability. Here is a detailed description of what an Odessa Texas Quitclaim Deed from Husband and Wife to LLC entails: In Odessa, Texas, a quitclaim deed from a husband and wife to an LLC allows for the transfer of property ownership from a married couple to a limited liability company. This type of transaction is often undertaken by couples who wish to hold their property under their LLC's ownership for various reasons, including asset protection, liability limitation, and tax advantages. When executing a quitclaim deed from husband and wife to LLC, the document relinquishes any interest, claim, or right the couple has in the property, transferring it to the LLC. It is essential to note that a quitclaim deed only transfers the current owner's interest in the property and does not provide any warranty or guarantee of the property's title. Therefore, it is crucial for both parties involved to ensure no encumbrances or potential issues with the property's title exist before proceeding with the transfer. Different types of Odessa Texas Quitclaim Deeds from Husband and Wife to LLC may include: 1. General Quitclaim Deed: This standard type of quitclaim deed transfers the entire interest the husband and wife have in the property to the LLC. It does not differentiate between individual percentages of ownership or contributions to the property. 2. Split Percentage Quitclaim Deed: In certain situations, a couple may wish to transfer ownership to their LLC but maintain specific individual ownership percentages. A split percentage quitclaim deed allows for the accurate allocation of ownership interests in the property between the husband, wife, and the LLC. 3. Special Quitclaim Deed: A special quitclaim deed could be used when certain conditions or restrictions need to be specified for the transfer of property to the LLC. This may include limitations on use, development rights, or specific language governing the transfer process. 4. Warranty Deed to LLC: Although not a quitclaim deed per se, some couples may prefer to transfer property ownership using a warranty deed instead. A warranty deed provides certain assurances and warranties about the property's title, assuring the LLC of a clean and clear transfer. It is advisable to seek professional legal advice or consult with a real estate attorney experienced in Texas property laws before executing any quitclaim deed. This ensures compliance with state-specific regulations and safeguards the interests of all parties involved in the transaction.