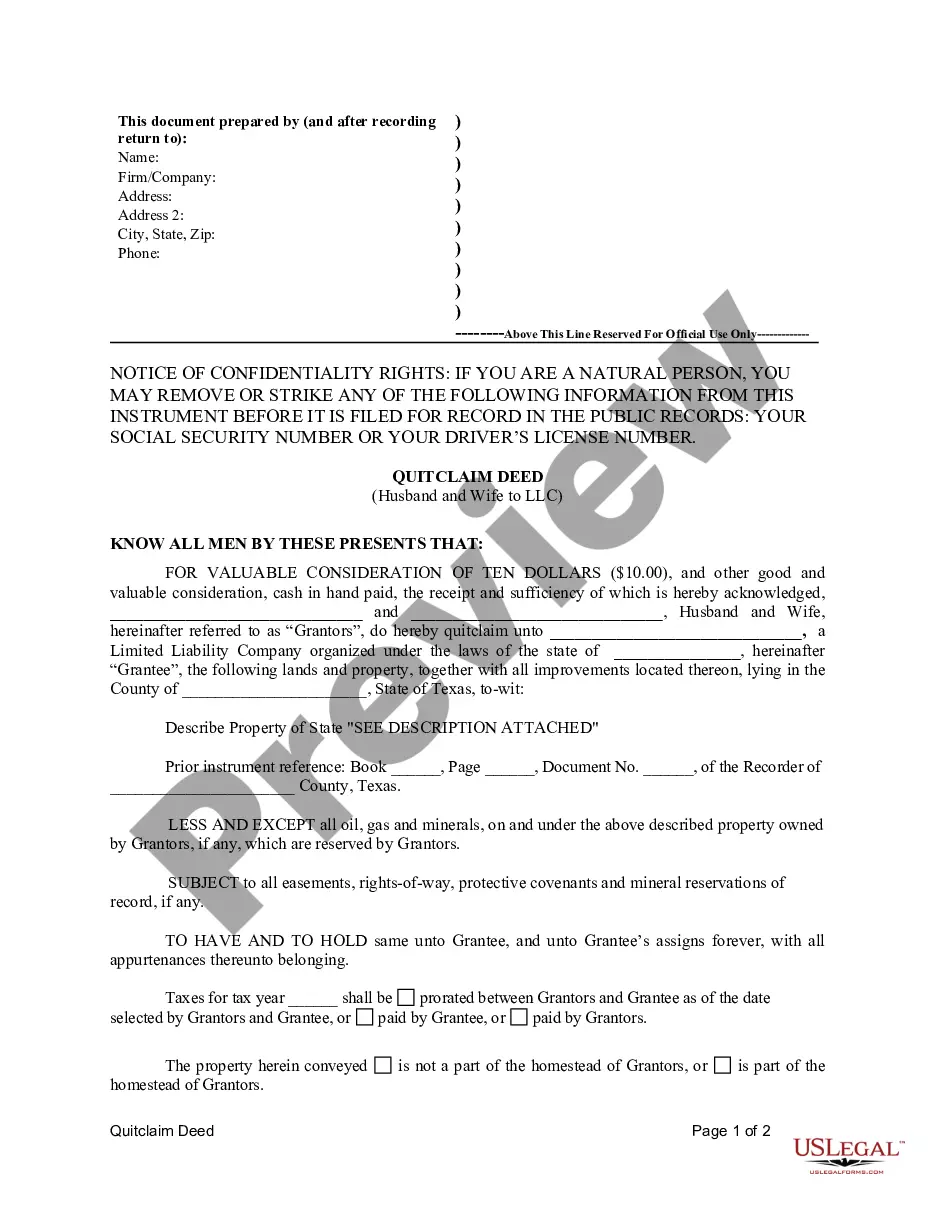

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

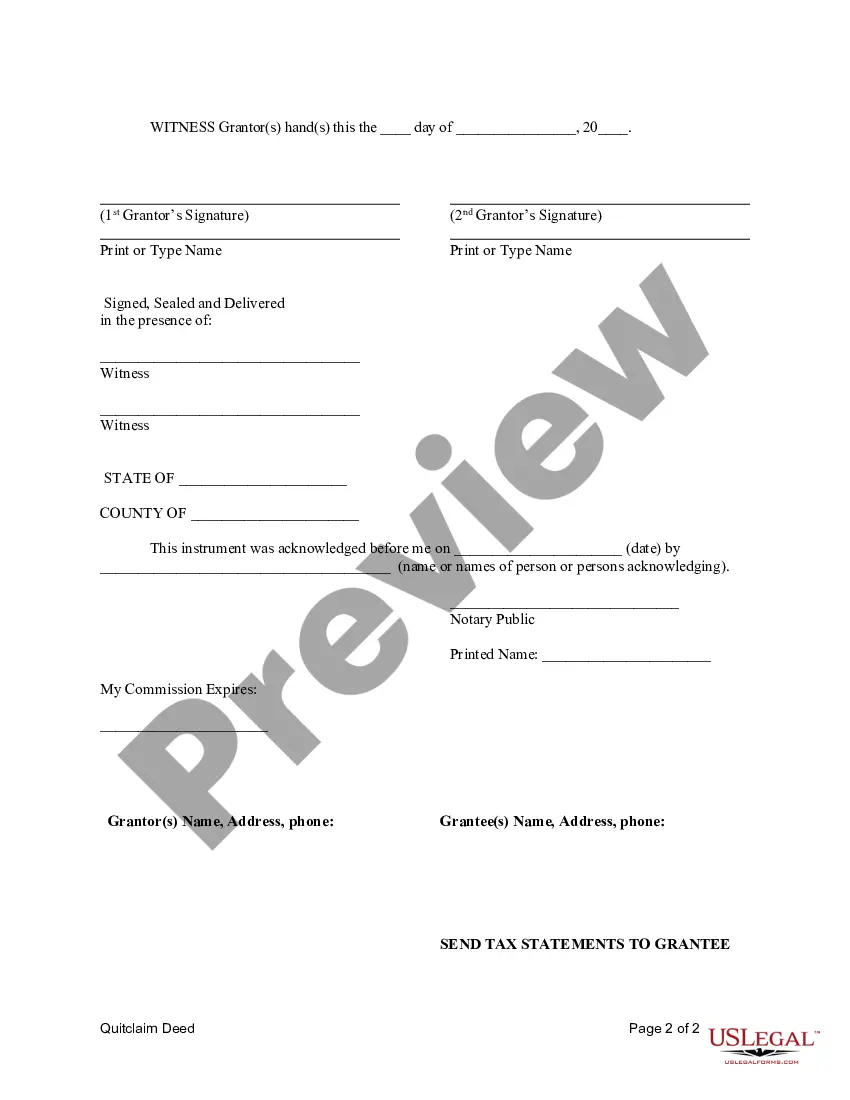

A Pearland Texas Quitclaim Deed is a legal document that transfers the ownership interest of a property from a husband and wife to a Limited Liability Company (LLC). This type of deed is commonly used when the spouses want to transfer their property into an LLC for various reasons, such as asset protection, tax benefits, or business purposes. The process of creating a Pearland Texas Quitclaim Deed involves specific steps and requirements. It is important to understand the various types of Quitclaim Deeds that can be utilized in this scenario, including: 1. Traditional Pearland Texas Quitclaim Deed from Husband and Wife to LLC: This type of deed is the standard form used for transferring property ownership from a married couple to an LLC in Pearland, Texas. It involves the husband and wife executing the deed, relinquishing their ownership interest, and transferring it to the LLC. The LLC then becomes the new legal owner of the property. 2. Pearland Texas Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: Joint tenancy with rights of survivorship is a common form of property ownership among married couples in Pearland, Texas. In this scenario, when one spouse passes away, the surviving spouse automatically inherits the deceased spouse's ownership interest. However, if the couple decides to transfer their property to an LLC, they can use this specific type of Quitclaim Deed to eliminate the survivorship rights and transfer the property solely to the LLC. 3. Pearland Texas Community Property Quitclaim Deed from Husband and Wife to LLC: Texas is a community property state, meaning that assets acquired during marriage are considered to be owned jointly by both spouses. A Community Property Quitclaim Deed allows the transfer of community property from a husband and wife to an LLC, effectively changing the ownership structure. This type of deed can be utilized when the couple wants to separate their personal assets from the property owned by the LLC. It is crucial to follow the legal guidelines and requirements when preparing a Pearland Texas Quitclaim Deed from Husband and Wife to LLC. Consider consulting an experienced real estate attorney or using online legal services that specialize in Texas real estate transactions to ensure the proper execution and recording of the deed. Keywords: Pearland Texas, Quitclaim Deed, Husband and Wife, LLC, property ownership, legal document, asset protection, tax benefits, business purposes, traditional, joint tenancy, rights of survivorship, community property, real estate transactions.A Pearland Texas Quitclaim Deed is a legal document that transfers the ownership interest of a property from a husband and wife to a Limited Liability Company (LLC). This type of deed is commonly used when the spouses want to transfer their property into an LLC for various reasons, such as asset protection, tax benefits, or business purposes. The process of creating a Pearland Texas Quitclaim Deed involves specific steps and requirements. It is important to understand the various types of Quitclaim Deeds that can be utilized in this scenario, including: 1. Traditional Pearland Texas Quitclaim Deed from Husband and Wife to LLC: This type of deed is the standard form used for transferring property ownership from a married couple to an LLC in Pearland, Texas. It involves the husband and wife executing the deed, relinquishing their ownership interest, and transferring it to the LLC. The LLC then becomes the new legal owner of the property. 2. Pearland Texas Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: Joint tenancy with rights of survivorship is a common form of property ownership among married couples in Pearland, Texas. In this scenario, when one spouse passes away, the surviving spouse automatically inherits the deceased spouse's ownership interest. However, if the couple decides to transfer their property to an LLC, they can use this specific type of Quitclaim Deed to eliminate the survivorship rights and transfer the property solely to the LLC. 3. Pearland Texas Community Property Quitclaim Deed from Husband and Wife to LLC: Texas is a community property state, meaning that assets acquired during marriage are considered to be owned jointly by both spouses. A Community Property Quitclaim Deed allows the transfer of community property from a husband and wife to an LLC, effectively changing the ownership structure. This type of deed can be utilized when the couple wants to separate their personal assets from the property owned by the LLC. It is crucial to follow the legal guidelines and requirements when preparing a Pearland Texas Quitclaim Deed from Husband and Wife to LLC. Consider consulting an experienced real estate attorney or using online legal services that specialize in Texas real estate transactions to ensure the proper execution and recording of the deed. Keywords: Pearland Texas, Quitclaim Deed, Husband and Wife, LLC, property ownership, legal document, asset protection, tax benefits, business purposes, traditional, joint tenancy, rights of survivorship, community property, real estate transactions.