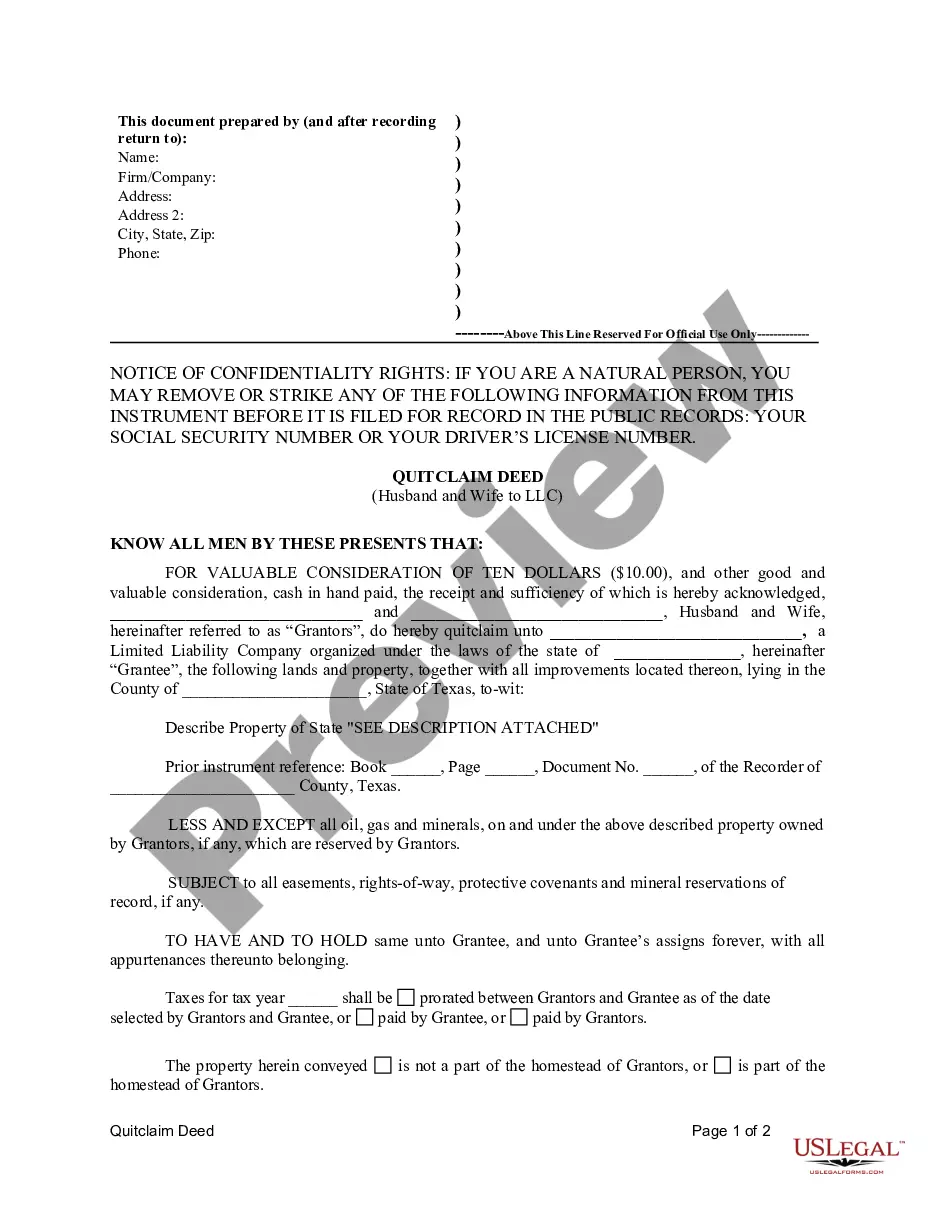

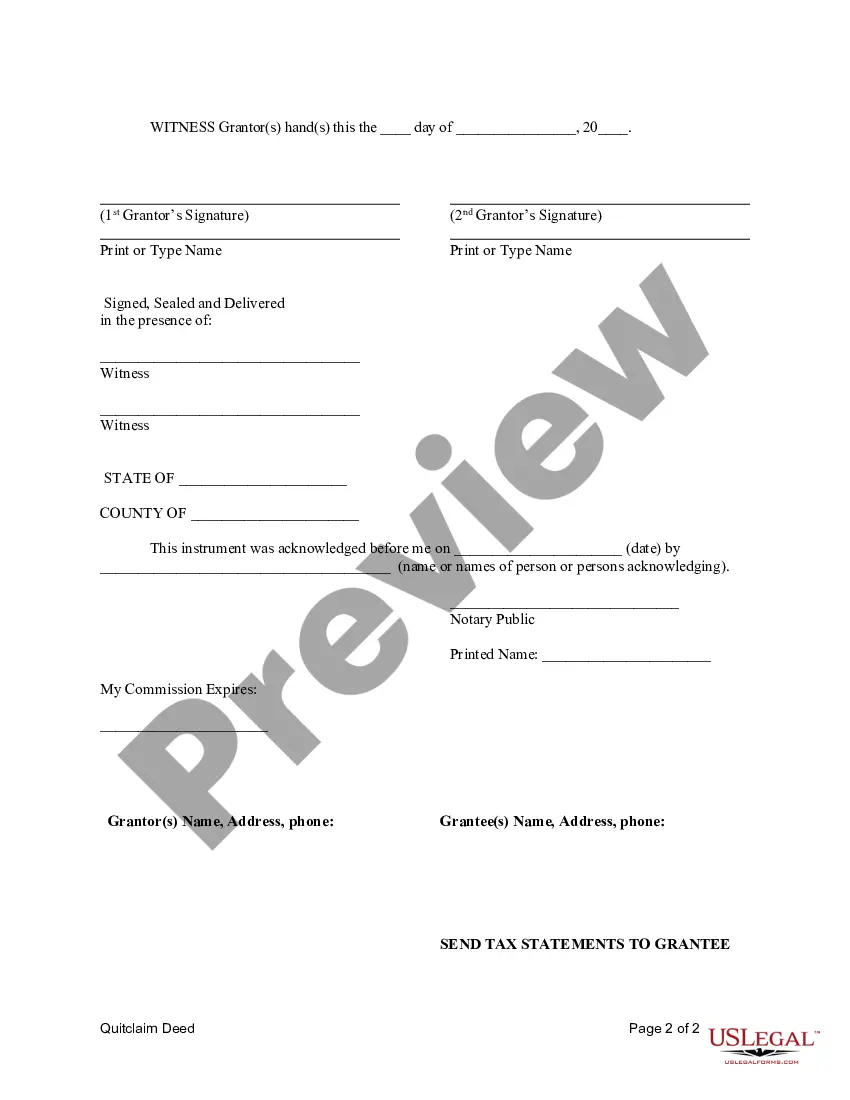

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Round Rock Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership rights of a property from a married couple to a limited liability company (LLC). This type of deed is commonly used when individuals want to transfer a property they jointly own to an LLC for various reasons, such as asset protection, business purposes, or estate planning. The Round Rock Texas Quitclaim Deed from Husband and Wife to LLC involves the voluntary transfer of ownership rights without any warranties or guarantees. It signifies that the husband and wife are relinquishing any ownership interests they have in the property to the LLC, without making any promises or representations about the property's title or condition. By executing this quitclaim deed, the husband and wife transfer their ownership rights, including any legal claims, to the LLC. The LLC then becomes the new owner of the property, taking on any associated rights, responsibilities, and liabilities. Different types of Round Rock Texas Quitclaim Deed from Husband and Wife to LLC may include: 1. Round Rock Texas Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when the property is owned as joint tenants. Joint tenants have equal ownership interests and rights in the property, and this deed allows them to transfer their joint tenancy interest to the LLC. 2. Round Rock Texas Tenancy in Common Quitclaim Deed from Husband and Wife to LLC: If the property is owned as tenants in common, this deed can be used. Unlike joint tenancy, tenants in common can have unequal ownership shares. This deed allows the husband and wife to transfer their ownership interests according to their respective shares to the LLC. 3. Round Rock Texas Community Property Quitclaim Deed from Husband and Wife to LLC: Texas is a community property state, which means that property acquired during marriage is generally considered community property, owned equally by both spouses. This deed type is specifically used for transferring community property from the husband and wife to the LLC. In conclusion, a Round Rock Texas Quitclaim Deed from Husband and Wife to LLC facilitates the transfer of property ownership from a married couple to an LLC. This legal document is commonly used for various purposes, and there are different types of deeds available depending on the nature of ownership and property classification.A Round Rock Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership rights of a property from a married couple to a limited liability company (LLC). This type of deed is commonly used when individuals want to transfer a property they jointly own to an LLC for various reasons, such as asset protection, business purposes, or estate planning. The Round Rock Texas Quitclaim Deed from Husband and Wife to LLC involves the voluntary transfer of ownership rights without any warranties or guarantees. It signifies that the husband and wife are relinquishing any ownership interests they have in the property to the LLC, without making any promises or representations about the property's title or condition. By executing this quitclaim deed, the husband and wife transfer their ownership rights, including any legal claims, to the LLC. The LLC then becomes the new owner of the property, taking on any associated rights, responsibilities, and liabilities. Different types of Round Rock Texas Quitclaim Deed from Husband and Wife to LLC may include: 1. Round Rock Texas Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when the property is owned as joint tenants. Joint tenants have equal ownership interests and rights in the property, and this deed allows them to transfer their joint tenancy interest to the LLC. 2. Round Rock Texas Tenancy in Common Quitclaim Deed from Husband and Wife to LLC: If the property is owned as tenants in common, this deed can be used. Unlike joint tenancy, tenants in common can have unequal ownership shares. This deed allows the husband and wife to transfer their ownership interests according to their respective shares to the LLC. 3. Round Rock Texas Community Property Quitclaim Deed from Husband and Wife to LLC: Texas is a community property state, which means that property acquired during marriage is generally considered community property, owned equally by both spouses. This deed type is specifically used for transferring community property from the husband and wife to the LLC. In conclusion, a Round Rock Texas Quitclaim Deed from Husband and Wife to LLC facilitates the transfer of property ownership from a married couple to an LLC. This legal document is commonly used for various purposes, and there are different types of deeds available depending on the nature of ownership and property classification.