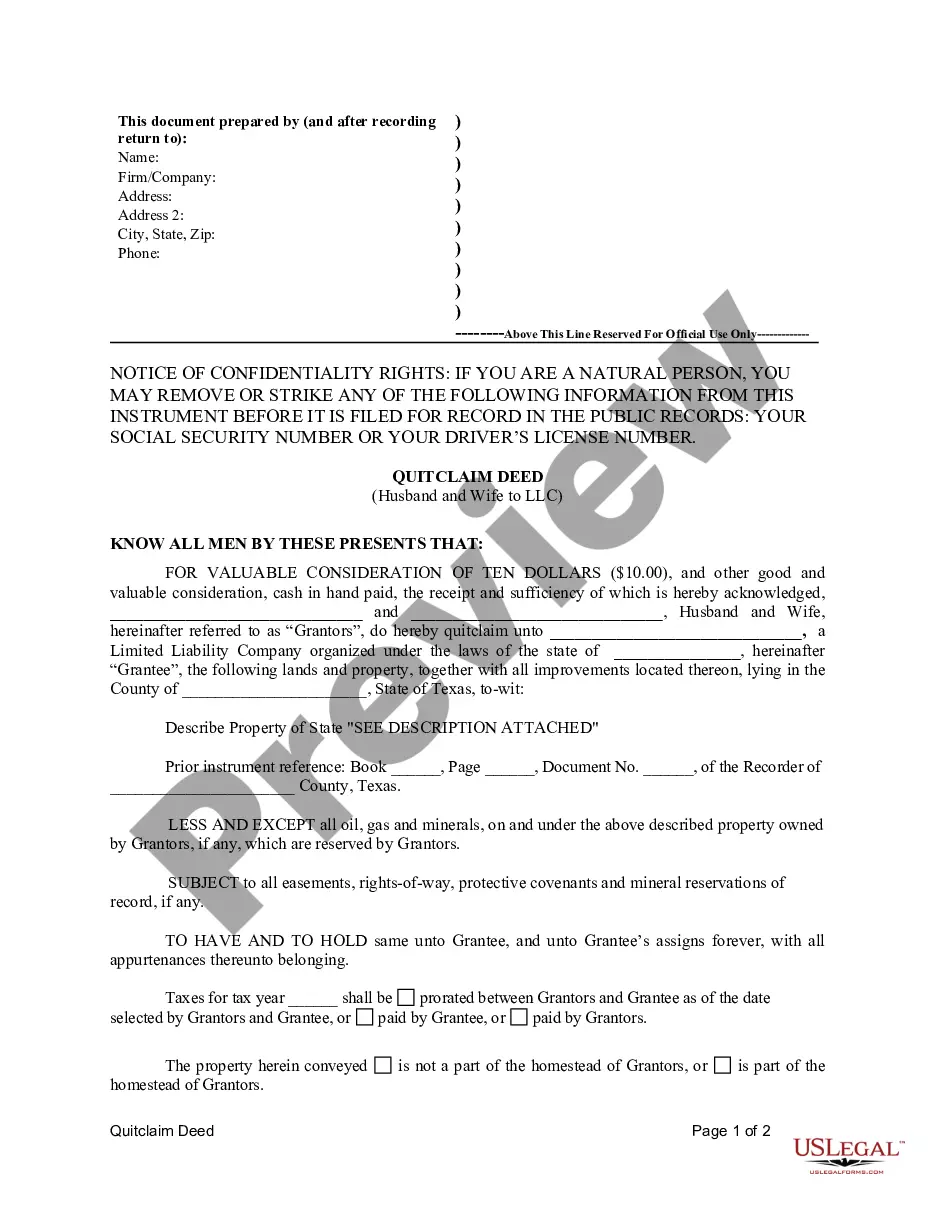

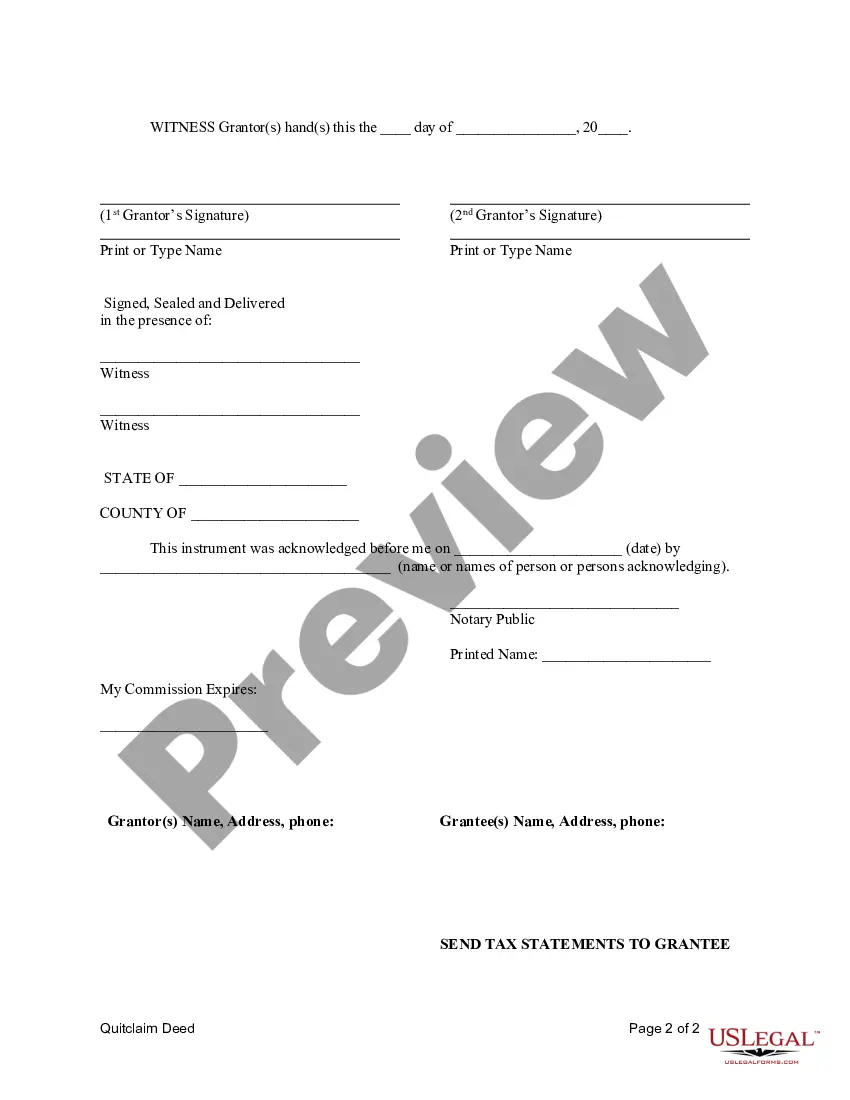

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Sugar Land Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership rights of a property from a married couple to a limited liability company (LLC) in the city of Sugar Land, Texas. This transfer of ownership can have various purposes, from estate planning to asset protection or business structuring. In a Sugar Land Texas Quitclaim Deed, the husband and wife, referred to as granters, relinquish any interest, claim, or ownership they hold in the property to the LLC, known as the grantee. It is essential to note that a quitclaim deed does not guarantee or imply that the property has a clear title, nor does it provide any warranty of ownership. It simply conveys whatever rights the granters possess without any guarantees. There are different types of Sugar Land Texas Quitclaim Deeds from Husband and Wife to LLC, depending on the specific circumstances and intentions behind the transfer: 1. Estate Planning Quitclaim Deed: This type of quitclaim deed is commonly used for estate planning purposes. It allows the husband and wife to transfer ownership of their property to an LLC, which is often set up as a family trust, to facilitate smooth transition and distribution of assets upon their demise. 2. Business Structuring Quitclaim Deed: This quitclaim deed is utilized when the property is being transferred to an LLC for business purposes. It serves as a useful tool for protecting personal assets and limiting liability for the husband and wife, especially if they engage in entrepreneurial or investment activities. 3. Asset Protection Quitclaim Deed: In situations where the husband and wife want to shield their personal assets from potential legal claims, this quitclaim deed can be used to transfer ownership to an LLC. This arrangement creates a separation between personal and business assets, offering an extra layer of protection. The Sugar Land Texas Quitclaim Deed from Husband and Wife to LLC requires careful consideration and consultation with legal professionals to ensure compliance with local, state, and federal laws. It is crucial to conduct due diligence on the property's ownership history and consult a real estate attorney or title company to verify the property's condition and any potential encumbrances before entering into such an agreement.A Sugar Land Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership rights of a property from a married couple to a limited liability company (LLC) in the city of Sugar Land, Texas. This transfer of ownership can have various purposes, from estate planning to asset protection or business structuring. In a Sugar Land Texas Quitclaim Deed, the husband and wife, referred to as granters, relinquish any interest, claim, or ownership they hold in the property to the LLC, known as the grantee. It is essential to note that a quitclaim deed does not guarantee or imply that the property has a clear title, nor does it provide any warranty of ownership. It simply conveys whatever rights the granters possess without any guarantees. There are different types of Sugar Land Texas Quitclaim Deeds from Husband and Wife to LLC, depending on the specific circumstances and intentions behind the transfer: 1. Estate Planning Quitclaim Deed: This type of quitclaim deed is commonly used for estate planning purposes. It allows the husband and wife to transfer ownership of their property to an LLC, which is often set up as a family trust, to facilitate smooth transition and distribution of assets upon their demise. 2. Business Structuring Quitclaim Deed: This quitclaim deed is utilized when the property is being transferred to an LLC for business purposes. It serves as a useful tool for protecting personal assets and limiting liability for the husband and wife, especially if they engage in entrepreneurial or investment activities. 3. Asset Protection Quitclaim Deed: In situations where the husband and wife want to shield their personal assets from potential legal claims, this quitclaim deed can be used to transfer ownership to an LLC. This arrangement creates a separation between personal and business assets, offering an extra layer of protection. The Sugar Land Texas Quitclaim Deed from Husband and Wife to LLC requires careful consideration and consultation with legal professionals to ensure compliance with local, state, and federal laws. It is crucial to conduct due diligence on the property's ownership history and consult a real estate attorney or title company to verify the property's condition and any potential encumbrances before entering into such an agreement.