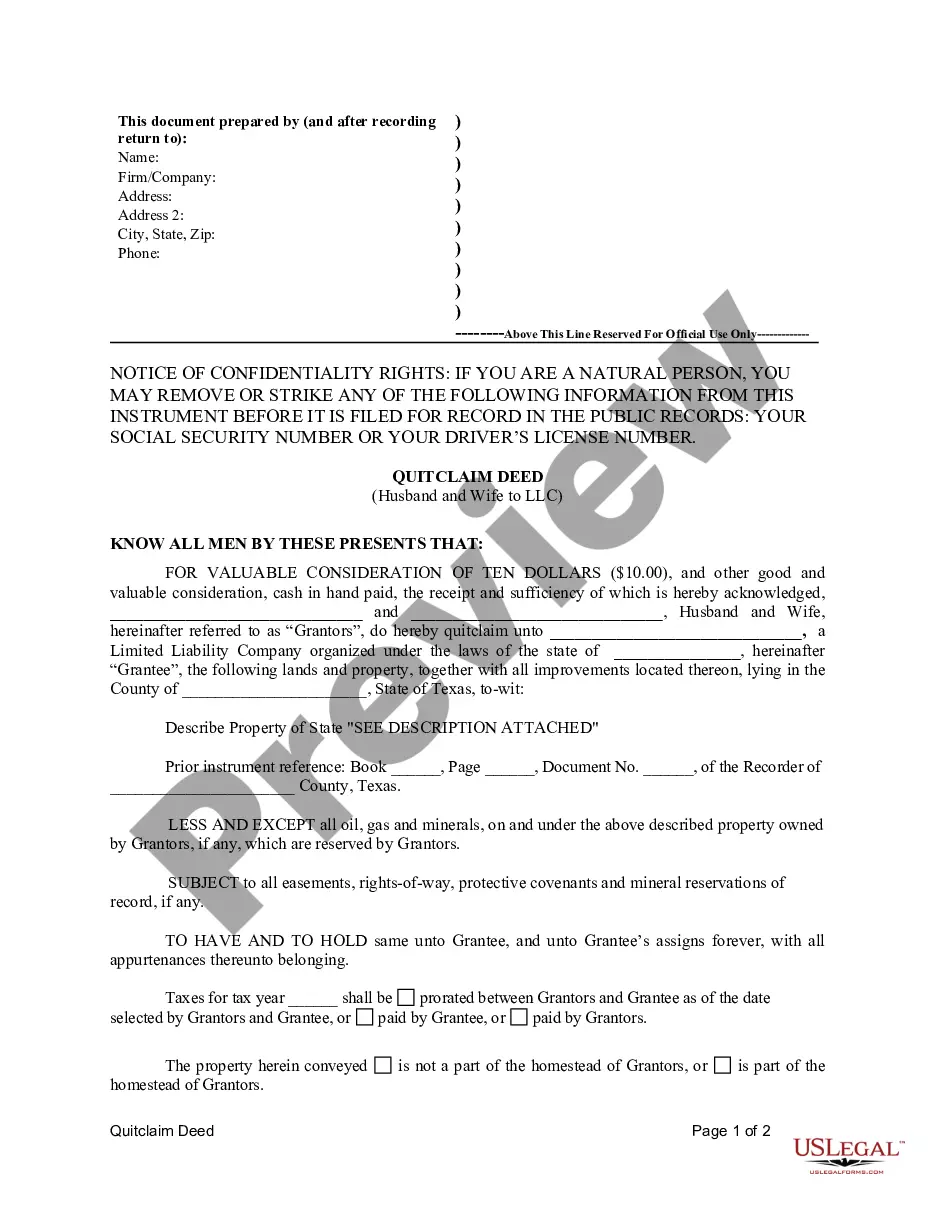

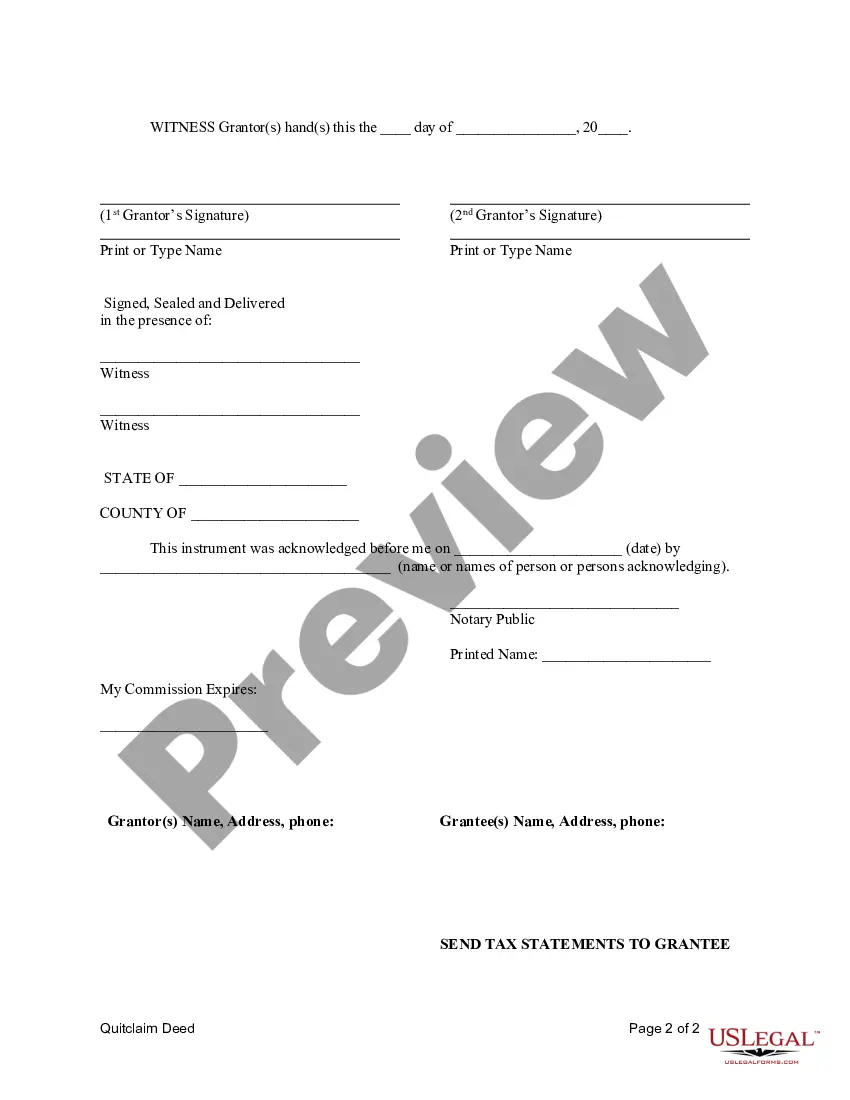

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Tarrant Texas Quitclaim Deed from Husband and Wife to LLC is a legally binding document that allows a married couple (husband and wife) to transfer their ownership interest or rights in a property to a limited liability company (LLC). This transfer can be done for various reasons, such as asset protection, business structuring, or estate planning. A quitclaim deed is commonly used when the conveyance is made without any warranties or guarantees regarding the property title. It simply transfers the interest of the granter (husband and wife) to the grantee (LLC), without any promise or assurance that the property has clear title. There are different types of Tarrant Texas Quitclaim Deed from Husband and Wife to LLC that can be executed based on specific circumstances: 1. General Tarrant Texas Quitclaim Deed from Husband and Wife to LLC: This is the most commonly used type of quitclaim deed. It transfers the entire ownership interest of the husband and wife to the LLC. 2. Partial Tarrant Texas Quitclaim Deed from Husband and Wife to LLC: In this variant, the spouses choose to transfer only a portion of their ownership interest to the LLC. For example, they may transfer a specific percentage or fraction of their rights. 3. Tarrant Texas Quitclaim Deed with Retained Life Estate from Husband and Wife to LLC: In this scenario, the husband and wife transfer their ownership interest to the LLC while reserving the right to live in, use, or profit from the property during their lifetime. This type of quitclaim deed provides security and flexibility to the couple while ensuring their interest ultimately passes on to the LLC. Keywords: Tarrant Texas, Quitclaim Deed, Husband and Wife, LLC, transfer, ownership interest, limited liability company, conveyance, warranties, guarantees, property title, clear title, circumstances, general, partial, retained life estate.A Tarrant Texas Quitclaim Deed from Husband and Wife to LLC is a legally binding document that allows a married couple (husband and wife) to transfer their ownership interest or rights in a property to a limited liability company (LLC). This transfer can be done for various reasons, such as asset protection, business structuring, or estate planning. A quitclaim deed is commonly used when the conveyance is made without any warranties or guarantees regarding the property title. It simply transfers the interest of the granter (husband and wife) to the grantee (LLC), without any promise or assurance that the property has clear title. There are different types of Tarrant Texas Quitclaim Deed from Husband and Wife to LLC that can be executed based on specific circumstances: 1. General Tarrant Texas Quitclaim Deed from Husband and Wife to LLC: This is the most commonly used type of quitclaim deed. It transfers the entire ownership interest of the husband and wife to the LLC. 2. Partial Tarrant Texas Quitclaim Deed from Husband and Wife to LLC: In this variant, the spouses choose to transfer only a portion of their ownership interest to the LLC. For example, they may transfer a specific percentage or fraction of their rights. 3. Tarrant Texas Quitclaim Deed with Retained Life Estate from Husband and Wife to LLC: In this scenario, the husband and wife transfer their ownership interest to the LLC while reserving the right to live in, use, or profit from the property during their lifetime. This type of quitclaim deed provides security and flexibility to the couple while ensuring their interest ultimately passes on to the LLC. Keywords: Tarrant Texas, Quitclaim Deed, Husband and Wife, LLC, transfer, ownership interest, limited liability company, conveyance, warranties, guarantees, property title, clear title, circumstances, general, partial, retained life estate.