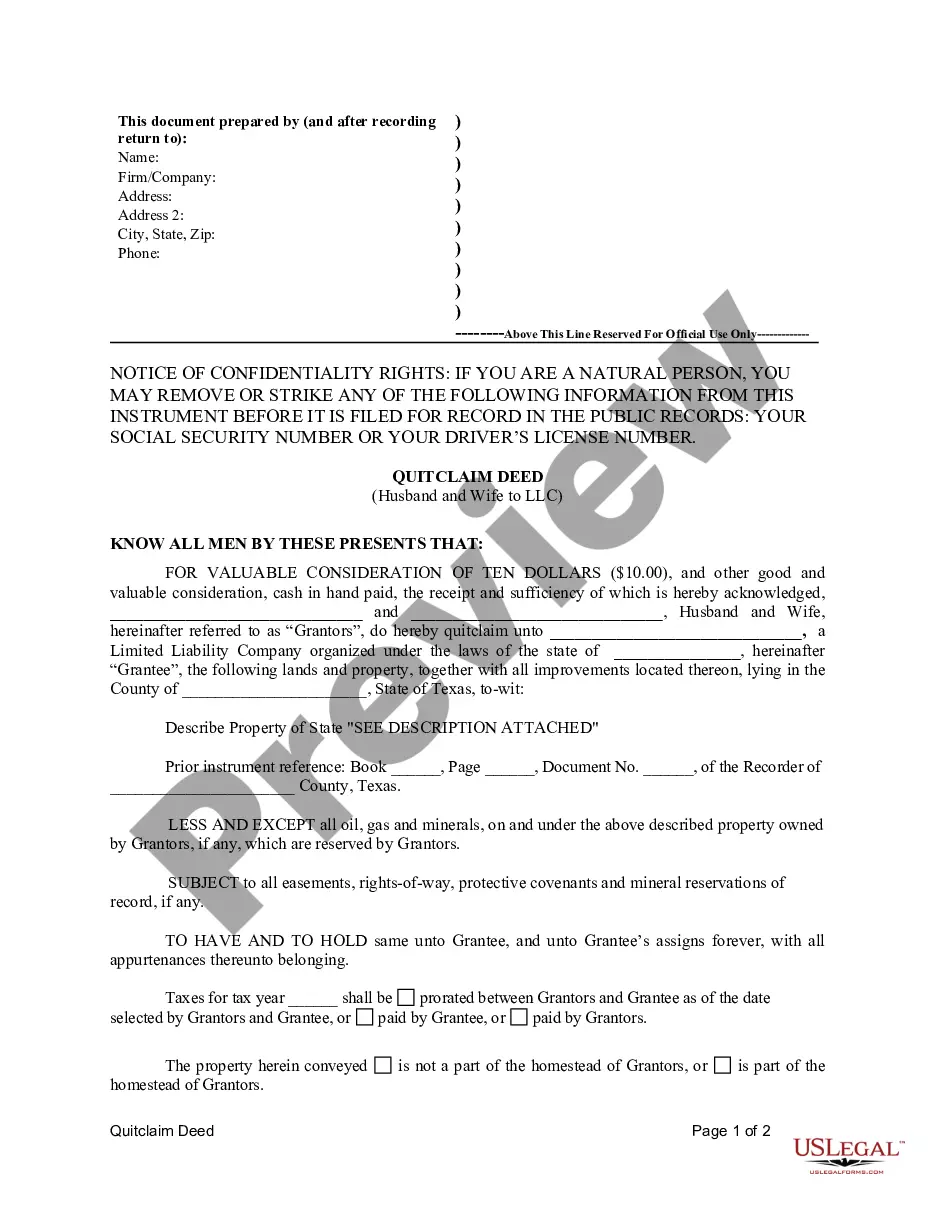

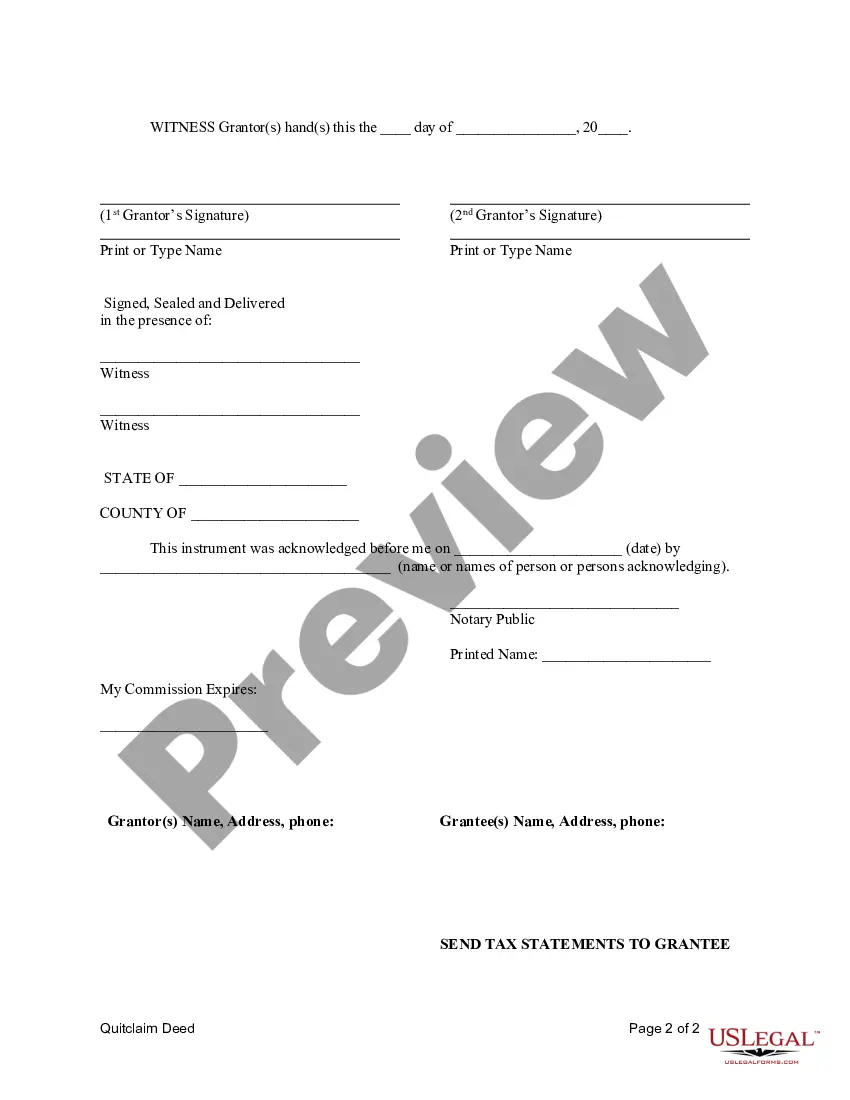

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Wichita Falls Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of real property, such as a house or land, from a married couple to a limited liability company (LLC). This type of transaction is commonly used when a couple wants to transfer ownership of their property to an LLC they have established, often for business or asset protection purposes. The process involves the husband and wife, referred to as granters, relinquishing their ownership rights to the property and transferring them to the LLC, known as the grantee. The transfer is made without any warranties or guarantees regarding the property's title or condition, making it important for both parties to conduct due diligence before executing the deed. There are different types of Wichita Falls Texas Quitclaim Deeds from Husband and Wife to LLC, including: 1. Absolute Quitclaim Deed: This is the most common type of quitclaim deed, where the husband and wife transfer their ownership interests in the property to the LLC with no conditions or reservations. 2. Quitclaim Deed with Encumbrances: In some cases, the husband and wife may transfer the property to the LLC while retaining certain encumbrances, such as mortgages or liens, which would then be assumed by the LLC. 3. Quitclaim Deed with Restrictions: This type of quitclaim deed can include specific restrictions or conditions imposed by the husband and wife for the LLC's use or future transfer of the property, such as limitations on development or conservation easements. It is crucial for all parties involved, including the husband and wife, to consult with a real estate attorney familiar with Texas laws to ensure a proper and legally-binding transfer of ownership. Additionally, it is recommended to conduct a thorough title search to identify any existing liens, encumbrances, or potential issues that may affect the property's title. This will help in mitigating risks and ensuring a smooth transfer process. Overall, a Wichita Falls Texas Quitclaim Deed from Husband and Wife to LLC offers a method for married couples to transfer property ownership to their LLC, allowing for greater control and potential benefits in terms of liability protection, tax planning, and business operations.A Wichita Falls Texas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of real property, such as a house or land, from a married couple to a limited liability company (LLC). This type of transaction is commonly used when a couple wants to transfer ownership of their property to an LLC they have established, often for business or asset protection purposes. The process involves the husband and wife, referred to as granters, relinquishing their ownership rights to the property and transferring them to the LLC, known as the grantee. The transfer is made without any warranties or guarantees regarding the property's title or condition, making it important for both parties to conduct due diligence before executing the deed. There are different types of Wichita Falls Texas Quitclaim Deeds from Husband and Wife to LLC, including: 1. Absolute Quitclaim Deed: This is the most common type of quitclaim deed, where the husband and wife transfer their ownership interests in the property to the LLC with no conditions or reservations. 2. Quitclaim Deed with Encumbrances: In some cases, the husband and wife may transfer the property to the LLC while retaining certain encumbrances, such as mortgages or liens, which would then be assumed by the LLC. 3. Quitclaim Deed with Restrictions: This type of quitclaim deed can include specific restrictions or conditions imposed by the husband and wife for the LLC's use or future transfer of the property, such as limitations on development or conservation easements. It is crucial for all parties involved, including the husband and wife, to consult with a real estate attorney familiar with Texas laws to ensure a proper and legally-binding transfer of ownership. Additionally, it is recommended to conduct a thorough title search to identify any existing liens, encumbrances, or potential issues that may affect the property's title. This will help in mitigating risks and ensuring a smooth transfer process. Overall, a Wichita Falls Texas Quitclaim Deed from Husband and Wife to LLC offers a method for married couples to transfer property ownership to their LLC, allowing for greater control and potential benefits in terms of liability protection, tax planning, and business operations.