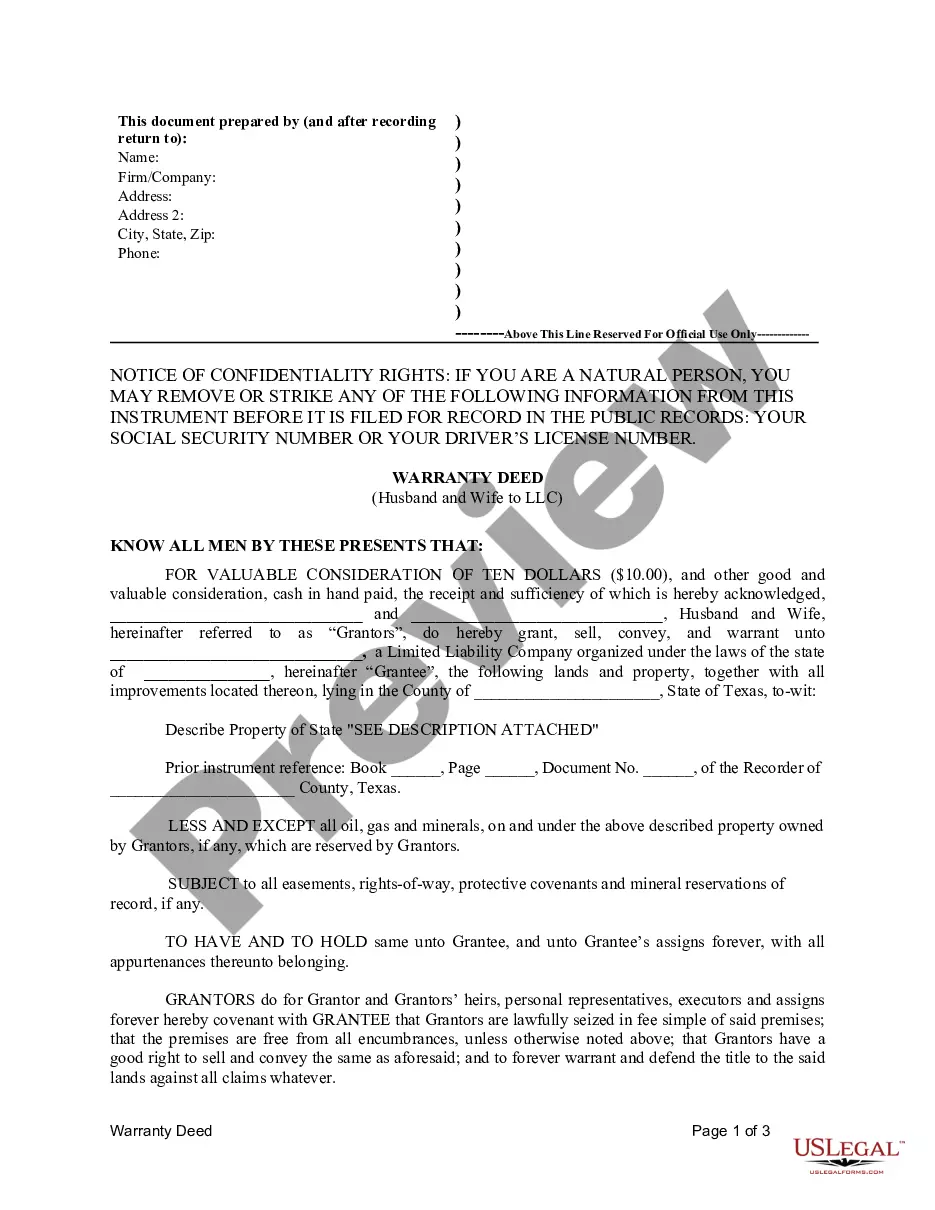

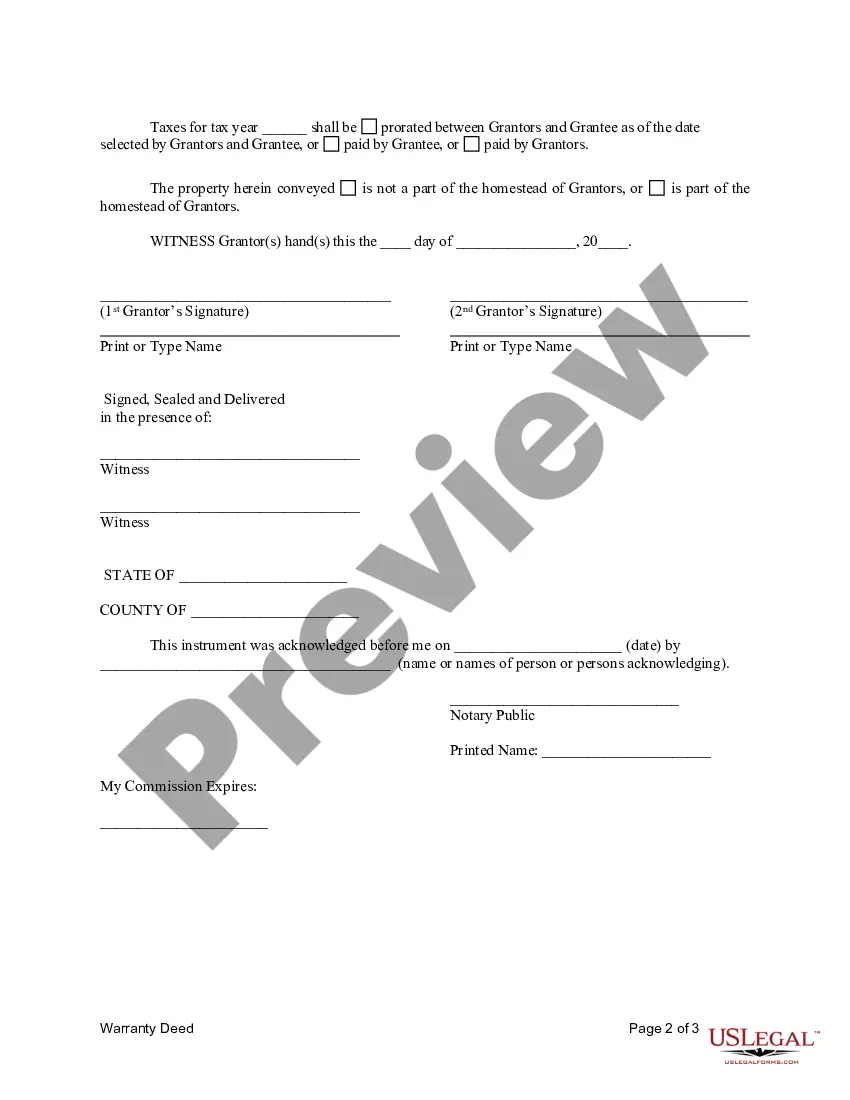

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A Harris Texas Warranty Deed from Husband and Wife to LLC is a legal document that transfers ownership of real estate property from a married couple (husband and wife) to a Limited Liability Company (LLC) in Harris County, Texas, while guaranteeing that the property is free from any defects in title. This type of deed provides the LLC with full ownership rights and protection against any potential claims or encumbrances on the property. The Harris Texas Warranty Deed from Husband and Wife to LLC serves as a secure method for individuals to transfer their personal property to an LLC they have formed or wish to establish. By executing this deed, the husband and wife are essentially conveying their ownership interest in the property to the LLC. There are a few variations of the Harris Texas Warranty Deed from Husband and Wife to LLC, including: 1. General Warranty Deed: This type of deed provides the highest level of protection for the buyer (LLC) as it includes extensive warranties by the granters (husband and wife). These warranties guarantee that the granters have clear and marketable title to the property, and they warrant to defend the title against any claims that may arise. 2. Special Warranty Deed: Unlike the general warranty deed, a special warranty deed limits the warranties made by the granters. It only guarantees that the property was not encumbered or adversely affected during the time the granters owned it. This means that any defects in title prior to their ownership are not covered. 3. Quitclaim Deed: A quitclaim deed is another option for transferring ownership, but it comes with the least amount of protection. The granters make no warranties or guarantees of title, and they simply convey whatever interest they have in the property to the LLC. It is important for the LLC to conduct a thorough title search to ensure there are no hidden title issues. When executing a Harris Texas Warranty Deed from Husband and Wife to LLC, it is recommended to consult with a real estate attorney to ensure all legal requirements are met. The deed must be properly prepared, signed, and notarized before it can be recorded with the county clerk's office, making the transfer of ownership official and legally binding. Overall, a Harris Texas Warranty Deed from Husband and Wife to LLC provides a secure means for a married couple to transfer property ownership to their LLC, offering protection against any potential claims or encumbrances. By choosing the appropriate type of warranty deed, the husband and wife can determine the level of protection they want to provide to the LLC regarding the property's title history.A Harris Texas Warranty Deed from Husband and Wife to LLC is a legal document that transfers ownership of real estate property from a married couple (husband and wife) to a Limited Liability Company (LLC) in Harris County, Texas, while guaranteeing that the property is free from any defects in title. This type of deed provides the LLC with full ownership rights and protection against any potential claims or encumbrances on the property. The Harris Texas Warranty Deed from Husband and Wife to LLC serves as a secure method for individuals to transfer their personal property to an LLC they have formed or wish to establish. By executing this deed, the husband and wife are essentially conveying their ownership interest in the property to the LLC. There are a few variations of the Harris Texas Warranty Deed from Husband and Wife to LLC, including: 1. General Warranty Deed: This type of deed provides the highest level of protection for the buyer (LLC) as it includes extensive warranties by the granters (husband and wife). These warranties guarantee that the granters have clear and marketable title to the property, and they warrant to defend the title against any claims that may arise. 2. Special Warranty Deed: Unlike the general warranty deed, a special warranty deed limits the warranties made by the granters. It only guarantees that the property was not encumbered or adversely affected during the time the granters owned it. This means that any defects in title prior to their ownership are not covered. 3. Quitclaim Deed: A quitclaim deed is another option for transferring ownership, but it comes with the least amount of protection. The granters make no warranties or guarantees of title, and they simply convey whatever interest they have in the property to the LLC. It is important for the LLC to conduct a thorough title search to ensure there are no hidden title issues. When executing a Harris Texas Warranty Deed from Husband and Wife to LLC, it is recommended to consult with a real estate attorney to ensure all legal requirements are met. The deed must be properly prepared, signed, and notarized before it can be recorded with the county clerk's office, making the transfer of ownership official and legally binding. Overall, a Harris Texas Warranty Deed from Husband and Wife to LLC provides a secure means for a married couple to transfer property ownership to their LLC, offering protection against any potential claims or encumbrances. By choosing the appropriate type of warranty deed, the husband and wife can determine the level of protection they want to provide to the LLC regarding the property's title history.