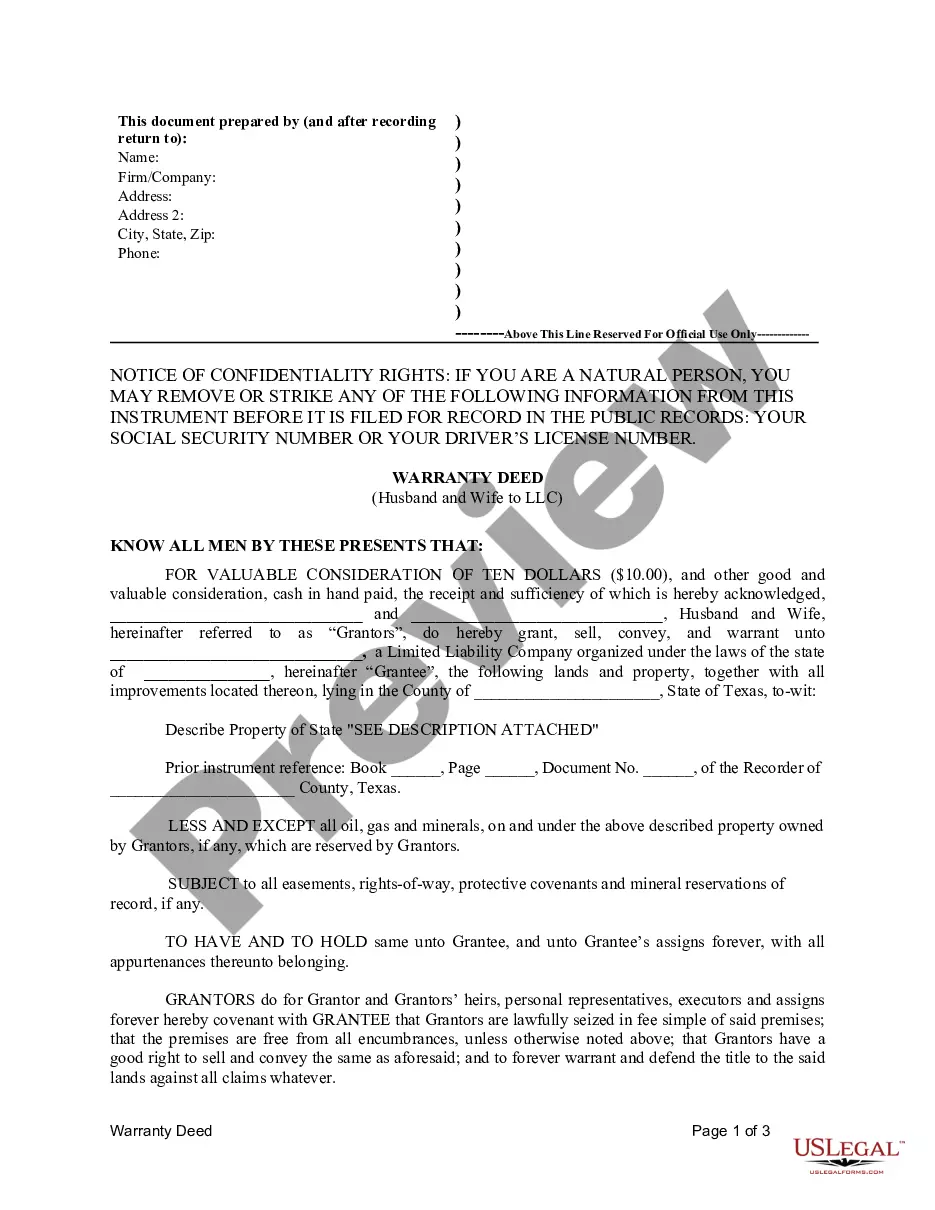

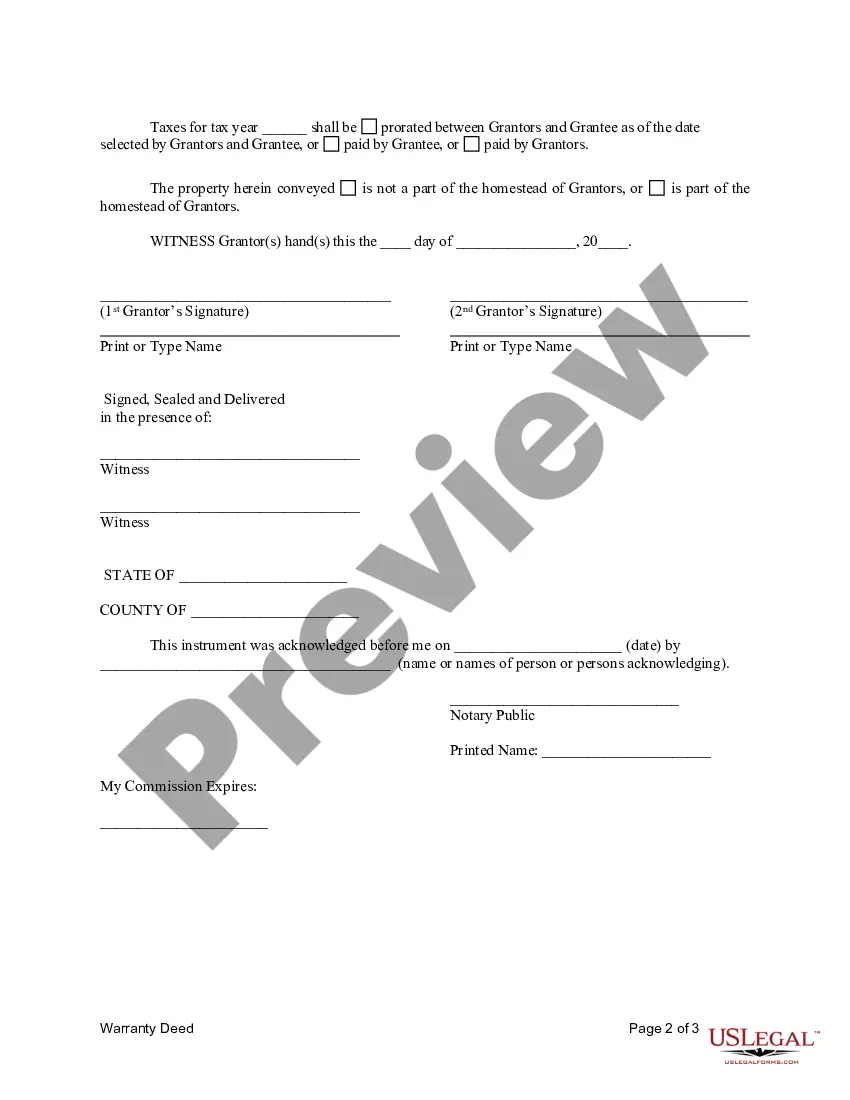

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A warranty deed is a legal document that transfers ownership rights of a property from one party to another. In the case of Round Rock, Texas, when a husband and wife wish to transfer ownership of real estate to their Limited Liability Company (LLC), a Round Rock Texas Warranty Deed from Husband and Wife to LLC is executed. This type of warranty deed ensures that the husband and wife, commonly referred to as the granters, guarantee that they are the lawful owners of the property and have the right to transfer ownership to the LLC, known as the grantee. Round Rock Texas Warranty Deed from Husband and Wife to LLC typically includes the following key elements: 1. Property Description: The deed includes a detailed and accurate description of the property being transferred, including its physical address, legal description, lot numbers, and any other relevant identifiers. 2. Granter and Grantee Information: The document should specify the names and contact information of both the husband and wife as the granters and the LLC as the grantee. It is essential to include their full legal names, ensuring it matches their respective legal documents. 3. Consideration: The warranty deed must outline the consideration or payment exchanged for the transfer of ownership. It could be a fair market value price, the husband and wife's investment in the LLC, or other agreed-upon terms. 4. Guarantee of Title: The warranty deed guarantees that the husband and wife have legal ownership of the property and have the right to transfer it to the LLC. The granters guarantee that the property is free from any encumbrances or claims that might affect the title, except as explicitly mentioned in the deed. 5. Covenants: Various covenants or promises by the granters will also be included in the warranty deed. These typically include covenants of basin (representation that the granters own the property), the right to convey (the granters have the right to transfer ownership), and against encumbrances (the property is free from liens or other burdens). Several types of Round Rock Texas Warranty Deeds from Husband and Wife to LLC may exist, depending on specific circumstances or intentions. Here are a few common variations: 1. General Warranty Deed: A comprehensive type of warranty deed that provides broad coverage and protection to the purchaser if any title issues or disputes arise in the future. 2. Special Warranty Deed: This type of warranty deed limits the warranty only to the period when the granter owned the property, offering protection against claims arising during their ownership but not prior to it. 3. Quitclaim Deed: Unlike a warranty deed, this legal document makes no guarantees about the granters' ownership or the existence of encumbrances. It merely transfers any current ownership rights without warranty. When transferring property from a husband and wife to an LLC in Round Rock, Texas, understanding the specific type of warranty deed being used is crucial, as it determines the extent of protection and guarantees provided to the grantee.A warranty deed is a legal document that transfers ownership rights of a property from one party to another. In the case of Round Rock, Texas, when a husband and wife wish to transfer ownership of real estate to their Limited Liability Company (LLC), a Round Rock Texas Warranty Deed from Husband and Wife to LLC is executed. This type of warranty deed ensures that the husband and wife, commonly referred to as the granters, guarantee that they are the lawful owners of the property and have the right to transfer ownership to the LLC, known as the grantee. Round Rock Texas Warranty Deed from Husband and Wife to LLC typically includes the following key elements: 1. Property Description: The deed includes a detailed and accurate description of the property being transferred, including its physical address, legal description, lot numbers, and any other relevant identifiers. 2. Granter and Grantee Information: The document should specify the names and contact information of both the husband and wife as the granters and the LLC as the grantee. It is essential to include their full legal names, ensuring it matches their respective legal documents. 3. Consideration: The warranty deed must outline the consideration or payment exchanged for the transfer of ownership. It could be a fair market value price, the husband and wife's investment in the LLC, or other agreed-upon terms. 4. Guarantee of Title: The warranty deed guarantees that the husband and wife have legal ownership of the property and have the right to transfer it to the LLC. The granters guarantee that the property is free from any encumbrances or claims that might affect the title, except as explicitly mentioned in the deed. 5. Covenants: Various covenants or promises by the granters will also be included in the warranty deed. These typically include covenants of basin (representation that the granters own the property), the right to convey (the granters have the right to transfer ownership), and against encumbrances (the property is free from liens or other burdens). Several types of Round Rock Texas Warranty Deeds from Husband and Wife to LLC may exist, depending on specific circumstances or intentions. Here are a few common variations: 1. General Warranty Deed: A comprehensive type of warranty deed that provides broad coverage and protection to the purchaser if any title issues or disputes arise in the future. 2. Special Warranty Deed: This type of warranty deed limits the warranty only to the period when the granter owned the property, offering protection against claims arising during their ownership but not prior to it. 3. Quitclaim Deed: Unlike a warranty deed, this legal document makes no guarantees about the granters' ownership or the existence of encumbrances. It merely transfers any current ownership rights without warranty. When transferring property from a husband and wife to an LLC in Round Rock, Texas, understanding the specific type of warranty deed being used is crucial, as it determines the extent of protection and guarantees provided to the grantee.