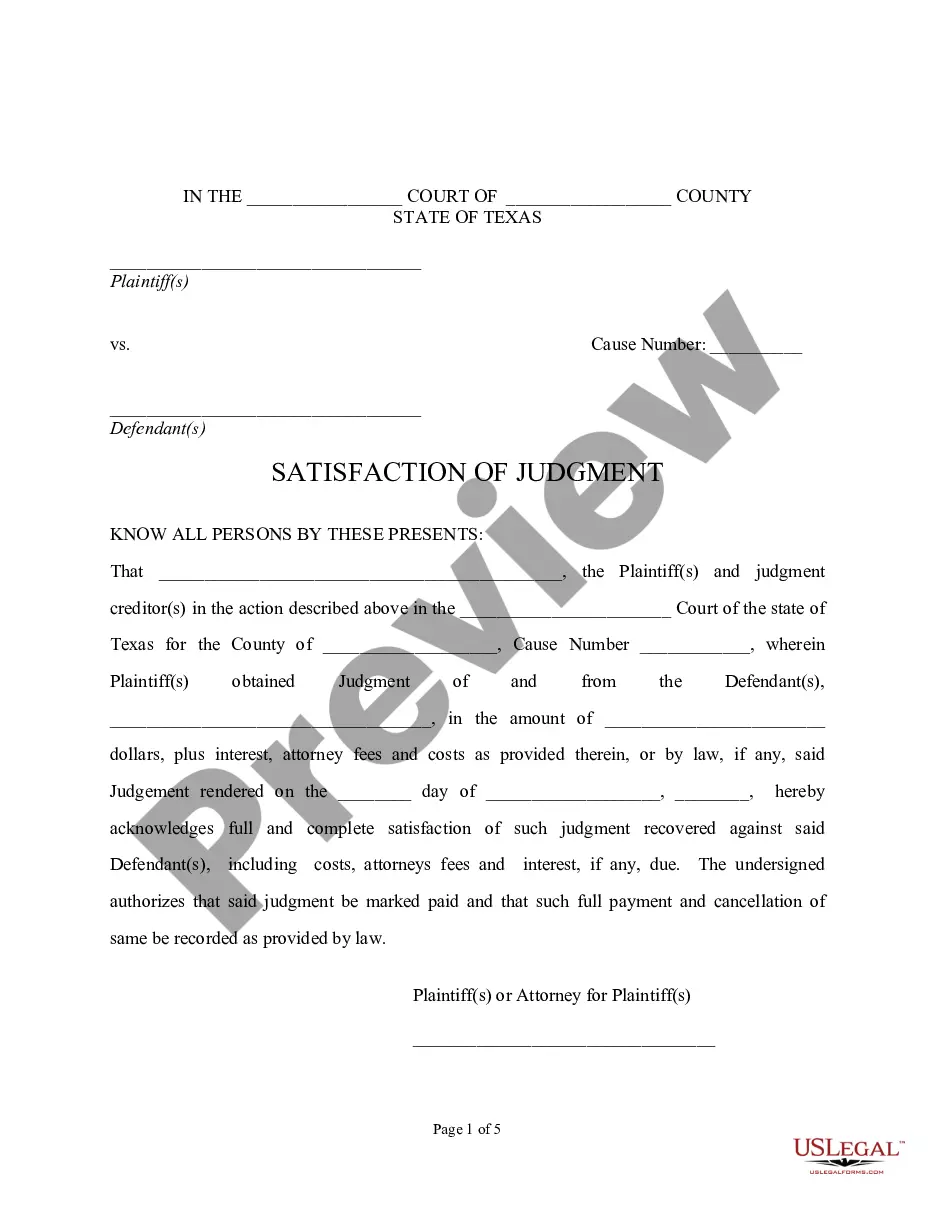

This is a satisfaction of judgment which indicates that a judgment has been paid in full, including all fees, costs and interest. It acknowledges full and complete satisfaction of the judgment and directs that the judgment be marked as paid in full.

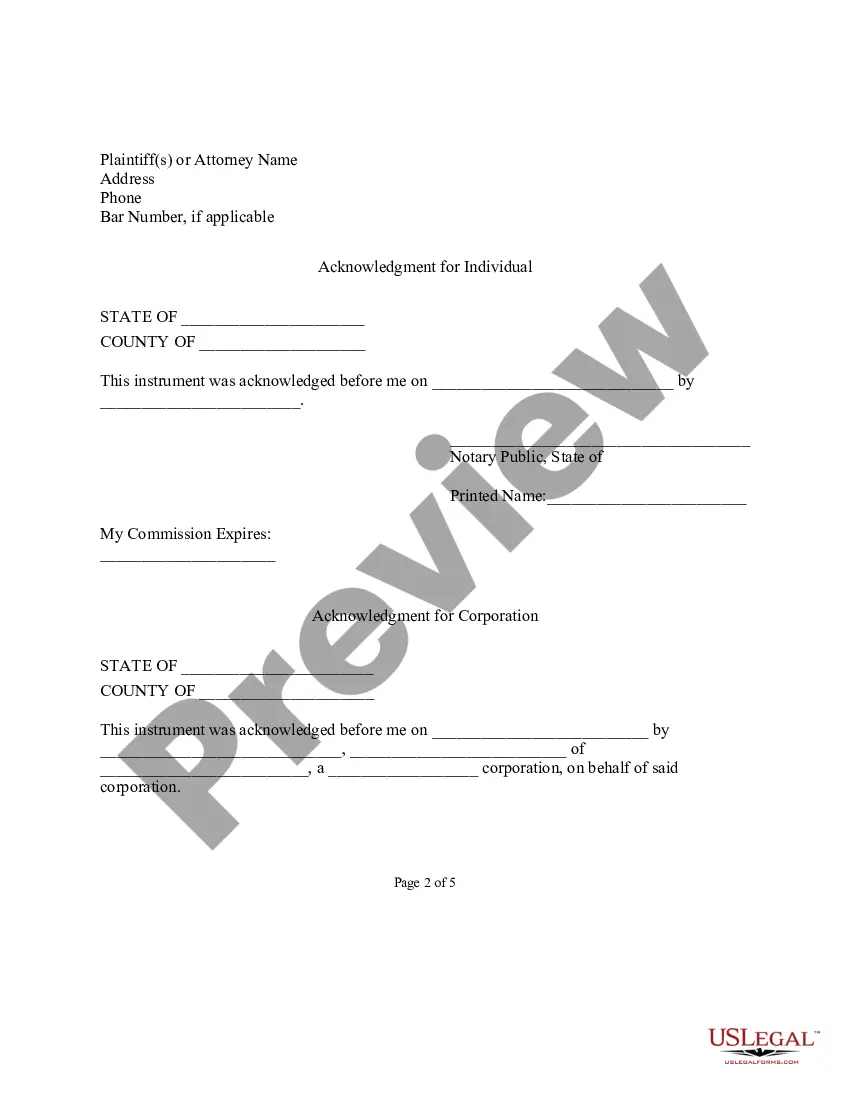

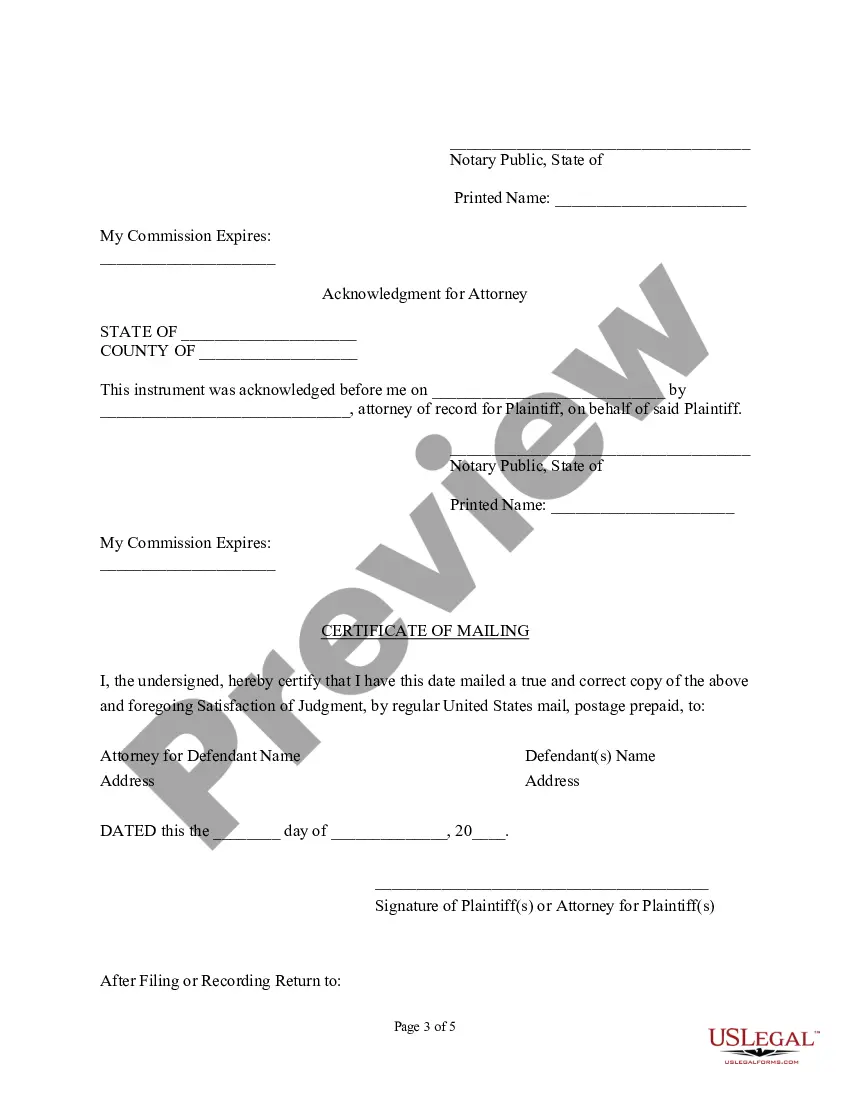

Sugar Land Texas Satisfaction of Judgment is a legal process that occurs after a judgment has been entered in a court case in Sugar Land, Texas. It refers to the fulfillment of the terms and conditions set by the court to resolve a lawsuit. When a judgment is satisfied, it means that the debtor has fulfilled their obligation to the creditor, ensuring that all monetary dues and other requirements have been met. The Satisfaction of Judgment process involves various steps to officially close the case. This procedure involves the documentation and filing of necessary paperwork, which certifies that the judgment has been satisfied. This typically includes the submission of a Satisfaction of Judgment form to the court, informing them that the debtor has met their obligations. There are different types of Sugar Land Texas Satisfaction of Judgment, depending on the nature of the case and the conditions set by the court. These may include: 1. Civil Judgment Satisfaction: This type of satisfaction refers to the resolution of civil legal matters, such as personal injury lawsuits, property disputes, or breach of contract cases. Once the party responsible for the judgment fulfills their obligations, a Satisfaction of Judgment is filed to conclude the case. 2. Small Claims Judgment Satisfaction: Small claims courts handle cases involving lower monetary limits. When a small claims judgment is handed down and the debtor satisfies the judge's ruling, a Satisfaction of Judgment is filed to officially close the case. 3. Criminal Judgment Satisfaction: In cases where criminal charges result in a judgment involving fines, restitution, or other penalties, the debtor must satisfy the judgment. Once the conditions are fulfilled, a Satisfaction of Judgment is filed to signify the completion of the sentence or financial obligations. 4. Tax Judgment Satisfaction: In instances where a judgment is made against a taxpayer by tax authorities, a Satisfaction of Judgment is filed once the outstanding tax liability has been paid. This serves as evidence that the taxpayer has fulfilled their obligations, settling the judgment against them. It is crucial for all parties involved in a Sugar Land Texas Satisfaction of Judgment to fully understand the court's requirements and adhere to them promptly. Failing to comply with the judgment may have legal consequences, further complicating the case. Seeking legal advice and assistance during this process can ensure a smoother and more efficient resolution.Sugar Land Texas Satisfaction of Judgment is a legal process that occurs after a judgment has been entered in a court case in Sugar Land, Texas. It refers to the fulfillment of the terms and conditions set by the court to resolve a lawsuit. When a judgment is satisfied, it means that the debtor has fulfilled their obligation to the creditor, ensuring that all monetary dues and other requirements have been met. The Satisfaction of Judgment process involves various steps to officially close the case. This procedure involves the documentation and filing of necessary paperwork, which certifies that the judgment has been satisfied. This typically includes the submission of a Satisfaction of Judgment form to the court, informing them that the debtor has met their obligations. There are different types of Sugar Land Texas Satisfaction of Judgment, depending on the nature of the case and the conditions set by the court. These may include: 1. Civil Judgment Satisfaction: This type of satisfaction refers to the resolution of civil legal matters, such as personal injury lawsuits, property disputes, or breach of contract cases. Once the party responsible for the judgment fulfills their obligations, a Satisfaction of Judgment is filed to conclude the case. 2. Small Claims Judgment Satisfaction: Small claims courts handle cases involving lower monetary limits. When a small claims judgment is handed down and the debtor satisfies the judge's ruling, a Satisfaction of Judgment is filed to officially close the case. 3. Criminal Judgment Satisfaction: In cases where criminal charges result in a judgment involving fines, restitution, or other penalties, the debtor must satisfy the judgment. Once the conditions are fulfilled, a Satisfaction of Judgment is filed to signify the completion of the sentence or financial obligations. 4. Tax Judgment Satisfaction: In instances where a judgment is made against a taxpayer by tax authorities, a Satisfaction of Judgment is filed once the outstanding tax liability has been paid. This serves as evidence that the taxpayer has fulfilled their obligations, settling the judgment against them. It is crucial for all parties involved in a Sugar Land Texas Satisfaction of Judgment to fully understand the court's requirements and adhere to them promptly. Failing to comply with the judgment may have legal consequences, further complicating the case. Seeking legal advice and assistance during this process can ensure a smoother and more efficient resolution.