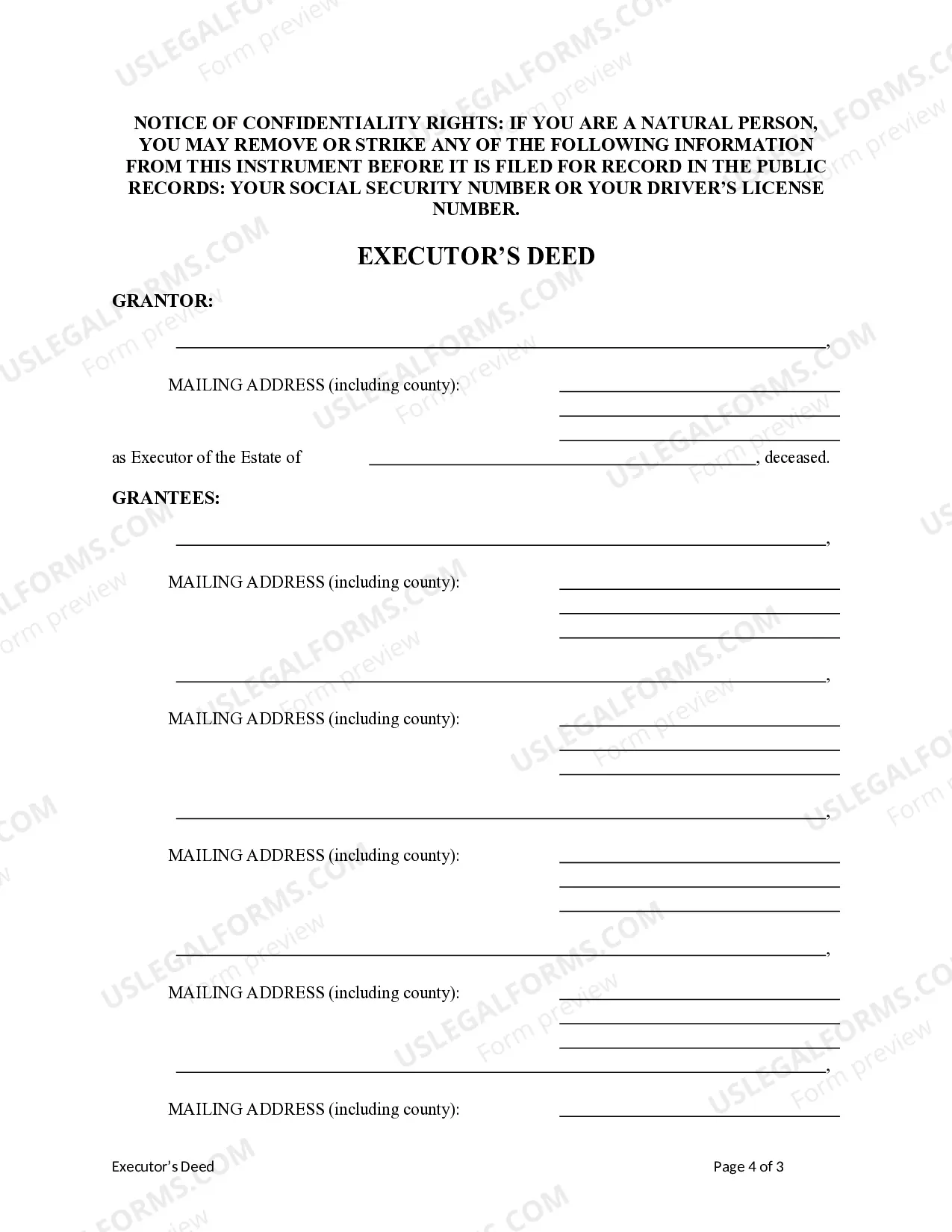

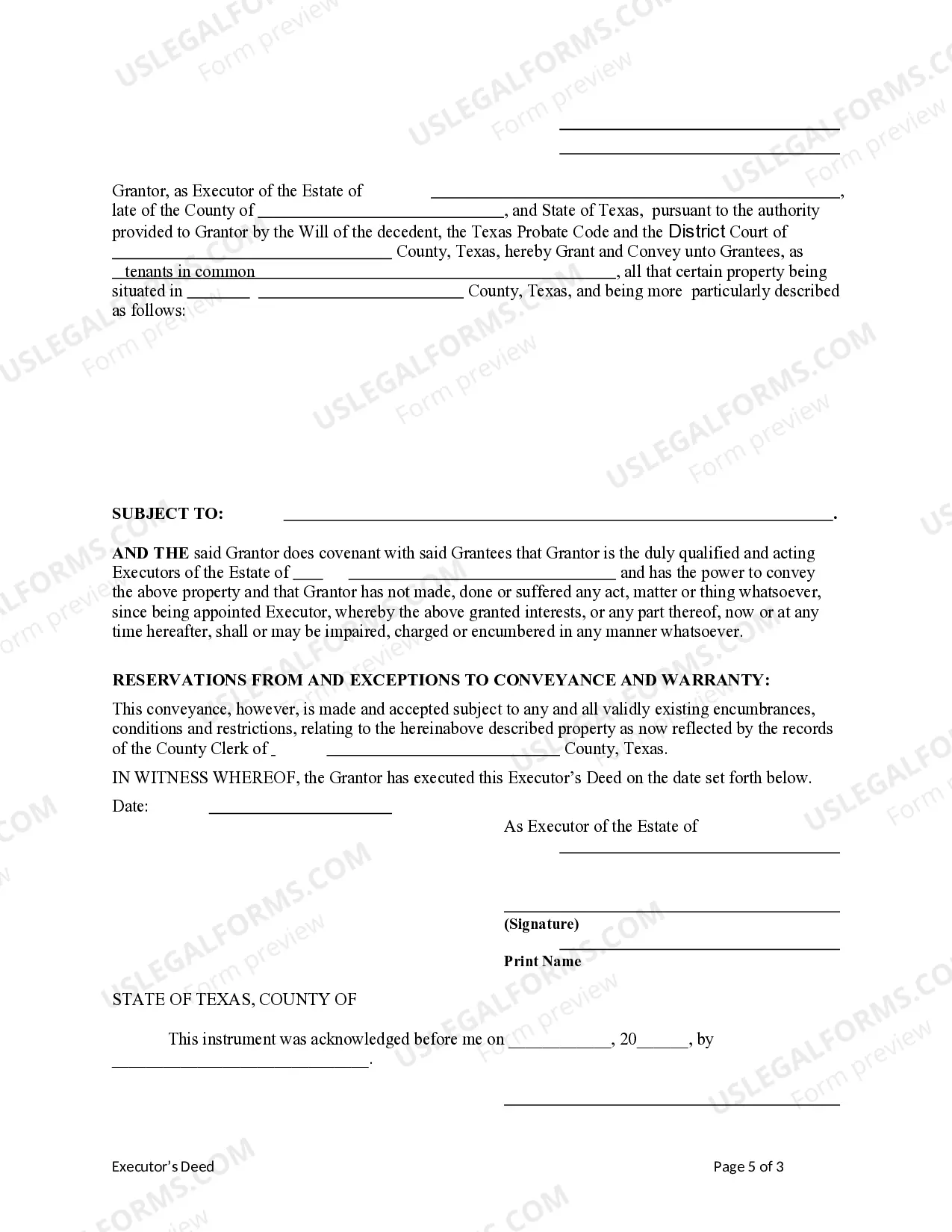

This form is an Executor's Deed where the Grantor is the executor of an estate and the Grantees are the beneficiaries or heirs of the estate. Grantor conveys the described property to the Grantees. This deed complies with all state statutory laws.

A Harris Texas Executor's Deed — Estate to Five Beneficiaries is a legal document used to transfer the ownership of property from a deceased person's estate to five designated beneficiaries. This type of deed is commonly used in Harris County, Texas, for the purpose of distributing assets and ensuring a smooth transfer of property rights. The Harris Texas Executor's Deed grants the authority to the executor, who is typically named in the deceased person's will or appointed by the court, to carry out the wishes of the deceased and distribute the estate's assets according to the will's provisions. The executor is responsible for managing the estate, settling any outstanding debts, and ultimately transferring the remaining property to the beneficiaries. There may be different versions or variations of the Harris Texas Executor's Deed — Estate to Five Beneficiaries, depending on specific circumstances and legal requirements. Some potential variations could include: 1. Harris Texas Executor's Deed — Estate to Five Beneficiaries with Contingencies: This type of deed might include conditions or contingencies that must be met before the property can be transferred to the beneficiaries. For instance, it could specify that the property will be divided equally among the beneficiaries only if the estate's debts and taxes have been fully paid. 2. Harris Texas Executor's Deed — Estate to Five Beneficiaries with Specific Instructions: In certain cases, the deceased person may have included specific instructions or conditions in their will regarding the distribution of property to the five beneficiaries. This version of the executor's deed would fulfill those instructions while complying with the Texas probate laws. 3. Harris Texas Executor's Deed — Estate to Five Beneficiaries with Undivided Interests: Instead of dividing the property equally among the five beneficiaries, this type of deed grants each beneficiary an undivided interest in the property. This means that each beneficiary holds an equal share in the property, and they have the right to jointly use and possess it, rather than having the property physically divided. It is crucial to consult with an experienced attorney or legal professional when dealing with a Harris Texas Executor's Deed — Estate to Five Beneficiaries to ensure compliance with state laws and proper execution of the document. Additionally, the specific terms and conditions of the deceased person's will should be carefully reviewed and followed to accurately distribute the property to the intended beneficiaries.