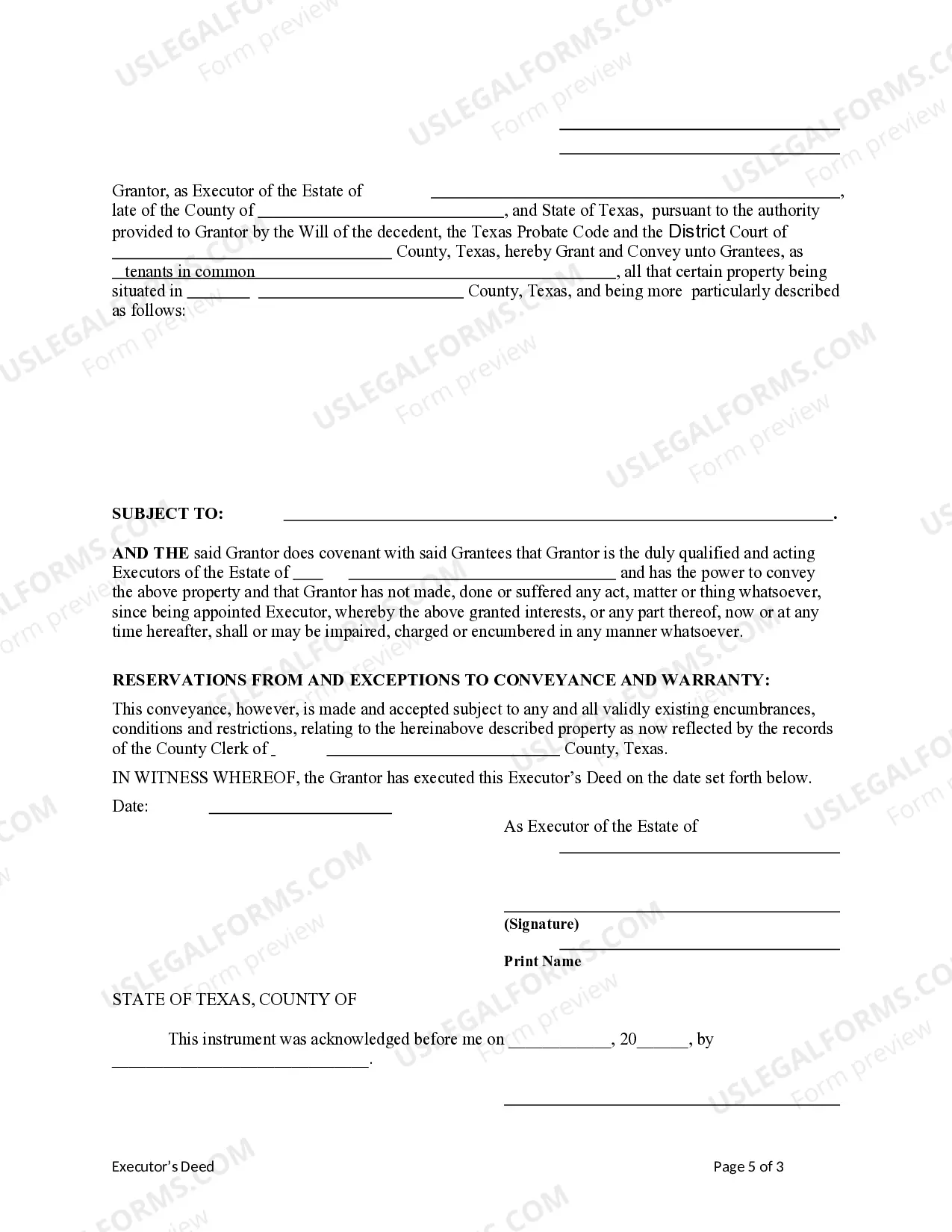

This form is an Executor's Deed where the Grantor is the executor of an estate and the Grantees are the beneficiaries or heirs of the estate. Grantor conveys the described property to the Grantees. This deed complies with all state statutory laws.

Pasadena Texas Executor's Deed - Estate to Five Beneficiaries

Description

How to fill out Texas Executor's Deed - Estate To Five Beneficiaries?

If you have previously employed our service, Log In to your account and store the Pasadena Texas Executor's Deed - Estate to Five Beneficiaries on your device by selecting the Download button. Ensure your subscription is active. If it’s not, renew it as per your payment plan.

If this is your initial engagement with our service, adhere to these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can locate it in your profile under the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to quickly discover and download any template for your personal or professional purposes!

- Ensure you’ve found an appropriate document. Review the description and utilize the Preview feature, if present, to verify if it fits your requirements. If it doesn’t, utilize the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and finalize a payment. Use your credit card information or the PayPal option to complete the payment.

- Obtain your Pasadena Texas Executor's Deed - Estate to Five Beneficiaries. Select the file format for your document and download it to your device.

- Complete your template. Print it or take advantage of online professional editors to fill it out and sign it digitally.

Form popularity

FAQ

A General Rule of Thumb The takeaway here is that the answer to the question of whether a beneficiary can stop the sale of property is generally no. Property sale is indicated in a will, and the provisions of that will are carried out by an executor. As such, the beneficiary can't go against these instructions.

Heir Property In order to transfer a deed after the death of an owner in Texas, the deceased property owner's name must be removed from the house title and the new owners of the property need to be identified. Note: A Deed is the document that allows a property transfer to take place.

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

It isn't legally possible for one of the co-executors to act without the knowledge or approval of the others. Co-executors will need to work together to deal with the estate of the person who has died. If one of the executors wishes to act alone, they must first get the consent of the other executors.

As an executor, you will have a duty to ensure that you are selling the property for the best possible price, for the benefit of the estate. For example, you must not sell the property at an undervalue to yourself, a member of your family, or indeed to one of the beneficiaries in the will.

When there is a will, the executor is responsible for selling the house, with the approval of the heirs. The executor may recruit a real estate agent or broker experienced in probate law to help with the sale. A formal appraisal may also be necessary. The selling process isn't quite like a traditional house sale.

In a joint tenancy, when one owner dies, his or her share of the property passes to the decedent's heirs or to the persons named in the decedent's will. In a joint tenancy with right of survivorship, when an owner dies, his or her share of the property goes to the other owners.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

(a) An executor, administrator, or temporary administrator a court finds to have taken care of and managed an estate in compliance with the standards of this title is entitled to receive a five percent commission on all amounts that the executor or administrator actually receives or pays out in cash in the

The executor will notify all creditors about the person's death and validate any claims before paying them to ensure that they are legitimate debts. Other duties include: Filing tax returns for the decedent and the estate and paying any taxes due. Notifying the Social Security Administration regarding benefits payments.