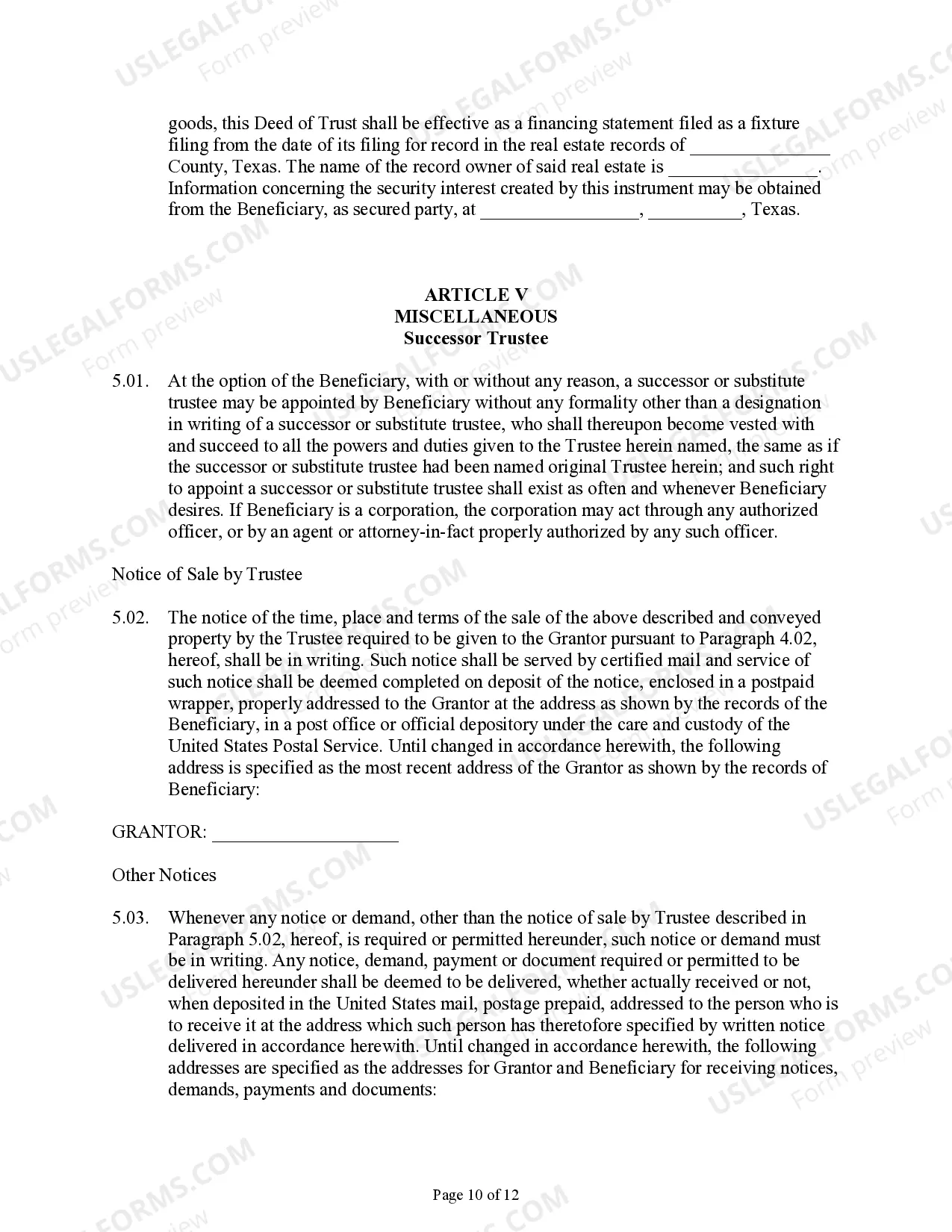

This detailed sample Deed of Trust and Security Agreement complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

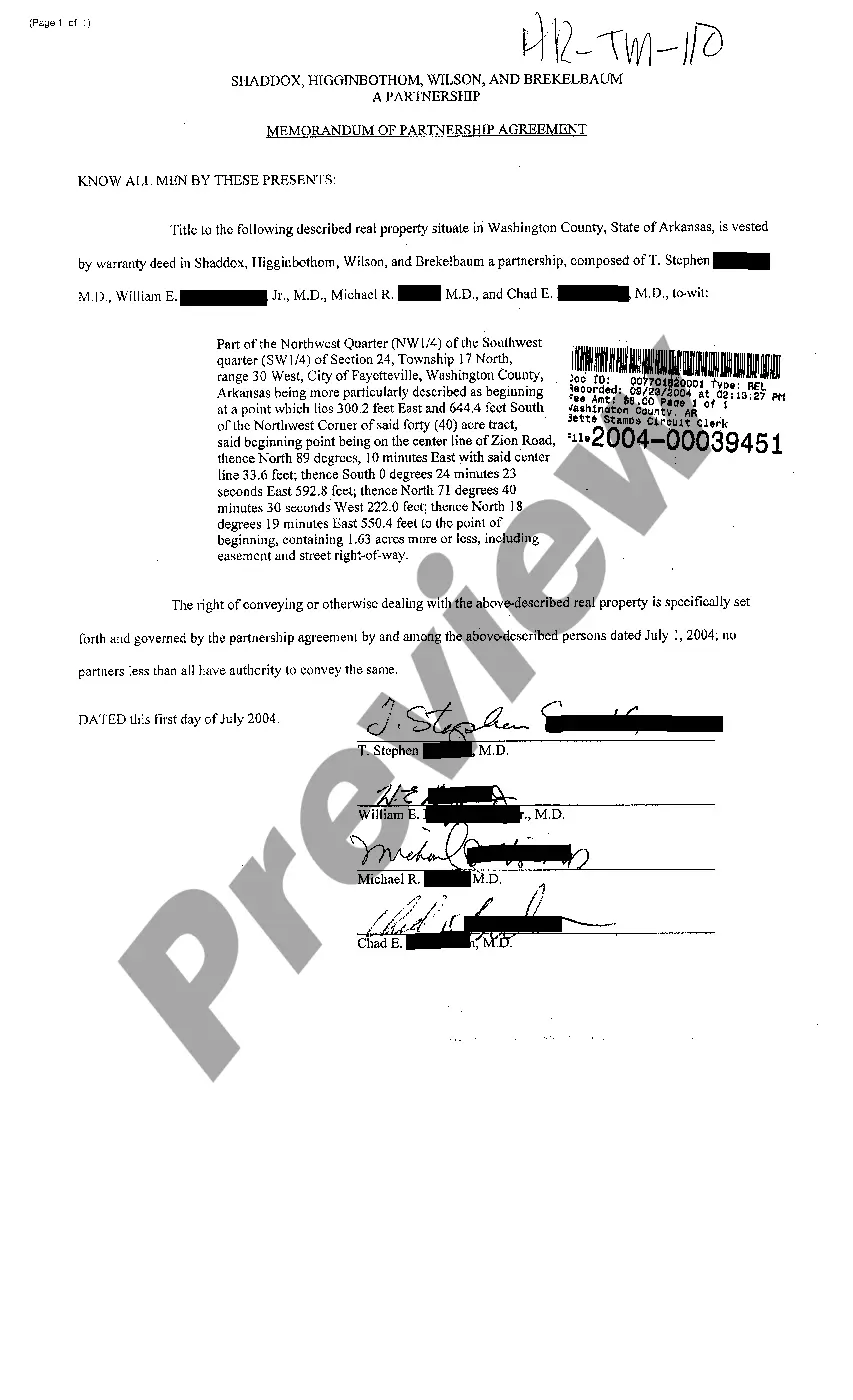

The Austin Texas Deed of Trust and Security Agreement is a legally binding document that establishes a lien on a property located in Austin, Texas. It is commonly used in real estate transactions where a borrower wishes to secure a loan or mortgage to purchase or refinance a property. This agreement ensures that the lender has a security interest in the property as collateral in case the borrower defaults on the loan. A Deed of Trust is often utilized instead of a mortgage in Austin, Texas, as it allows for a non-judicial foreclosure process in the event of default, which can be more efficient and cost-effective for both parties involved. The agreement typically involves three parties: the borrower, known as the trust or, the lender, known as the beneficiary, and a neutral third party, referred to as the trustee. The Deed of Trust contains various clauses and provisions that outline the terms and conditions of the loan agreement, such as the principal amount borrowed, the interest rate, the repayment schedule, and any other specific conditions agreed upon by both parties. It also includes a legal description of the property being financed and grants the lender a lien or security interest, allowing them to initiate foreclosure proceedings if the borrower fails to meet their obligations. In Austin, Texas, there are various types of Deeds of Trust and Security Agreements, including: 1. General Deed of Trust: This is the most common type and is used for regular real estate transactions where a borrower secures a loan to purchase a property. 2. Deed of Trust with Assignment of Rents: In addition to the property itself, this agreement grants the lender the right to collect rent from tenants of the property in case of default. 3. Deed of Trust for Construction Loan: Used for financing a construction project, this agreement includes provisions related to the disbursement of funds in stages as the construction progresses. 4. Deed of Trust with Substitution of Trustee: This type of agreement allows for the substitution of the trustee, usually through a written request by the beneficiary. It is important to note that the terms and conditions of the Austin Texas Deed of Trust and Security Agreement can vary depending on the specific agreement between the borrower and the lender.The Austin Texas Deed of Trust and Security Agreement is a legally binding document that establishes a lien on a property located in Austin, Texas. It is commonly used in real estate transactions where a borrower wishes to secure a loan or mortgage to purchase or refinance a property. This agreement ensures that the lender has a security interest in the property as collateral in case the borrower defaults on the loan. A Deed of Trust is often utilized instead of a mortgage in Austin, Texas, as it allows for a non-judicial foreclosure process in the event of default, which can be more efficient and cost-effective for both parties involved. The agreement typically involves three parties: the borrower, known as the trust or, the lender, known as the beneficiary, and a neutral third party, referred to as the trustee. The Deed of Trust contains various clauses and provisions that outline the terms and conditions of the loan agreement, such as the principal amount borrowed, the interest rate, the repayment schedule, and any other specific conditions agreed upon by both parties. It also includes a legal description of the property being financed and grants the lender a lien or security interest, allowing them to initiate foreclosure proceedings if the borrower fails to meet their obligations. In Austin, Texas, there are various types of Deeds of Trust and Security Agreements, including: 1. General Deed of Trust: This is the most common type and is used for regular real estate transactions where a borrower secures a loan to purchase a property. 2. Deed of Trust with Assignment of Rents: In addition to the property itself, this agreement grants the lender the right to collect rent from tenants of the property in case of default. 3. Deed of Trust for Construction Loan: Used for financing a construction project, this agreement includes provisions related to the disbursement of funds in stages as the construction progresses. 4. Deed of Trust with Substitution of Trustee: This type of agreement allows for the substitution of the trustee, usually through a written request by the beneficiary. It is important to note that the terms and conditions of the Austin Texas Deed of Trust and Security Agreement can vary depending on the specific agreement between the borrower and the lender.