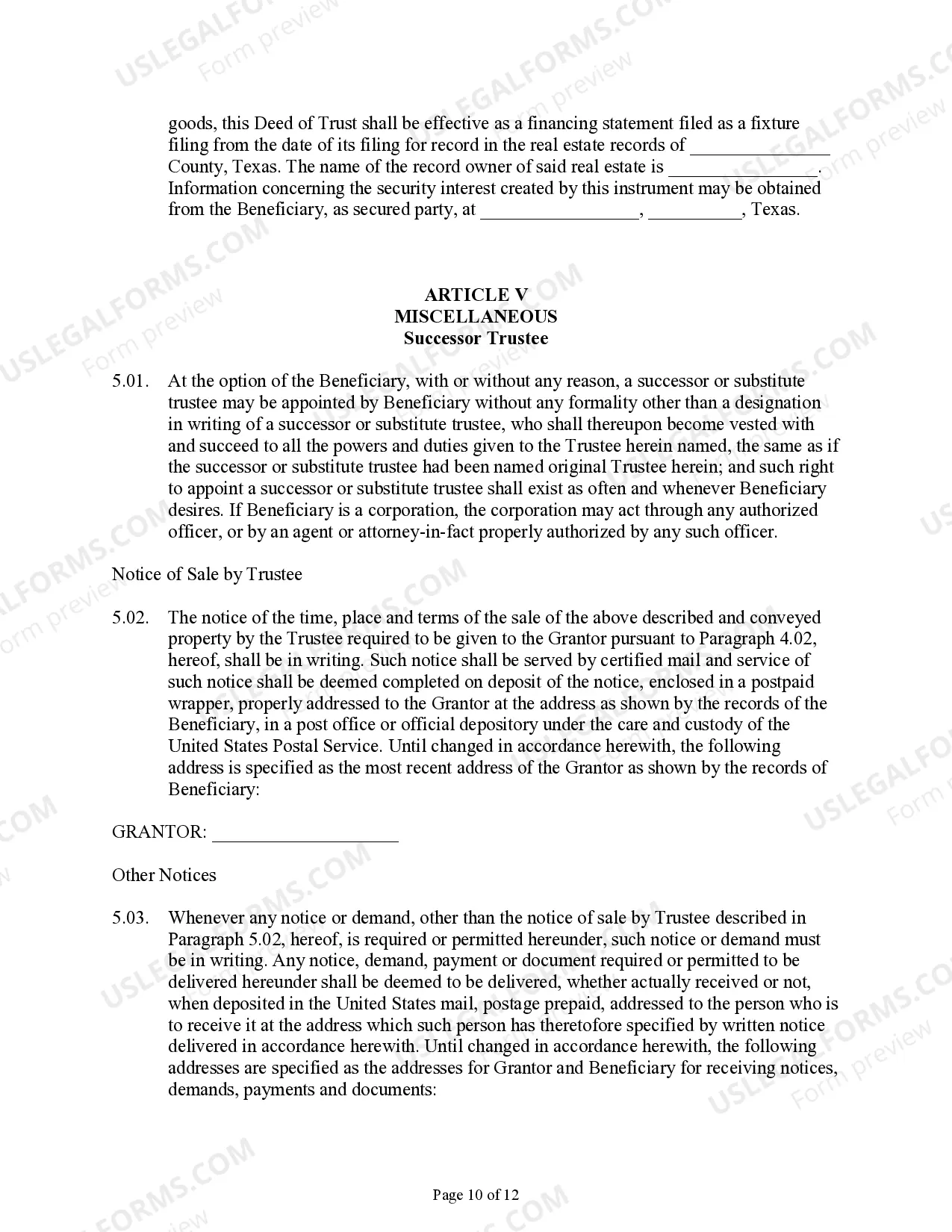

This detailed sample Deed of Trust and Security Agreement complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

The Brownsville Texas Deed of Trust and Security Agreement is a legal document that establishes a lien on real property to secure a loan or debt. It is commonly used in real estate transactions in Brownsville, Texas, to protect the lender's interest in the property until the debt is fully paid off. This agreement outlines the terms and conditions of the loan, including the principal amount, interest rate, and repayment schedule. It also includes details about the property, such as its legal description, boundaries, and any existing liens or encumbrances. Keywords related to this topic include: Brownsville Texas, Deed of Trust, Security Agreement, real property, loan, debt, lender, interest, repayment, principal amount, interest rate, legal description, boundaries, liens, encumbrances. There are different types of Brownsville Texas Deed of Trust and Security Agreements, depending on the specific circumstances of the transaction. Some common variations include: 1. Residential Deed of Trust and Security Agreement: This type of agreement is used when a borrower obtains a loan to purchase or refinance a residential property, such as a house or a condominium, in Brownsville, Texas. 2. Commercial Deed of Trust and Security Agreement: This agreement is used in commercial real estate transactions, where the borrower seeks financing for commercial properties like office buildings, retail spaces, or industrial facilities in Brownsville, Texas. 3. Construction Deed of Trust and Security Agreement: This type of agreement is specifically tailored for construction projects in Brownsville, Texas. It provides a security interest in the property being constructed, ensuring that the lender retains control until the construction is complete and the loan is repaid. 4. Second Deed of Trust and Security Agreement: In some cases, a borrower may seek additional financing on a property that already has an existing loan secured by a Deed of Trust. This second agreement establishes a secondary lien on the property, subordinate to the first Deed of Trust. 5. Subordination Agreement: Sometimes, when multiple loans are involved in a property transaction, a subordination agreement may be used. It determines the priority of the liens, specifying which lender's interest takes precedence in case of default or foreclosure. Keywords related to the different types of agreements include: residential, commercial, construction, second, subordination, financing, control, property, priority, foreclosure. Understanding the different types of Brownsville Texas Deed of Trust and Security Agreements is crucial for both lenders and borrowers involved in real estate dealings. These agreements protect the rights and interests of all parties involved in borrowing and lending transactions while ensuring compliance with applicable laws and regulations.The Brownsville Texas Deed of Trust and Security Agreement is a legal document that establishes a lien on real property to secure a loan or debt. It is commonly used in real estate transactions in Brownsville, Texas, to protect the lender's interest in the property until the debt is fully paid off. This agreement outlines the terms and conditions of the loan, including the principal amount, interest rate, and repayment schedule. It also includes details about the property, such as its legal description, boundaries, and any existing liens or encumbrances. Keywords related to this topic include: Brownsville Texas, Deed of Trust, Security Agreement, real property, loan, debt, lender, interest, repayment, principal amount, interest rate, legal description, boundaries, liens, encumbrances. There are different types of Brownsville Texas Deed of Trust and Security Agreements, depending on the specific circumstances of the transaction. Some common variations include: 1. Residential Deed of Trust and Security Agreement: This type of agreement is used when a borrower obtains a loan to purchase or refinance a residential property, such as a house or a condominium, in Brownsville, Texas. 2. Commercial Deed of Trust and Security Agreement: This agreement is used in commercial real estate transactions, where the borrower seeks financing for commercial properties like office buildings, retail spaces, or industrial facilities in Brownsville, Texas. 3. Construction Deed of Trust and Security Agreement: This type of agreement is specifically tailored for construction projects in Brownsville, Texas. It provides a security interest in the property being constructed, ensuring that the lender retains control until the construction is complete and the loan is repaid. 4. Second Deed of Trust and Security Agreement: In some cases, a borrower may seek additional financing on a property that already has an existing loan secured by a Deed of Trust. This second agreement establishes a secondary lien on the property, subordinate to the first Deed of Trust. 5. Subordination Agreement: Sometimes, when multiple loans are involved in a property transaction, a subordination agreement may be used. It determines the priority of the liens, specifying which lender's interest takes precedence in case of default or foreclosure. Keywords related to the different types of agreements include: residential, commercial, construction, second, subordination, financing, control, property, priority, foreclosure. Understanding the different types of Brownsville Texas Deed of Trust and Security Agreements is crucial for both lenders and borrowers involved in real estate dealings. These agreements protect the rights and interests of all parties involved in borrowing and lending transactions while ensuring compliance with applicable laws and regulations.