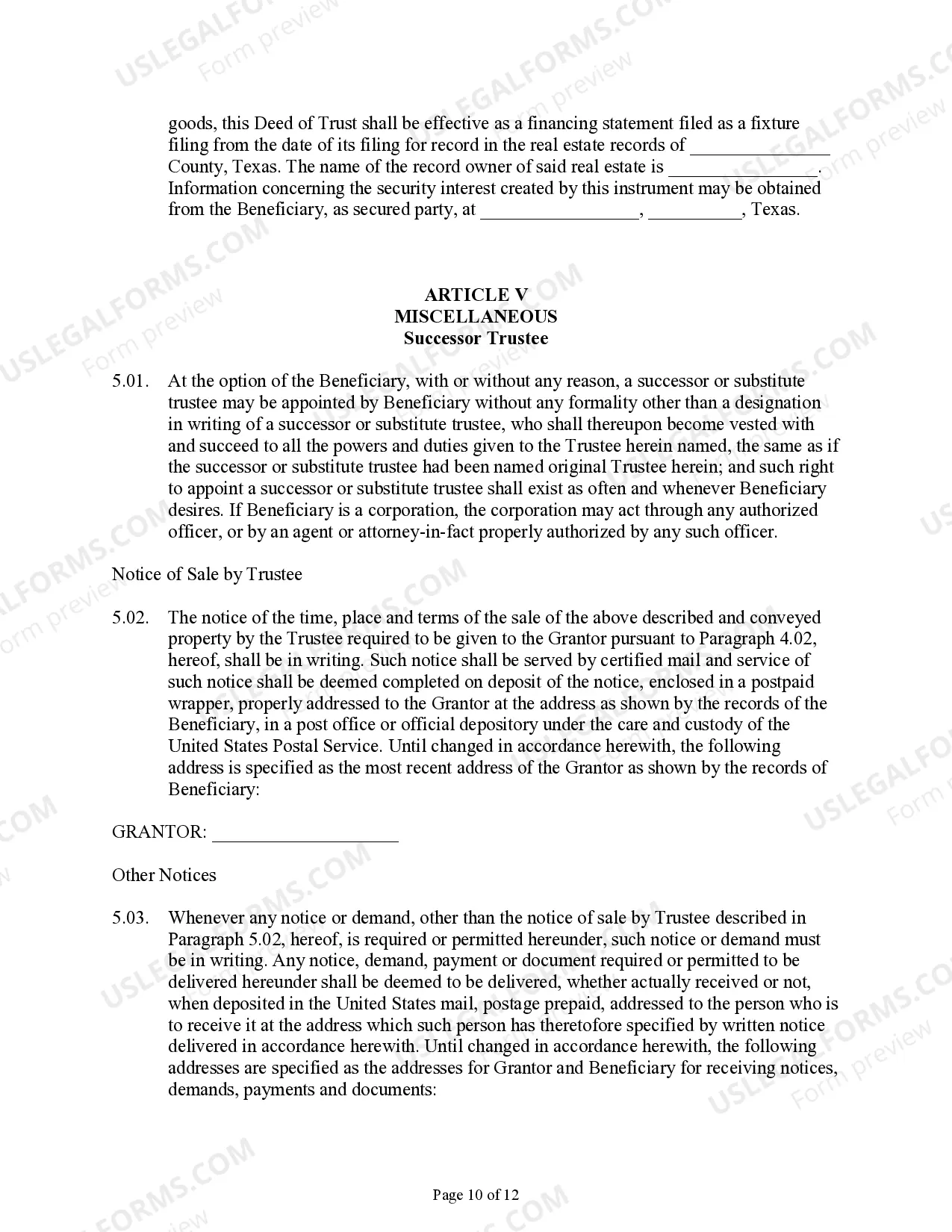

This detailed sample Deed of Trust and Security Agreement complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

In Fort Worth, Texas, a Deed of Trust and Security Agreement is a legal document that serves to secure a loan by establishing a lien on real property. This agreement is commonly used in real estate transactions where the borrower (also known as the trust or granter) pledges their property as collateral for a loan. The lender (also known as the beneficiary or mortgagee) is the party who receives the security interest on the property. The Fort Worth Texas Deed of Trust and Security Agreement contains relevant information about the parties involved, details of the property being used as collateral, and the terms and conditions of the loan. It outlines the rights and obligations of both the borrower and the lender, ensuring each party's interests are protected. There may be different types of Fort Worth Texas Deed of Trust and Security Agreements, such as residential, commercial, or agricultural. Residential Deeds of Trust are commonly used for loans involving residential properties, while commercial Deeds of Trust are apt for commercial property transactions. Agricultural Deeds of Trust are specifically designed for loans related to agricultural properties. Regardless of the type, the Deed of Trust and Security Agreement typically includes provisions related to loan repayment, interest rates, escrow accounts, default and foreclosure procedures, and conditions for releasing the lien on the property upon loan satisfaction. This document plays a pivotal role in real estate financing, assuring lenders that their financial interests are protected through the lateralization of the property. When the borrower fully repays the loan, the Deed of Trust and Security Agreement is typically released or reconvened, effectively removing the lien on the property. In case of default, however, it gives the lender the ability to initiate foreclosure proceedings and sell the property to recover the outstanding debt. It is important to note that while this description broadly outlines the purpose and nature of a Fort Worth Texas Deed of Trust and Security Agreement, the specific terms and conditions may vary depending on the agreement between the parties involved and the legal requirements of the state of Texas. It is always recommended consulting with legal professionals or experts in real estate transactions to ensure compliance with relevant regulations and to obtain accurate and personalized advice.In Fort Worth, Texas, a Deed of Trust and Security Agreement is a legal document that serves to secure a loan by establishing a lien on real property. This agreement is commonly used in real estate transactions where the borrower (also known as the trust or granter) pledges their property as collateral for a loan. The lender (also known as the beneficiary or mortgagee) is the party who receives the security interest on the property. The Fort Worth Texas Deed of Trust and Security Agreement contains relevant information about the parties involved, details of the property being used as collateral, and the terms and conditions of the loan. It outlines the rights and obligations of both the borrower and the lender, ensuring each party's interests are protected. There may be different types of Fort Worth Texas Deed of Trust and Security Agreements, such as residential, commercial, or agricultural. Residential Deeds of Trust are commonly used for loans involving residential properties, while commercial Deeds of Trust are apt for commercial property transactions. Agricultural Deeds of Trust are specifically designed for loans related to agricultural properties. Regardless of the type, the Deed of Trust and Security Agreement typically includes provisions related to loan repayment, interest rates, escrow accounts, default and foreclosure procedures, and conditions for releasing the lien on the property upon loan satisfaction. This document plays a pivotal role in real estate financing, assuring lenders that their financial interests are protected through the lateralization of the property. When the borrower fully repays the loan, the Deed of Trust and Security Agreement is typically released or reconvened, effectively removing the lien on the property. In case of default, however, it gives the lender the ability to initiate foreclosure proceedings and sell the property to recover the outstanding debt. It is important to note that while this description broadly outlines the purpose and nature of a Fort Worth Texas Deed of Trust and Security Agreement, the specific terms and conditions may vary depending on the agreement between the parties involved and the legal requirements of the state of Texas. It is always recommended consulting with legal professionals or experts in real estate transactions to ensure compliance with relevant regulations and to obtain accurate and personalized advice.