This detailed sample Deed of Trust and Security Agreement complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

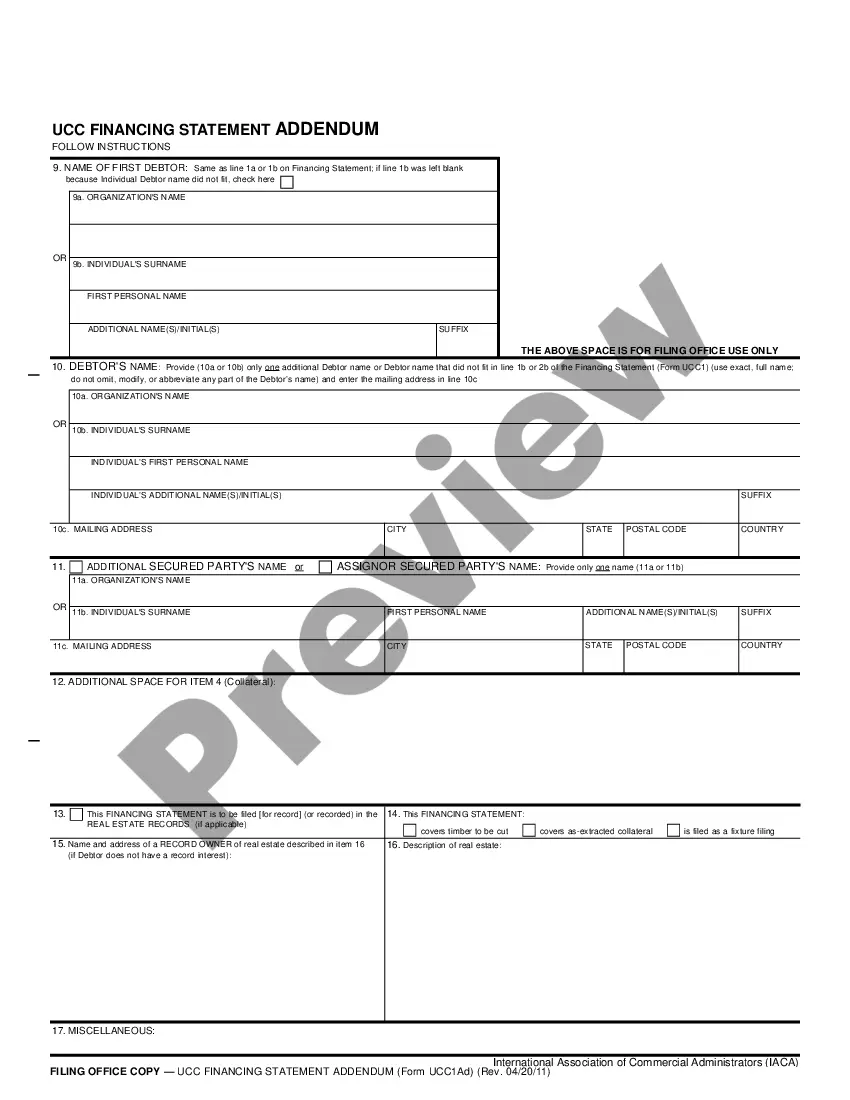

The Frisco Texas Deed of Trust and Security Agreement is a legal document that serves as a means to secure financial transactions related to real estate in Frisco, Texas. This agreement is created between a lender (or mortgagee) and a borrower (or mortgagor) to establish a lien on the property in question. In its essence, the Frisco Texas Deed of Trust and Security Agreement is a type of mortgage that provides security for the lender. It ensures that the lender has a claim on the property in the event that the borrower defaults on their loan payments. This agreement serves as a safeguard for the lender's investment, allowing them to potentially foreclose on the property and recoup their losses if needed. There are several types of Frisco Texas Deed of Trust and Security Agreements that are commonly used: 1. Traditional Deed of Trust: This is the most common type of agreement where the lender holds the legal title to the property until the borrower has fulfilled their financial obligations, such as repaying the loan amount with interest. 2. Subordinate Deed of Trust: This type of agreement is used when there is already an existing deed of trust on the property. The new deed of trust is considered secondary to the original one and may have different conditions and terms. 3. Wraparound Deed of Trust: This agreement allows the borrower to secure additional funds while maintaining the existing loan. The new loan "wraps around" the original one, and the borrower makes a single payment to the new lender who then distributes the appropriate amounts to the primary lender. 4. Deed of Trust with Assignment of Rents: In this type of agreement, the borrower agrees to assign the rental income from the property to the lender. This provides additional security for the lender in case of default. Overall, the Frisco Texas Deed of Trust and Security Agreement functions as a legally binding contract that outlines the terms and conditions for a real estate loan. It protects both the lender and the borrower's interests and ensures a smooth and secure transaction.