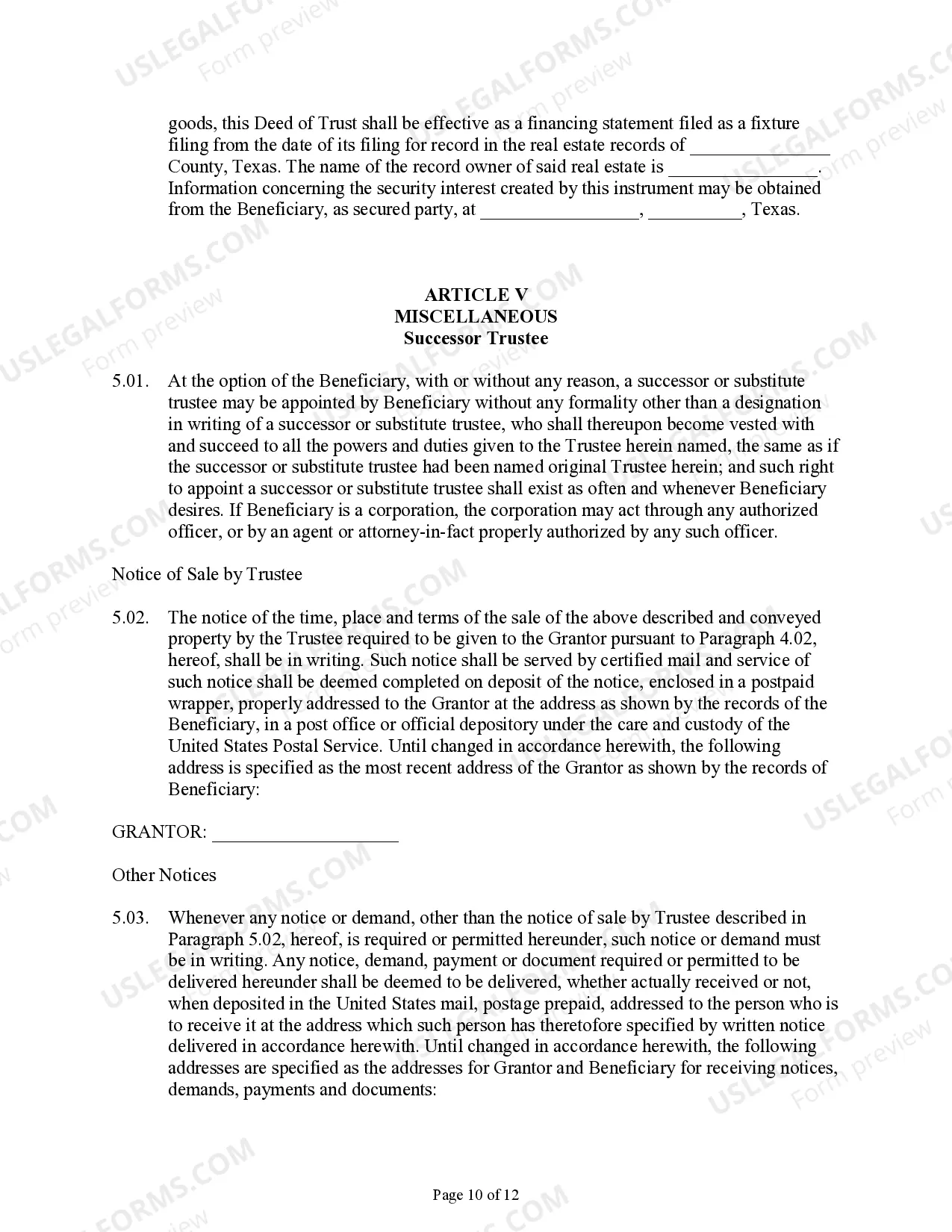

This detailed sample Deed of Trust and Security Agreement complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Laredo, Texas Deed of Trust and Security Agreement is a legal document that ensures the repayment of a loan or mortgage by placing a lien on a property located in Laredo, Texas. This agreement outlines the terms and conditions under which the borrower pledges the property as collateral to secure the loan. One type of Laredo Texas Deed of Trust and Security Agreement is a Residential Deed of Trust and Security Agreement. This type of agreement is typically used when an individual borrower purchases or refinances a residential property, such as a house or a condominium, in Laredo, Texas. The Residential Deed of Trust and Security Agreement will specify the loan amount, interest rate, repayment terms, and contains provisions regarding default and foreclosure procedures. Another type of Laredo Texas Deed of Trust and Security Agreement is a Commercial Deed of Trust and Security Agreement. This agreement is used for commercial properties, such as office buildings, retail spaces, or warehouses, located in Laredo, Texas. The Commercial Deed of Trust and Security Agreement covers similar aspects as the residential agreement but may include additional provisions specific to commercial properties, such as rules regarding lease agreements with tenants and property management responsibilities. Additionally, there may be variations within each type of deed of trust and security agreement, depending on the lender, borrower, and specific requirements of the transaction. These variations can include provisions related to loan modification, release of the lien, prepayment penalties, subordination agreements, and more. It is important for all parties involved to carefully review and understand the terms stated in the specific Laredo Texas Deed of Trust and Security Agreement they are entering into. Overall, the Laredo Texas Deed of Trust and Security Agreement serves as a vital legal document in real estate transactions, providing protection for lenders and ensuring that borrowers fulfill their financial obligations.Laredo, Texas Deed of Trust and Security Agreement is a legal document that ensures the repayment of a loan or mortgage by placing a lien on a property located in Laredo, Texas. This agreement outlines the terms and conditions under which the borrower pledges the property as collateral to secure the loan. One type of Laredo Texas Deed of Trust and Security Agreement is a Residential Deed of Trust and Security Agreement. This type of agreement is typically used when an individual borrower purchases or refinances a residential property, such as a house or a condominium, in Laredo, Texas. The Residential Deed of Trust and Security Agreement will specify the loan amount, interest rate, repayment terms, and contains provisions regarding default and foreclosure procedures. Another type of Laredo Texas Deed of Trust and Security Agreement is a Commercial Deed of Trust and Security Agreement. This agreement is used for commercial properties, such as office buildings, retail spaces, or warehouses, located in Laredo, Texas. The Commercial Deed of Trust and Security Agreement covers similar aspects as the residential agreement but may include additional provisions specific to commercial properties, such as rules regarding lease agreements with tenants and property management responsibilities. Additionally, there may be variations within each type of deed of trust and security agreement, depending on the lender, borrower, and specific requirements of the transaction. These variations can include provisions related to loan modification, release of the lien, prepayment penalties, subordination agreements, and more. It is important for all parties involved to carefully review and understand the terms stated in the specific Laredo Texas Deed of Trust and Security Agreement they are entering into. Overall, the Laredo Texas Deed of Trust and Security Agreement serves as a vital legal document in real estate transactions, providing protection for lenders and ensuring that borrowers fulfill their financial obligations.