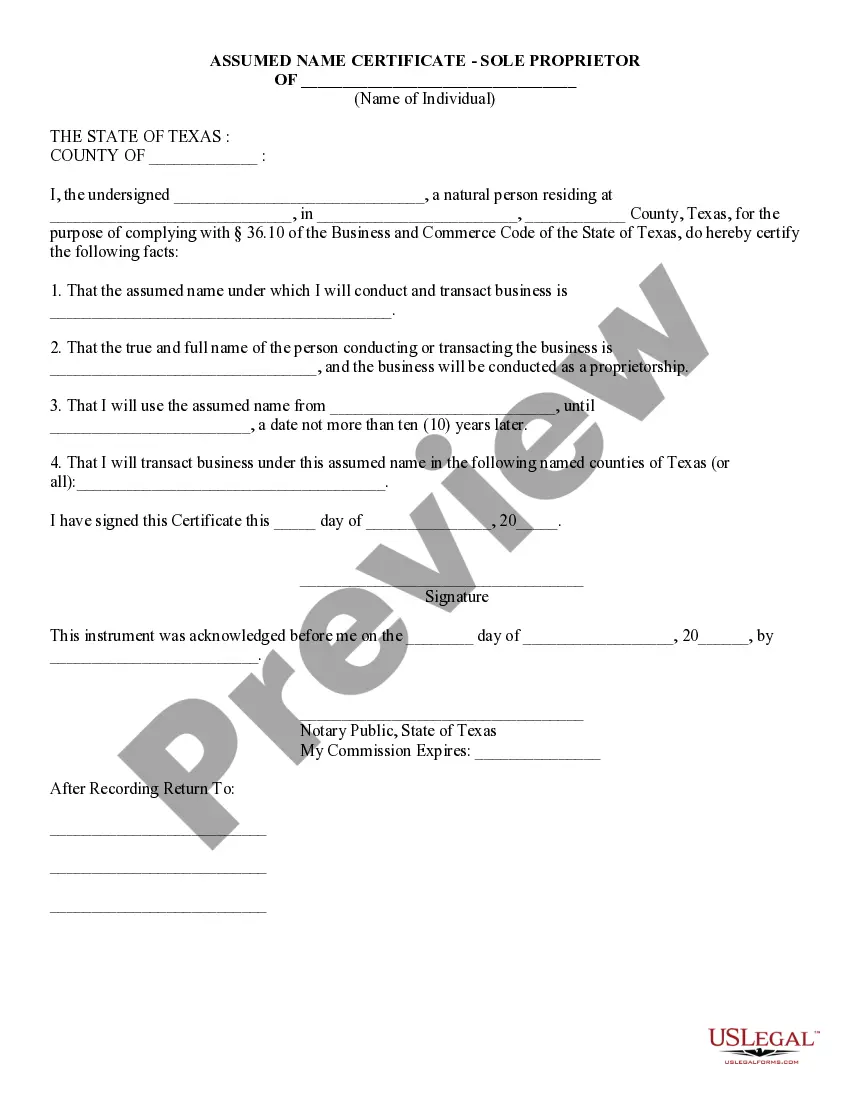

This detailed sample Assumed Name Certificate (Sole Proprietor) complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats. TX-1039

Keywords: Harris Texas Assumed Name Certificate, Sole Proprietor, types, detailed description. Harris Texas Assumed Name Certificate — Sole Proprietor is a legal document that allows an individual to operate a business under a fictitious name in Harris County, Texas. This certificate is necessary for sole proprietors who wish to conduct business using a name other than their legal personal name. There are two main types of Harris Texas Assumed Name Certificate — Sole Proprietor: 1. Initial Filing: This type of certificate is filed when an individual starts a new business as a sole proprietor and wishes to operate under a fictitious name. The initial filing requires providing basic details such as the legal name of the sole proprietor, address, contact information, and the assumed business name. It also involves paying the required filing fee. 2. Amended Filing: An amended filing is necessary when there are changes to the information provided in the initial filing. Changes may include a change in the assumed business name, sole proprietor's address, contact information, or any other relevant details. Filing an amendment ensures that the business information remains accurate and up-to-date. Similarly, a filing fee is required for an amended filing. The Harris Texas Assumed Name Certificate — Sole Proprietor provides legal protection to sole proprietors when conducting business under an assumed name. It helps establish the identity of the business and allows customers and clients to identify the owner behind the business name. Sole proprietors must file the Harris Texas Assumed Name Certificate with the Harris County Clerk's Office. This filing ensures that the business name is registered and protects the sole proprietor's rights to use the assumed name within Harris County. By filing this certificate, sole proprietors can also access certain banking services, such as opening a business bank account, as financial institutions often require this documentation. In conclusion, the Harris Texas Assumed Name Certificate — Sole Proprietor is an essential legal document that enables sole proprietors to operate a business using a fictitious name. Whether filing an initial certificate or making amendments to an existing one, sole proprietors must ensure compliance with the Harris County Clerk's Office to protect their business identity and operate lawfully within Harris County, Texas.Keywords: Harris Texas Assumed Name Certificate, Sole Proprietor, types, detailed description. Harris Texas Assumed Name Certificate — Sole Proprietor is a legal document that allows an individual to operate a business under a fictitious name in Harris County, Texas. This certificate is necessary for sole proprietors who wish to conduct business using a name other than their legal personal name. There are two main types of Harris Texas Assumed Name Certificate — Sole Proprietor: 1. Initial Filing: This type of certificate is filed when an individual starts a new business as a sole proprietor and wishes to operate under a fictitious name. The initial filing requires providing basic details such as the legal name of the sole proprietor, address, contact information, and the assumed business name. It also involves paying the required filing fee. 2. Amended Filing: An amended filing is necessary when there are changes to the information provided in the initial filing. Changes may include a change in the assumed business name, sole proprietor's address, contact information, or any other relevant details. Filing an amendment ensures that the business information remains accurate and up-to-date. Similarly, a filing fee is required for an amended filing. The Harris Texas Assumed Name Certificate — Sole Proprietor provides legal protection to sole proprietors when conducting business under an assumed name. It helps establish the identity of the business and allows customers and clients to identify the owner behind the business name. Sole proprietors must file the Harris Texas Assumed Name Certificate with the Harris County Clerk's Office. This filing ensures that the business name is registered and protects the sole proprietor's rights to use the assumed name within Harris County. By filing this certificate, sole proprietors can also access certain banking services, such as opening a business bank account, as financial institutions often require this documentation. In conclusion, the Harris Texas Assumed Name Certificate — Sole Proprietor is an essential legal document that enables sole proprietors to operate a business using a fictitious name. Whether filing an initial certificate or making amendments to an existing one, sole proprietors must ensure compliance with the Harris County Clerk's Office to protect their business identity and operate lawfully within Harris County, Texas.