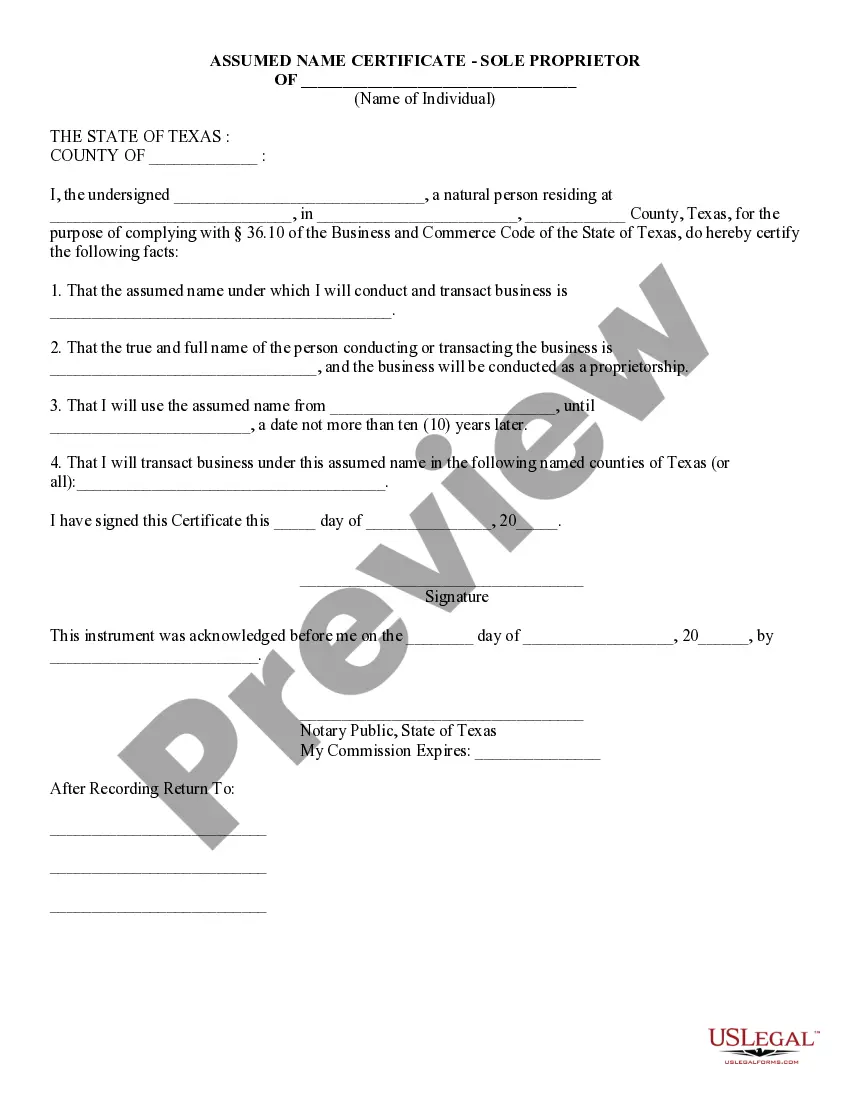

This detailed sample Assumed Name Certificate (Sole Proprietor) complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats. TX-1039

Houston Texas Assumed Name Certificate - Sole Proprietor

Description

How to fill out Texas Assumed Name Certificate - Sole Proprietor?

If you are looking for an applicable form, it’s unfeasible to locate a superior service than the US Legal Forms website – one of the most extensive online repositories.

Here you can discover numerous templates for both corporate and personal uses by categories and areas, or keywords.

With the top-notch search functionality, locating the latest Houston Texas Assumed Name Certificate - Sole Proprietor is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the file format and download it onto your device.

- Moreover, the relevance of each record is validated by a group of expert attorneys who routinely assess the templates on our platform and update them according to the most recent state and county requirements.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Houston Texas Assumed Name Certificate - Sole Proprietor is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, just follow the guidelines below.

- Ensure you have located the form you require. Read its details and utilize the Preview feature (if available) to review its content. If it does not satisfy your requirements, utilize the Search option located at the top of the screen to find the appropriate document.

- Verify your choice. Choose the Buy now option. After that, select your desired pricing plan and provide information to register for an account.

Form popularity

FAQ

The filing fee for registering a DBA or Fictitious name (Assumed Name Certificate) in Texas varies from county to county but averages around $15 per DBA for sole proprietors and partnerships and $25 for Corporations and LLCs.

Texas requires that all corporations, limited liability companies (LLCs), limited partnerships (LPs), limited liability partnerships (LLPs), or out of state companies that regularly transact business in Texas under a name different from their legal name, must file a DBA with the Texas Secretary of State.

The filing fee for registering a DBA or Fictitious name (Assumed Name Certificate) in Texas varies from county to county but averages around $15 per DBA for sole proprietors and partnerships and $25 for Corporations and LLCs.

The cost to set up a DBA varies by state, county, city, and business structure. In general, you will end up spending from $10 to $100 on registering your DBA.

In general, sole proprietorships and partnerships need to register and file the business name (DBA or assumed name) with their local county clerk's office. If you decide to incorporate, the Secretary of State's Office (SOS) website has information on choosing the right legal structure for you.

In Houston, visit the website of the Harris County Clerk's Office or go to the office in person at the Harris County Civil Courthouse, 201 Caroline Street. Complete the form and remit with the $25 fee. Your DBA registration is good for 10 years; after ten years, you have to renew if you want to continue using the name.

A separate assumed name certificate must be filed for each assumed name that may be used by a registrant. Please note that if the name entered as the assumed name in item 1 is exactly the same as the legal name of the registrant, the certificate will be rejected for failing to provide an assumed name.

Sole proprietorships and general partnerships need not file at the state level, but will need to file for a DBA in the relevant county clerk offices if they are using a name other than the legal name of their owners.

The trade name must be filed with the county clerk office in the county where the company operates. Sole proprietorships and general partnerships need not file at the state level, but will need to file for a DBA in the relevant county clerk offices if they are using a name other than the legal name of their owners.

Corporations, LLCs, LPs, and LLPs must register a Texas DBA name with the Secretary of State. You can do so electronically via the state's online business services portal, SOSDirect. Sign in to your account to access the Assumed Name Certificate. Complete the form online and pay the required filing fee.