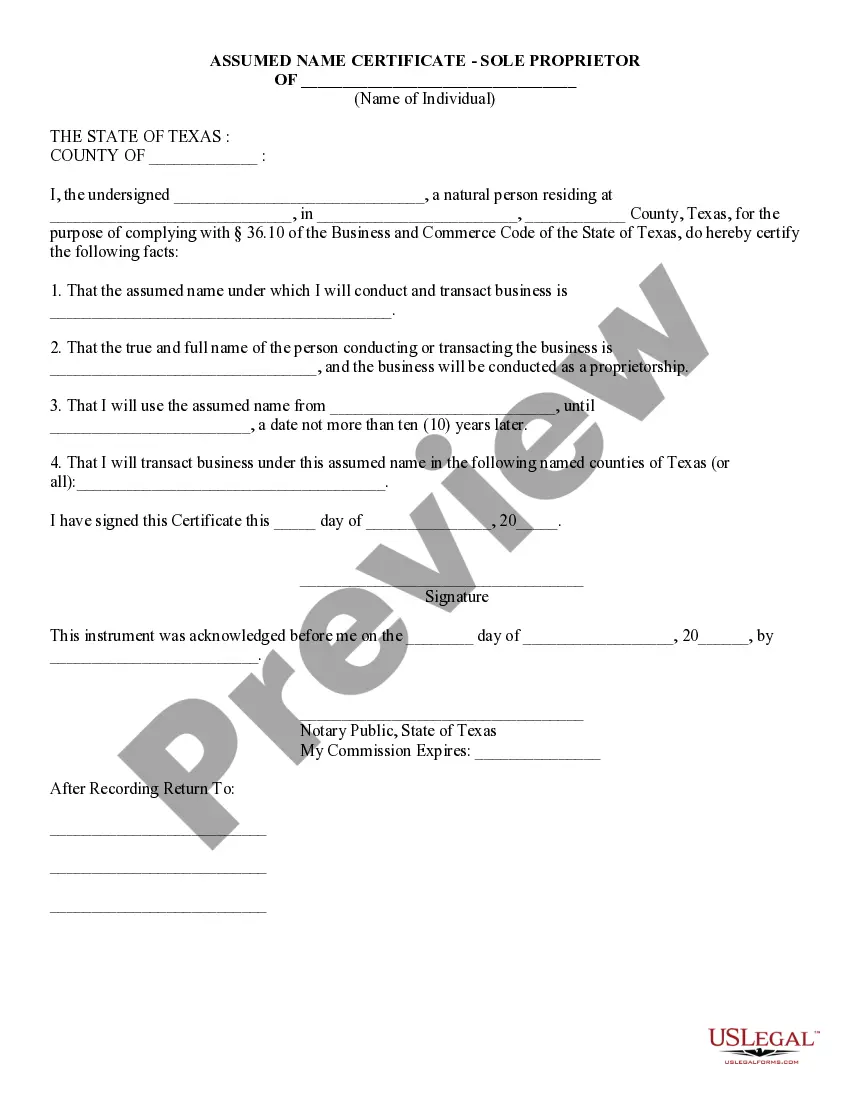

This detailed sample Assumed Name Certificate (Sole Proprietor) complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats. TX-1039

McAllen, Texas Assumed Name Certificate — Sole Proprietor is a legal document required for businesses operating under a name that is different from the legal name of the owner. This certificate, also known as a "Doing Business As" (DBA) certificate, allows sole proprietors in McAllen, Texas, to conduct business operations under a chosen trade name. By obtaining a McAllen Texas Assumed Name Certificate — Sole Proprietor, entrepreneurs can establish their business identity, open bank accounts, enter into contracts, obtain permits, and build a professional reputation under a unique business name that best represents their products or services. This document is essential for sole proprietors who wish to operate their ventures without incorporating a formal business entity like a limited liability company (LLC) or corporation. There are various types of McAllen Texas Assumed Name Certificates — Sole Proprietor, depending on the nature of the business. Some common examples include: 1. Individuals Operating Under Their Legal Name: Sole proprietors who opt to conduct business operations using their legal name do not require a DBA certificate. For instance, if John Smith starts a business using his real name as "John Smith Consulting," he does not need to file for an assumed name certificate. 2. Individuals Operating Under a Trade Name: In cases where sole proprietors plan to use a trade name or a fictitious name for their business, they have to file a McAllen Texas Assumed Name Certificate — Sole Proprietor. For instance, if John Smith wants to operate his consulting business as "Smith Consulting Services," he would need to file for a DBA certificate to use the assumed name. It is important to note that while the McAllen Texas Assumed Name Certificate — Sole Proprietor allows business owners to operate under a trade name, it does not provide legal protection or create a separate legal entity. Sole proprietors remain personally liable for all business debts and obligations. To obtain a McAllen Texas Assumed Name Certificate — Sole Proprietor, business owners must complete an application with the appropriate county clerk's office. The application typically requires information such as the owner's legal name, trade name, business address, and a notarized signature. Once approved, the certificate is usually valid for a certain period (varying by jurisdiction) and must be renewed periodically to ensure its continued use. In summary, the McAllen Texas Assumed Name Certificate — Sole Proprietor allows sole proprietors in McAllen, Texas, to conduct business operations under a trade name different from their legal name. This certificate is necessary for establishing a professional image, obtaining permits, and performing financial transactions under the chosen business name. By correctly filing this legal document, sole proprietors can confidently operate their businesses while complying with state regulations.McAllen, Texas Assumed Name Certificate — Sole Proprietor is a legal document required for businesses operating under a name that is different from the legal name of the owner. This certificate, also known as a "Doing Business As" (DBA) certificate, allows sole proprietors in McAllen, Texas, to conduct business operations under a chosen trade name. By obtaining a McAllen Texas Assumed Name Certificate — Sole Proprietor, entrepreneurs can establish their business identity, open bank accounts, enter into contracts, obtain permits, and build a professional reputation under a unique business name that best represents their products or services. This document is essential for sole proprietors who wish to operate their ventures without incorporating a formal business entity like a limited liability company (LLC) or corporation. There are various types of McAllen Texas Assumed Name Certificates — Sole Proprietor, depending on the nature of the business. Some common examples include: 1. Individuals Operating Under Their Legal Name: Sole proprietors who opt to conduct business operations using their legal name do not require a DBA certificate. For instance, if John Smith starts a business using his real name as "John Smith Consulting," he does not need to file for an assumed name certificate. 2. Individuals Operating Under a Trade Name: In cases where sole proprietors plan to use a trade name or a fictitious name for their business, they have to file a McAllen Texas Assumed Name Certificate — Sole Proprietor. For instance, if John Smith wants to operate his consulting business as "Smith Consulting Services," he would need to file for a DBA certificate to use the assumed name. It is important to note that while the McAllen Texas Assumed Name Certificate — Sole Proprietor allows business owners to operate under a trade name, it does not provide legal protection or create a separate legal entity. Sole proprietors remain personally liable for all business debts and obligations. To obtain a McAllen Texas Assumed Name Certificate — Sole Proprietor, business owners must complete an application with the appropriate county clerk's office. The application typically requires information such as the owner's legal name, trade name, business address, and a notarized signature. Once approved, the certificate is usually valid for a certain period (varying by jurisdiction) and must be renewed periodically to ensure its continued use. In summary, the McAllen Texas Assumed Name Certificate — Sole Proprietor allows sole proprietors in McAllen, Texas, to conduct business operations under a trade name different from their legal name. This certificate is necessary for establishing a professional image, obtaining permits, and performing financial transactions under the chosen business name. By correctly filing this legal document, sole proprietors can confidently operate their businesses while complying with state regulations.