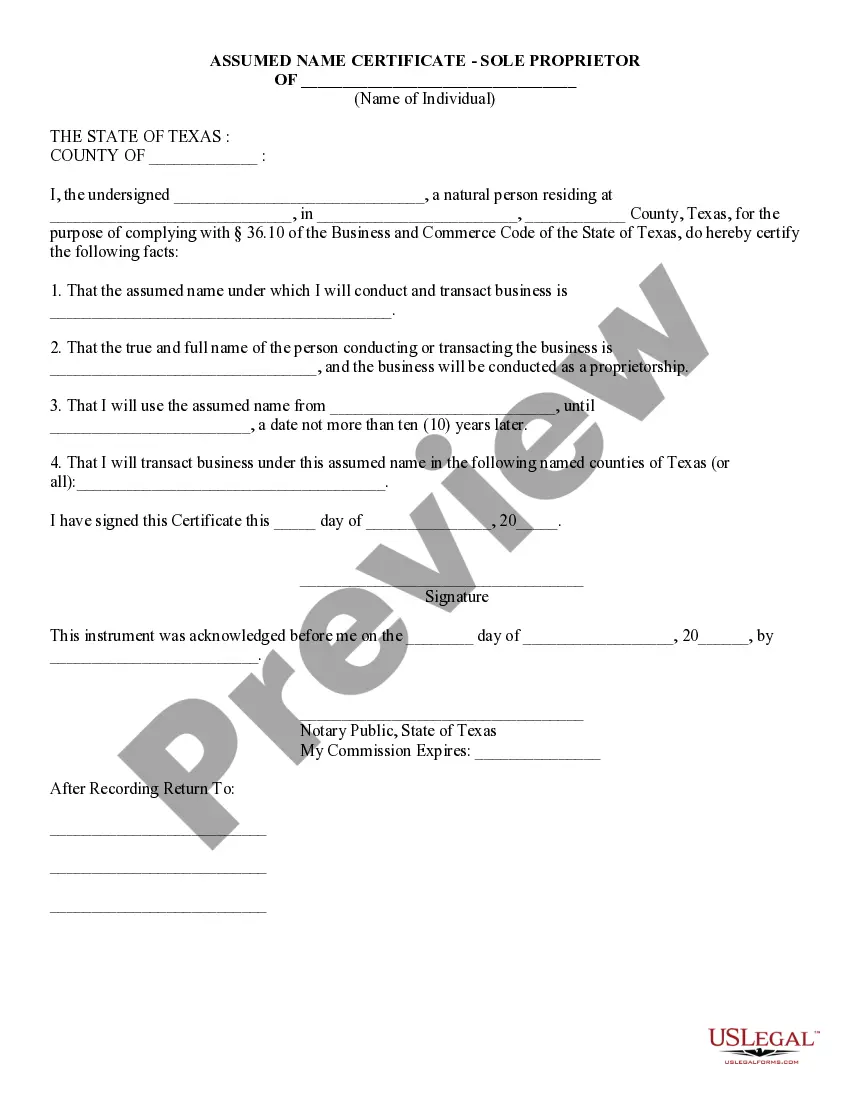

This detailed sample Assumed Name Certificate (Sole Proprietor) complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats. TX-1039

Tarrant Texas Assumed Name Certificate — Sole Proprietor: A Comprehensive Guide In Tarrant County, Texas, a Sole Proprietor is an individual who operates a business under a name that is different from their legal name. To establish this alternative business name, individuals are required to file a Tarrant Texas Assumed Name Certificate with the County Clerk's office. This document provides legal recognition to the assumed name, allowing entrepreneurs to conduct business under a different identity. The Tarrant Texas Assumed Name Certificate — Sole Proprietor is a crucial step for aspiring business owners who desire to establish credibility and professionalism while maintaining their flexibility and independence. By filing this certificate, individuals signal their intent to operate a sole proprietorship business under an assumed name, showcasing their commitment to conducting legitimate business activities in Tarrant County. Keywords: Tarrant Texas Assumed Name Certificate, Sole Proprietor, Tarrant County, Texas, business, legal name, alternative business name, file, County Clerk's office, document, legal recognition, entrepreneurs, assumed name, conduct business, credibility, professionalism, flexibility, independence, sole proprietorship, legitimate business activities. Different Types of Tarrant Texas Assumed Name Certificates — Sole Proprietor: 1. Initial Assumed Name Certificate: This type of certificate is filed when a sole proprietor starts a new business or assumes a name different from their legal or personal name. It is the first step in the process of establishing an assumed name and must be filed with the County Clerk's office. 2. Renewal Assumed Name Certificate: Typically, an assumed name certificate expires after 10 years from the date of filing. To maintain the validity and legal status of the assumed name, sole proprietors must renew the certificate by filing a renewal assumed name certificate with the County Clerk's office before expiration. 3. Amendment Assumed Name Certificate: This type of certificate is filed when a sole proprietor needs to make changes to the assumed name previously filed, such as altering the name or business address. An amendment certificate should be filed promptly to ensure accurate and up-to-date information. 4. Withdrawal of Assumed Name Certificate: In cases where a sole proprietor decides to discontinue using an assumed name, they can file a withdrawal of assumed name certificate. This document formally terminates the use of the assumed name, allowing the sole proprietor to revert to using their legal or personal name. Keywords: Assumed Name Certificate, Initial Assumed Name Certificate, Renewal Assumed Name Certificate, Amendment Assumed Name Certificate, Withdrawal of Assumed Name Certificate, sole proprietor, Tarrant County, Texas, business, legal status, filing, County Clerk's office, expiration, changes, accuracy, discontinuation.Tarrant Texas Assumed Name Certificate — Sole Proprietor: A Comprehensive Guide In Tarrant County, Texas, a Sole Proprietor is an individual who operates a business under a name that is different from their legal name. To establish this alternative business name, individuals are required to file a Tarrant Texas Assumed Name Certificate with the County Clerk's office. This document provides legal recognition to the assumed name, allowing entrepreneurs to conduct business under a different identity. The Tarrant Texas Assumed Name Certificate — Sole Proprietor is a crucial step for aspiring business owners who desire to establish credibility and professionalism while maintaining their flexibility and independence. By filing this certificate, individuals signal their intent to operate a sole proprietorship business under an assumed name, showcasing their commitment to conducting legitimate business activities in Tarrant County. Keywords: Tarrant Texas Assumed Name Certificate, Sole Proprietor, Tarrant County, Texas, business, legal name, alternative business name, file, County Clerk's office, document, legal recognition, entrepreneurs, assumed name, conduct business, credibility, professionalism, flexibility, independence, sole proprietorship, legitimate business activities. Different Types of Tarrant Texas Assumed Name Certificates — Sole Proprietor: 1. Initial Assumed Name Certificate: This type of certificate is filed when a sole proprietor starts a new business or assumes a name different from their legal or personal name. It is the first step in the process of establishing an assumed name and must be filed with the County Clerk's office. 2. Renewal Assumed Name Certificate: Typically, an assumed name certificate expires after 10 years from the date of filing. To maintain the validity and legal status of the assumed name, sole proprietors must renew the certificate by filing a renewal assumed name certificate with the County Clerk's office before expiration. 3. Amendment Assumed Name Certificate: This type of certificate is filed when a sole proprietor needs to make changes to the assumed name previously filed, such as altering the name or business address. An amendment certificate should be filed promptly to ensure accurate and up-to-date information. 4. Withdrawal of Assumed Name Certificate: In cases where a sole proprietor decides to discontinue using an assumed name, they can file a withdrawal of assumed name certificate. This document formally terminates the use of the assumed name, allowing the sole proprietor to revert to using their legal or personal name. Keywords: Assumed Name Certificate, Initial Assumed Name Certificate, Renewal Assumed Name Certificate, Amendment Assumed Name Certificate, Withdrawal of Assumed Name Certificate, sole proprietor, Tarrant County, Texas, business, legal status, filing, County Clerk's office, expiration, changes, accuracy, discontinuation.