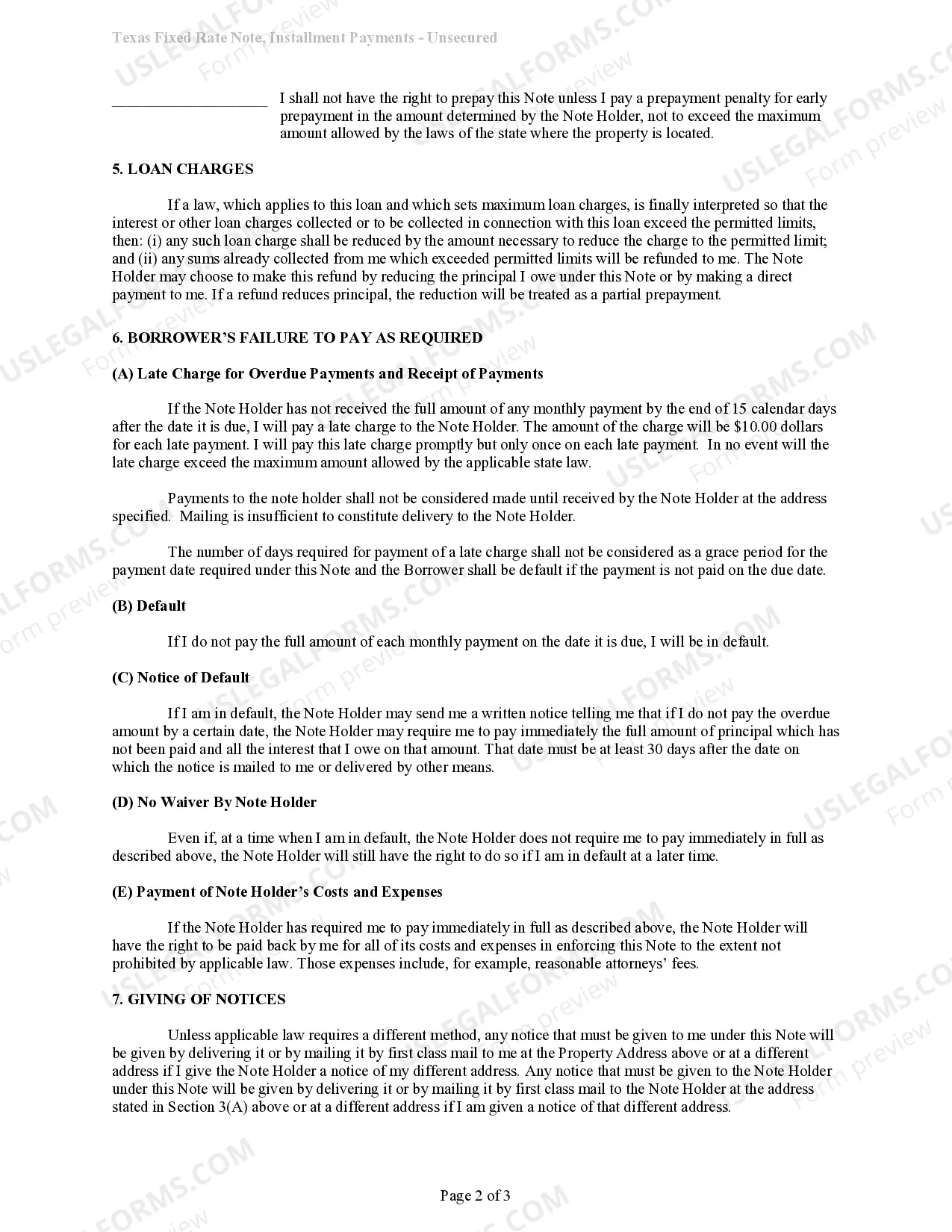

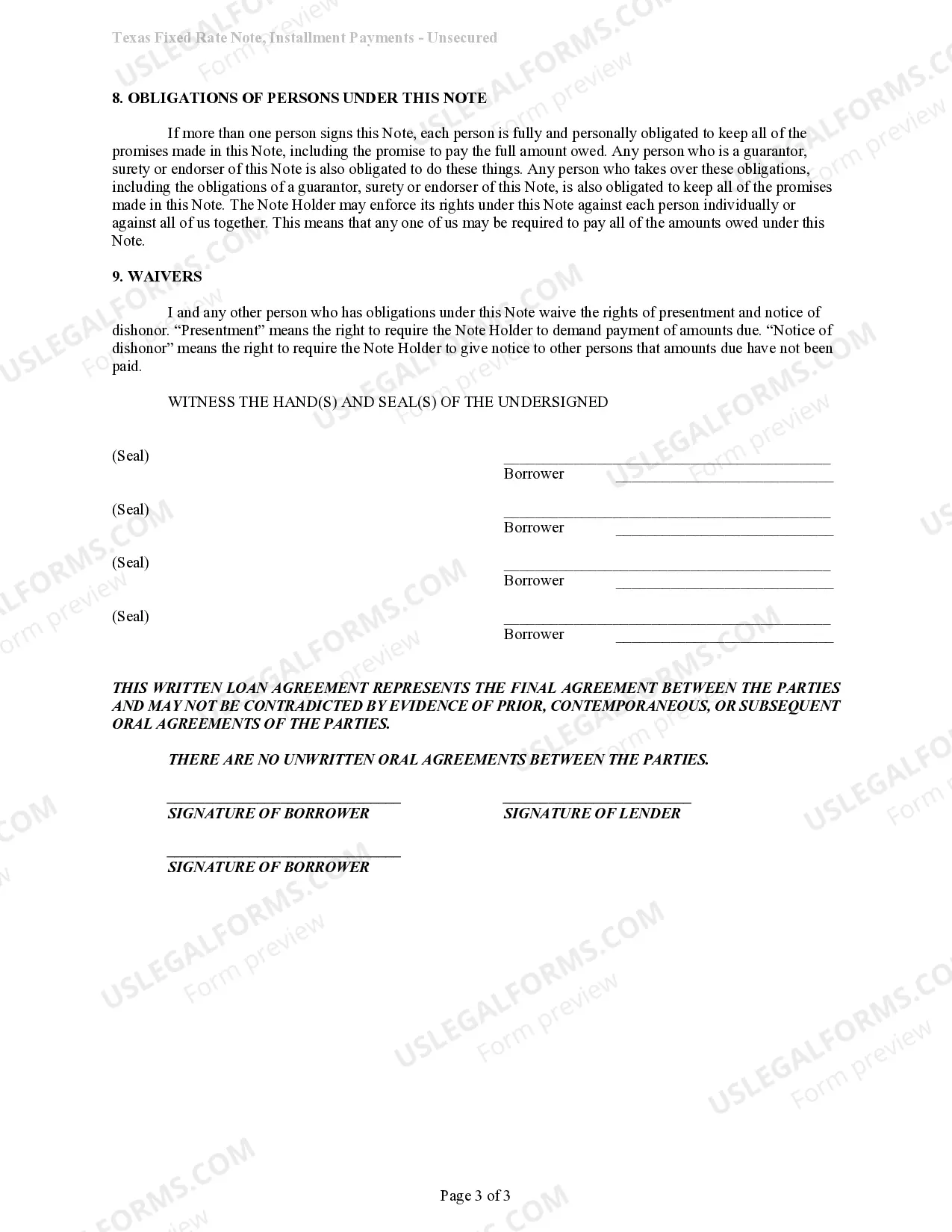

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan Are you in need of financial assistance in Arlington, Texas? Our Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan might be the perfect solution for you. Whether you require funds for medical emergencies, debt consolidation, home renovations, or any other personal financial need, our loan can provide the financial support you need without requiring collateral. Our Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan offers the following features: 1. Unsecured Loan: Our loan does not require any collateral, such as property or assets, to secure the loan. This makes it an accessible option for individuals who may not have valuable assets to offer as security. 2. Installment Payments: We provide the convenience of installment payments, allowing you to repay the loan in multiple equal payments over a predetermined period. This helps borrowers manage their finances effectively without straining their budgets. 3. Fixed Rate: Our loan offers a fixed interest rate, which means your interest rate remains constant throughout the loan term. This ensures predictable monthly payments, making budgeting easier and providing peace of mind. 4. Personal Signature Loan: This loan type is granted based on your personal creditworthiness and signature. We evaluate your credit score, income, employment status, and other financial factors to determine your eligibility and interest rate. Different types of Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loans may include: 1. Short-Term Signature Loan: This loan has a shorter term, usually ranging from a few months to a year. It is suitable for borrowers who need immediate funds and can repay the loan quickly. 2. Long-Term Signature Loan: This loan has a longer repayment term, often ranging from several years. It is ideal for borrowers who require a higher loan amount and the flexibility of smaller monthly payments. 3. Consolidation Signature Loan: Designed for borrowers looking to consolidate their existing debts into a single loan, this option allows you to simplify your finances and potentially reduce your overall interest rate. 4. Emergency Signature Loan: This loan type caters to individuals facing unexpected financial emergencies, such as medical bills or car repairs. It provides quick access to funds when you need them the most. In conclusion, our Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a flexible and accessible financial solution for residents of Arlington, Texas. Whether you need a short-term loan, long-term loan, consolidation loan, or emergency loan, we have options to suit various needs. Contact us today to learn more about how our loan can assist you in achieving your financial goals.Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan Are you in need of financial assistance in Arlington, Texas? Our Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan might be the perfect solution for you. Whether you require funds for medical emergencies, debt consolidation, home renovations, or any other personal financial need, our loan can provide the financial support you need without requiring collateral. Our Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan offers the following features: 1. Unsecured Loan: Our loan does not require any collateral, such as property or assets, to secure the loan. This makes it an accessible option for individuals who may not have valuable assets to offer as security. 2. Installment Payments: We provide the convenience of installment payments, allowing you to repay the loan in multiple equal payments over a predetermined period. This helps borrowers manage their finances effectively without straining their budgets. 3. Fixed Rate: Our loan offers a fixed interest rate, which means your interest rate remains constant throughout the loan term. This ensures predictable monthly payments, making budgeting easier and providing peace of mind. 4. Personal Signature Loan: This loan type is granted based on your personal creditworthiness and signature. We evaluate your credit score, income, employment status, and other financial factors to determine your eligibility and interest rate. Different types of Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loans may include: 1. Short-Term Signature Loan: This loan has a shorter term, usually ranging from a few months to a year. It is suitable for borrowers who need immediate funds and can repay the loan quickly. 2. Long-Term Signature Loan: This loan has a longer repayment term, often ranging from several years. It is ideal for borrowers who require a higher loan amount and the flexibility of smaller monthly payments. 3. Consolidation Signature Loan: Designed for borrowers looking to consolidate their existing debts into a single loan, this option allows you to simplify your finances and potentially reduce your overall interest rate. 4. Emergency Signature Loan: This loan type caters to individuals facing unexpected financial emergencies, such as medical bills or car repairs. It provides quick access to funds when you need them the most. In conclusion, our Arlington Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan is a flexible and accessible financial solution for residents of Arlington, Texas. Whether you need a short-term loan, long-term loan, consolidation loan, or emergency loan, we have options to suit various needs. Contact us today to learn more about how our loan can assist you in achieving your financial goals.