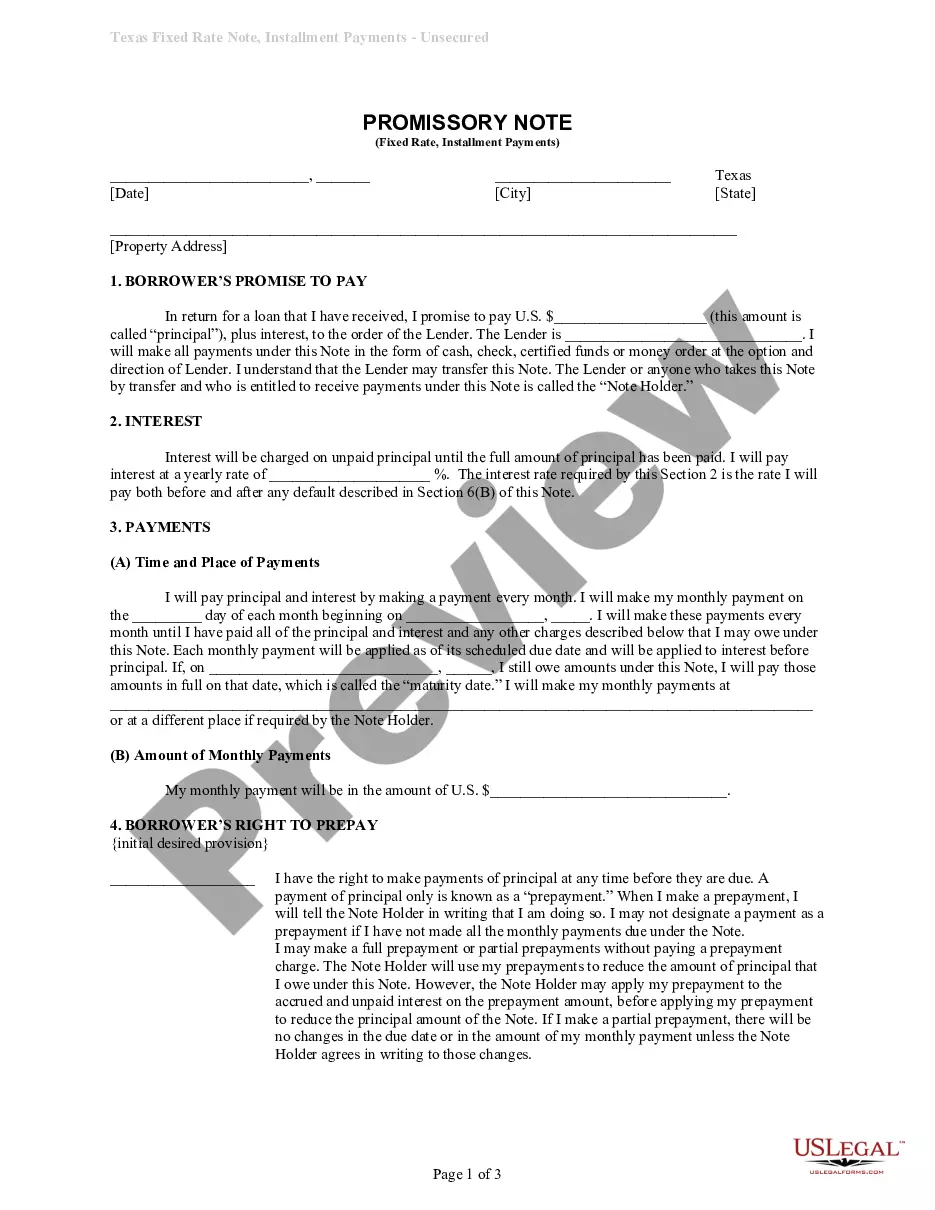

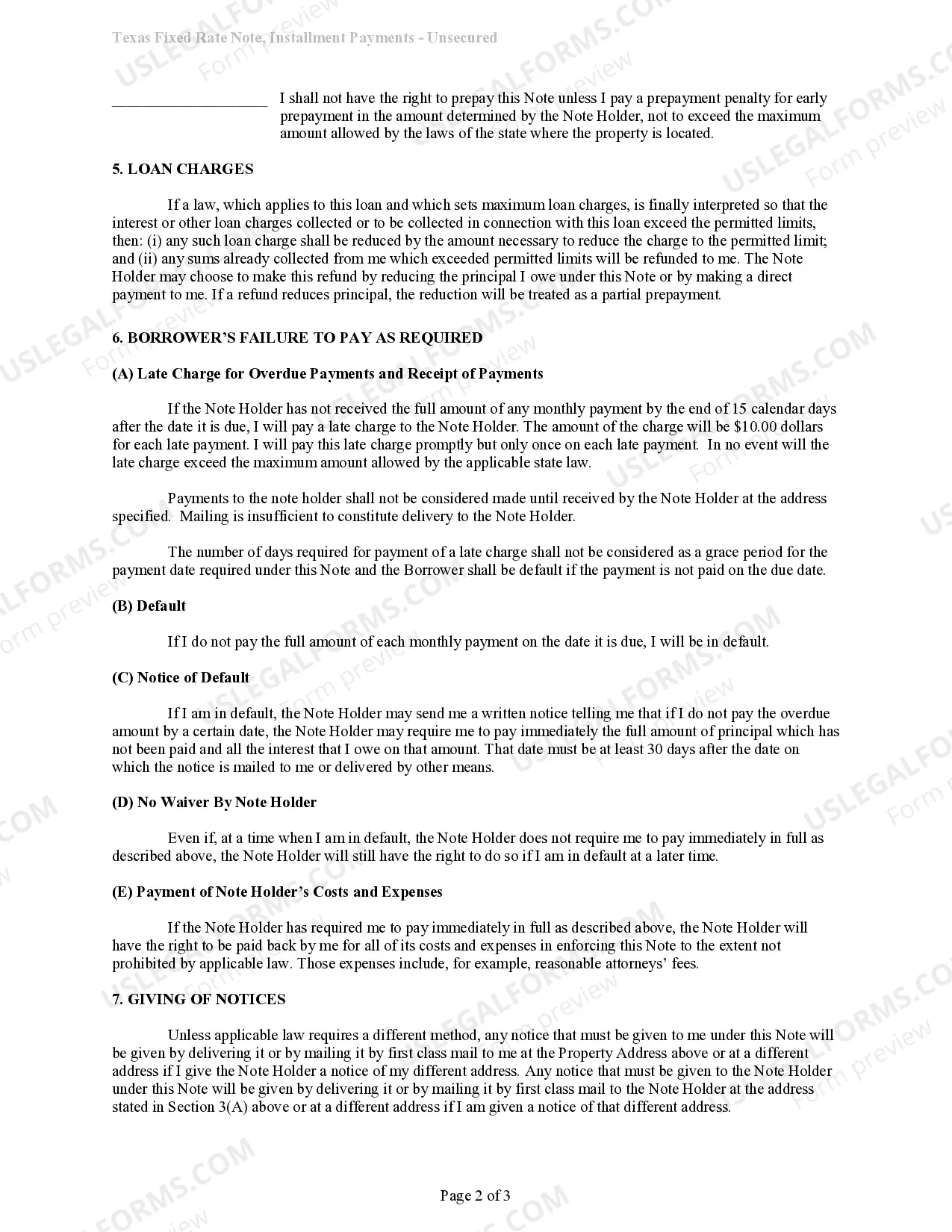

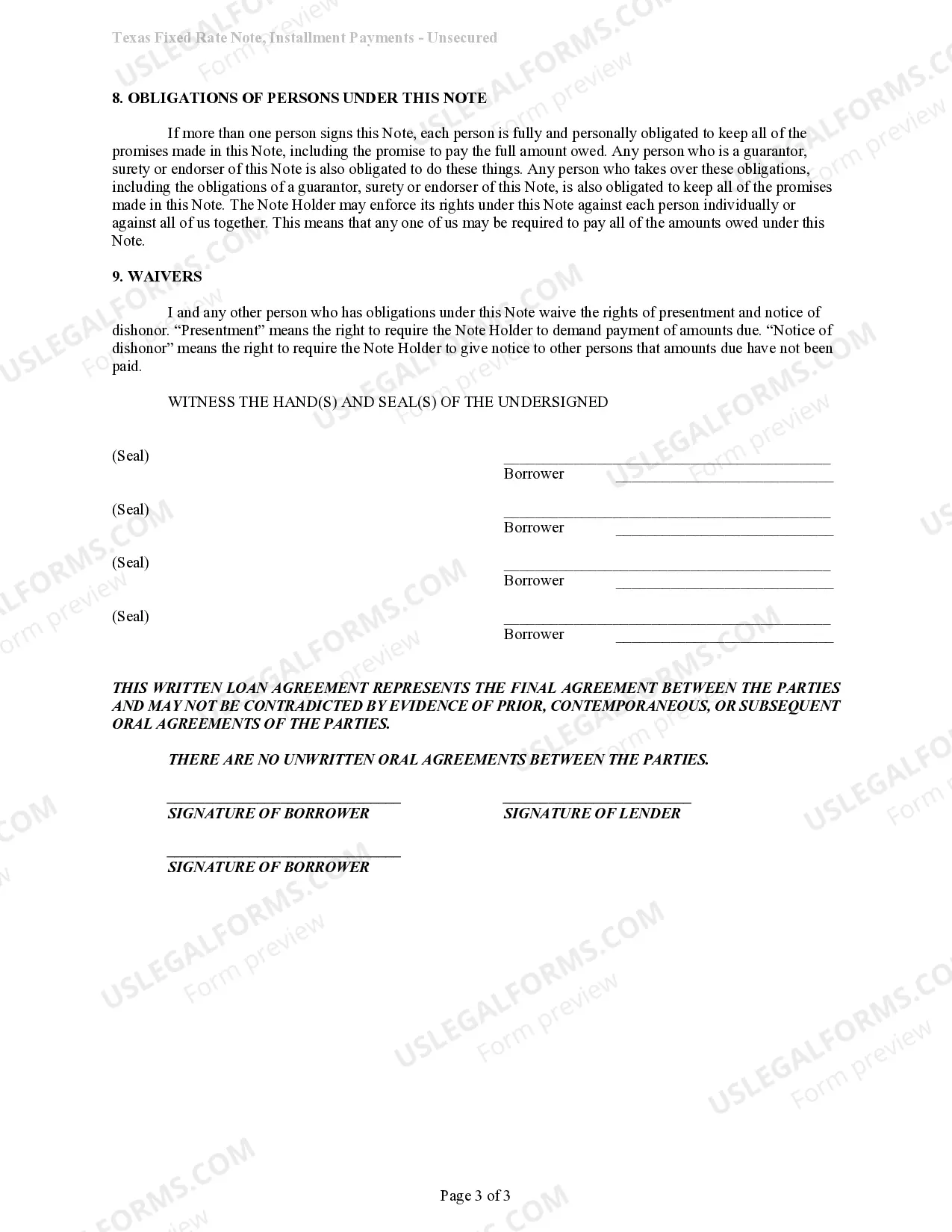

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan: A Comprehensive Guide When in need of financial assistance, a Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan can be a reliable option. This type of loan allows individuals to borrow funds without providing any collateral, relying solely on their personal creditworthiness. This article will delve into the details of this loan and discuss its various types. Firstly, let's understand the primary features of a Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan. This loan involves the lender (typically a financial institution or credit union) providing a specific amount of money to the borrower, who then agrees to repay the loan in installments. The loan's interest rate is fixed from the beginning, ensuring predictable and consistent monthly payments throughout the loan term. Key Features: 1. Flexibility: A Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan offers flexibility in terms of how the borrowed funds can be used. Whether it's for consolidating debt, covering unexpected expenses, funding education, or any personal financial need, the borrower has full control over their loan purpose. 2. No Collateral Required: One significant advantage of this loan type is that it does not necessitate any collateral. Unlike secured loans that require assets as collateral, an unsecured personal signature loan relies solely on the borrower's creditworthiness, income, and financial history. 3. Installment Repayment: With fixed-rate installment payments, the borrower pays a predetermined amount each month, ensuring a structured repayment schedule. This predictability allows borrowers to effectively budget their finances and manage their monthly expenses while repaying the loan. 4. Fixed Interest Rate: Carrollton Texas Unsecured Promissory Notes with Installment Payments come with a fixed interest rate. This means that the interest charged on the loan remains constant throughout the loan duration, safeguarding borrowers from sudden rate fluctuations and unexpected payment increases. 5. Personal Signature: As the name suggests, a personal signature loan solely relies on the borrower's signature as a guarantee of repayment. This demonstrates the lender's trust in the borrower's integrity and ability to fulfill their financial obligations. Types of Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan: 1. Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Auto Loan: Designed specifically for purchasing a vehicle, this loan helps borrowers finance their car without collateral. It offers competitive interest rates and a convenient repayment structure. 2. Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Education Loan: Tailored for students pursuing higher education, this loan assists in covering tuition fees, books, and other educational expenses. It provides flexible repayment terms and interest rates conducive to a student's financial situation. 3. Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Debt Consolidation Loan: This loan allows borrowers to consolidate multiple debts into a single, manageable repayment plan. It aims to simplify debt management, reduce interest rates, and potentially lower monthly payments. In conclusion, a Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan proves beneficial for various financial needs without requiring collateral. With its flexibility, predictable repayment schedule, and fixed interest rates, this loan type offers convenience and peace of mind to borrowers. Whether for auto purchases, education financing, or debt consolidation, these loans are a reliable option for Carrollton residents seeking financial stability.Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan: A Comprehensive Guide When in need of financial assistance, a Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan can be a reliable option. This type of loan allows individuals to borrow funds without providing any collateral, relying solely on their personal creditworthiness. This article will delve into the details of this loan and discuss its various types. Firstly, let's understand the primary features of a Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan. This loan involves the lender (typically a financial institution or credit union) providing a specific amount of money to the borrower, who then agrees to repay the loan in installments. The loan's interest rate is fixed from the beginning, ensuring predictable and consistent monthly payments throughout the loan term. Key Features: 1. Flexibility: A Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan offers flexibility in terms of how the borrowed funds can be used. Whether it's for consolidating debt, covering unexpected expenses, funding education, or any personal financial need, the borrower has full control over their loan purpose. 2. No Collateral Required: One significant advantage of this loan type is that it does not necessitate any collateral. Unlike secured loans that require assets as collateral, an unsecured personal signature loan relies solely on the borrower's creditworthiness, income, and financial history. 3. Installment Repayment: With fixed-rate installment payments, the borrower pays a predetermined amount each month, ensuring a structured repayment schedule. This predictability allows borrowers to effectively budget their finances and manage their monthly expenses while repaying the loan. 4. Fixed Interest Rate: Carrollton Texas Unsecured Promissory Notes with Installment Payments come with a fixed interest rate. This means that the interest charged on the loan remains constant throughout the loan duration, safeguarding borrowers from sudden rate fluctuations and unexpected payment increases. 5. Personal Signature: As the name suggests, a personal signature loan solely relies on the borrower's signature as a guarantee of repayment. This demonstrates the lender's trust in the borrower's integrity and ability to fulfill their financial obligations. Types of Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan: 1. Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Auto Loan: Designed specifically for purchasing a vehicle, this loan helps borrowers finance their car without collateral. It offers competitive interest rates and a convenient repayment structure. 2. Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Education Loan: Tailored for students pursuing higher education, this loan assists in covering tuition fees, books, and other educational expenses. It provides flexible repayment terms and interest rates conducive to a student's financial situation. 3. Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Debt Consolidation Loan: This loan allows borrowers to consolidate multiple debts into a single, manageable repayment plan. It aims to simplify debt management, reduce interest rates, and potentially lower monthly payments. In conclusion, a Carrollton Texas Unsecured Promissory Note with Installment Payments — Fixed Rat— - Personal Signature Loan proves beneficial for various financial needs without requiring collateral. With its flexibility, predictable repayment schedule, and fixed interest rates, this loan type offers convenience and peace of mind to borrowers. Whether for auto purchases, education financing, or debt consolidation, these loans are a reliable option for Carrollton residents seeking financial stability.