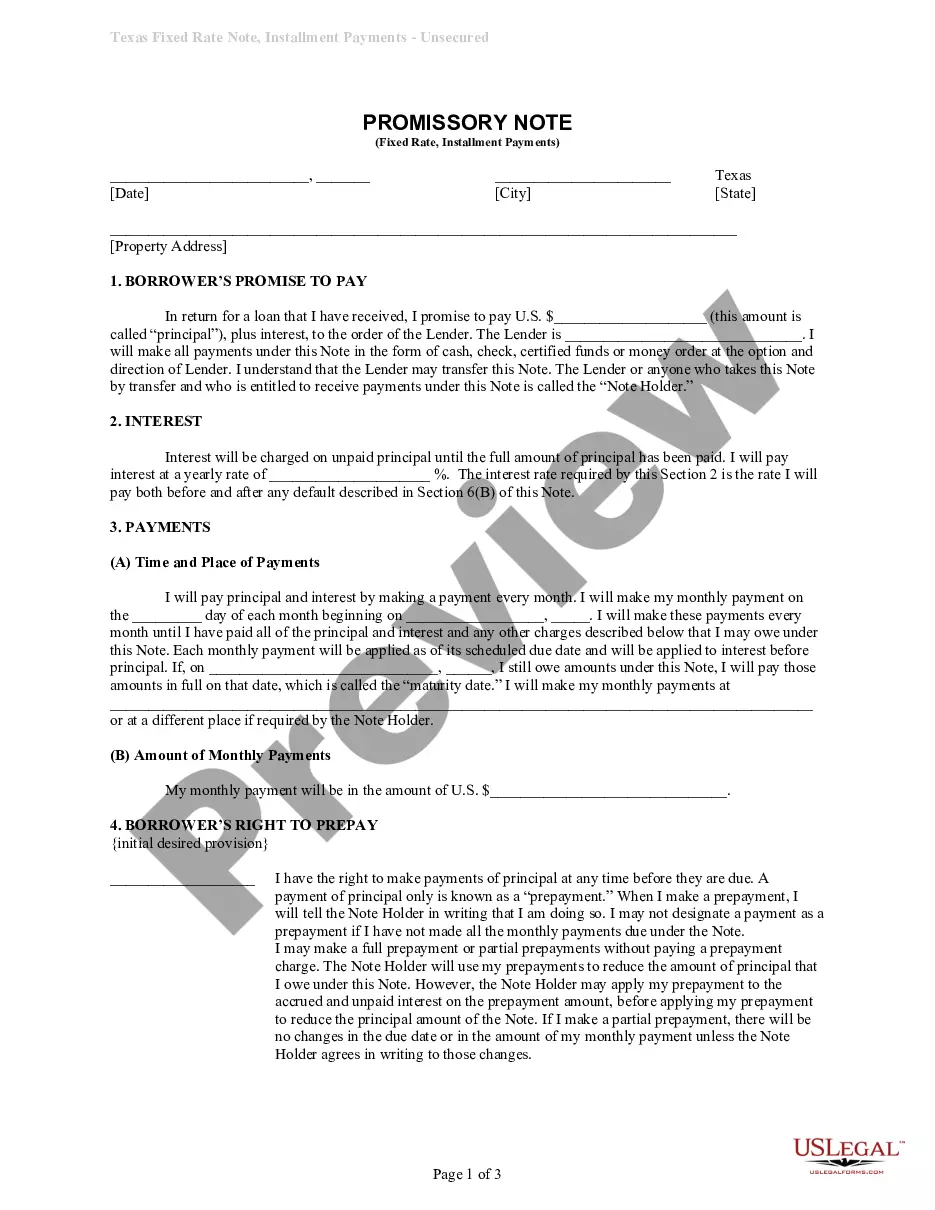

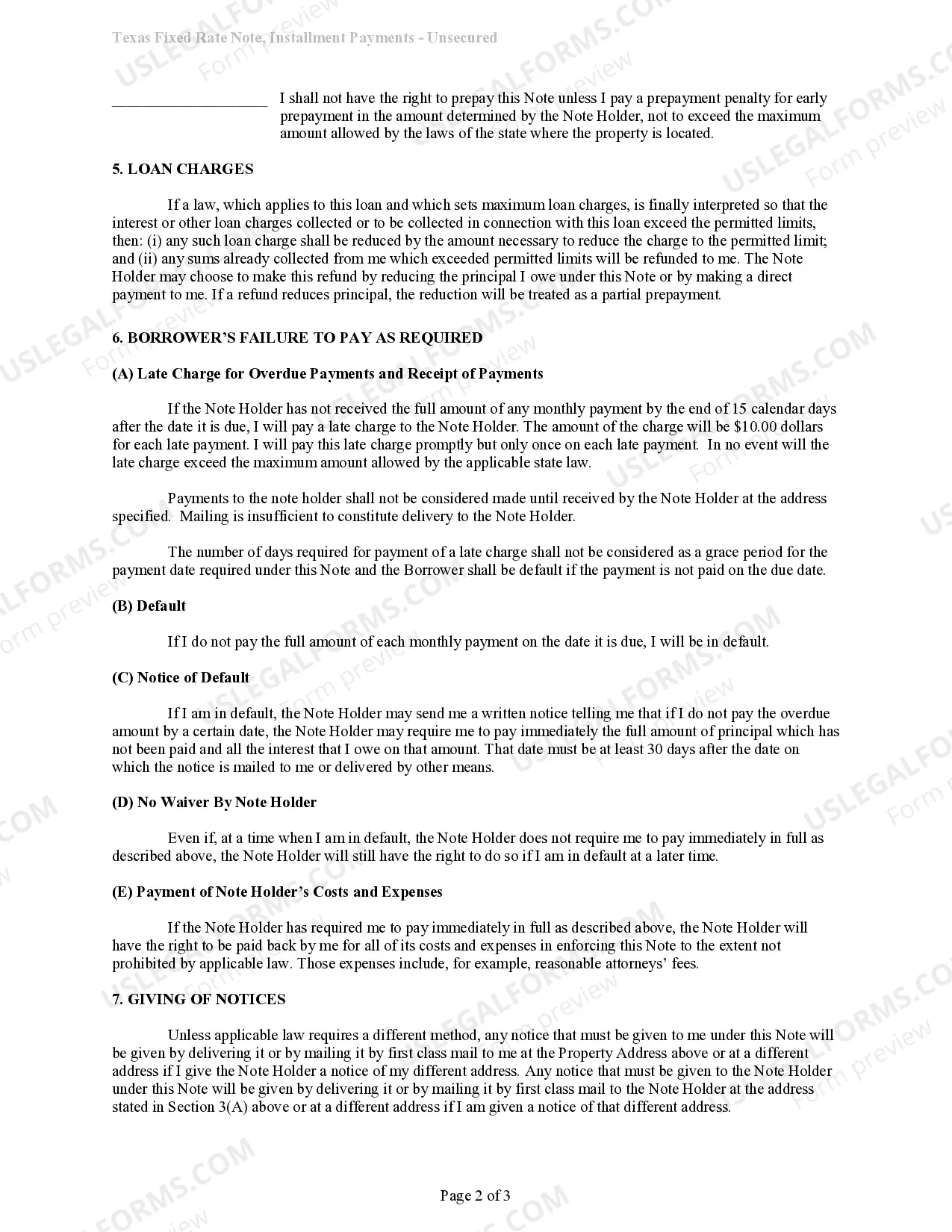

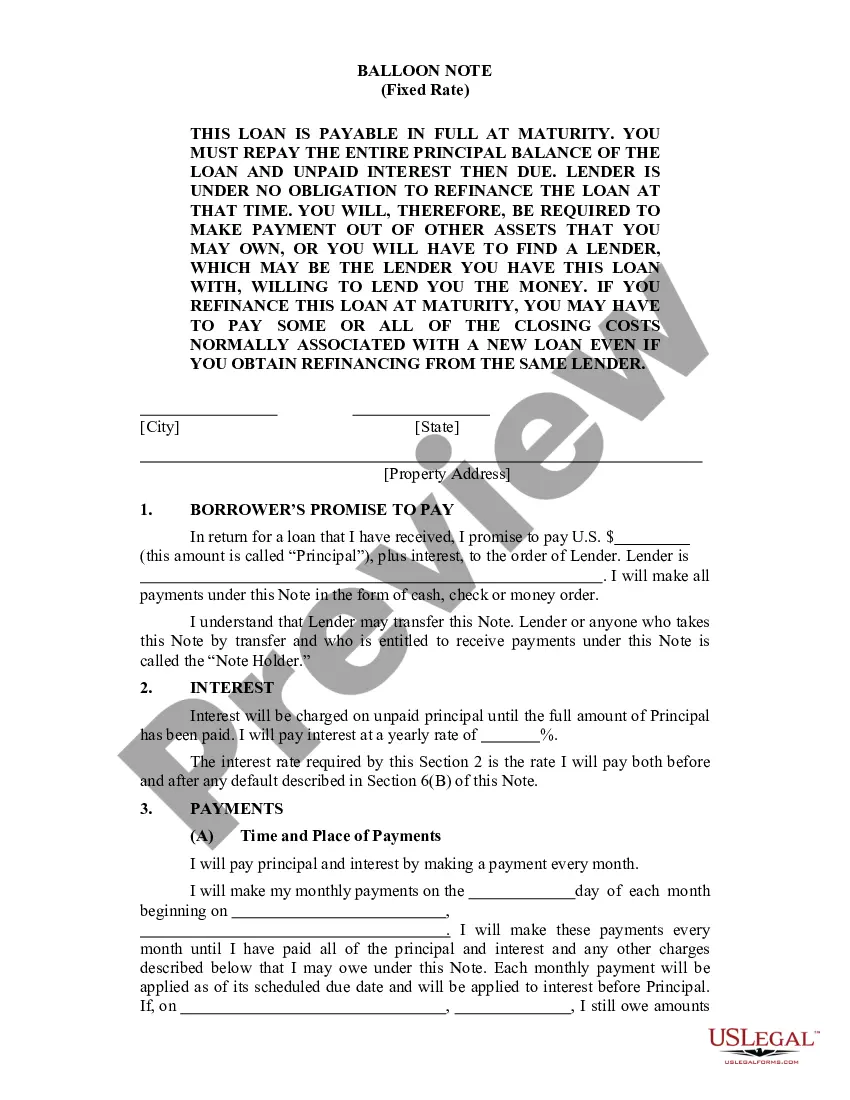

This detailed sample Promissory Note complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Odessa Texas Unsecured Promissory Note with Installment Payments - Fixed Rate - Personal Signature Loan

Description

How to fill out Texas Unsecured Promissory Note With Installment Payments - Fixed Rate - Personal Signature Loan?

Finding validated forms tailored to your local laws can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements as well as any real-world scenarios.

All the materials are accurately organized by usage area and jurisdictional regions, making the retrieval of the Odessa Texas Unsecured Promissory Note with Installment Payments - Fixed Rate - Personal Signature Loan as straightforward as possible.

Safeguarding your paperwork in an orderly fashion and aligned with legal obligations is crucial. Take advantage of the US Legal Forms library to always have the necessary document templates for any requirements right at your fingertips!

- Ensure to examine the Preview mode and document description.

- Verify that you have selected the appropriate one that aligns with your needs and fully meets your local jurisdiction standards.

- Search for an alternative template if necessary.

- If you detect any discrepancies, utilize the Search tab above to find the correct document. If it fits your requirements, proceed to the next step.

- Purchase the document by clicking the Buy Now button and choosing your desired subscription plan. You will need to register an account to access the library’s offerings.

Form popularity

FAQ

The most common example of a signature loan is an unsecured personal loan. Many banks and lenders offer small loans to customers without requiring collateral. Instead, they look at the customer's credit history and use that to decide on maximum loan amounts and interest rates.

Unsecured loans are loans that don't require collateral. They're also referred to as signature loans because a signature is all that's needed if you meet the lender's borrowing requirements.

Signature Loans vs Installment Loans But signature loans are not the same as installment loans. Usually installment loans offer larger loan amounts than signature loans, which usually offer smaller loan amounts. Signature loans usually come with a shorter loan term and a shorter payment plan.

A signature loan is a fixed-rate, unsecured personal loan offered by an online lender, bank or credit union. It's called a signature loan because it's secured by your signature instead of collateral, like a car or an investment account. Getting approved for a signature loan will likely depend on your creditworthiness.

Because you don't need to offer the lender collateral on an unsecured loan, you won't put your assets at risk if you need to borrow money to pay for a major expense, such as a wedding or medical emergency, or to consolidate high interest credit card debt.

An unsecured loan is a loan that doesn't require any type of collateral. Instead of relying on a borrower's assets as security, lenders approve unsecured loans based on a borrower's creditworthiness. Examples of unsecured loans include personal loans, student loans, and credit cards.

A signature loan is an unsecured personal loan. Unlike a secured loan, this type of loan doesn't require you to pledge collateral ? something of value, like a bank account or house ? a lender can seize if you fail to repay the loan.

Typically, an unsecured personal loan can be used for almost any reason, like making home improvements, paying off accumulated medical bills, or consolidating credit card debt. However, be sure to check the terms of a loan so you understand any limits before you sign.

A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral.

Unsecured personal loans generally range from about $1,000 to $50,000. They're typically repaid in fixed monthly payments over a set period of time, typically two to five years. They're offered by banks, credit unions and online lenders.