This detailed sample Deed in Lieu of Foreclosure complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Edinburg Texas Deed in Lieu of Foreclosure

Description

How to fill out Texas Deed In Lieu Of Foreclosure?

We consistently endeavor to diminish or avert legal harm when handling intricate legal or financial issues.

To achieve this, we subscribe to legal services which are generally very expensive.

Nevertheless, not all legal challenges are as convoluted.

The majority can be addressed on our own.

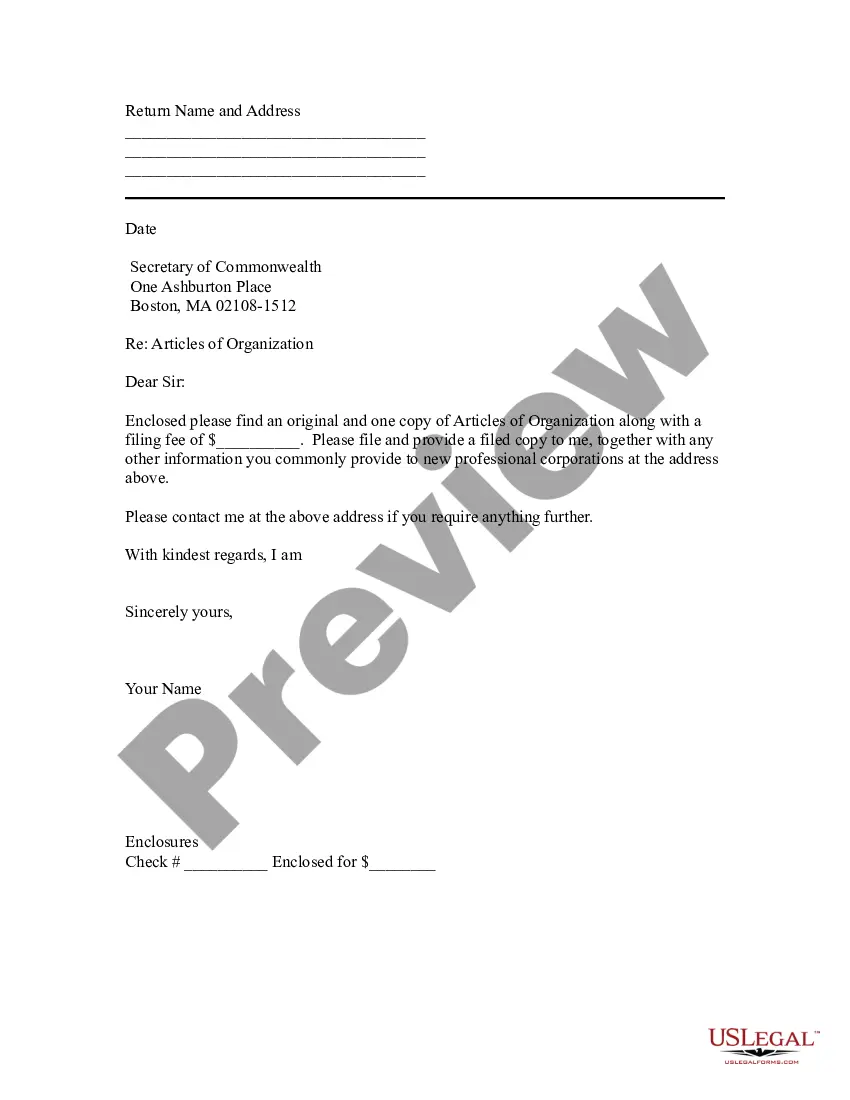

Take advantage of US Legal Forms whenever you need to quickly and securely locate and download the Edinburg Texas Deed in Lieu of Foreclosure or any other document. Simply Log In to your account and click the Get button next to it. If you misplaced the document, you can always retrieve it again in the My documents section.

- US Legal Forms is an online repository of current DIY legal documents that range from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection empowers you to manage your affairs independently, without hiring legal professionals.

- We offer access to legal document templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, significantly easing the search process.

Form popularity

FAQ

One disadvantage of a deed in lieu of foreclosure is that it may negatively impact your credit score, similar to a traditional foreclosure. Additionally, lenders might require that you prove financial hardship, and there could be specific tax implications to consider. It is advisable to weigh these points carefully before proceeding with the Edinburg Texas Deed in Lieu of Foreclosure, as they may affect your financial future.

When choosing a deed in lieu of foreclosure, a seller should gather several key documents. Important items include the original mortgage agreement, a recent property title, any correspondence with the lender, and a property appraisal if available. Collecting these documents ahead of time can make the Edinburg Texas Deed in Lieu of Foreclosure process more efficient and clear.

Filing a deed in lieu requires submitting the signed deed to your local county clerk's office. It's crucial to verify that all documents are accurate and complete to avoid delays. Once filed, the lender will generally release any mortgage obligations tied to the property, allowing you to move forward. For assistance, you might explore uslegalforms, as they provide tools to help navigate the Edinburg Texas Deed in Lieu of Foreclosure process.

Executing a deed in lieu of foreclosure involves several steps. First, you should negotiate with your lender to reach an agreement on the terms. Next, prepare the necessary documents, including the deed itself, and ensure all parties sign them. If you need guidance during this process, consider using uslegalforms, which can simplify each step when dealing with an Edinburg Texas Deed in Lieu of Foreclosure.

The timeline for a deed in lieu of foreclosure can vary, but typically it takes around 30 to 60 days from the initial agreement to its completion. Factors such as lender cooperation, document preparation, and local regulations can influence this timeline. For those pursuing the Edinburg Texas Deed in Lieu of Foreclosure, organizing documentation promptly can help expedite the process.

To file a deed in lieu of foreclosure, you need to obtain approval from your lender first, preparing the necessary documents that include the deed itself. The signed deed must then be notarized and recorded with your local county office. For assistance in navigating this process in Edinburg, Texas, consider utilizing platforms like USLegalForms to streamline the required paperwork.

No, a lender is not obligated to accept a deed in lieu of foreclosure. They may weigh various factors, including the value of the property and the homeowner's financial situation, before making a decision. If you are considering this option in Edinburg, Texas, it may be beneficial to communicate transparently with your lender.

There isn't a specific property code solely dedicated to deeds in lieu of foreclosure in Texas, as this process is often governed by broader foreclosure and property laws. For a homeowner in Edinburg, Texas, it’s important to get legal advice for a thorough understanding of how different codes affect your situation.

Property code 5.012 in Texas addresses issues related to foreclosure notices and the rights of borrowers to receive them. This code emphasizes communication and transparency between lenders and borrowers. If you are involved in a potential deed in lieu of foreclosure scenario in Edinburg, Texas, understanding this code can be advantageous.

Filing a deed in lieu of foreclosure involves several steps, beginning with obtaining your lender's consent. You must prepare the deed, sign it in front of a notary, and then file it with your local county clerk. If you need guidance on the process in Edinburg, Texas, tools like USLegalForms can offer assistance in ensuring proper fulfillment of these steps.