This detailed sample Deed in Lieu of Foreclosure complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Laredo Texas Deed in Lieu of Foreclosure

Description

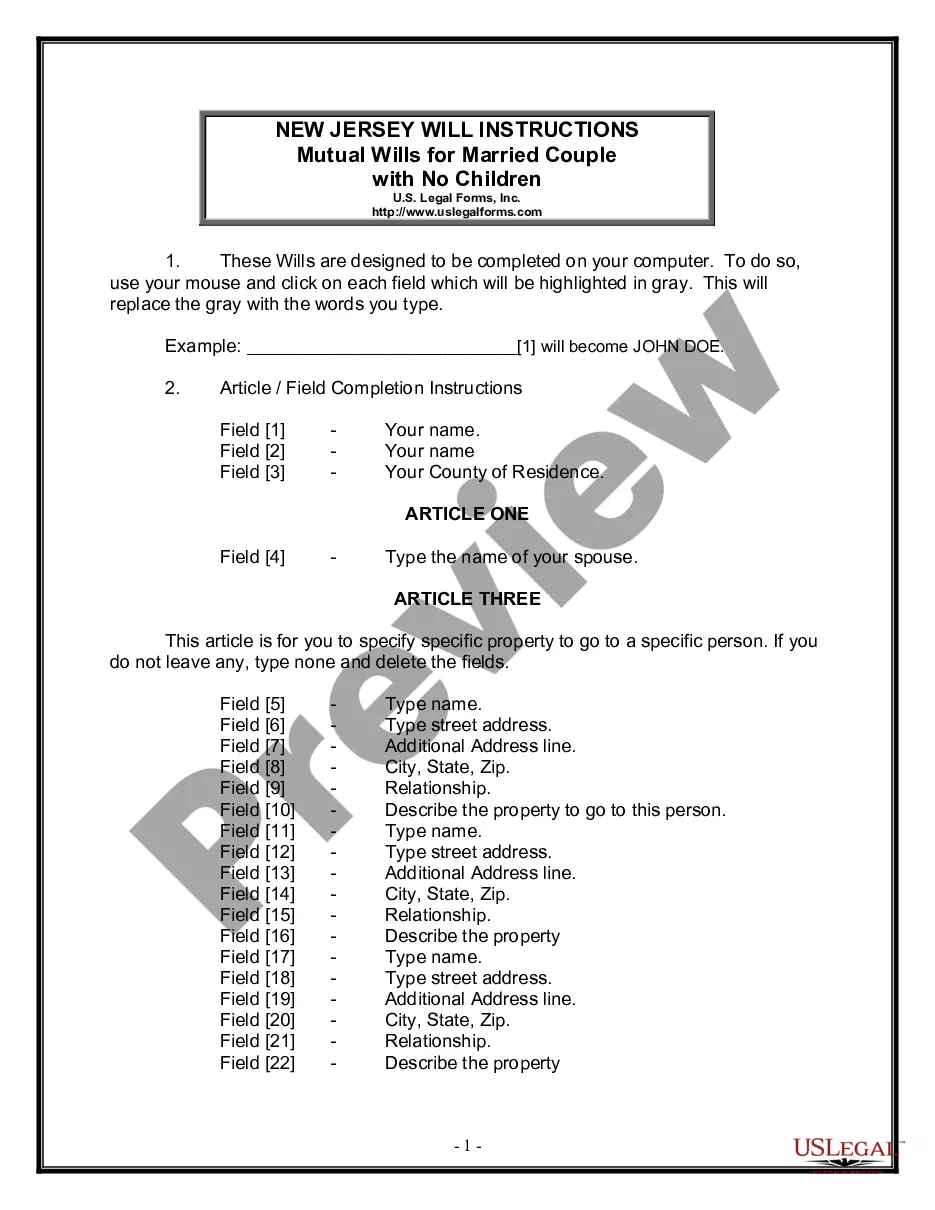

How to fill out Texas Deed In Lieu Of Foreclosure?

Regardless of your social or professional rank, finishing legal paperwork is a regrettable requirement in today’s job market.

Frequently, it’s nearly impossible for individuals without a legal education to produce this type of documentation from the ground up, largely because of the intricate terminology and legal subtleties associated with it.

This is where US Legal Forms steps in to assist.

Verify that the form you have located is suitable for your area, as the regulations for one state or county may not apply to another.

Examine the form and read through a brief overview (if available) of situations for which the document may be utilized.

- Our service offers an extensive collection of over 85,000 ready-to-utilize state-specific documents applicable to nearly every legal situation.

- US Legal Forms is also a valuable resource for partners or legal advisors seeking to expedite their work with our DIY paperwork.

- Whether you require the Laredo Texas Deed in Lieu of Foreclosure or any other document suitable for your state or county, US Legal Forms has everything readily available.

- Here's how to acquire the Laredo Texas Deed in Lieu of Foreclosure in mere minutes using our reliable service.

- If you are currently a subscriber, feel free to Log In to your account to access the desired form.

- But if you're not acquainted with our platform, make sure to adhere to these instructions before securing the Laredo Texas Deed in Lieu of Foreclosure.

Form popularity

FAQ

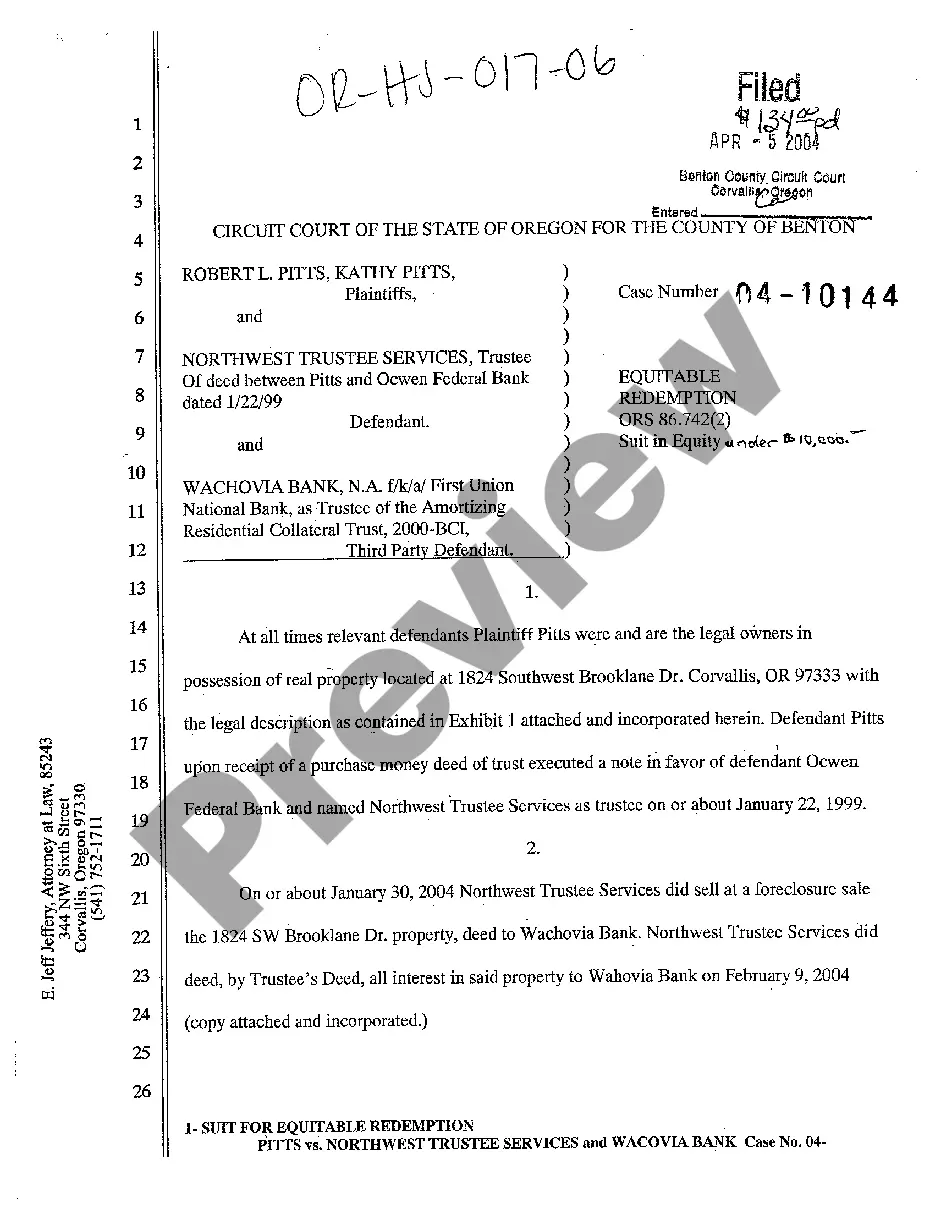

A Laredo Texas Deed in Lieu of Foreclosure is a legal agreement where you voluntarily transfer your property to the lender to avoid foreclosure. This option can help you eliminate the mortgage debt while protecting your credit score compared to a traditional foreclosure. It’s an advantageous choice for homeowners looking for a more straightforward solution to their financial struggles.

The timeline for completing a Laredo Texas Deed in Lieu of Foreclosure can vary, but it generally takes a few weeks to a couple of months. After you submit the necessary documents, the lender will review your application and may require a property inspection. Once approved, you can expect to finalize the transaction quickly, allowing you to move on from your financial issues.

Writing a foreclosure letter requires clear communication and a structured format. Start with your contact information, date, and the lender's details. Explain your situation in simple terms, mentioning your property in Laredo, Texas, and your intent to pursue a deed in lieu of foreclosure. Ensure you include any relevant details, such as your mortgage account number and request for guidance on the next steps you should take.

A deed in lieu of foreclosure allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. For instance, if you own a home in Laredo, Texas, and cannot keep up with mortgage payments, you might consider a deed in lieu of foreclosure. This agreement may help you settle your debt without further legal action or damage to your credit. By choosing this path, you can start fresh while avoiding the lengthy foreclosure process.

To file a Laredo Texas deed in lieu of foreclosure, you need to first communicate with your lender to discuss your situation. Once both parties agree, you'll need to prepare the necessary documents, sign them, and then record the deed with your local government office. Using platforms like US Legal Forms can simplify this process by providing templates and guidance tailored for your specific needs. Ensuring all steps are correctly followed is essential for a smooth transfer.

For lenders, a significant disadvantage of accepting a Laredo Texas deed in lieu of foreclosure is the potential loss of collateral value. If the property's market value has declined, the lender may incur losses that exceed their original investment. Additionally, the process can involve legal costs and logistical challenges that add to the lender’s overall expenses. Therefore, lenders often weigh these factors carefully before accepting such arrangements.

An important disadvantage of a Laredo Texas deed in lieu of foreclosure is that it may not relieve you from all your liabilities. While the lender may agree to take back the property, they might still pursue you for any unpaid mortgage balance. This situation can lead to further financial strain. It’s crucial to clarify these terms before proceeding with this option.

No, a lender is not obligated to accept a Laredo Texas deed in lieu of foreclosure. They must evaluate the circumstances and the condition of the property before making a decision. If the property’s value has significantly decreased, or if there are other legal issues, the lender may refuse the deed in lieu. Understanding this can help you prepare more effectively for the potential alternatives.

One disadvantage of a Laredo Texas deed in lieu of foreclosure is that it may negatively impact your credit score. While it is less damaging than a formal foreclosure, a deed in lieu still indicates to lenders that you could not meet your mortgage obligations. This change can affect your ability to secure future loans. Moreover, you may still be responsible for any remaining balance on your mortgage, known as a deficiency.

To file a deed in lieu of foreclosure, you first need to complete the deed form according to your lender's specifications. Once the document is finalized and signed, it must be recorded with the local county office where the property is located. Leveraging platforms like uslegalforms helps streamline this filing process, ensuring that you meet all local requirements efficiently.