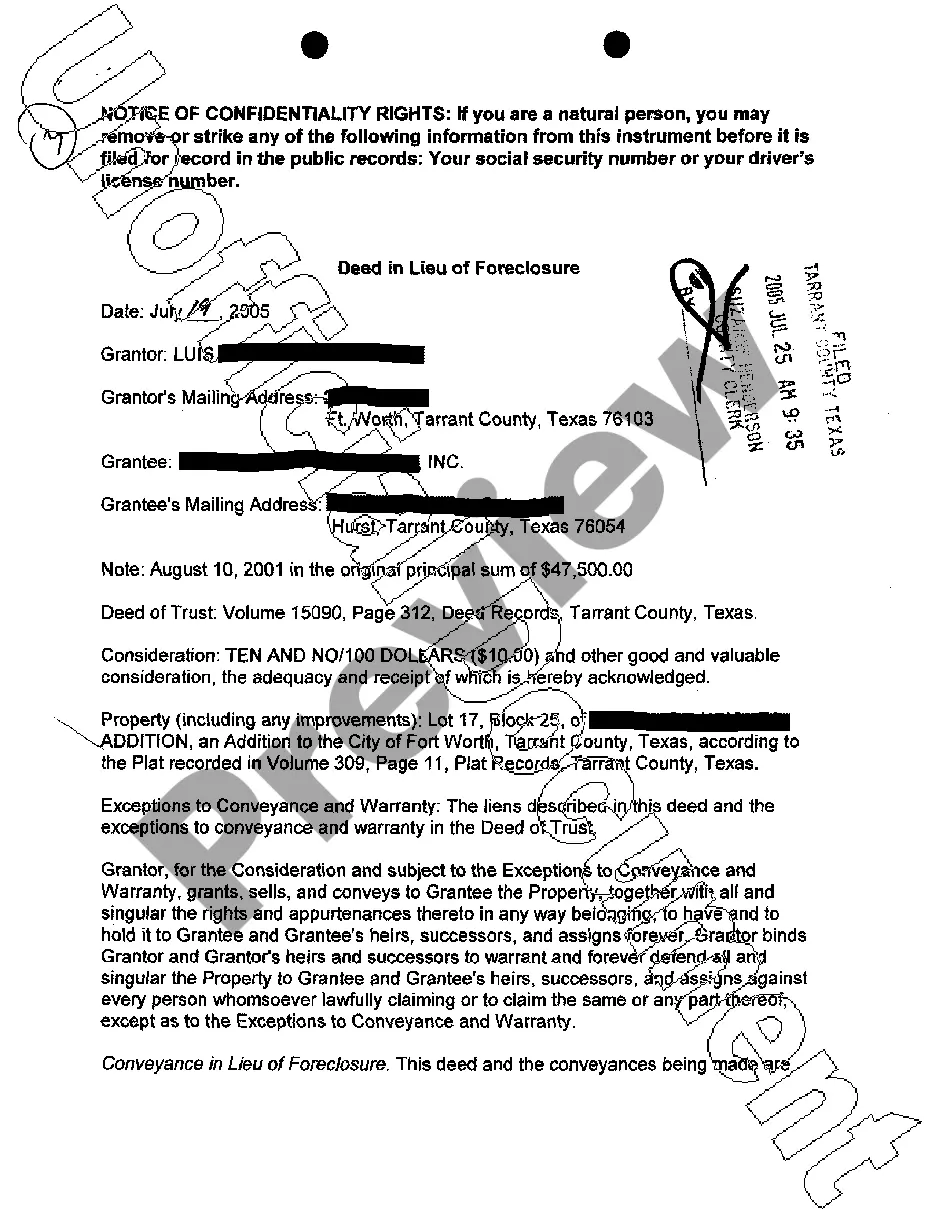

This detailed sample Deed in Lieu of Foreclosure complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Lewisville Texas Deed in Lieu of Foreclosure is a legal process that allows homeowners in Lewisville, Texas, who are facing imminent foreclosure, to voluntarily transfer the ownership of their property to the mortgage lender in order to avoid foreclosure proceedings. This option is often sought when homeowners are unable to maintain their mortgage payments and have exhausted all other possible alternatives. Deed in Lieu of Foreclosure, also known as a "mortgage deed," is a mutually agreed-upon arrangement between the homeowner and the lender, where the homeowner transfers the title or deed of their property back to the lender in exchange for the discharge of their mortgage debt. This option can provide homeowners some relief from the financial burden associated with foreclosure, while also helping lenders avoid the costs and time-consuming nature of a traditional foreclosure process. There are no different types of Lewisville Texas Deed in Lieu of Foreclosure specifically. However, it is important to note that the terms of the agreement may vary depending on the lender's guidelines and the homeowner's unique circumstances. Some key considerations in a Lewisville Texas Deed in Lieu of Foreclosure may include: 1. Financial Hardship: Homeowners must demonstrate that they are experiencing financial hardship, such as a loss of income, illness, divorce, or other circumstances that have made it difficult for them to meet their mortgage obligations. 2. Negotiation Process: The homeowner initiates the conversation with the mortgage lender to explore the possibility of a Deed in Lieu of Foreclosure. Both parties negotiate the terms and conditions of the agreement, including the release of any remaining mortgage obligations, potential financial incentives, and the timeline for the transfer of ownership. 3. Property Valuation: The lender typically conducts a comprehensive evaluation of the property to determine its fair market value, which helps determine the final terms of the Deed in Lieu agreement. This valuation may involve an appraisal or a broker's opinion of value. 4. Release of Mortgage Debt: The primary objective of a Deed in Lieu of Foreclosure is to discharge the homeowner's mortgage debt. However, there may be other financial obligations associated with the property, such as second mortgages or unpaid property taxes, which need to be negotiated and resolved as part of the agreement. 5. Impact on Credit Score: It's important to understand that entering into a Deed in Lieu of Foreclosure can have a negative impact on the homeowner's credit score. This could affect their ability to obtain credit or secure housing in the future. 6. Relocation Assistance: In some cases, the lender may offer financial assistance to the homeowner to help with relocation expenses and facilitate a smooth transition out of the property. This can vary depending on the lender's policies and the homeowner's circumstances. Overall, the Lewisville Texas Deed in Lieu of Foreclosure is a potential option for homeowners who find themselves in distressful financial situations and are unable to continue making mortgage payments. It provides an alternative to the foreclosure process, allowing homeowners to relinquish ownership of their property and potentially alleviate the financial burden associated with an underwater or unaffordable mortgage. However, it is crucial for homeowners to consult with legal and financial professionals before pursuing this option to fully understand the implications and potential alternatives available to them.