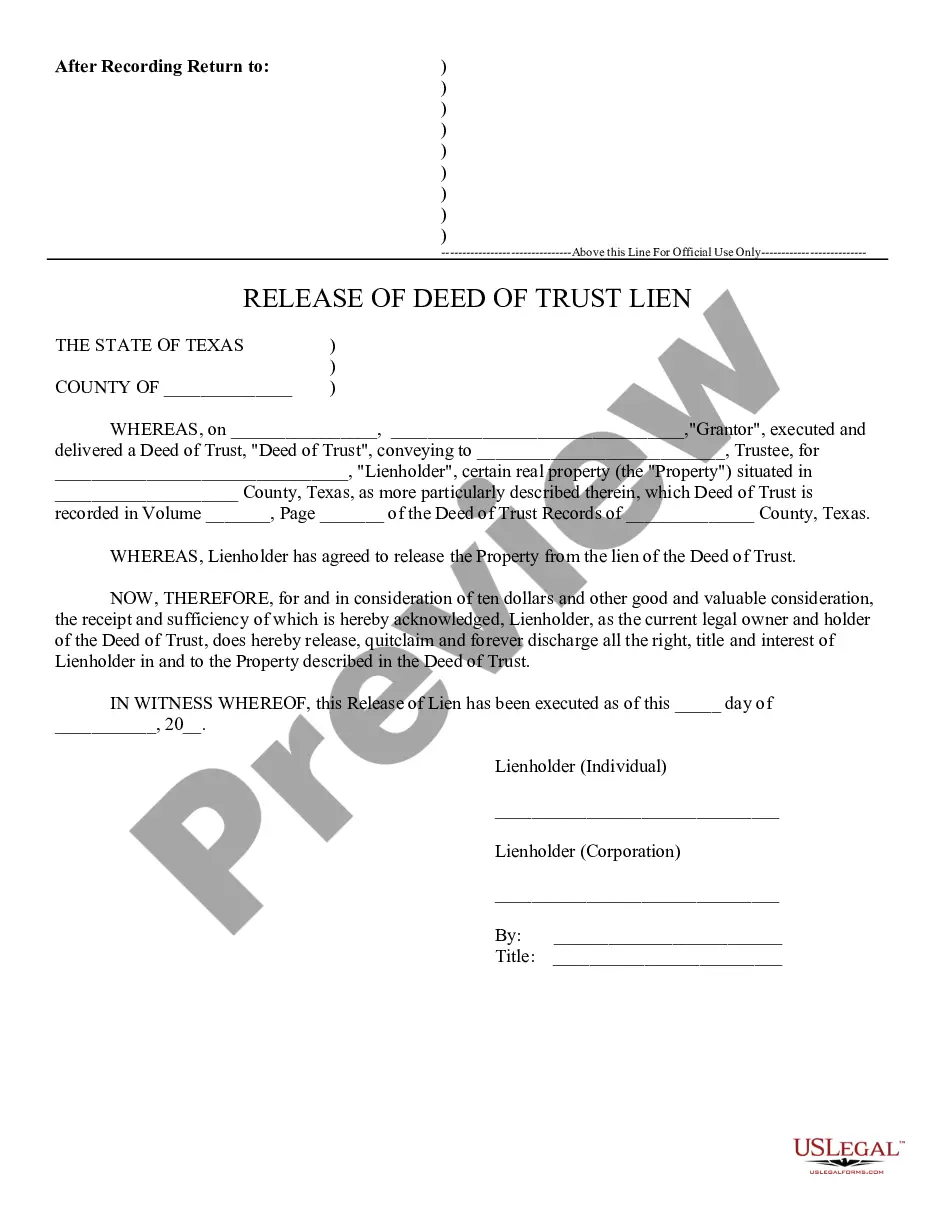

This form is a release of a deed of trust lien. Grantor executed and delivered a deed of trust to the trustee for the lienholder. The lienholder has agreed to release the property from the lien of the deed of trust and discharge all right and title to the property.

A Bexar Texas Release of Lien is a legal document that serves to release a lien placed on a property in Bexar County, Texas. This document effectively removes the property's encumbrance and allows the owner to transfer the property free and clear of any liens. Liens can be placed on a property for various reasons, such as unpaid debts, construction work, or unpaid taxes. When a lien is filed, it becomes a legal claim against the property, making it difficult for the property owner to sell or refinance the property without addressing the lien's requirements. To release a lien in Bexar County, Texas, the property owner must follow the appropriate legal procedures. First, they must obtain a Release of Lien form. This form may vary depending on the type of lien being released, as there are different types of liens that can be placed on a property. Some common types of liens that might require a release in Bexar County include: 1. Mechanics' Liens: These liens are typically placed by contractors, subcontractors, or suppliers who have provided labor or materials for construction or improvement work on the property. A Mechanics' Lien Release form must be filed to release this type of lien. 2. Property Tax Liens: When property taxes go unpaid, the taxing authority may place a tax lien on the property. To release a property tax lien, the property owner must fulfill their outstanding tax obligations and obtain a Release of Property Tax Lien. 3. Judgment Liens: If a party obtains a court judgment against a property owner, they may place a judgment lien on the property. To release a judgment lien, the property owner must satisfy the judgment or negotiate a settlement with the judgment creditor. Once the appropriate Release of Lien form is obtained, it must be completed accurately, signed by the lien holder, and notarized. The completed form must then be filed with the Bexar County Clerk's Office along with any required supporting documentation, such as proof of payment or a court order. Upon receiving the release, the County Clerk will update the property records, officially releasing the lien from the property. In summary, a Bexar Texas Release of Lien is a legal document used to release a lien on a property in Bexar County, Texas. This document is necessary for property owners to clear their property from any outstanding liens and regain full ownership rights. By understanding the different types of liens that may require a release, property owners can navigate the process effectively and ensure a smooth transfer of property ownership.