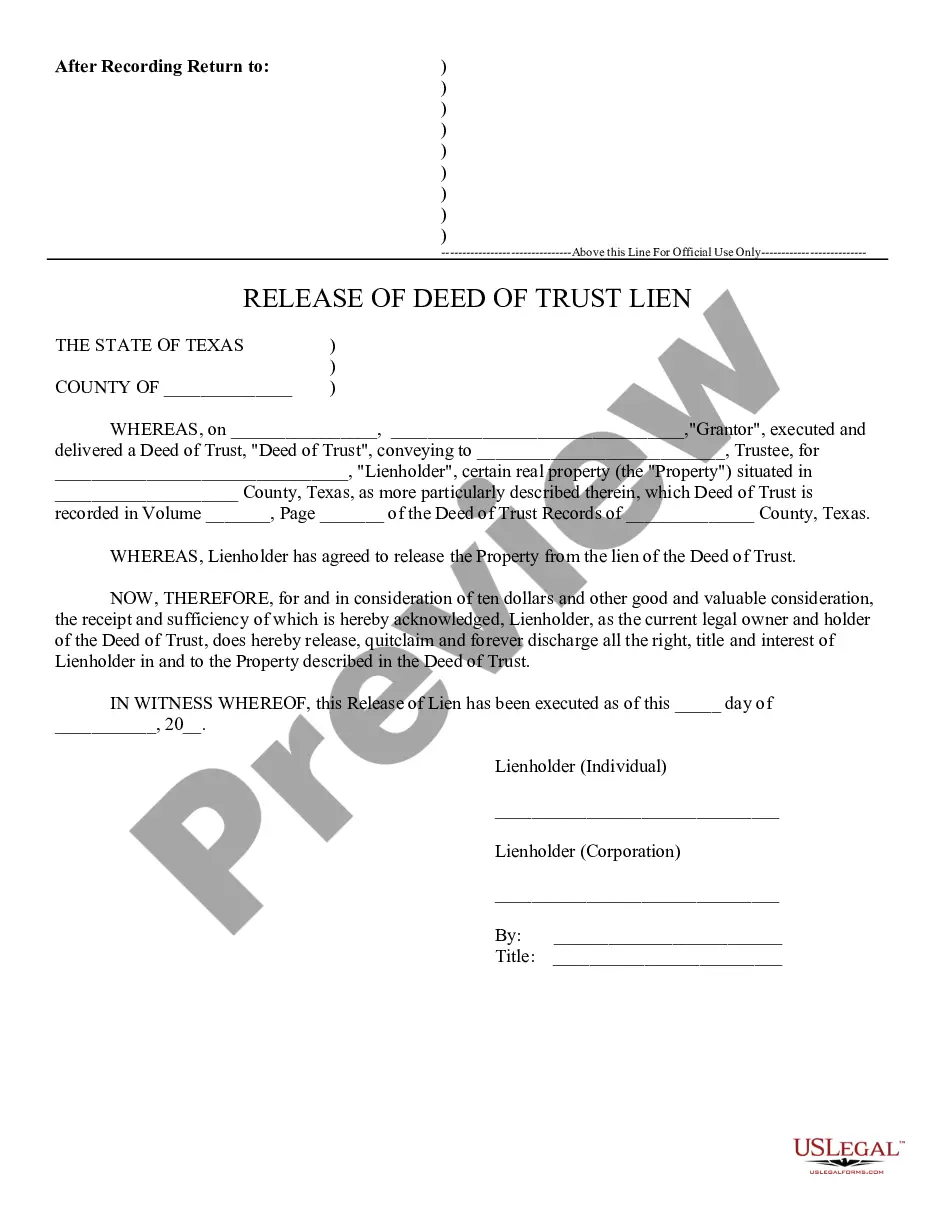

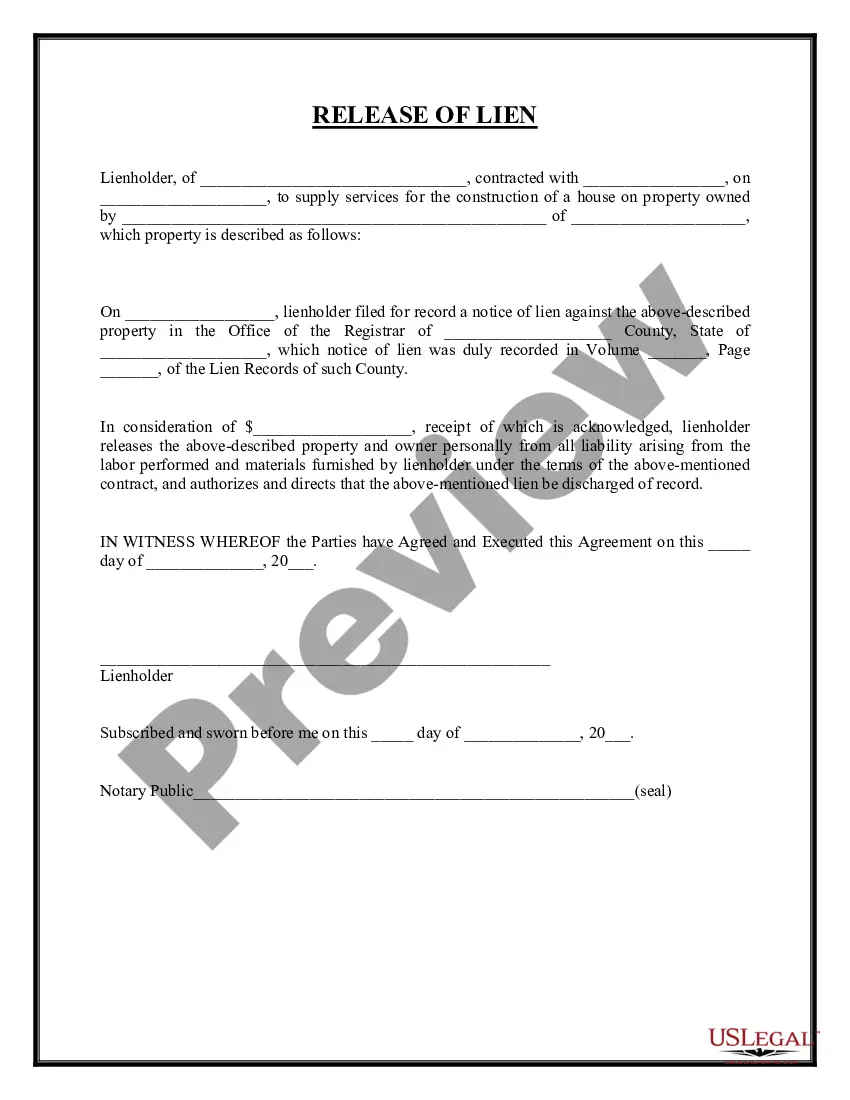

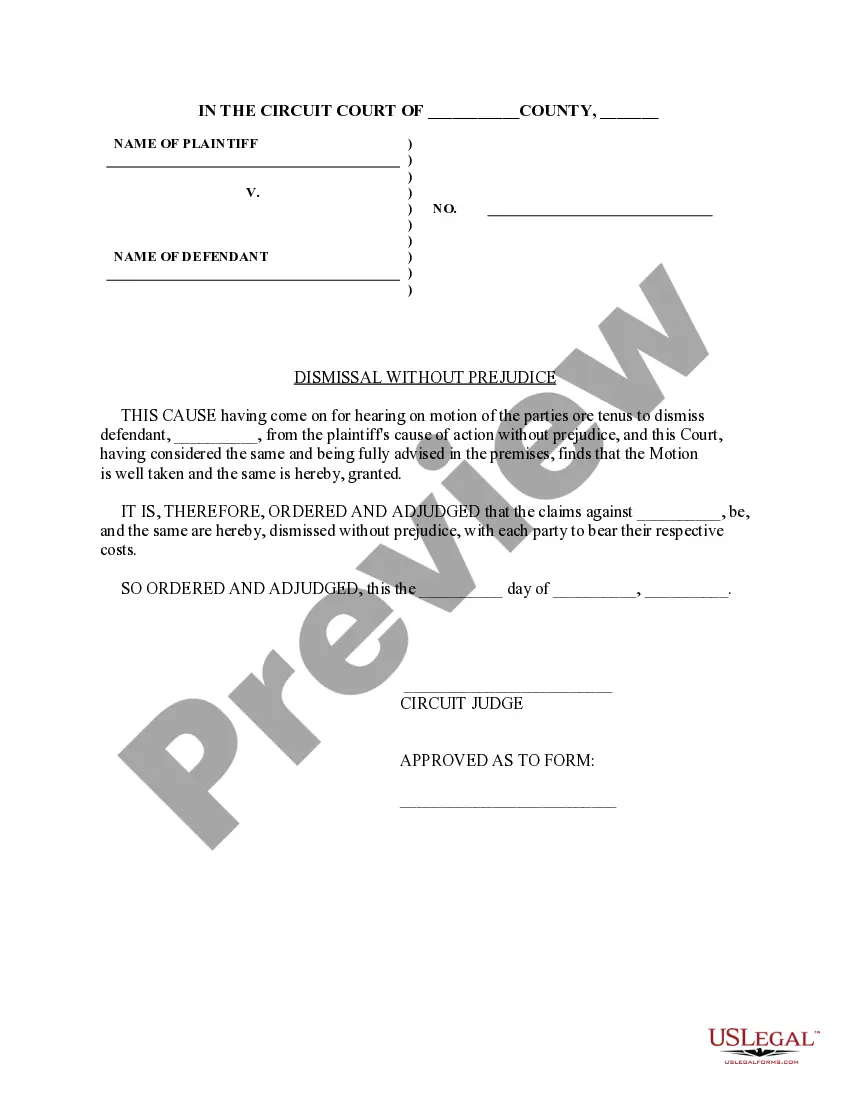

This form is a release of a deed of trust lien. Grantor executed and delivered a deed of trust to the trustee for the lienholder. The lienholder has agreed to release the property from the lien of the deed of trust and discharge all right and title to the property.

Carrollton Texas Release of Lien

Description

How to fill out Texas Release Of Lien?

If you've previously used our service, Log In to your account and obtain the Carrollton Texas Release of Lien on your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continual access to every document you have purchased: you can locate it in your profile under the My documents section whenever you wish to reuse it. Make the most of the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Ensure you’ve located an appropriate document. Browse through the description and utilize the Preview option, if available, to verify it satisfies your requirements. If it’s not suitable, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or use the PayPal option to finalize the transaction.

- Obtain your Carrollton Texas Release of Lien. Choose the file format for your document and save it on your device.

- Complete your form. Print it or utilize online editing tools to fill it out and sign it electronically.

Form popularity

FAQ

Once a lien is released in Texas, obtaining a clear title for your property is the next step. You should first ensure that the lien release form is properly filed with the county clerk’s office. After that, you can request an updated title from your local title office. Having the release properly documented gives you the peace of mind that your title is clean. Services like US Legal Forms can guide you through the necessary steps to ensure a smooth process.

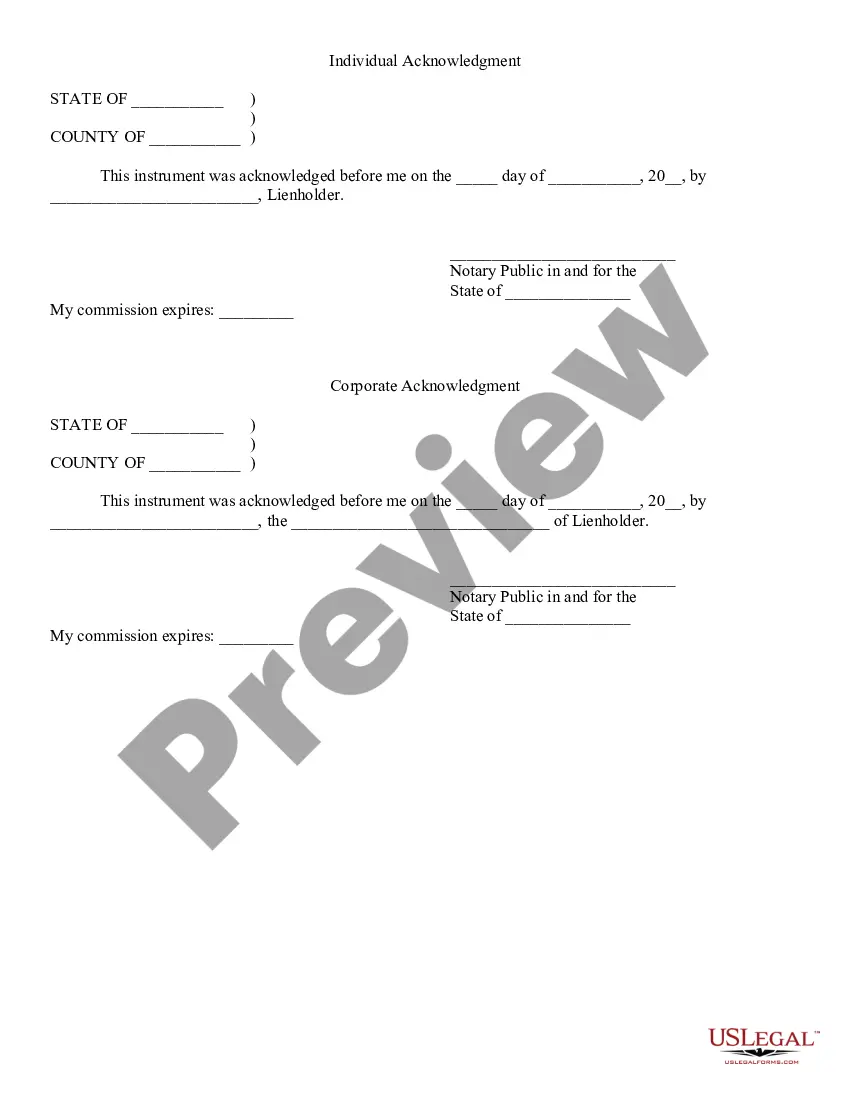

In Texas, the release of lien must be signed by the lienholder, typically the individual or company that originally placed the lien. If the lienholder is a business, an authorized representative must sign on their behalf. Ensure that all signatures are clear, as this validates the release and allows for smoother processing. Using resources like US Legal Forms can help ensure that you have the right people signing the right documents.

In Texas, a lien release does not necessarily have to be notarized, but doing so can add an extra layer of assurance and authenticity to the document. Having the signature of the lienholder notarized can help avoid potential disputes in the future. Therefore, while it's not a strict requirement, it is a good practice to consider when completing your Carrollton Texas Release of Lien.

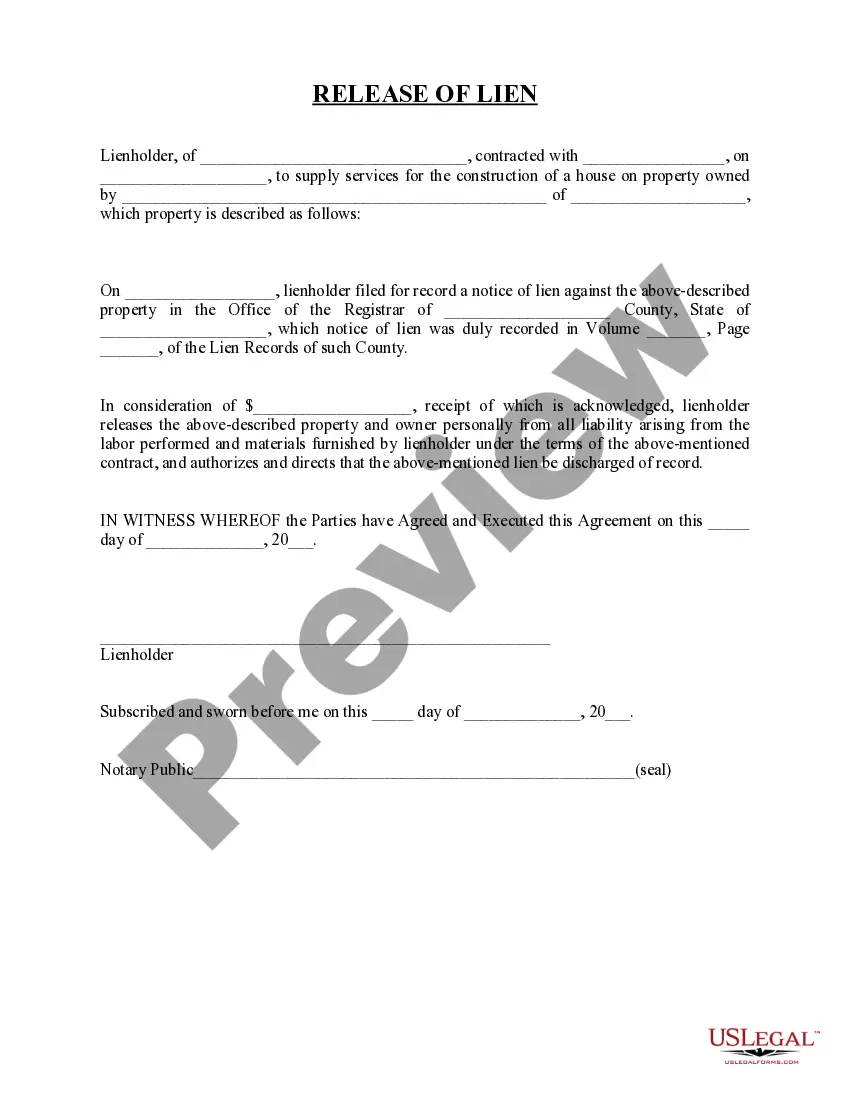

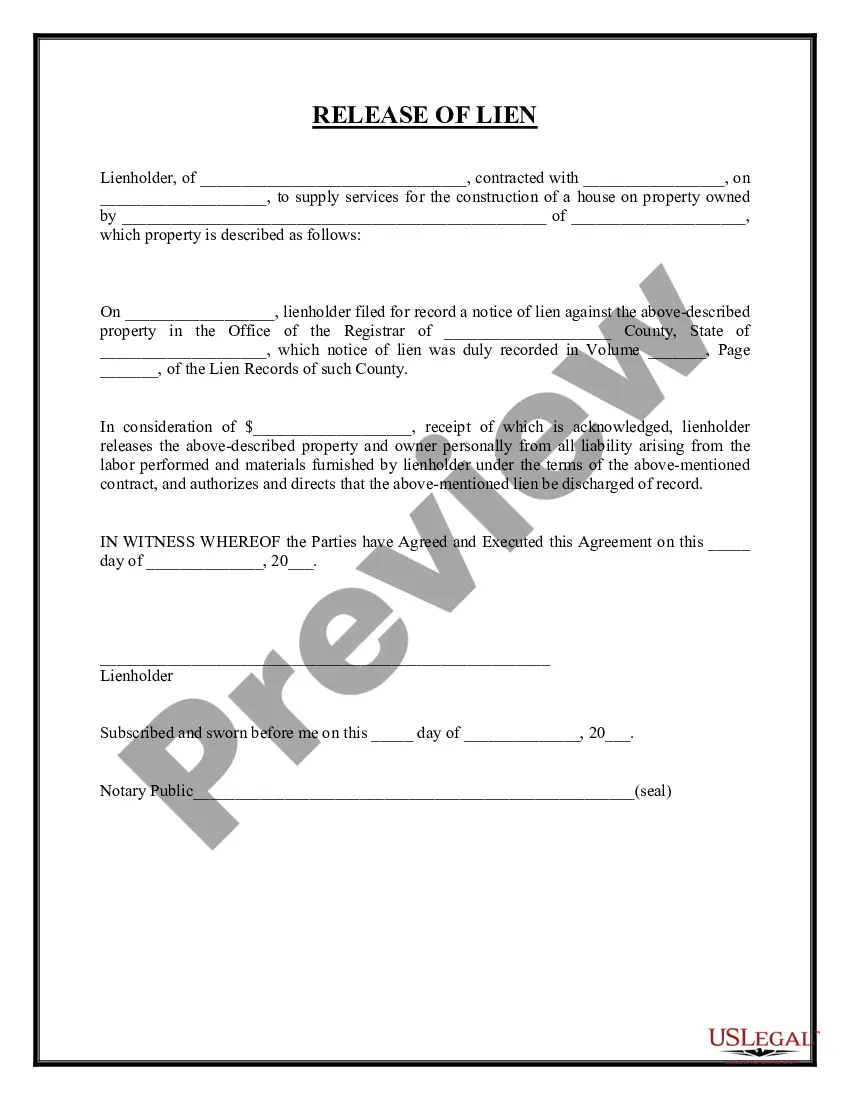

A lien release form in Texas is a legal document that officially releases a lien against a property. This form indicates that the debt or obligation tied to the property has been satisfied. Having a valid lien release is important to ensure that you have clear title to your property. You can easily obtain this form through platforms like US Legal Forms, which can provide the necessary templates.

To file a release of lien on your property in Texas, you need to submit your lien release form to the county clerk where your property resides. It's advisable to check with the county office for any specific requirements or fees associated with the filing. The filing process officially eliminates the lien, allowing you to move forward with confidence. You can use US Legal Forms to find the correct documentation and streamline this process.

To complete a lien release in Carrollton, Texas, start by filling out the appropriate lien release form. Ensure that both the property details and the lien amount are accurately specified. It's crucial to have the lienholder sign this form, as their signature is essential for it to be valid. Once completed, the form must be filed with your county clerk's office.

In Texas, a bank is required to release a lien within a specific time frame once a debt is satisfied. Generally, they must complete this process within a reasonable period, typically no longer than 30 days. If a bank fails to do so, you can take steps to compel them to complete the Carrollton Texas Release of Lien. Consider consulting platforms like US Legal Forms for guidance on how to address this situation effectively.

To perform a release of lien in Texas, you first need to obtain the appropriate form. This document typically requires information about the lien holder, the property, and the original agreement. Once you fill out the form, you must sign and file it with the county clerk where the lien was recorded. Using US Legal Forms can simplify this process by providing you with easy access to the necessary forms for a Carrollton Texas Release of Lien.

Requesting a lien removal involves reaching out to the lienholder and asking for a lien release document. Be sure to have any supporting documentation and proof of payment ready. Once the lienholder issues the release, file it with your county clerk to ensure the Carrollton Texas Release of Lien is officially recognized.

You can obtain your lien release from the lienholder, usually a bank or financial institution. It is essential to contact them directly and provide information about your payment status. After they verify the information, they will issue the necessary document, which you must file for the Carrollton Texas Release of Lien.