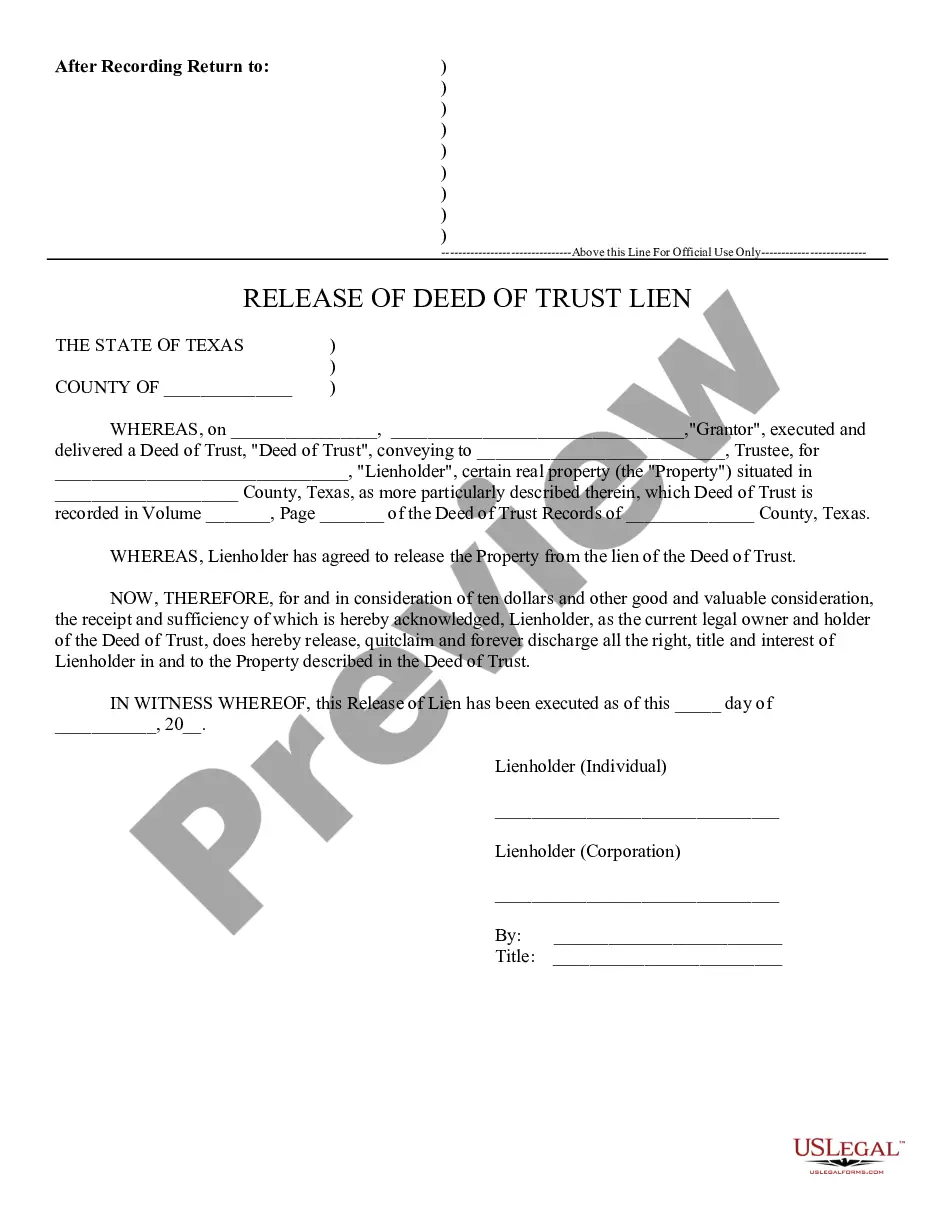

This form is a release of a deed of trust lien. Grantor executed and delivered a deed of trust to the trustee for the lienholder. The lienholder has agreed to release the property from the lien of the deed of trust and discharge all right and title to the property.

A Plano Texas Release of Lien is a legal document that clears a property or asset from any existing liens or claims against it. When a lien is placed on a property, it serves as a legal right for the lien holder to claim the property if the owner fails to repay a debt or fulfill their legal obligations. However, when the debt is repaid or the obligations are fulfilled, a Release of Lien is necessary to remove the lien holder's rights and free the property from any encumbrances. In Plano, Texas, property owners often encounter the need for a Release of Lien in various situations, such as when repaying a mortgage, settling a construction lien, or paying off a judgment. Depending on the type of lien and the circumstances, there are different types of Plano Texas Release of Liens that apply. Some of these include: 1. Mortgage Release of Lien: This type of release is used when a property owner has fully paid off their mortgage loan. The lien holder, typically a mortgage company or lender, issues the Release of Lien to acknowledge that the debt has been satisfied, and the property is now free from the mortgage lien. 2. Mechanics' Lien Release: In the construction industry, contractors, suppliers, or subcontractors may place a mechanics' lien on a property if they are not paid for their services or materials. Once the payment dispute is resolved, a Mechanics' Lien Release is obtained to remove the lien from the property title. 3. Judgment Lien Release: If a court awards a judgment against a property owner, a judgment lien may be filed on the property as a means of enforcing payment. When the judgment is paid off, a Release of Lien is obtained to clear the property title and remove any restrictions on it. 4. Tax Lien Release: In cases where property owners have unpaid taxes, local government entities may place a tax lien on the property. Once the outstanding taxes are paid in full, a Tax Lien Release is obtained, releasing the property from any tax liens that may be affecting it. It is essential to understand that a Release of Lien is a legal document that must be properly executed and filed with the relevant authorities, such as the county clerk's office or the property records office. This ensures that the release is recorded and reflects in the property's public records, thereby providing legal proof that the lien has been released and the property is now free from any encumbrances. In summary, a Plano Texas Release of Lien is a crucial document that removes any liens or claims against a property or asset. Whether it is a Mortgage Release of Lien, Mechanics' Lien Release, Judgment Lien Release, or Tax Lien Release, obtaining the appropriate release is necessary to clear the property's title and ensure its marketability.A Plano Texas Release of Lien is a legal document that clears a property or asset from any existing liens or claims against it. When a lien is placed on a property, it serves as a legal right for the lien holder to claim the property if the owner fails to repay a debt or fulfill their legal obligations. However, when the debt is repaid or the obligations are fulfilled, a Release of Lien is necessary to remove the lien holder's rights and free the property from any encumbrances. In Plano, Texas, property owners often encounter the need for a Release of Lien in various situations, such as when repaying a mortgage, settling a construction lien, or paying off a judgment. Depending on the type of lien and the circumstances, there are different types of Plano Texas Release of Liens that apply. Some of these include: 1. Mortgage Release of Lien: This type of release is used when a property owner has fully paid off their mortgage loan. The lien holder, typically a mortgage company or lender, issues the Release of Lien to acknowledge that the debt has been satisfied, and the property is now free from the mortgage lien. 2. Mechanics' Lien Release: In the construction industry, contractors, suppliers, or subcontractors may place a mechanics' lien on a property if they are not paid for their services or materials. Once the payment dispute is resolved, a Mechanics' Lien Release is obtained to remove the lien from the property title. 3. Judgment Lien Release: If a court awards a judgment against a property owner, a judgment lien may be filed on the property as a means of enforcing payment. When the judgment is paid off, a Release of Lien is obtained to clear the property title and remove any restrictions on it. 4. Tax Lien Release: In cases where property owners have unpaid taxes, local government entities may place a tax lien on the property. Once the outstanding taxes are paid in full, a Tax Lien Release is obtained, releasing the property from any tax liens that may be affecting it. It is essential to understand that a Release of Lien is a legal document that must be properly executed and filed with the relevant authorities, such as the county clerk's office or the property records office. This ensures that the release is recorded and reflects in the property's public records, thereby providing legal proof that the lien has been released and the property is now free from any encumbrances. In summary, a Plano Texas Release of Lien is a crucial document that removes any liens or claims against a property or asset. Whether it is a Mortgage Release of Lien, Mechanics' Lien Release, Judgment Lien Release, or Tax Lien Release, obtaining the appropriate release is necessary to clear the property's title and ensure its marketability.