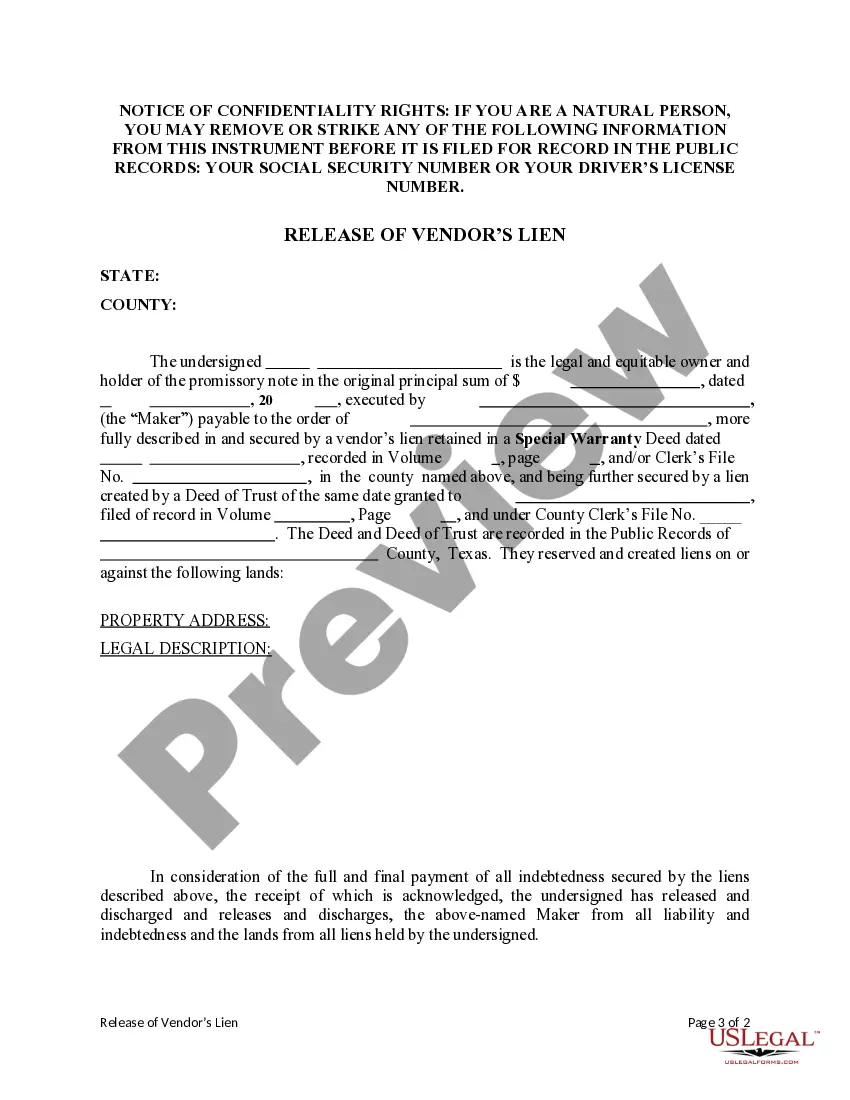

This form is a release of a retained vendor's lien. The lienholder has agreed to release the property from the lien of the deed of trust and discharge all right and title to the property.

Tarrant Texas Release of Vendor's Lien

Description

How to fill out Texas Release Of Vendor's Lien?

Finding authenticated templates pertinent to your regional laws can be difficult unless you utilize the US Legal Forms repository.

It’s a digital assortment of over 85,000 legal documents for both personal and business requirements and various real-world situations.

All the paperwork is accurately categorized by usage area and jurisdiction, so searching for the Tarrant Texas Release of Vendor's Lien becomes as easy as pie.

Keep your documentation organized and in accordance with legal standards is critically important. Utilize the US Legal Forms library to always have vital document templates for any requirements right at your fingertips!

- Examine the Preview mode and document description.

- Ensure you’ve chosen the correct one that fulfills your requirements and fully complies with your local jurisdiction standards.

- Search for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

- Acquire the document.

Form popularity

FAQ

The records for unincorporated areas are all filed with the Tarrant County Clerk's office at 200 Taylor Street, 3rd Floor, Ft. Worth, TX 76102.

If you require assistance in accessing the information, please contact the Criminal Courts Administrator's office at 817-884-2797.

Can I file an Affidavit of Heirship with the Probate courts? No, these documents should be filed in the County Clerk Official Public Records Office located in room B20 at 100 W. Weatherford, Fort Worth, Texas.

The surviving spouse automatically receives all community property. Separate personal property also goes completely to the surviving spouse, while separate real property is split down the middle between the surviving spouse and the deceased's parents, siblings or siblings' descendants, in that order.

Where do I file a Small Estates Affidavit? These documents are filed in County Clerk's Probate Office located in room 233 at 100. W. Weatherford St., Fort Worth, Texas 76196.

The County Clerk's office maintains Official Public Records beginning in 1836. The records include deeds, land patent records, mortgages, judgments and tax liens.

Texas property records are available at the tax assessor's office or the county recorder's office in the county where the property is located. Generally, property records are straightforward to obtain.

It does not transfer title to real property. However, Texas Estates Code 203.001 says it becomes evidence about the property once it has been on file for five years. The legal effect of the affidavit of heirship is that it creates a clean chain of title transfer to the decedent's heirs.

Any person may access Texas public records, except in situations where the information is confidential or disclosure is prohibited by law (Texas Government Code Chapter 552.007).

The public is able to access documents, such as deeds, birth and death certificates, military discharge records, and others through the register of deeds. There may be a fee to access or copy public records through the register of deeds.